CoreWeave Inc. (CRWV) Stock's Tuesday Decline: A Comprehensive Overview

Table of Contents

Analyzing the Market Conditions on Tuesday

Tuesday's market presented a complex backdrop for CoreWeave's (CRWV) decline. It's crucial to assess whether broader market trends influenced the CRWV stock price or if company-specific factors were the primary driver. We need to look at the overall market sentiment and the performance of similar companies.

- Overall market performance on Tuesday: The broader market experienced a [insert actual market performance data for Tuesday, e.g., slight downturn, significant sell-off, etc.]. This provides context – was it a sector-specific issue, or part of a wider trend?

- Performance of other cloud computing stocks: A comparison with other cloud computing stocks like [mention a few comparable companies] on Tuesday is essential. Did they also experience declines, suggesting a sector-wide correction? This helps determine whether the CRWV drop was isolated or part of a broader trend within the cloud computing sector.

- Impact of broader economic factors: Were there any significant economic news releases, such as interest rate hikes or inflation reports, that could have negatively impacted investor sentiment toward tech stocks, including CRWV? Considering macroeconomic factors is crucial for a complete analysis.

Assessing CoreWeave's (CRWV) Specific Factors

While market conditions play a role, it's equally important to examine CoreWeave-specific factors that might have contributed to the Tuesday decline.

- Any news releases or announcements from CoreWeave: Did CoreWeave release any earnings reports, updates, or guidance on or before Tuesday that might have disappointed investors? Any negative news, even if seemingly minor, can significantly affect stock prices.

- Analyst ratings and changes in ratings: A sudden shift in analyst ratings could significantly impact investor confidence. Did any major investment banks downgrade their outlook for CRWV?

- Investor sentiment analysis: Understanding investor sentiment is crucial. Were there any significant changes in investor sentiment concerning CoreWeave's future prospects? Were there concerns about increased competition, slower-than-expected growth, or other challenges impacting the company's long-term vision?

The Role of Short Selling and Market Speculation

Short selling and market speculation can amplify negative trends. Let's examine their potential influence on the CRWV stock price.

- Short interest data for CRWV: High short interest suggests a significant number of investors betting against the stock. Checking the short interest data for CRWV before and after the decline can shed light on whether short selling contributed to the price drop.

- Analysis of social media sentiment regarding CRWV: Social media platforms can be a barometer of investor sentiment. Analyzing social media discussions about CRWV can provide insights into potential narratives driving the stock's decline.

- Potential impact of algorithmic trading: High-frequency algorithmic trading can exacerbate price swings. It's worth considering the potential role of algorithmic trading in the CRWV price drop.

Technical Analysis of the CRWV Stock Chart

A technical analysis of the CRWV stock chart can provide further insight into the decline.

- Key chart patterns observed: Were there any identifiable chart patterns (e.g., head and shoulders, bearish engulfing patterns) that preceded the drop, suggesting a potential technical sell-off?

- Support and resistance levels breached: Did the CRWV stock price break through key support levels, indicating a potential weakening of the underlying price trend?

- Trading volume analysis: Did the decline correlate with unusually high trading volume, suggesting a strong sell-off? Analyzing trading volume provides context on the intensity of the price movement. [Insert relevant chart here if possible]

Conclusion: Understanding and Navigating the CoreWeave (CRWV) Stock Decline

CoreWeave's (CRWV) Tuesday decline resulted from a combination of factors. Broader market conditions, company-specific news (or lack thereof), increased short selling, and technical chart patterns likely contributed to the price drop. While the short-term implications are uncertain, investors need to carefully analyze both short-term volatility and the long-term potential of CRWV. It's crucial to remember that the stock market is inherently unpredictable.

To make informed decisions, conduct thorough research. Monitor CoreWeave's stock performance closely, analyze CoreWeave's future growth potential, and understand the CoreWeave stock market fluctuations by examining the company's financial statements and future prospects. This will allow you to navigate the complexities of investing in rapidly evolving cloud computing stocks like CRWV. Remember, this article is for informational purposes only and is not financial advice.

Featured Posts

-

Vybz Kartels Message Of Support Amidst Dancehall Stars Travel Issues To Trinidad And Tobago

May 22, 2025

Vybz Kartels Message Of Support Amidst Dancehall Stars Travel Issues To Trinidad And Tobago

May 22, 2025 -

Updated Route 15 On Ramp Remains Closed After Crash

May 22, 2025

Updated Route 15 On Ramp Remains Closed After Crash

May 22, 2025 -

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Degerlendirmesi

May 22, 2025

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Degerlendirmesi

May 22, 2025 -

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025 -

The Unfolding Drama David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

The Unfolding Drama David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

Latest Posts

-

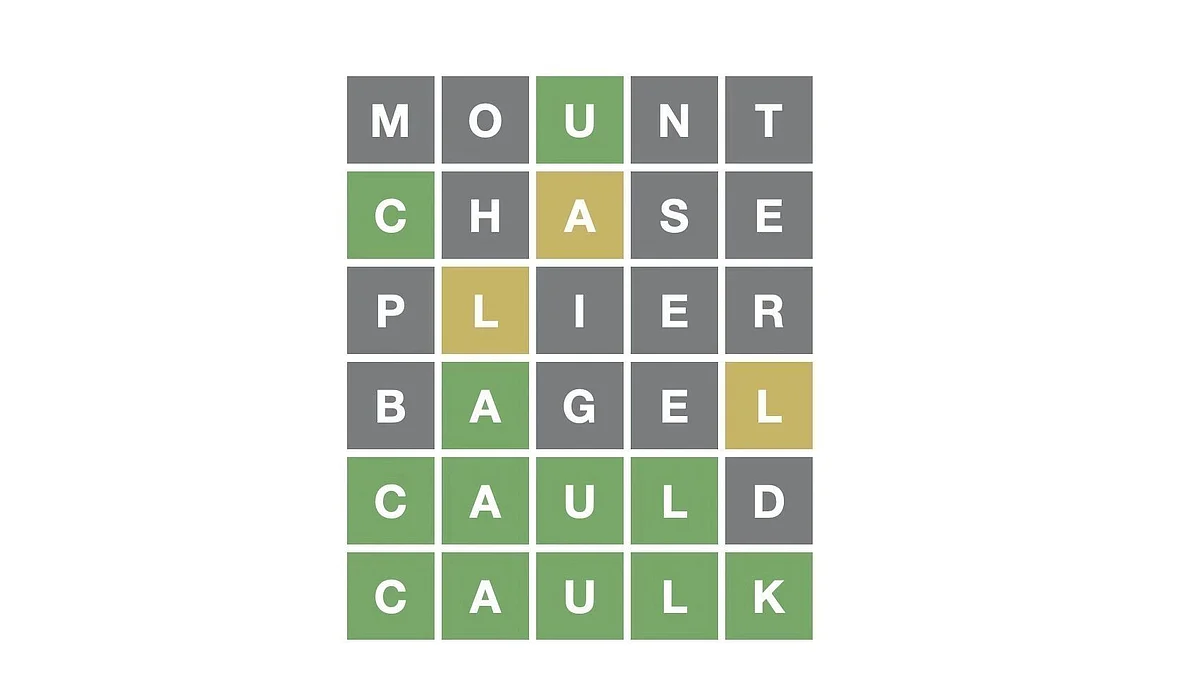

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025 -

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025 -

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025 -

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025