D-Wave Quantum Inc. (QBTS) Stock: Deciphering Monday's Market Movement

Table of Contents

Analyzing the Day's Trading Volume and Price Action

Understanding Monday's price action requires a close examination of trading volume and price chart patterns. This analysis helps determine whether the movement was driven by fundamental factors or purely speculative trading.

Unusual Trading Activity

Monday's trading in QBTS exhibited unusual activity compared to recent periods. Analyzing the price chart reveals significant highs and lows throughout the day, indicating volatility.

- Volume Comparison: Monday's trading volume was significantly higher than the average daily volume over the past week, month, and quarter. A precise comparison requires access to real-time trading data, but anecdotal evidence suggests a substantial increase. This elevated volume suggests a higher level of investor interest and activity.

- Candlestick Patterns: While a detailed technical analysis would require specific chart data, potential candlestick patterns like bullish engulfing or bearish hammers could offer clues about the prevailing sentiment. Observing these patterns alongside volume data provides a more comprehensive view.

- Support/Resistance Levels: Any significant price gaps or breaks of previously established support or resistance levels would further underscore the magnitude of Monday's price movement. These breaks often signify a shift in market sentiment.

Identifying Potential Catalysts

Several factors could have contributed to the QBTS stock price fluctuations on Monday. Pinpointing the exact cause often requires a combination of analysis.

- Company Announcements: Did D-Wave announce any new partnerships, significant product launches, or groundbreaking research breakthroughs that could have influenced investor confidence? Any press releases or official company communications should be reviewed.

- Broader Market Influences: It's essential to consider broader market trends. Did the overall technology sector experience a significant downturn or upturn? Were there any interest rate changes or other macroeconomic factors that might have impacted QBTS?

- Analyst Ratings and Price Targets: Changes in analyst ratings or price targets for QBTS could also contribute to price volatility. A positive upgrade might drive the price upward, while a downgrade could lead to a decline.

Assessing the Impact on Long-Term Investment Strategies

While Monday's price fluctuations are noteworthy, it's crucial to assess their impact on long-term investment strategies in QBTS. This requires considering both the potential for growth and the inherent risks involved.

Long-Term Growth Potential

The long-term outlook for D-Wave Quantum Inc. and the quantum computing sector remains promising. D-Wave's position as a leading player in this emerging field offers significant growth potential.

- Competitive Advantages: D-Wave's technological advancements and unique approach to quantum computing provide a competitive edge. Analyzing their patent portfolio and research publications reveals their innovations.

- Market Size and Target Markets: The potential market for quantum computing applications is vast, spanning various industries. Understanding D-Wave's target markets and their potential market share is crucial for assessing long-term growth.

- Financial Health: Reviewing D-Wave's financial statements, including revenue growth, profitability, and debt levels, provides a clearer picture of the company's financial health and stability.

Risk Assessment

Investing in a quantum computing company, especially one in its relatively early stages of development, carries inherent risks.

- Technological Risks: The field of quantum computing is still evolving, and technological hurdles remain. Unexpected setbacks in research and development could negatively impact the company's progress.

- Financial Risks: As a young company, D-Wave faces typical financial risks associated with growth and scaling. Profitability and cash flow need careful consideration.

- Competitive Landscape: The quantum computing industry is highly competitive, with established tech giants and emerging startups vying for market share. Increased competition could negatively impact D-Wave's growth trajectory.

Conclusion

Monday's price movements in D-Wave Quantum Inc. (QBTS) stock were likely influenced by a combination of factors, including increased trading volume, potential catalysts such as company announcements or broader market influences, and investor sentiment. While short-term fluctuations are expected, the long-term growth potential of D-Wave and the quantum computing sector remains significant. However, investors should carefully consider the inherent risks associated with investing in a relatively young and volatile company.

Call to Action: Understanding the intricacies of QBTS stock requires ongoing analysis. Continue to monitor D-Wave Quantum Inc. (QBTS) stock and stay informed about industry developments to make well-informed investment decisions. Further research into D-Wave Quantum Inc. (QBTS) stock, including its financial statements, technology roadmap, and competitive landscape, is strongly recommended.

Featured Posts

-

Buy Canadian Assessing The Long Term Effects Of Tariffs On Beauty

May 21, 2025

Buy Canadian Assessing The Long Term Effects Of Tariffs On Beauty

May 21, 2025 -

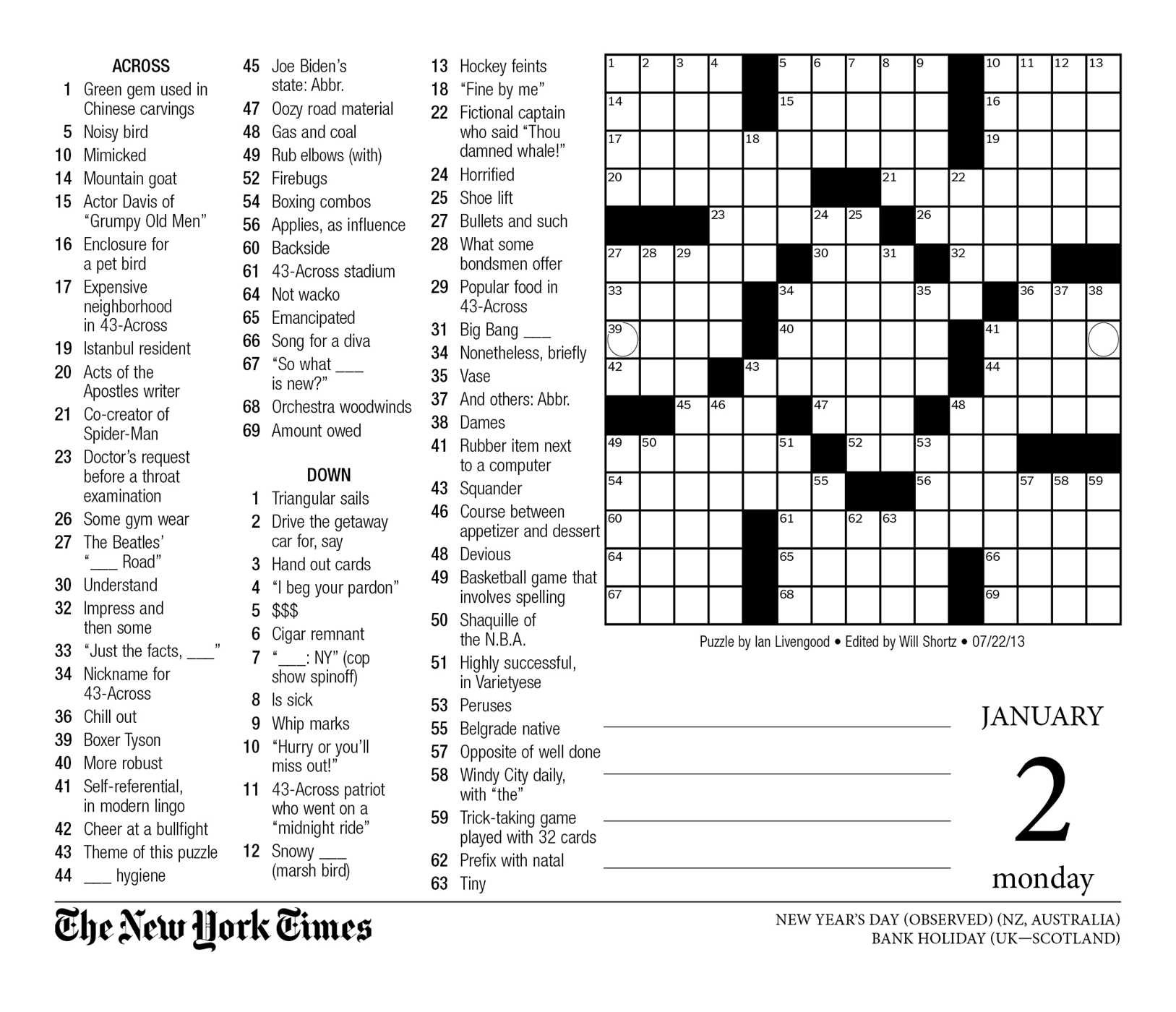

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 21, 2025

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 21, 2025 -

Ankuendigung Endgueltige Bauform Durch Architektin Festgelegt

May 21, 2025

Ankuendigung Endgueltige Bauform Durch Architektin Festgelegt

May 21, 2025 -

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025 -

Analyzing The Kartel Rum Culture Connection Via Stabroek News

May 21, 2025

Analyzing The Kartel Rum Culture Connection Via Stabroek News

May 21, 2025

Latest Posts

-

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025 -

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025