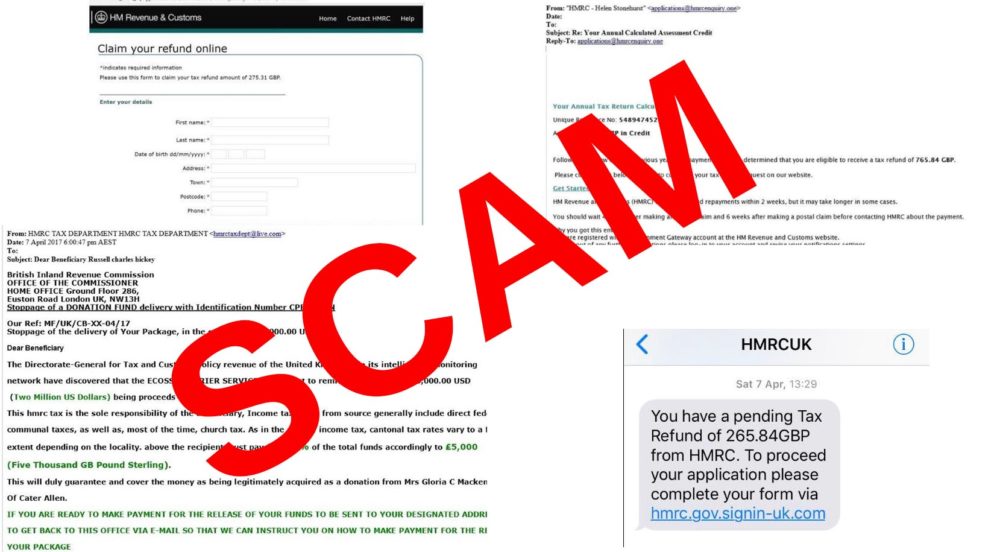

Could You Be Due An HMRC Refund? A Payslip Check Could Reveal Thousands

Table of Contents

Common Reasons for HMRC Underpayments and Potential Refunds

Several factors can lead to an HMRC underpayment, resulting in a potential tax refund. Understanding these reasons is the first step towards reclaiming your money. Let's examine some common culprits:

-

Incorrect tax code: Your tax code determines how much Income Tax is deducted from your earnings. An incorrect code, whether outdated or wrongly assigned, can lead to significant overpayment. For example, an incorrect code might deduct tax as if you were single and earning a higher amount than you actually are.

-

Changes in circumstances: Life changes like marriage, having a child, starting a new job, or becoming self-employed can dramatically affect your tax liability. Failing to notify HMRC about these changes could result in an underpayment or overpayment. It's crucial to inform HMRC promptly of any such alterations.

-

Payroll errors: Sometimes, mistakes happen in payroll processing. Incorrect calculations of your gross pay, tax deductions, or National Insurance contributions can all lead to an underpayment of tax. Regularly reviewing your payslip is vital to catch these errors.

-

Self-assessment inaccuracies: If you're self-employed or have other untaxed income, errors in your self-assessment tax return can easily lead to underpayment. Double-checking your return before submission is crucial to avoid this.

Review your personal circumstances and your tax documents carefully. If you've experienced any of these situations, you might be due a tax refund!

How to Check Your Payslips for Potential HMRC Refund Indicators

Examining your payslips meticulously is key to uncovering potential HMRC refund indicators. Here's a step-by-step guide:

-

Understand the key terms: Familiarize yourself with essential payslip terminology like "tax code," "tax deducted," and "National Insurance contributions." Understanding these terms will allow you to better interpret your payslip information.

-

Look for inconsistencies: Check for irregularities in your tax deductions across multiple payslips. Are the deductions consistent with your income and tax code? Any significant discrepancies could point to a potential problem.

-

Compare to your estimated tax liability: Estimate your tax liability based on your income and tax code. Does the tax deducted on your payslips match your estimate? A large difference could indicate an underpayment.

-

Verify your tax code: Log into your HMRC online account and check that your tax code is correct and up-to-date. This is a vital first step in ensuring your tax deductions are accurate.

Specific areas to examine on your payslip:

- Tax code verification: Confirm your tax code on your payslip matches the one on your HMRC online account.

- Consistency of tax deducted: Ensure the tax deducted is consistent across your payslips, accounting for any changes in your income or circumstances.

- Comparison with estimated tax: Compare the total tax deducted over a period with your estimated tax liability for that period.

Remember to keep records of your payslips for at least six years, as this is helpful for any potential future tax refund claims.

Steps to Claim Your HMRC Refund

Claiming a tax refund from HMRC is a straightforward process. Here's how to do it:

-

Gather your documents: You'll need your payslips, P60s (if applicable), and any other relevant documentation that supports your claim.

-

Complete the relevant form: HMRC provides online forms for tax refund claims. Ensure you complete the form accurately and provide all the necessary information.

-

Submit your claim: You can submit your claim online through the HMRC website or by post, depending on your preference. The online method is generally faster and more efficient.

-

Track your claim: HMRC will provide a reference number to track the progress of your claim. You can check the status online.

Links: [Insert links to relevant HMRC websites and online forms here]

Expect some processing time for your claim; it may take several weeks.

Seeking Professional Help for Complex Cases

While claiming an HMRC refund is typically straightforward, some situations may warrant professional assistance. If you have a complex tax situation, such as multiple years of potential underpayment or significant discrepancies in your tax records, consulting a tax advisor or accountant is highly recommended. They can navigate the complexities of tax law and ensure you receive the full amount of your refund.

Resources for finding qualified tax professionals: [Insert links to relevant resources here]

Professional assistance can save you time, reduce stress, and potentially lead to a more successful outcome in securing your HMRC refund.

Secure Your HMRC Refund Today

Checking your payslips regularly can uncover significant HMRC refunds. Common reasons for underpayment exist, and claiming a tax refund is achievable. Don't leave money on the table! Check your payslips today and see if you're due an HMRC refund. Start your claim now and potentially receive thousands back. Remember to utilize the resources and links provided to assist you in this process. Claim your rightful HMRC refund today!

[Insert relevant links to HMRC resources here]

Featured Posts

-

Eurovision 2025 Introducing The Contestants

May 20, 2025

Eurovision 2025 Introducing The Contestants

May 20, 2025 -

Escola Na Tijuca Incendio Causa Tristeza Em Pais E Ex Alunos

May 20, 2025

Escola Na Tijuca Incendio Causa Tristeza Em Pais E Ex Alunos

May 20, 2025 -

Analysis Of Sasol Sol S Post 2021 Strategy Update

May 20, 2025

Analysis Of Sasol Sol S Post 2021 Strategy Update

May 20, 2025 -

Family Struck By Train Two Adults Killed Children Injured One Missing

May 20, 2025

Family Struck By Train Two Adults Killed Children Injured One Missing

May 20, 2025 -

Bbc To Produce Tv Series Based On Agatha Christies Endless Night

May 20, 2025

Bbc To Produce Tv Series Based On Agatha Christies Endless Night

May 20, 2025

Latest Posts

-

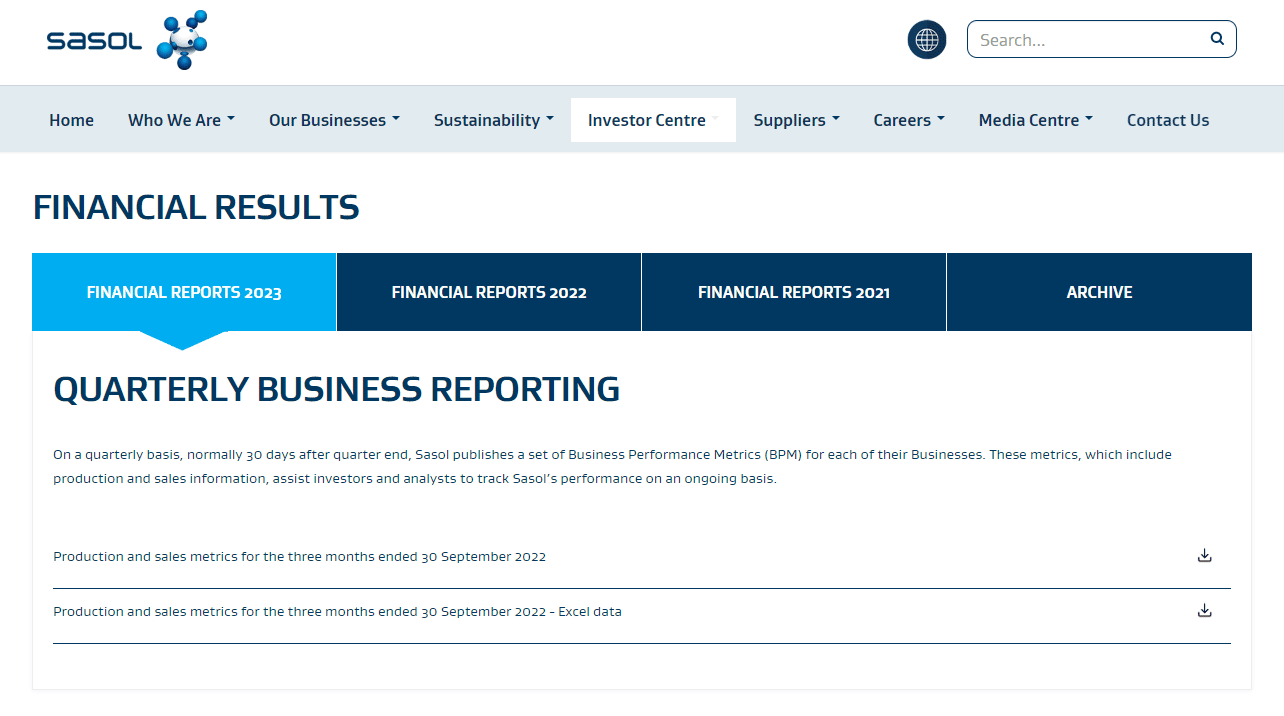

Snl Season 50 Finale Sets Ratings Record

May 20, 2025

Snl Season 50 Finale Sets Ratings Record

May 20, 2025 -

Family Struck By Train Two Adults Killed Children Injured One Missing

May 20, 2025

Family Struck By Train Two Adults Killed Children Injured One Missing

May 20, 2025 -

Mangas Disaster Warning Causes Drop In Japan Tourism

May 20, 2025

Mangas Disaster Warning Causes Drop In Japan Tourism

May 20, 2025 -

Snls 50th Season Finale A Record Breaking Success

May 20, 2025

Snls 50th Season Finale A Record Breaking Success

May 20, 2025 -

Tragedy On Railroad Bridge Two Adults Dead Children Injured

May 20, 2025

Tragedy On Railroad Bridge Two Adults Dead Children Injured

May 20, 2025