CoreWeave Stock Performance: A Current Analysis

Table of Contents

The cloud computing market is exploding, a dynamic landscape fueled by the insatiable demand for processing power. Within this rapidly evolving sector, CoreWeave has carved a prominent niche. This article aims to analyze CoreWeave stock performance, providing insights into its current standing and potential future trends. We'll examine its business model, financial health, and the factors influencing its stock price to offer a comprehensive understanding of CoreWeave stock performance.

CoreWeave's Business Model and Competitive Landscape

CoreWeave's Value Proposition

CoreWeave differentiates itself through its focus on GPU-accelerated cloud computing, a crucial element for applications like AI, machine learning, and high-performance computing. This specialization provides a strong value proposition, targeting a specific segment within the broader cloud market. Their commitment to sustainability, utilizing renewable energy sources for their data centers, also sets them apart from competitors like AWS, Google Cloud, and Azure who are increasingly focusing on this area, but may not have the same level of commitment.

- Specific examples of CoreWeave's competitive advantages: Superior performance for GPU-intensive workloads, competitive pricing strategies, and a strong focus on customer support and tailored solutions.

- Analysis of their target market and market share: CoreWeave primarily targets businesses and researchers with high-performance computing needs, securing a growing share within this lucrative niche. Precise market share data is often proprietary but their aggressive growth suggests a significant uptake.

- Mention key partnerships and collaborations: Strategic partnerships with hardware providers and software developers expand their capabilities and market reach, further solidifying their position.

Financial Performance and Key Metrics

Revenue Growth and Profitability

While CoreWeave is a privately held company, (and therefore detailed financial information isn't publicly available), its significant funding rounds indicate substantial investor confidence and strong revenue growth. News reports suggest impressive year-over-year revenue increases, though specific figures remain undisclosed due to their private status. Analysis of their funding rounds suggests a healthy financial standing and expectation of strong future revenue streams.

- Specific financial data (e.g., year-over-year revenue growth, net income, etc.): While precise figures are unavailable publicly, press releases and industry analyses suggest significant growth. Further information would be needed for a deeper quantitative analysis.

- Comparison to competitors' financial performance (if possible): A direct comparison is difficult without access to CoreWeave's private financial data. However, indirect comparisons can be made through industry benchmarks and growth rates of publicly traded competitors in the GPU-accelerated cloud computing space.

- Discussion of any significant financial events (e.g., funding rounds, acquisitions): Large funding rounds signal investor confidence and provide capital for expansion and innovation, key drivers of positive CoreWeave stock performance (were it publicly traded).

Factors Influencing CoreWeave Stock Performance

Market Sentiment and Investor Confidence

While CoreWeave's stock is not publicly traded, investor sentiment in the private market is crucial. Positive news, such as successful product launches or strategic partnerships, would likely boost investor confidence and increase valuation in any future IPO. Conversely, negative news, or broader market downturns, could impact investor perception and valuation.

- Analysis of analyst ratings and price targets: While there are no public ratings for a non-public company, private equity valuations and funding rounds can provide insights into investor sentiment and perceived value.

- Discussion of any significant news events affecting the company (e.g., product launches, regulatory changes): Significant new product releases or large partnerships would influence investor perception. Regulatory changes affecting the cloud computing industry would have an indirect impact.

- Mention broader macroeconomic factors impacting the tech sector: Overall economic conditions and investor sentiment toward the tech sector significantly influence investor appetite for cloud computing companies, impacting CoreWeave's potential valuation in any future market entry.

Future Outlook and Predictions for CoreWeave Stock

Growth Potential and Risks

CoreWeave's growth potential is substantial, given the increasing demand for GPU-accelerated computing. Expansion into new markets and product lines further enhances their future prospects. However, risks remain, including intense competition from established players and potential economic downturns that could impact spending on cloud services.

- Predictions about future revenue growth and profitability: While concrete predictions are speculative, the company's trajectory suggests strong future revenue growth, potentially driven by continued adoption of their services. Profitability will depend on factors like operational efficiency and managing competition.

- Discussion of potential expansion into new markets or product lines: CoreWeave may explore new applications of its GPU-powered platform, expanding into adjacent markets or developing specialized services to further differentiate itself.

- Analysis of potential risks, such as competition, economic downturn, or technological disruption: Competition from established cloud providers and potential shifts in technology represent key risks. Economic downturns could reduce client spending, impacting CoreWeave’s growth.

Conclusion

Analyzing CoreWeave stock performance, even in its pre-public stage, reveals a company with a strong value proposition in a rapidly growing market. While precise financial data remains unavailable publicly, available information points towards robust growth, substantial investor confidence, and significant future potential. However, navigating the competitive landscape and responding to broader economic conditions will be crucial to sustained success. Continue to track CoreWeave stock performance, should it become publicly traded, for future investment opportunities. Stay updated on the latest CoreWeave stock analysis to make informed investment decisions, and monitor news sources for updates as the company develops.

Featured Posts

-

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025 -

Blake Lively And Taylor Swift Subpoena Report Fuels Friendship Strain Speculation

May 22, 2025

Blake Lively And Taylor Swift Subpoena Report Fuels Friendship Strain Speculation

May 22, 2025 -

Wordle Help Nyt April 8th Puzzle 1389 Solution And Clues

May 22, 2025

Wordle Help Nyt April 8th Puzzle 1389 Solution And Clues

May 22, 2025 -

Grocery Prices Soar Inflations Latest Victim

May 22, 2025

Grocery Prices Soar Inflations Latest Victim

May 22, 2025 -

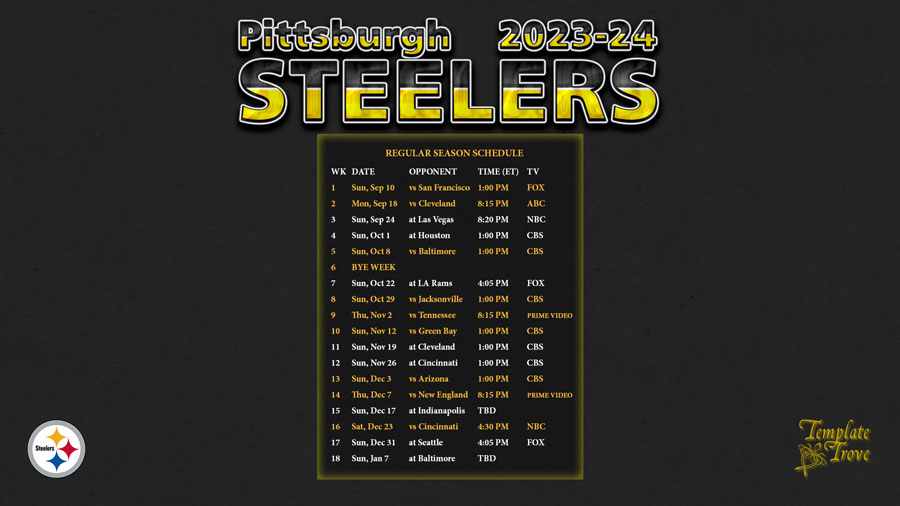

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025

Latest Posts

-

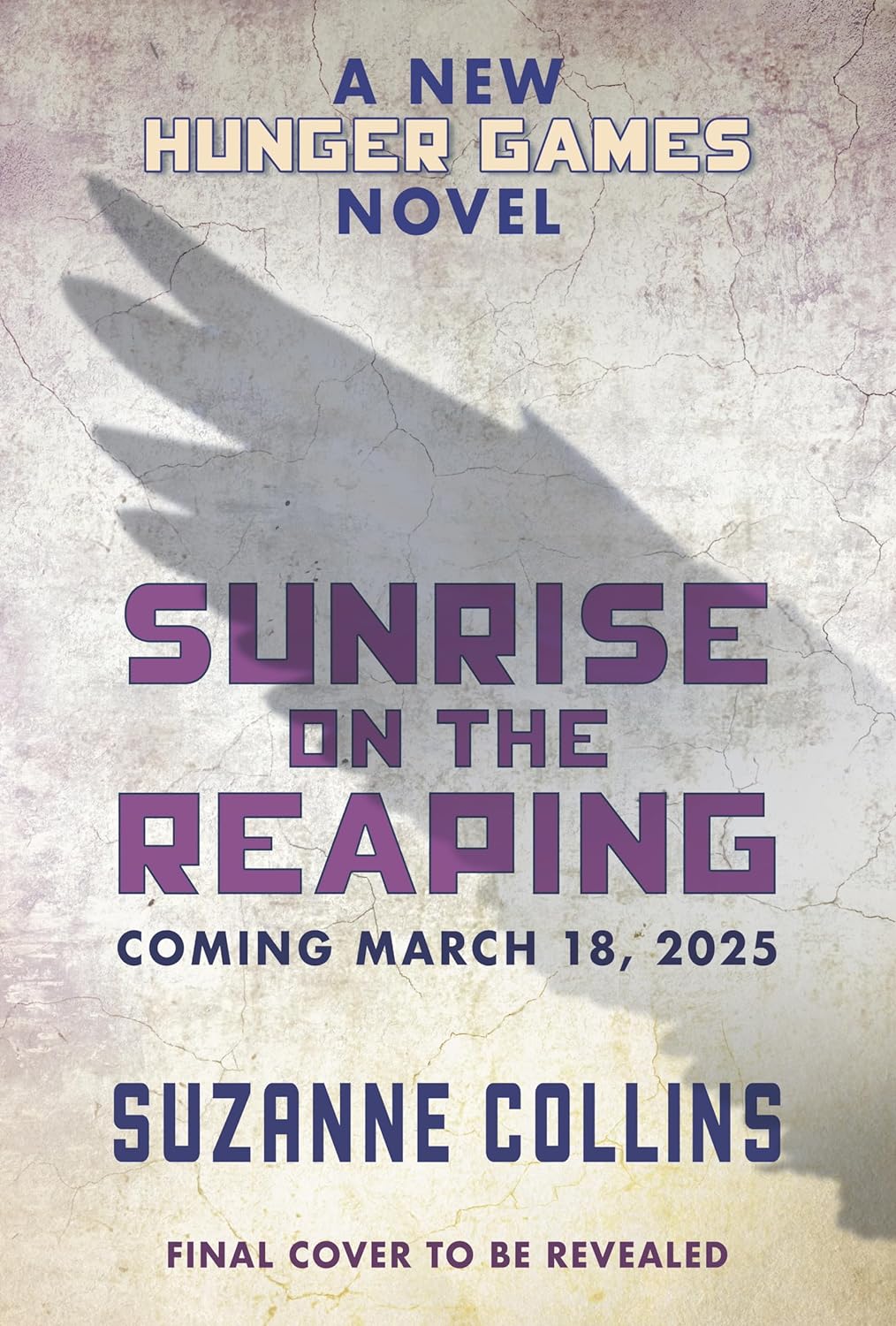

The Hunger Games Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025

The Hunger Games Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025 -

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025 -

2018

May 23, 2025

2018

May 23, 2025 -

Hollywood Legends Complete Story Debut Film And Oscar Win Streaming On Disney

May 23, 2025

Hollywood Legends Complete Story Debut Film And Oscar Win Streaming On Disney

May 23, 2025 -

A Hollywood Legends Oscar Winning Role And Early Film Debut Only On Disney

May 23, 2025

A Hollywood Legends Oscar Winning Role And Early Film Debut Only On Disney

May 23, 2025