Credit Score Impact Of Unpaid Student Loans: A Guide

Table of Contents

How Unpaid Student Loans Affect Your Credit Score

Unpaid student loans significantly damage your credit score. When you miss a payment, your loan servicer reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion. This negative information is recorded on your credit report, impacting your creditworthiness. The mechanics of this impact are tied directly to your FICO score, a widely used credit scoring model.

- Negative impact on credit score: Even a single missed payment can lead to a substantial drop in your credit score, potentially hundreds of points. The longer the delinquency persists, the more severe the impact. A significant drop in your FICO score can make it harder to get approved for future credit.

- Potential for collection agencies: If your delinquency persists beyond 90 days, your loan may be transferred to a collection agency, further damaging your credit report and resulting in additional fees.

- Difficulty obtaining future loans: A poor credit score due to unpaid student loans can make it extremely difficult to obtain future loans, including mortgages, auto loans, and even credit cards. Lenders view borrowers with a history of delinquency as high-risk.

- Higher interest rates on future borrowing: Even if you are approved for a loan, a damaged credit score resulting from unpaid student loans will likely lead to significantly higher interest rates, increasing the overall cost of borrowing.

- Impact on rental applications and employment opportunities: Some landlords and employers perform credit checks as part of their screening process. A poor credit history can negatively impact your chances of securing a rental property or a new job.

Your credit report acts as a financial biography, detailing your payment history, which heavily influences your credit score. Payment history accounts for a significant portion (35%) of your FICO score. A history of missed student loan payments will negatively affect this crucial component, resulting in a lower overall score and hindering your access to credit.

Understanding the Stages of Student Loan Delinquency

The impact of unpaid student loans on your credit worsens with each passing month of delinquency. Understanding these stages is crucial:

- 30-day delinquency: This is the initial stage of delinquency. While the impact on your credit score is relatively small at this point, it's a significant warning sign. It's crucial to take action immediately.

- 60-day delinquency: Your credit score will experience a more significant decrease at this stage. Lenders start to view you as a higher-risk borrower.

- 90-day delinquency: Reaching 90 days of delinquency often results in your loan being marked as "default." This is a serious event with potentially severe consequences.

- Default: Defaulting on your student loans triggers serious repercussions, including wage garnishment, tax refund offset, and a severely damaged credit history. The negative mark on your credit report can remain for seven years, making it extremely challenging to rebuild your credit.

The length of time these negative marks stay on your credit report can significantly impact your future financial opportunities. Understanding the progression of delinquency and its lasting impact on your credit history is vital for proactive management of your student loans.

Strategies to Avoid Default and Protect Your Credit

Several strategies can help you manage your student loan debt and protect your credit score:

- Income-driven repayment plans (IDR): IDR plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including ICR, PAYE, REPAYE, andIBR. Eligibility criteria vary, so it's essential to explore the options available to you.

- Deferment and forbearance: Deferment temporarily postpones your payments, while forbearance reduces or suspends your payments. While these options can provide short-term relief, they usually don't eliminate the debt and may still impact your credit score.

- Loan consolidation: Consolidating your loans into a single loan can simplify your payments and potentially lower your monthly payment. However, it may not always lower your interest rate.

- Contacting your loan servicer: Proactive communication with your loan servicer is vital. Explain your financial situation and explore possible solutions before your loan becomes delinquent.

- Seeking professional help from a credit counselor: A credit counselor can provide personalized guidance on managing your debt and improving your credit.

Understanding and utilizing these resources can help you avoid default and maintain a healthy credit score.

Rebuilding Your Credit After Student Loan Default

Rebuilding your credit after defaulting on student loans is a challenging but achievable process:

- Paying off defaulted loans: Negotiating a settlement with your loan servicer or collection agency may be an option to resolve the debt.

- Credit repair strategies: Dispute any inaccurate information on your credit report. Errors can happen, and correcting them is crucial for improving your score.

- Building positive credit history: Consider obtaining a credit-builder loan or a secured credit card to establish a positive credit history.

- Monitoring your credit report regularly: Regularly check your credit report for accuracy and identify any potential problems early on.

Rebuilding credit takes time and consistent effort. However, by taking proactive steps, you can gradually improve your creditworthiness and gain access to better financial opportunities.

Conclusion

The impact of unpaid student loans on your credit score can be severe and long-lasting. Understanding the stages of delinquency and the various strategies for managing your student loan debt is crucial to protecting your financial well-being. By proactively addressing your student loan payments and utilizing available resources, you can mitigate the negative impact on your credit score and avoid the significant consequences of default. Take control of your financial future and learn more about managing your student loan debt today. Don't let unpaid student loans damage your credit – take action now!

Featured Posts

-

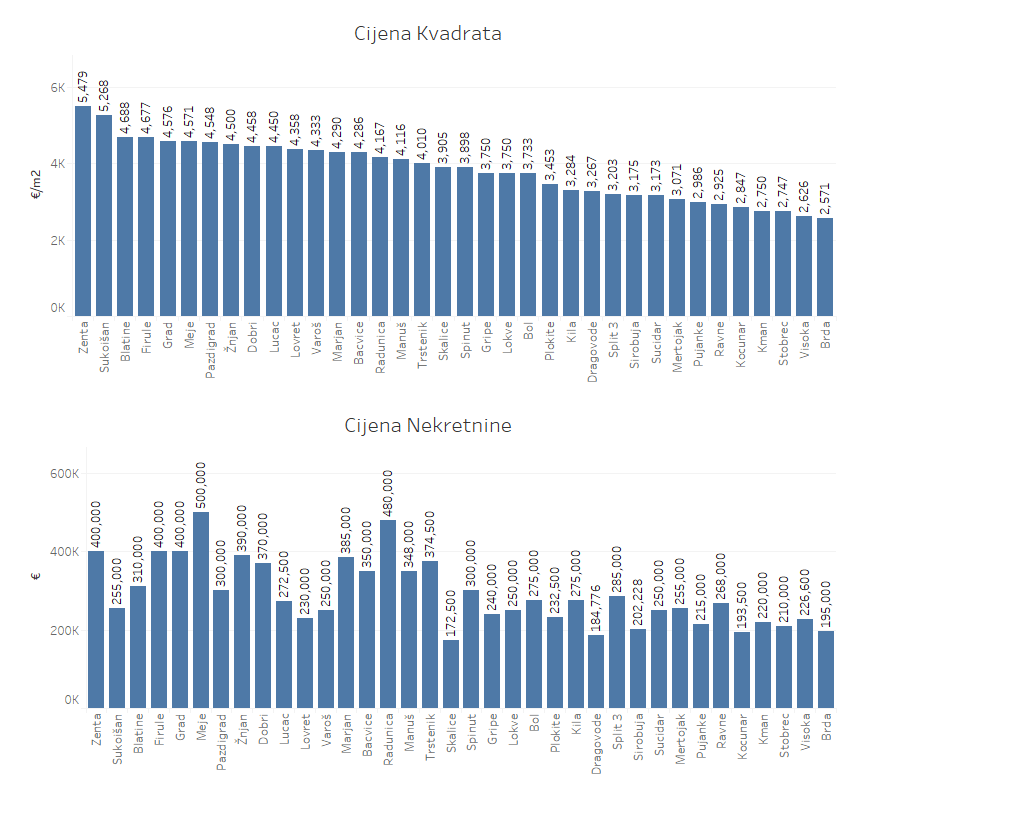

Analiza Trzista Nekretnina Kupovina Stanova Od Strane Srba U Inostranstvu

May 17, 2025

Analiza Trzista Nekretnina Kupovina Stanova Od Strane Srba U Inostranstvu

May 17, 2025 -

Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Free And Legal Options

May 17, 2025

Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Free And Legal Options

May 17, 2025 -

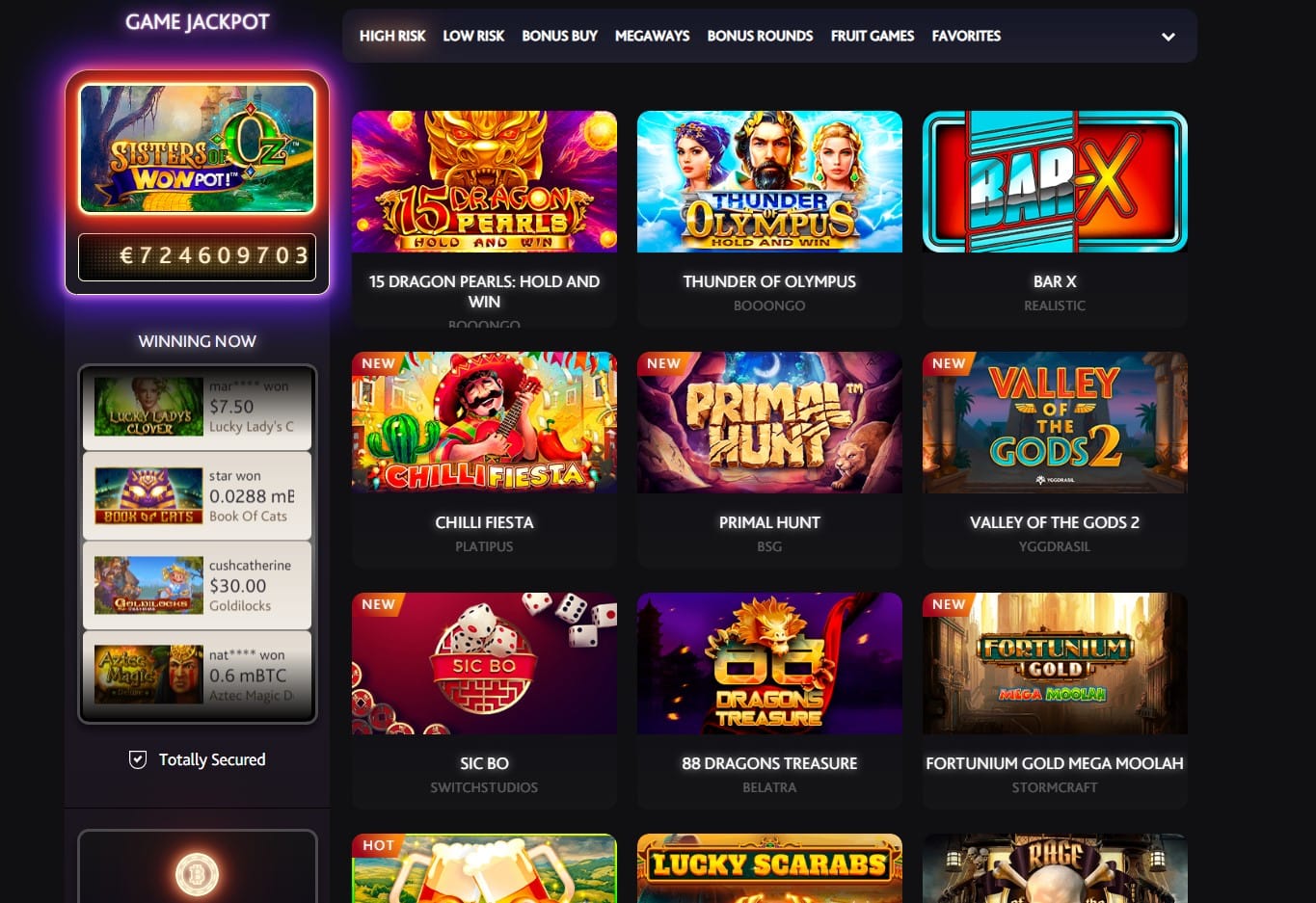

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025 -

Reta Nba Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025

Reta Nba Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025 -

Todays Mlb Game Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025

Todays Mlb Game Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025

Latest Posts

-

Angel Reese Supports Wnba Player Lockout Threat

May 17, 2025

Angel Reese Supports Wnba Player Lockout Threat

May 17, 2025 -

Wnbas Toronto Tempo Assessing The Latest Franchise Updates

May 17, 2025

Wnbas Toronto Tempo Assessing The Latest Franchise Updates

May 17, 2025 -

Toronto Tempo Wnba Team Recent Announcements And Future Prospects

May 17, 2025

Toronto Tempo Wnba Team Recent Announcements And Future Prospects

May 17, 2025 -

Positive Developments Toronto Tempos Latest Wnba Franchise News

May 17, 2025

Positive Developments Toronto Tempos Latest Wnba Franchise News

May 17, 2025 -

Belgica 0 1 Portugal Resumen Del Partido Goles Y Mejores Momentos

May 17, 2025

Belgica 0 1 Portugal Resumen Del Partido Goles Y Mejores Momentos

May 17, 2025