Crypto Market Rally: Bitcoin Benefits From US-China Trade Talks

Table of Contents

Reduced Trade Uncertainty Fuels Risk-On Sentiment

Easing trade tensions between the US and China have a profound impact on global investor sentiment, creating a "risk-on" environment. This means investors are more willing to allocate capital to assets considered riskier, including cryptocurrencies like Bitcoin.

Global Market Response

Reduced trade uncertainty leads to a ripple effect across global markets:

- Increased stock market performance: Major indices like the S&P 500 and Nasdaq often see gains as investor confidence improves. For example, positive news regarding trade deals has historically resulted in immediate upticks in these indices.

- Higher demand for emerging markets: Emerging economies, often sensitive to trade disputes, experience increased investment flows.

- Reduced safe-haven asset demand: The demand for traditionally safe-haven assets, such as gold and government bonds, decreases as investors seek higher returns in riskier assets.

The shift from a "risk-off" to a "risk-on" sentiment is crucial. During periods of high geopolitical uncertainty, investors flock to safe-haven assets, reducing capital available for riskier ventures. Positive trade news reverses this trend.

Bitcoin as a Risk-On Asset

Bitcoin's price often mirrors the broader market's risk appetite. Historical data demonstrates this correlation:

- Periods of increased market uncertainty: Bitcoin's price typically sees downward pressure during times of heightened global uncertainty, such as escalating trade wars.

- Periods of stability: Conversely, periods of reduced trade tensions and improved global economic outlook usually see Bitcoin's price rise alongside traditional asset classes.

Analyzing the correlation between Bitcoin's price and the S&P 500 during past US-China trade negotiation periods reveals a clear link. A positive correlation suggests that Bitcoin is increasingly viewed as a risky, but potentially high-reward, asset within diversified portfolios.

Increased Institutional Investor Interest

Reduced geopolitical risk, stemming from positive US-China trade developments, makes institutional investors more comfortable allocating funds to cryptocurrencies.

Positive Trade News Attracts Institutional Capital

The decrease in uncertainty encourages institutional involvement:

- Examples of institutional investment: Grayscale Bitcoin Trust, a prominent example, has seen significant inflows during periods of reduced trade tensions. Other institutional investors, including some hedge funds and pension funds, are also gradually increasing their crypto exposure.

- Regulatory landscape influence: While regulatory clarity remains a crucial factor, reduced geopolitical risk lowers the overall uncertainty, making regulatory hurdles appear less daunting to institutional investors. Previously, high uncertainty often led institutions to adopt a "wait-and-see" approach.

Diversification Strategies

In a positive trade outlook, Bitcoin is increasingly viewed as a valuable addition to a diversified portfolio:

- Low correlation with traditional assets: Bitcoin has historically shown a relatively low correlation with traditional assets like stocks and bonds, making it an effective tool for portfolio risk reduction.

- Potential for higher returns and reduced portfolio risk: The potential for significant gains, combined with its low correlation, makes Bitcoin an attractive option for risk-adjusted returns.

Including Bitcoin in a portfolio can mitigate losses during times of global market volatility, offering a hedge against traditional asset downturns, particularly when fueled by macroeconomic factors like trade wars.

Increased Liquidity and Trading Volume

Positive trade news significantly boosts investor confidence, directly leading to increased trading activity in the cryptocurrency market.

Impact of Positive Sentiment on Trading Activity

The surge in optimism translates into higher trading volumes:

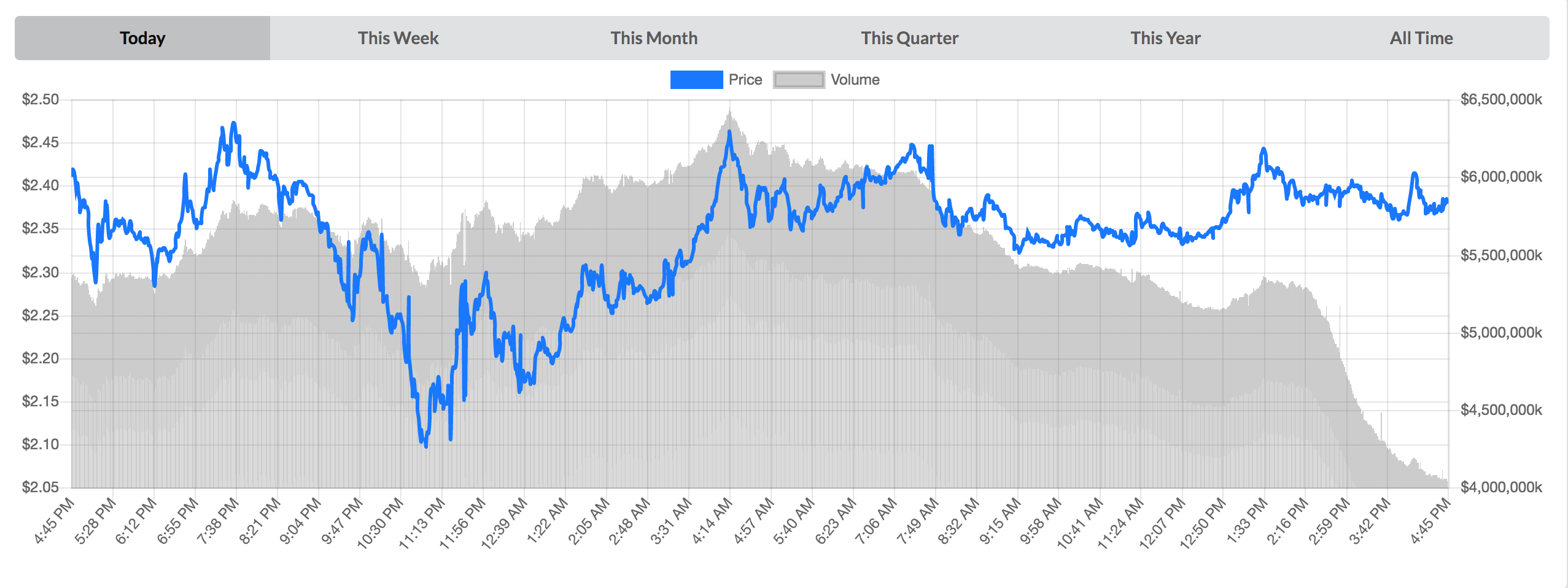

- Increased trading volume: Data shows a clear upward trend in Bitcoin and altcoin trading volume following positive US-China trade developments. This heightened activity indicates a growing influx of capital into the market.

- Relationship between increased trading volume and price appreciation: Higher trading volume generally indicates increased demand, which often leads to price appreciation.

Improved Market Depth and Price Stability

Increased liquidity resulting from higher trading volume stabilizes the market:

- Price volatility during periods of high and low trading volume: Comparing Bitcoin's price volatility during periods of high and low trading volumes clearly shows that higher liquidity leads to reduced price swings.

- Impact of large buy/sell orders: Increased liquidity cushions the impact of large buy or sell orders, preventing dramatic price fluctuations and fostering a more stable market environment. This stability is further enhanced by the positive sentiment fueled by positive trade news.

Conclusion

The recent crypto market rally, notably Bitcoin's surge, is strongly connected to positive developments in US-China trade talks. Reduced trade uncertainty is boosting investor confidence, increasing risk appetite, and attracting institutional capital to the crypto market. Increased trading volume and improved market liquidity further fuel this rally. The relationship between global macroeconomic factors and cryptocurrency performance highlights the growing importance of understanding these dynamics. Stay informed on the latest developments in US-China trade negotiations and their impact on the crypto market rally, particularly for assets like Bitcoin. Keep monitoring the situation for future insights and potential investment opportunities in the ever-evolving world of cryptocurrencies.

Featured Posts

-

The Running Man Glen Powells Fitness Regime And Method Acting

May 08, 2025

The Running Man Glen Powells Fitness Regime And Method Acting

May 08, 2025 -

Road Rage Leads To Van Striking Motorcycle Cnn News

May 08, 2025

Road Rage Leads To Van Striking Motorcycle Cnn News

May 08, 2025 -

Aston Villa Ps Zh Analiz Poyedinkiv U Yevrokubkakh

May 08, 2025

Aston Villa Ps Zh Analiz Poyedinkiv U Yevrokubkakh

May 08, 2025 -

Best Streaming Services For Los Angeles Angels Games 2025

May 08, 2025

Best Streaming Services For Los Angeles Angels Games 2025

May 08, 2025 -

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025

Latest Posts

-

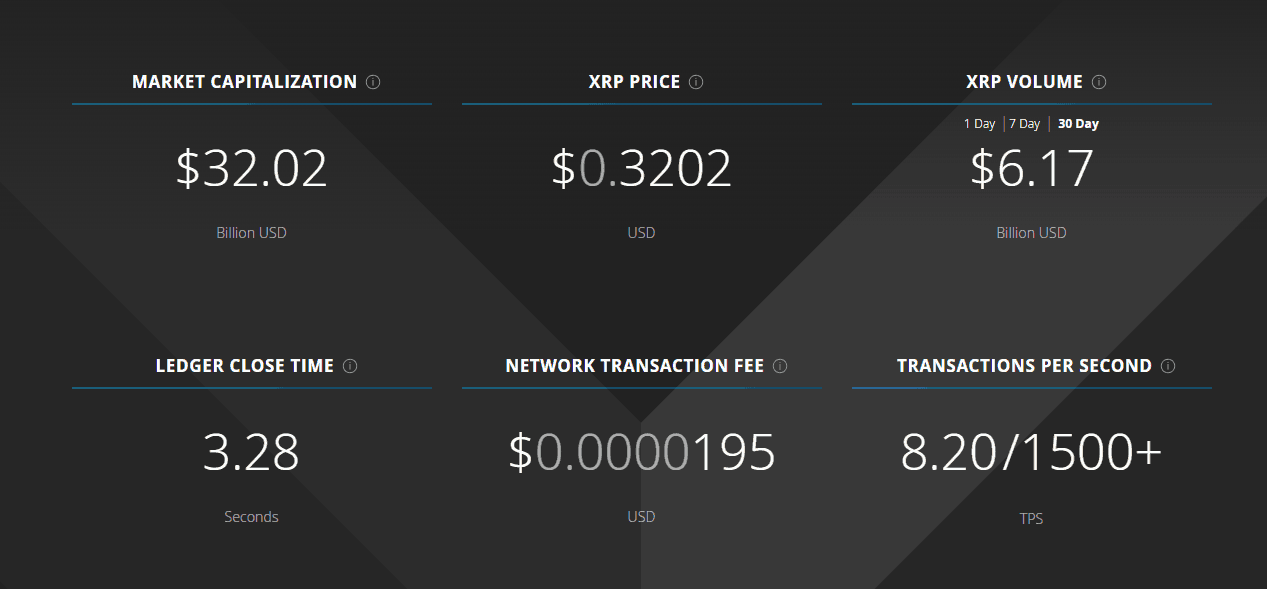

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025 -

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025 -

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025