Corporate Earnings Strength: A Temporary Trend? Expert Analysis

Table of Contents

Factors Contributing to Current Corporate Earnings Strength

Several interconnected factors have contributed to the unexpected strength in corporate earnings. Understanding these drivers is crucial for assessing the sustainability of this trend.

Post-Pandemic Demand and Supply Chain Recovery

The lingering effects of pent-up demand from the pandemic continue to fuel robust corporate earnings. Simultaneously, improvements in supply chain efficiency, albeit still fragile in some sectors, have lessened production bottlenecks and increased profitability.

- Automotive sector recovery: The automotive industry, hampered by chip shortages in previous years, has seen a significant rebound in production and sales, boosting earnings.

- Technology sector sustained growth: The technology sector, a key driver of economic growth, continues to demonstrate strong earnings, fueled by ongoing digital transformation and cloud computing adoption.

- Increased consumer spending in certain sectors: Consumer spending, particularly in areas like travel and leisure, has remained resilient, contributing to higher earnings for businesses in these sectors. However, this is showing signs of weakening.

Strategic Pricing and Cost-Cutting Measures

Many companies have effectively managed inflationary pressures through strategic pricing adjustments and aggressive cost-cutting initiatives. This proactive approach has helped to protect profit margins despite rising input costs.

- Increased automation leading to reduced labor costs: Automation and process optimization have played a significant role in reducing operational expenses for numerous companies.

- Supply chain diversification to reduce reliance on single sources: Businesses have diversified their supply chains to mitigate risks associated with geopolitical instability and supplier disruptions.

- Examples of successful cost-cutting: Companies like [insert example of a company that implemented successful cost-cutting measures] have demonstrated the effectiveness of these strategies in maintaining profitability.

Government Stimulus and Fiscal Policies

Government stimulus packages and fiscal policies implemented in response to the pandemic have played a role in supporting corporate profits. These measures, while beneficial in the short-term, have also raised concerns about potential long-term inflationary pressures. The impact of future policy changes, including potential interest rate hikes and reduced government spending, remains to be seen.

Potential Risks and Threats to Sustained Corporate Earnings Strength

While current corporate earnings strength is undeniable, several significant risks could undermine its sustainability.

Inflationary Pressures and Rising Interest Rates

Persistent inflation and rising interest rates pose a considerable threat to corporate earnings. Higher interest rates increase borrowing costs for businesses, potentially impacting investment decisions and slowing economic growth, thereby reducing consumer demand. This pressure could squeeze profit margins and ultimately decrease corporate earnings.

Geopolitical Uncertainty and Supply Chain Volatility

Ongoing geopolitical tensions and the resulting supply chain volatility continue to be a significant concern. Unexpected disruptions, such as the war in Ukraine, can significantly impact production, increase input costs, and reduce corporate profitability. The potential for further disruptions remains a key risk factor.

Recessionary Risks and Economic Slowdown

The probability of an economic recession is a major factor impacting the long-term outlook for corporate earnings. A recession would likely lead to reduced consumer spending and decreased business investment, negatively affecting corporate profitability across various sectors. Sectors highly sensitive to economic downturns, such as the automotive and housing industries, are particularly vulnerable.

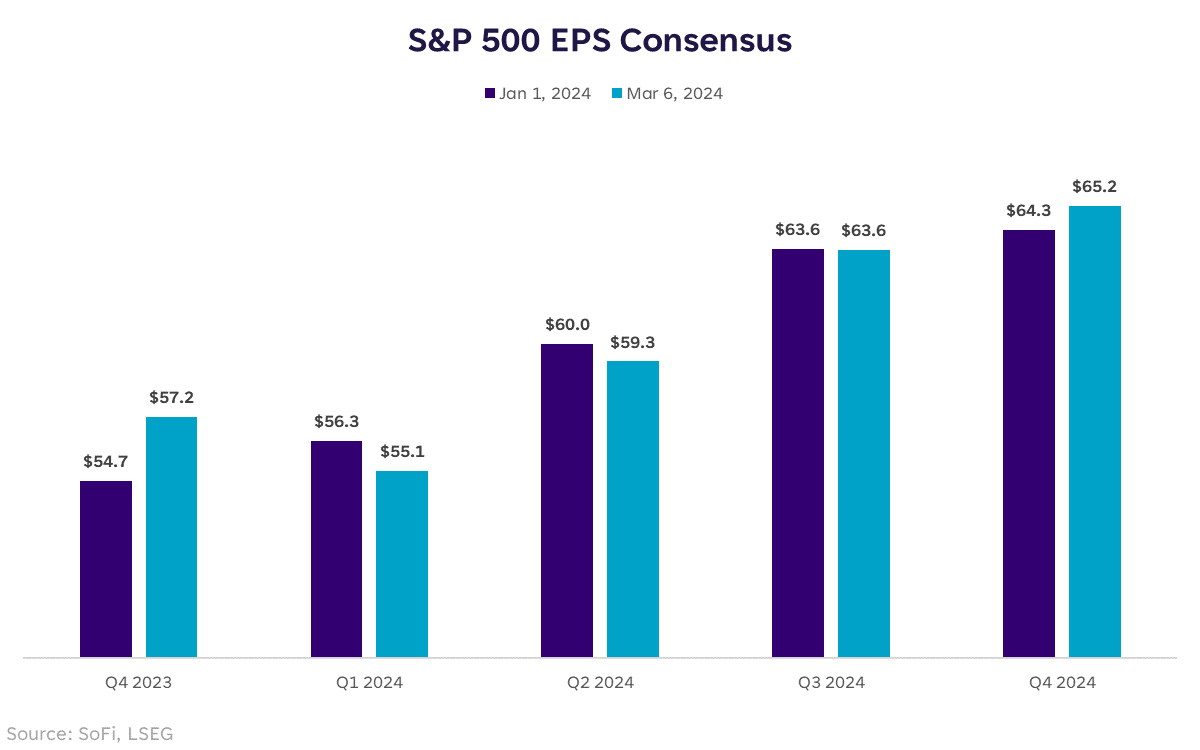

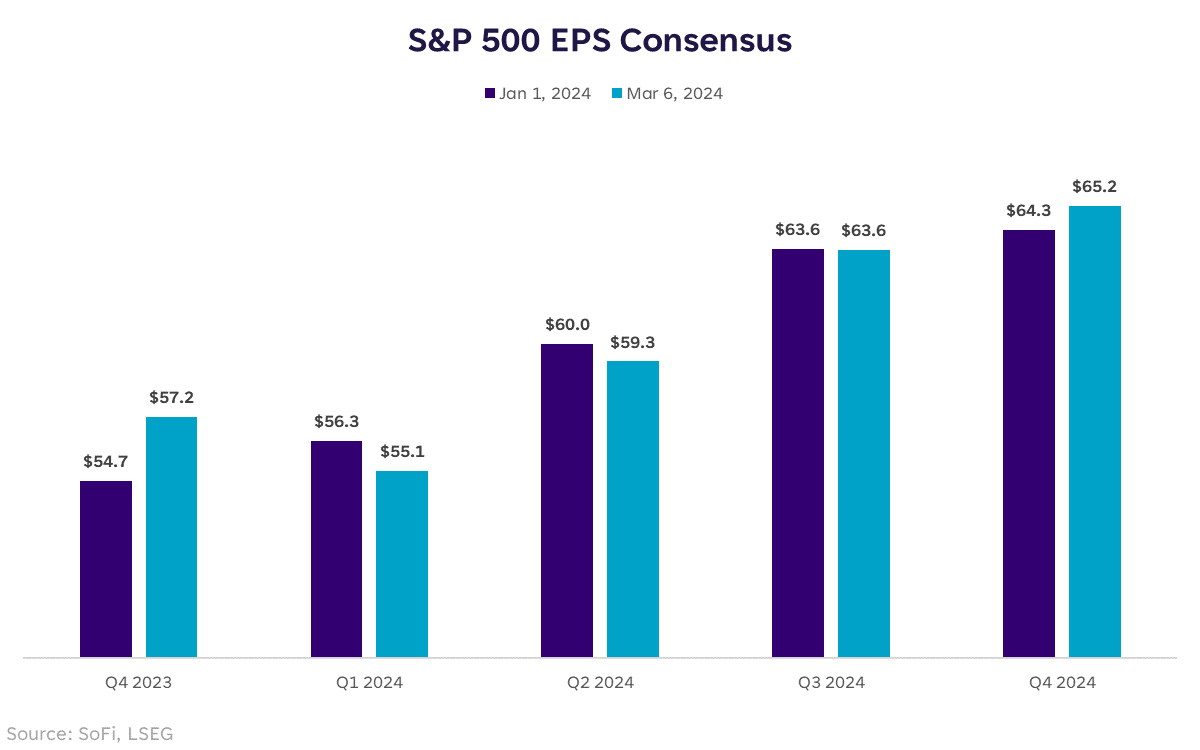

Expert Opinions and Predictions on the Future of Corporate Earnings

Financial analysts hold diverse views on the future of corporate earnings strength. Some remain optimistic, citing the resilience of consumer spending and the ongoing recovery in certain sectors. Others express caution, highlighting the risks associated with inflation, rising interest rates, and potential recessionary pressures. Many analysts predict a moderation in corporate earnings growth in the coming quarters, though the extent of this slowdown remains uncertain. A consensus forecast isn't yet clear.

Conclusion: Assessing the Long-Term Outlook for Corporate Earnings Strength

In conclusion, while several factors have contributed to the current strength in corporate earnings, the sustainability of this trend is far from guaranteed. Inflationary pressures, rising interest rates, geopolitical uncertainty, and the risk of a recession present significant headwinds. While short-term corporate earnings strength remains a reality, the long-term outlook remains uncertain and requires careful monitoring. Is the current corporate earnings strength sustainable? Based on the analysis, the answer is cautiously pessimistic. While the near term looks reasonably positive, significant headwinds threaten long-term growth.

Stay informed about the evolving landscape of corporate earnings. Subscribe to our newsletter for regular updates and expert analysis on corporate earnings strength and its implications for investors and the broader economy.

Featured Posts

-

Oi Kalyteres Tileoptikes Metadoseis Gia To Pasxa E Thessalia Gr

May 30, 2025

Oi Kalyteres Tileoptikes Metadoseis Gia To Pasxa E Thessalia Gr

May 30, 2025 -

Gorillaz 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025 -

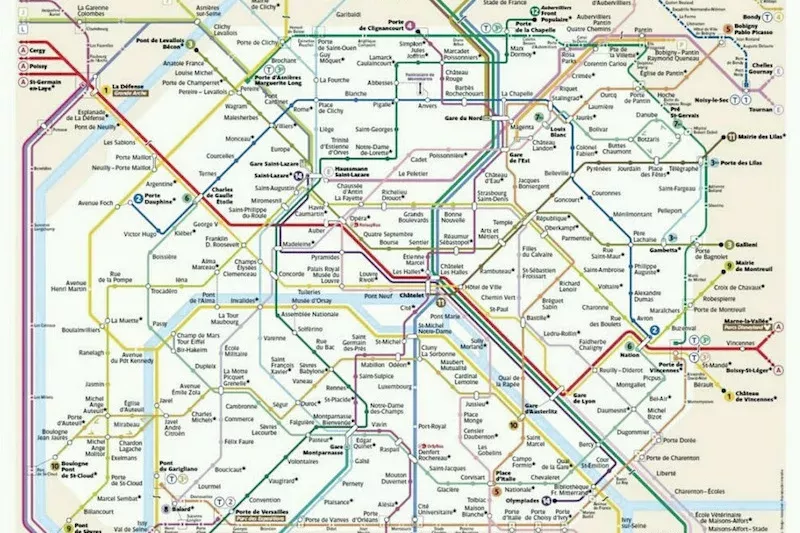

Paris Neighborhood Guide Expert Recommendations

May 30, 2025

Paris Neighborhood Guide Expert Recommendations

May 30, 2025 -

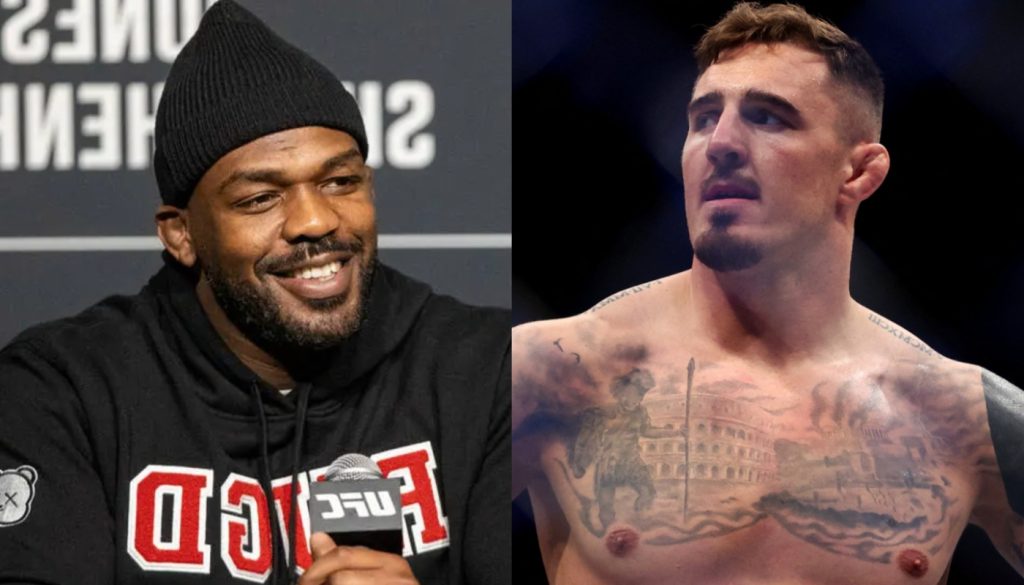

Jones Vs Aspinall Heated Exchange Highlights Ufcs Ongoing Drama

May 30, 2025

Jones Vs Aspinall Heated Exchange Highlights Ufcs Ongoing Drama

May 30, 2025 -

Cts Eventim Q1 Adjusted Ebitda And Revenue Growth

May 30, 2025

Cts Eventim Q1 Adjusted Ebitda And Revenue Growth

May 30, 2025