Corporate Earnings: The Solid Present And Uncertain Future

Table of Contents

Corporate earnings represent the profit a company makes after deducting all expenses from its revenue. They're a vital indicator of a company's financial health, influencing stock prices, investment decisions, and the overall economic outlook. Strong corporate earnings generally signal a healthy economy, while declining earnings often foreshadow economic slowdowns. This article will explore the current robust performance and analyze the factors contributing to the uncertainty surrounding future corporate earnings.

The Strong Present: Analyzing Current Corporate Earnings Performance

The current corporate earnings landscape presents a mixed bag. While some sectors are thriving, others face headwinds.

Record Profits in Key Sectors

Several key sectors are experiencing impressive growth, driving overall positive corporate earnings figures.

- Technology: Companies like Acme Corp and BetaTech have exceeded expectations, driven by strong demand for AI-related products and services. Their strong revenue growth and high profit margins are contributing significantly to overall positive corporate earnings. Acme Corp reported a 25% increase in earnings per share (EPS), while BetaTech saw a 15% surge.

- Energy: The energy sector has benefitted from increased global demand and higher commodity prices, leading to substantial profit increases. Gamma Energy's Q3 earnings report showed a remarkable 30% jump in EPS, fueled by robust oil and gas production.

- Healthcare: The pharmaceutical and biotechnology sub-sectors continue to perform well, driven by new drug launches and increased demand for healthcare services.

These examples highlight the strong sector-specific performance contributing to the positive overall picture of corporate earnings. However, this strong performance needs to be seen within the context of the broader economic picture.

Positive Economic Indicators Supporting Current Earnings

Several positive macroeconomic factors underpin the current robust corporate earnings:

- Low Unemployment Rate: A low unemployment rate indicates a strong labor market, boosting consumer spending and driving demand for goods and services.

- Robust Consumer Spending: Increased consumer confidence translates into higher consumer spending, fueling demand and consequently, corporate revenue.

- Government Stimulus: In some regions, continued government spending programs are stimulating economic activity and contributing to corporate growth. For instance, investment in infrastructure projects supports related industries.

These factors, reflected in positive GDP growth and a relatively high consumer confidence index, currently contribute to strong corporate earnings. However, several challenges lie ahead that could significantly alter this positive trend.

Clouds on the Horizon: Factors Contributing to Future Uncertainty

Despite the strong present, several significant factors cast doubt on the sustainability of current corporate earnings.

Global Economic Slowdown

The risk of a global economic slowdown or even a recession looms large. Several factors contribute to this concern:

- Geopolitical Risks: Ongoing geopolitical instability creates uncertainty and disrupts supply chains, negatively impacting corporate earnings.

- Inflationary Pressures: Persistent inflation increases production costs and reduces consumer purchasing power, dampening demand and profit margins.

- Interest Rate Hikes: Central banks' efforts to combat inflation through interest rate hikes increase borrowing costs for companies, hindering investment and expansion.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks continue to impact production and increase costs for many businesses.

Rising Interest Rates and Their Impact on Corporate Debt

Rising interest rates significantly impact corporate profitability. Increased borrowing costs affect:

- Investment Decisions: Companies may postpone or cancel expansion projects due to higher borrowing costs.

- Debt Servicing: Higher interest payments reduce profitability and potentially strain company finances, increasing the risk of defaults.

- Financial Risk: Increased debt burdens increase financial risk and limit companies' ability to invest in innovation and growth.

Geopolitical Instability and Supply Chain Vulnerabilities

Geopolitical events create significant uncertainty and disrupt supply chains.

- Global Conflicts: Ongoing conflicts increase commodity prices, disrupt trade routes, and negatively impact businesses operating in affected regions.

- Political Instability: Uncertain political climates in various regions increase risk and reduce business confidence, impacting investments and growth.

- Risk Management: Companies need robust risk management strategies to mitigate the impacts of geopolitical events and supply chain disruptions.

Conclusion: Navigating the Future of Corporate Earnings

In conclusion, while current corporate earnings show strength in key sectors, supported by positive macroeconomic indicators, significant uncertainties cloud the future. Rising interest rates, geopolitical instability, and the potential for a global economic slowdown pose considerable challenges. Understanding corporate earnings requires a careful consideration of both present performance and future risks.

Key Takeaways: Investors and businesses must carefully consider the interplay between robust current performance and the looming economic uncertainties. Analyzing future corporate earnings necessitates a thorough assessment of these factors, and the development of robust risk mitigation strategies is crucial.

Call to Action: To effectively navigate the complexities of the corporate earnings landscape, actively research and analyze corporate earnings reports, stay updated on macroeconomic trends, and develop comprehensive risk management strategies for mitigating the challenges ahead. Understanding corporate earnings, analyzing future corporate earnings, and managing corporate earnings risk are essential for long-term success in this volatile environment.

Featured Posts

-

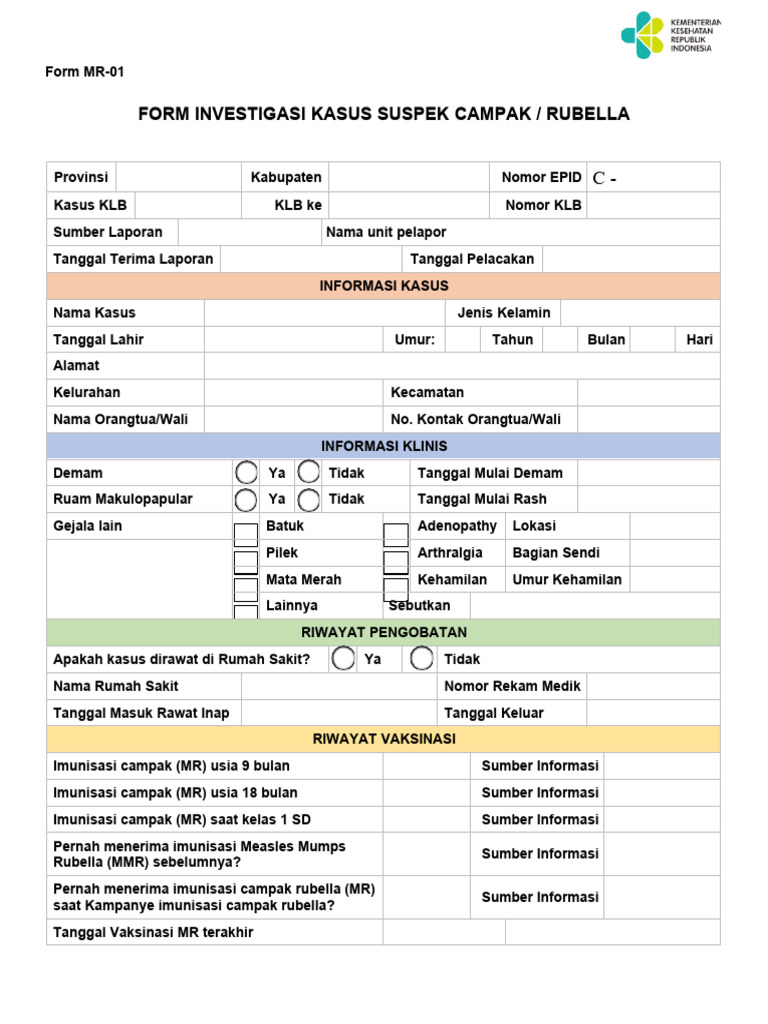

Kasus Suspek Campak Di Pohuwato Meningkat Dinkes Gorontalo Soroti Rendahnya Imunisasi Anak

May 30, 2025

Kasus Suspek Campak Di Pohuwato Meningkat Dinkes Gorontalo Soroti Rendahnya Imunisasi Anak

May 30, 2025 -

Ticketmaster Aclara Sus Precios De Boletos Lo Que Necesitas Saber

May 30, 2025

Ticketmaster Aclara Sus Precios De Boletos Lo Que Necesitas Saber

May 30, 2025 -

Glasgow Hampden Park Metallica Announces World Tour Stop

May 30, 2025

Glasgow Hampden Park Metallica Announces World Tour Stop

May 30, 2025 -

Mobilite Durable Le Renforcement De La Cooperation Franco Vietnamienne

May 30, 2025

Mobilite Durable Le Renforcement De La Cooperation Franco Vietnamienne

May 30, 2025 -

Success Breeds Success Honda Motorcycles And Champion Riders

May 30, 2025

Success Breeds Success Honda Motorcycles And Champion Riders

May 30, 2025