CoreWeave Stock: What's Happening Now?

Table of Contents

CoreWeave's Business Model and Market Position

CoreWeave operates in the rapidly expanding market of GPU cloud computing, providing high-performance computing (HPC) resources specifically tailored for artificial intelligence (AI) workloads. Its unique selling proposition (USP) lies in its ability to offer scalable, cost-effective, and sustainable AI infrastructure solutions. This is achieved through a sophisticated data center infrastructure built upon repurposed gaming GPUs, resulting in a more environmentally friendly and financially efficient operation compared to traditional methods.

- Target Market: CoreWeave caters to a diverse range of clients, including AI developers, researchers in academia and industry, and businesses deploying AI-powered applications. This broad market reach provides strong potential for growth.

- Technological Advancements and Partnerships: CoreWeave boasts cutting-edge technology and has forged strategic partnerships to further enhance its offerings. These partnerships ensure access to leading software and hardware, allowing them to stay ahead of the curve in the competitive GPU cloud computing landscape.

- Market Share and Growth Potential: While not yet a market leader, CoreWeave is aggressively pursuing market share in the rapidly expanding AI infrastructure sector. Its innovative approach and strategic positioning offer considerable growth potential, especially given the increasing demand for powerful computing resources fueled by the AI boom. However, competition from giants like AWS, Google Cloud, and Microsoft Azure remains a significant factor.

- Recent Strategic Partnerships or Acquisitions: Keeping a close eye on CoreWeave's announcements regarding new partnerships and acquisitions is vital, as these moves significantly impact its market positioning and future prospects. Such information often significantly influences investor sentiment and the stock price.

Recent Financial Performance and Future Outlook

Analyzing CoreWeave's financial performance requires accessing publicly available information, such as financial statements and investor reports. Key metrics to monitor include revenue growth, profitability (profit margin), and cash flow. Significant revenue increases in recent quarters suggest strong demand for its services. However, achieving profitability and sustainable cash flow remain critical factors to assess the long-term viability and financial health of the company.

- Recent Financial Reports or Announcements: Regularly checking for press releases and financial reports provides insights into CoreWeave's financial standing. These reports will offer valuable data to support investment decisions.

- Financial Projections and Growth Expectations: CoreWeave's growth projections are crucial. Understanding management's expectations and comparing them to industry benchmarks helps assess the company's realistic growth trajectory.

- Risks and Challenges: Even with positive growth, CoreWeave faces inherent risks, such as maintaining its technological edge, securing sufficient capital for expansion, and managing competitive pressures.

- Analyst Ratings and Price Targets: Following analyst ratings and price targets from reputable financial institutions can provide an external perspective on the company's value and potential for future price appreciation.

Factors Influencing CoreWeave Stock Price

Numerous factors influence CoreWeave's stock price, making it vital to understand the broader market context and specific events impacting the company.

- Market Volatility and Investor Sentiment: The tech sector's volatility significantly impacts CoreWeave's stock. Broader market trends, investor sentiment, and overall economic conditions heavily influence investor decisions.

- News Related to AI Development and Adoption: Positive news regarding AI development and adoption generally boosts sentiment towards AI infrastructure companies like CoreWeave, positively affecting its stock price. Conversely, negative news can have a detrimental effect.

- Competitive Pressures: The intense competition from established cloud providers puts constant pressure on CoreWeave's pricing and market share.

- Regulatory Changes: New regulations related to data privacy, cybersecurity, or cloud computing could significantly impact CoreWeave's operations and profitability, influencing the stock price.

Risks Associated with Investing in CoreWeave Stock

Investing in CoreWeave, or any stock, carries inherent risks. It's crucial to acknowledge these before committing any capital.

- Market Risk: The inherent volatility of the tech market exposes CoreWeave's stock to significant price swings. This risk cannot be eliminated entirely.

- Financial Risk: CoreWeave's financial performance is subject to fluctuations, impacting investor confidence and the stock price. Potential financial instability needs careful scrutiny.

- Technology Risk: The rapid pace of technological advancements poses a risk. CoreWeave's technology might become outdated, rendering it less competitive.

- Competitive Risk: The fierce competition from established players in the cloud computing market represents a constant threat to CoreWeave's market share and profitability.

- Regulatory Risk: Changes in regulations could negatively affect CoreWeave's business model and operations.

Conclusion

CoreWeave presents a compelling investment opportunity within the burgeoning AI infrastructure market. Its innovative business model and strategic focus position it for potential growth. However, investors must be aware of the significant risks associated with investing in a relatively new company operating in a highly competitive and volatile sector. Thorough research, including careful analysis of financial reports, market trends, and competitive landscapes, is paramount.

Call to Action: Stay informed about CoreWeave stock and the ever-evolving AI infrastructure market. Consult with a financial advisor before making any investment decisions. Remember to conduct your own thorough due diligence before investing in CoreWeave stock or any other security.

Featured Posts

-

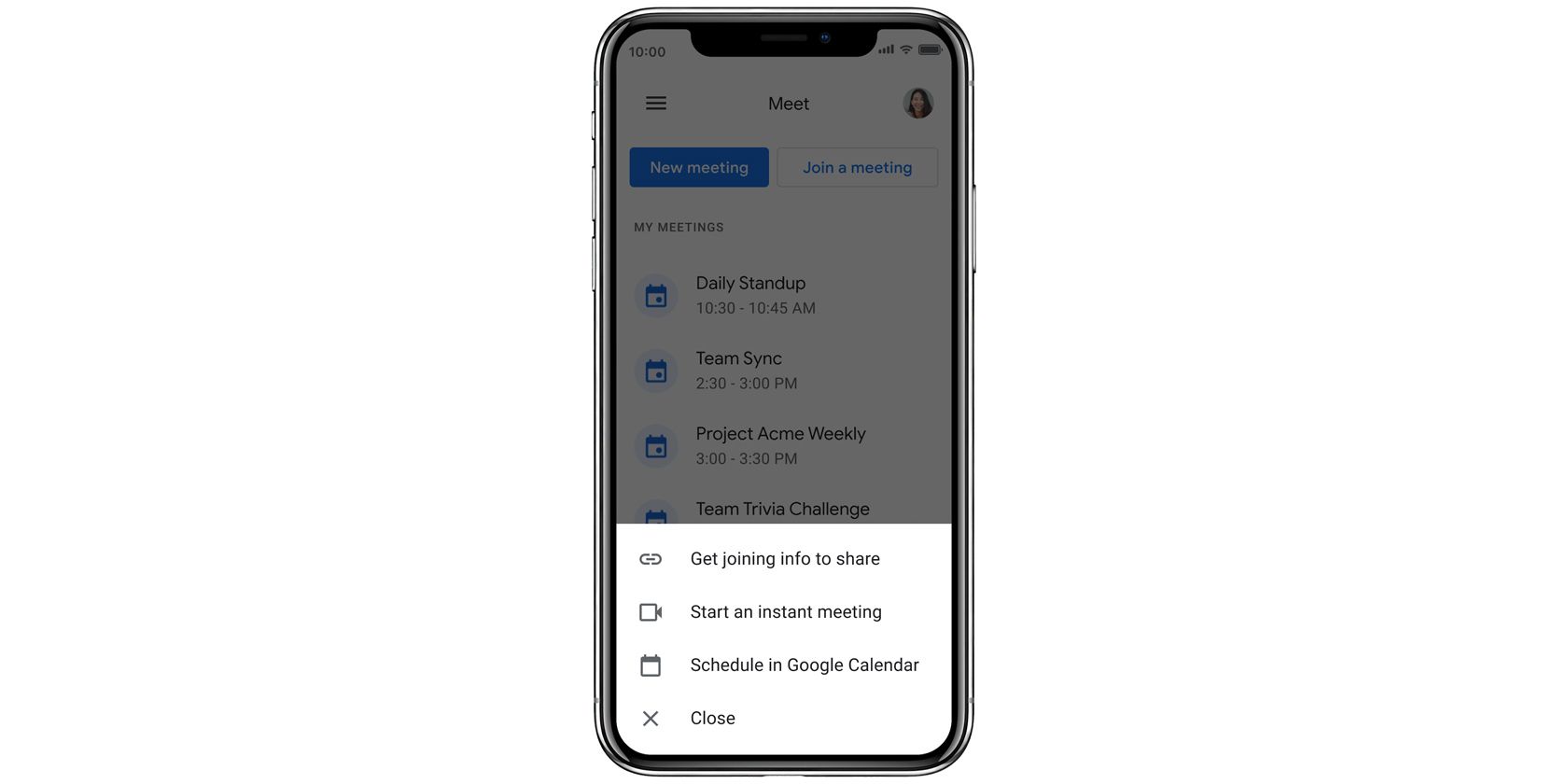

Googles Updates To Enhance Virtual Meetings

May 22, 2025

Googles Updates To Enhance Virtual Meetings

May 22, 2025 -

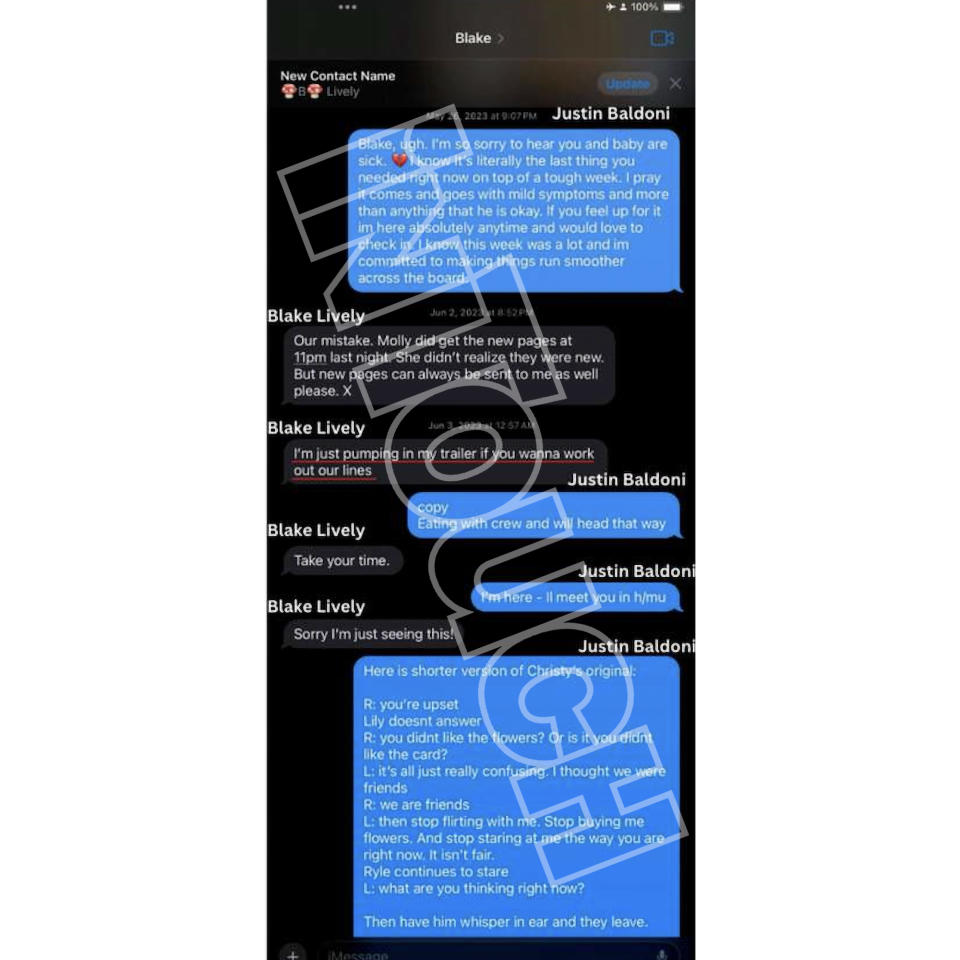

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025 -

Blake Lively Alleged Controversies And News Bored Panda

May 22, 2025

Blake Lively Alleged Controversies And News Bored Panda

May 22, 2025 -

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 22, 2025

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 22, 2025 -

Peppa Pigs Mum Announces Babys Gender Fans React

May 22, 2025

Peppa Pigs Mum Announces Babys Gender Fans React

May 22, 2025

Latest Posts

-

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025 -

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025 -

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025 -

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025