Cost-Cutting Measures Surge As U.S. Firms Face Tariff Uncertainty

Table of Contents

Impact of Tariff Uncertainty on U.S. Businesses

Tariff uncertainty has significantly impacted U.S. businesses, creating a challenging economic environment. The fluctuating nature of tariffs makes it difficult for companies to accurately forecast costs and plan for the future. This uncertainty leads to several detrimental effects:

-

Increased prices for imported goods and raw materials: Tariffs directly increase the cost of imported goods, impacting both production costs and final product pricing. This can lead to reduced competitiveness in the global market.

-

Difficulty in accurate financial forecasting and long-term planning: The unpredictable nature of tariffs makes it nearly impossible for businesses to create reliable financial projections, hindering long-term strategic planning and investment decisions. This uncertainty impacts everything from capital expenditures to hiring strategies.

-

Reduced consumer demand due to higher prices: Increased input costs often translate to higher prices for consumers, potentially leading to decreased demand and impacting sales volumes. Businesses must carefully balance cost increases with maintaining market share.

-

Potential for relocation of manufacturing operations overseas: To avoid the high cost of importing or manufacturing domestically, some companies might consider relocating their operations to countries with lower tariffs or production costs, potentially leading to job losses in the U.S.

-

Increased administrative burden of navigating complex tariff regulations: The complexity of tariff regulations requires significant time and resources dedicated to compliance. This administrative burden adds to overall operational costs.

Keywords: Tariff uncertainty, import costs, U.S. businesses, economic uncertainty, supply chain disruption, financial forecasting, global competitiveness.

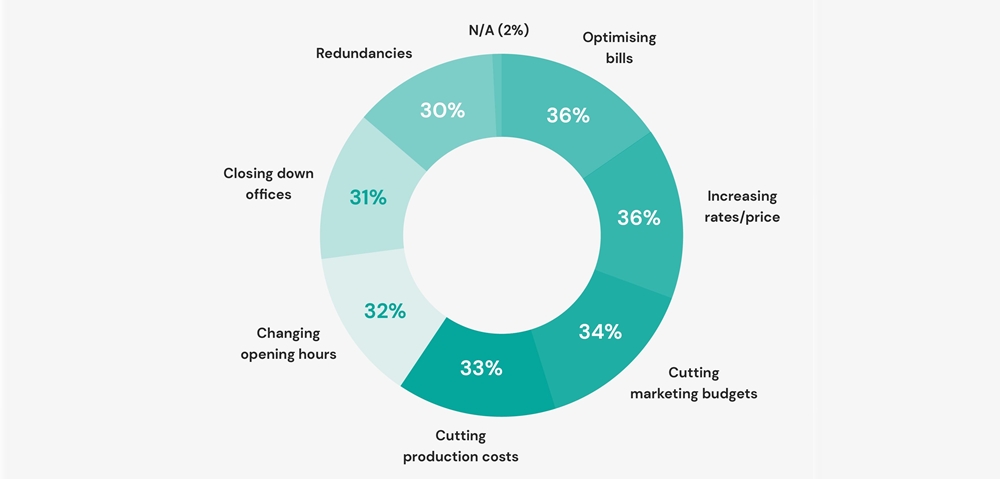

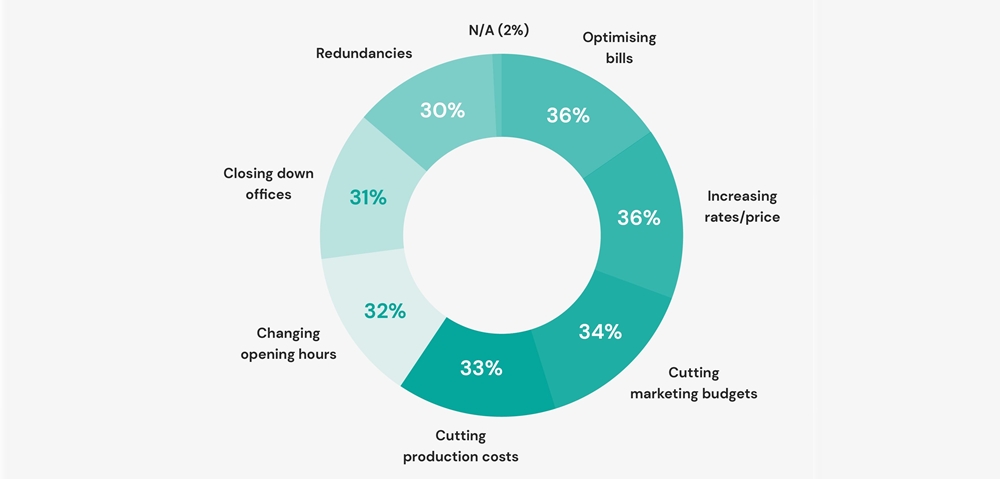

Cost-Cutting Strategies Employed by U.S. Firms

Faced with these challenges, U.S. firms are implementing a range of cost-cutting strategies to mitigate the impact of tariffs and improve their bottom line. These strategies fall into several key areas:

Supply Chain Optimization

Optimizing the supply chain is a critical strategy for cost reduction. Companies are actively exploring various approaches:

-

Reshoring and nearshore sourcing initiatives: Bringing manufacturing back to the U.S. or sourcing from nearby countries reduces reliance on distant suppliers and mitigates tariff risks. This often involves significant capital investment but offers long-term benefits.

-

Investing in automation and technology to improve efficiency: Automation can streamline processes, reduce labor costs, and improve overall productivity. This includes utilizing robotics, AI-powered systems, and advanced manufacturing technologies.

-

Negotiating better terms with suppliers: Stronger relationships with suppliers can lead to better pricing, improved delivery times, and enhanced supply chain resilience.

-

Implementing just-in-time inventory management: Reducing inventory levels minimizes storage costs and reduces the risk of obsolescence due to fluctuating demand.

Operational Efficiency Improvements

Beyond the supply chain, improving operational efficiency is key to cutting costs:

-

Implementing lean manufacturing principles: Lean manufacturing eliminates waste and maximizes efficiency throughout the production process, leading to significant cost savings.

-

Investing in employee training and development: A well-trained workforce is more productive and efficient, reducing errors and improving output.

-

Optimizing energy consumption: Reducing energy usage through efficient equipment and practices lowers operating costs and contributes to environmental sustainability.

-

Utilizing technology to automate tasks and improve workflows: Automation extends beyond manufacturing; it can streamline administrative tasks and improve overall workflow efficiency.

Workforce Adjustments

While difficult, workforce adjustments are sometimes necessary to maintain financial stability:

-

Implementing voluntary separation programs: Offering attractive severance packages to employees willing to leave can help reduce headcount without resorting to layoffs.

-

Freezing salaries or reducing bonuses: These measures can help control labor costs in the short term but should be approached cautiously to maintain employee morale.

-

Reducing overtime hours: Carefully managing overtime can significantly impact labor expenses without compromising productivity.

-

Temporary layoffs: In extreme cases, temporary layoffs might be necessary, though this option should be considered a last resort due to its impact on employees and business reputation. Ethical considerations, including fair treatment and communication, are paramount.

Keywords: Supply chain management, operational efficiency, workforce optimization, cost reduction strategies, automation, lean manufacturing, ethical considerations, employee retention.

Long-Term Implications and Future Outlook

The long-term effects of these cost-cutting measures on the U.S. economy and businesses are complex and multifaceted:

-

Potential for decreased innovation and long-term competitiveness: Focusing solely on short-term cost reductions might lead to neglecting research and development, potentially harming long-term competitiveness.

-

Impact on employment levels and the overall labor market: Workforce adjustments can lead to job losses and negatively impact the labor market, particularly in sectors heavily impacted by tariffs.

-

The potential for increased domestic manufacturing but with potential downsides: Reshoring might increase domestic manufacturing, but it could also lead to higher labor costs and increased competition for resources.

-

The role of government policy in mitigating the effects of tariff uncertainty: Government policies play a significant role in supporting businesses during times of economic uncertainty. Policies aimed at fostering innovation, supporting reshoring initiatives, and providing financial assistance can help mitigate the impact of tariffs.

Keywords: Economic impact, long-term sustainability, business competitiveness, government policy, future outlook, reshoring, job losses, innovation.

Conclusion

The surge in cost-cutting measures among U.S. firms is a direct response to the uncertainty surrounding tariffs. Companies are employing a range of strategies, from supply chain optimization to workforce adjustments, to mitigate the impact on their bottom line. While these measures provide short-term relief, the long-term consequences require careful consideration. Understanding and proactively implementing effective cost-cutting measures is crucial for U.S. businesses to navigate the current economic climate and maintain competitiveness. By carefully analyzing your operations and exploring the options outlined above, your business can better withstand the challenges of tariff uncertainty and build a more resilient future. Learn more about navigating tariff uncertainty and implementing effective cost reduction strategies today.

Featured Posts

-

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025 -

Hollywoods Biggest Strike In Decades Actors And Writers Unite

Apr 29, 2025

Hollywoods Biggest Strike In Decades Actors And Writers Unite

Apr 29, 2025 -

Federal Intervention In Minnesota The Transgender Sports Debate

Apr 29, 2025

Federal Intervention In Minnesota The Transgender Sports Debate

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025 -

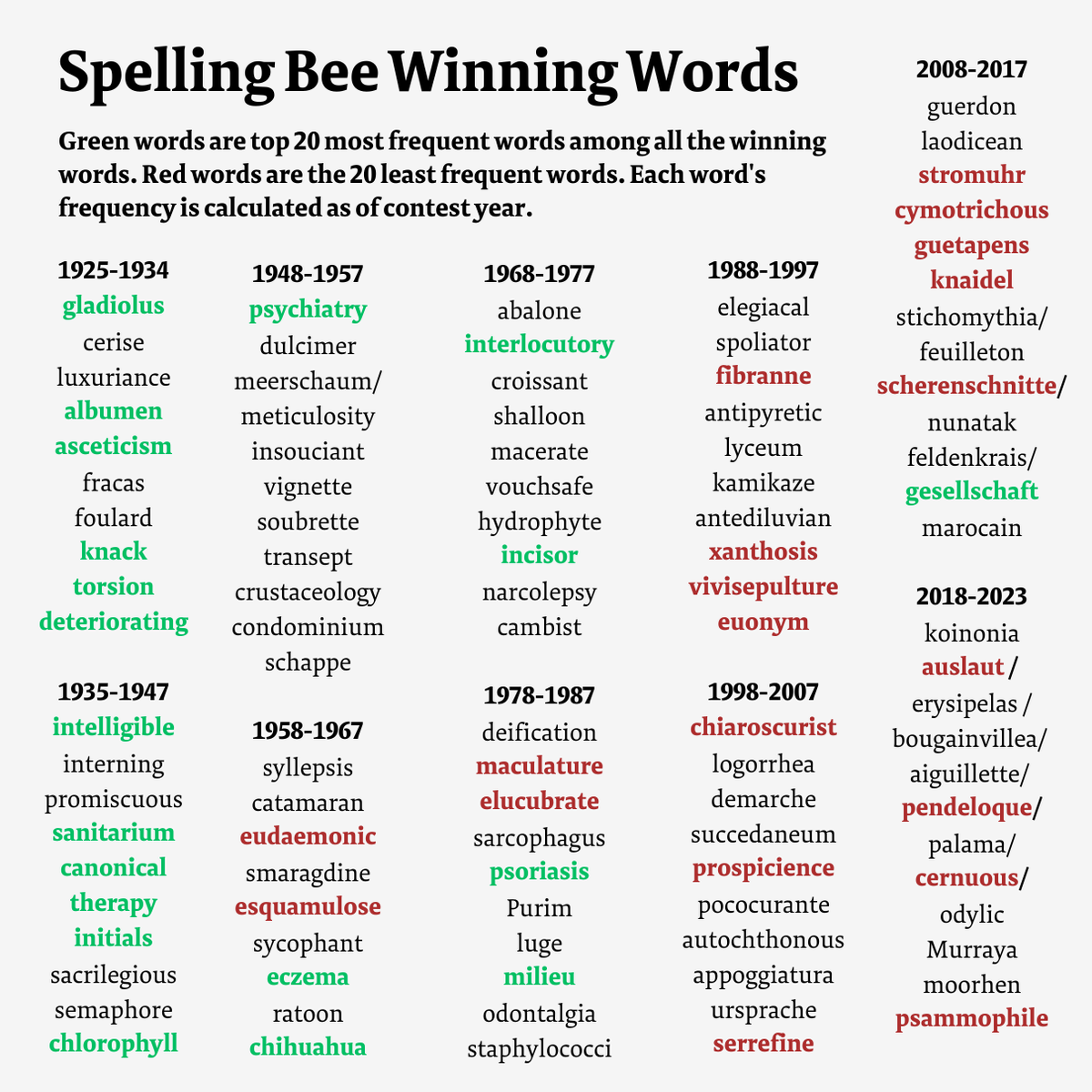

Nyt Spelling Bee February 10 2025 Complete Guide To Solving

Apr 29, 2025

Nyt Spelling Bee February 10 2025 Complete Guide To Solving

Apr 29, 2025