Crude Oil Market Update: April 24, 2024 Analysis And Insights

Table of Contents

Global Crude Oil Price Trends

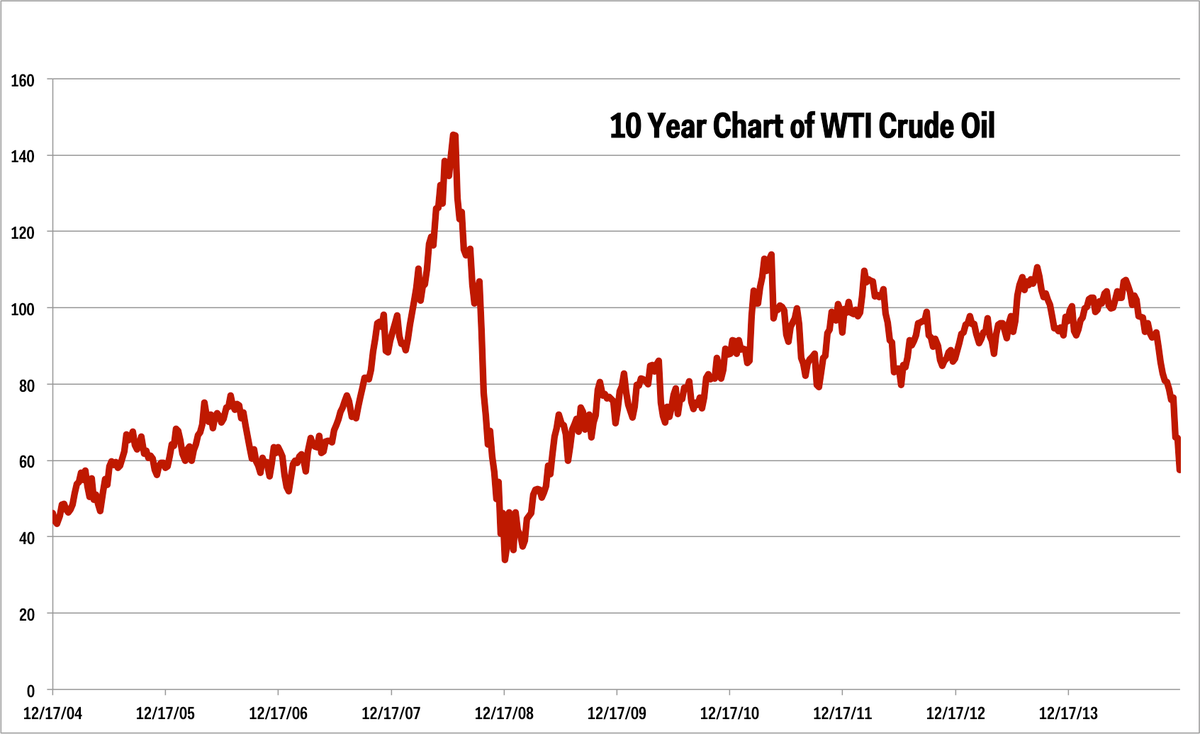

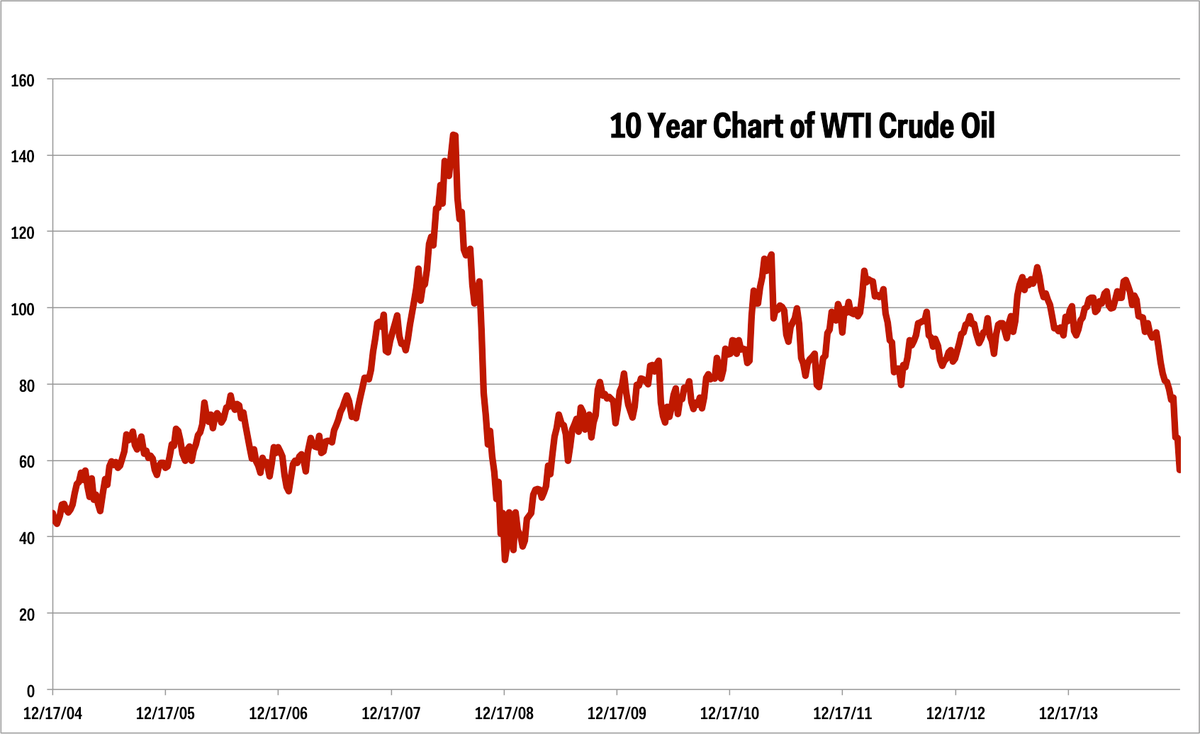

As of April 24, 2024, Brent crude oil is trading at [Insert Current Brent Price] and West Texas Intermediate (WTI) crude oil is priced at [Insert Current WTI Price]. (Note: Replace bracketed information with actual prices on the publication date.) [Insert Chart/Graph showing price movements of Brent and WTI crude oil over the past month]. The recent price movements reflect a complex interplay of factors:

-

Supply Disruptions: OPEC+ production cuts continue to influence global supply. Geopolitical instability in [mention specific regions experiencing unrest impacting oil production] further exacerbates the situation, leading to potential shortages and price increases.

-

Demand Fluctuations: Global economic growth, while showing signs of slowing in some regions, remains a significant driver of oil demand. Seasonal changes, particularly increased travel during certain times of the year, also contribute to fluctuating demand.

-

Inventory Levels: Current crude oil inventory levels stand at [Insert Current Inventory Data]. Low inventories typically exert upward pressure on prices, indicating a tighter supply situation.

-

Speculative Trading: Market speculation and investor sentiment significantly impact oil price volatility. News events, economic forecasts, and political developments can trigger dramatic price swings.

Geopolitical Factors Affecting the Crude Oil Market

Geopolitics plays a crucial role in shaping the crude oil market. The ongoing situation in [mention specific geopolitical hotspot impacting oil] continues to cast a shadow over global oil supply chains.

-

OPEC+ Influence: The decisions made by OPEC+ member nations regarding oil production quotas significantly affect global supply and prices. Any changes to their production strategies will have a direct impact on the oil market.

-

US and Russia's Role: The United States and Russia, two major oil producers, wield considerable influence over global oil markets. US production levels and sanctions imposed on Russia continue to shape the global oil landscape.

-

Sanctions and Trade Disputes: Sanctions on certain oil-producing nations and trade disputes between countries can disrupt oil supply chains, leading to price volatility and shortages.

Supply and Demand Dynamics in the Crude Oil Market

Understanding the global balance between crude oil supply and demand is crucial for accurate price forecasting.

-

Oil Production: New oil discoveries and technological advancements in extraction methods continually impact global oil production capacity. However, these gains are often offset by declining production in mature oil fields.

-

Renewable Energy Growth: The expansion of renewable energy sources such as solar and wind power presents a long-term challenge to the demand for crude oil. While the transition is gradual, it signifies a shift in the energy landscape.

-

Major Oil-Consuming Countries: China, the United States, and India are among the world's largest oil consumers. Changes in their economic growth rates and energy policies directly influence global demand.

Future Outlook and Predictions for Crude Oil Prices

Predicting future crude oil prices is inherently uncertain, given the numerous variables at play. However, based on the current analysis, we can offer a cautious outlook.

-

Potential Price Ranges: We anticipate crude oil prices to remain within a range of [Insert Price Range] in the coming months, barring any unforeseen geopolitical events or significant changes in global economic conditions.

-

Investment Strategies: Investors should adopt a diversified approach and carefully consider the inherent risks associated with oil price volatility before making investment decisions.

Conclusion: Key Takeaways and Call to Action

This crude oil market update for April 24, 2024, highlights the significant impact of geopolitical factors, supply and demand dynamics, and speculative trading on crude oil prices. Staying informed about these crucial elements is essential for understanding and navigating this volatile market. The interplay between OPEC+ decisions, global economic growth, and geopolitical stability will continue to shape the future of crude oil. Stay informed about crucial developments in the crude oil market with our regular updates. Subscribe now for insightful crude oil market analysis and price predictions!

Featured Posts

-

Activision Blizzard Acquisition Ftc Challenges Court Decision In Favor Of Microsoft

Apr 25, 2025

Activision Blizzard Acquisition Ftc Challenges Court Decision In Favor Of Microsoft

Apr 25, 2025 -

Safe Makeup Storage Solutions For Homes With Teens

Apr 25, 2025

Safe Makeup Storage Solutions For Homes With Teens

Apr 25, 2025 -

Bears Unexpected 2025 Nfl Draft Target Electrifying Playmaker

Apr 25, 2025

Bears Unexpected 2025 Nfl Draft Target Electrifying Playmaker

Apr 25, 2025 -

Former Charlottesville Meteorologist Arrested Felony Sexual Extortion Charges Filed

Apr 25, 2025

Former Charlottesville Meteorologist Arrested Felony Sexual Extortion Charges Filed

Apr 25, 2025 -

Finding Beauty After Mastectomy Linda Evangelistas Experience

Apr 25, 2025

Finding Beauty After Mastectomy Linda Evangelistas Experience

Apr 25, 2025

Latest Posts

-

2025 A Good Year For Stephen King Regardless Of The Monkey Films Reception

May 10, 2025

2025 A Good Year For Stephen King Regardless Of The Monkey Films Reception

May 10, 2025 -

Charlz Iii Nagradil Stivena Fraya Istoriya Rytsarstva

May 10, 2025

Charlz Iii Nagradil Stivena Fraya Istoriya Rytsarstva

May 10, 2025 -

Stephen King In 2025 The Monkey Movies Potential Impact On The Authors Year

May 10, 2025

Stephen King In 2025 The Monkey Movies Potential Impact On The Authors Year

May 10, 2025 -

Rytsarskoe Zvanie Dlya Stivena Fraya Zasluzhennaya Nagrada

May 10, 2025

Rytsarskoe Zvanie Dlya Stivena Fraya Zasluzhennaya Nagrada

May 10, 2025 -

Will 2025 Be A Great Year For Stephen King Fans Even If The Monkey Movie Disappoints

May 10, 2025

Will 2025 Be A Great Year For Stephen King Fans Even If The Monkey Movie Disappoints

May 10, 2025