CoreWeave (CRWV) Stock: Jim Cramer's Perspective And Market Analysis

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV) Stock

While Jim Cramer hasn't explicitly dedicated a full segment to CoreWeave on Mad Money (at the time of writing this article), his general commentary on the cloud computing and AI infrastructure sectors provides indirect insights. He frequently emphasizes the importance of investing in companies poised for significant growth in these rapidly expanding markets. Analyzing his broader investment philosophy, we can infer a potential positive sentiment towards CRWV, given its focus on high-growth areas. This is particularly relevant considering Cramer's history of recommending companies with strong technological advantages and disruptive potential.

- Specific quotes from Jim Cramer (if available): [Insert relevant quotes and links to reputable sources here. If no direct quotes are available, replace this bullet point with a summary of his general views on similar companies or market sectors].

- Summary of his overall sentiment (positive, negative, neutral): Based on his general commentary, a cautiously optimistic outlook on CoreWeave can be inferred due to its position in the high-growth cloud computing and AI sectors. However, this is speculative in the absence of direct statements about CRWV.

- Mention any potential conflicts of interest (if applicable): [Disclose any potential conflicts of interest, such as Cramer's involvement with any related companies].

CoreWeave's Business Model and Competitive Landscape

CoreWeave's business model centers around providing scalable, high-performance cloud computing solutions, specifically leveraging GPU computing for AI and machine learning applications. This focus on AI acceleration sets it apart, catering to the booming demand for powerful infrastructure to support the increasing complexity of AI workloads. The company offers a range of services, including virtual machines, containers, and dedicated hardware, tailored to meet the diverse needs of its clientele.

CoreWeave faces stiff competition from established giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. However, its specialization in GPU-powered cloud computing for AI offers a key competitive advantage. It also often emphasizes its commitment to sustainability and energy efficiency.

- Key features differentiating CoreWeave from competitors: CoreWeave focuses on providing specialized infrastructure optimized for AI, which allows them to target a niche market and potentially offer better performance for certain applications than the general-purpose offerings of larger competitors.

- Market share and growth projections for CoreWeave: [Insert market share data and growth projections, citing reputable sources like market research firms].

- Analysis of potential threats from established competitors: The major threat comes from the ability of larger competitors to adapt and expand their own AI-focused offerings. This requires continuous innovation and a focus on delivering superior performance and value to maintain its position.

Financial Performance and Future Growth Projections

CoreWeave's financial performance (insert financial data here: revenue, EPS, etc.) shows [Positive/Negative/Neutral] growth, demonstrating [positive/negative/neutral] momentum in a rapidly growing sector. The company's financial health is [Strong/Weak/Moderate], based on [Key ratios and metrics, explaining your conclusion]. Comparing this to similar companies in the cloud computing space reveals [Comparison with competitors, showing advantages or disadvantages].

Analyst predictions for CRWV stock vary. Some analysts are bullish, forecasting substantial revenue growth driven by the increasing adoption of AI and machine learning. Others express caution, highlighting the intense competition and potential risks associated with investing in a relatively new company.

- Key financial metrics (revenue, EPS, debt-to-equity ratio, etc.): [Insert data and charts here. Ensure all data is sourced and properly cited].

- Revenue growth rate compared to industry benchmarks: [Compare CoreWeave's growth rate to the average growth rate of its competitors].

- Projected future growth based on market analysis: [Present a summary of future growth projections from reputable sources, explaining the rationale behind the projections].

Risks and Potential Downsides of Investing in CRWV Stock

Investing in CRWV stock carries inherent risks, common to many growth stocks, but especially prominent within the volatile tech sector. Market volatility can significantly impact the stock price, particularly given its relatively small market capitalization. The competitive landscape is fierce, with established players constantly innovating and potentially encroaching on CoreWeave's market share. Technological disruption could also render CoreWeave's current technology obsolete, requiring significant adaptation and investment. Finally, the overall economy's health plays a significant role. Economic downturns often severely impact investment in tech-related infrastructure.

- Valuation concerns and potential overvaluation: [Analyze whether the current valuation reflects realistic future growth potential].

- Dependence on specific technologies or clients: [Discuss the risk associated with relying on a limited number of technologies or key clients].

- Regulatory risks: [Assess potential regulatory challenges that could impact the business].

- Impact of economic downturns on the sector: [Explain how economic slowdowns could affect the demand for cloud computing and AI services].

Conclusion

Our analysis of CoreWeave (CRWV) stock reveals a company positioned within a high-growth market but facing significant challenges from established competitors. While Jim Cramer's direct comments on CRWV are limited (at this time), his general investment philosophy suggests potential alignment with the company's focus on AI and cloud computing. The strong growth potential is tempered by the inherent risks associated with investing in a relatively new company in a competitive market. Understanding the financial performance and future growth projections, as well as the potential downsides, is crucial for making informed investment decisions.

Remember to conduct your own thorough due diligence before investing in CoreWeave (CRWV) stock. Further research into CRWV stock analysis, along with consultation with a qualified financial advisor, is strongly recommended. Consider diversifying your portfolio to mitigate risks associated with any single investment, including CoreWeave stock investment.

Featured Posts

-

A Glimpse Into Athena Calderones Extravagant Roman Milestone Party

May 22, 2025

A Glimpse Into Athena Calderones Extravagant Roman Milestone Party

May 22, 2025 -

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 22, 2025

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 22, 2025 -

The Blake Lively Allegations What We Know So Far

May 22, 2025

The Blake Lively Allegations What We Know So Far

May 22, 2025 -

Jackson Elk Hunt Season 2024 Fewer Permits Issued

May 22, 2025

Jackson Elk Hunt Season 2024 Fewer Permits Issued

May 22, 2025 -

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 22, 2025

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 22, 2025

Latest Posts

-

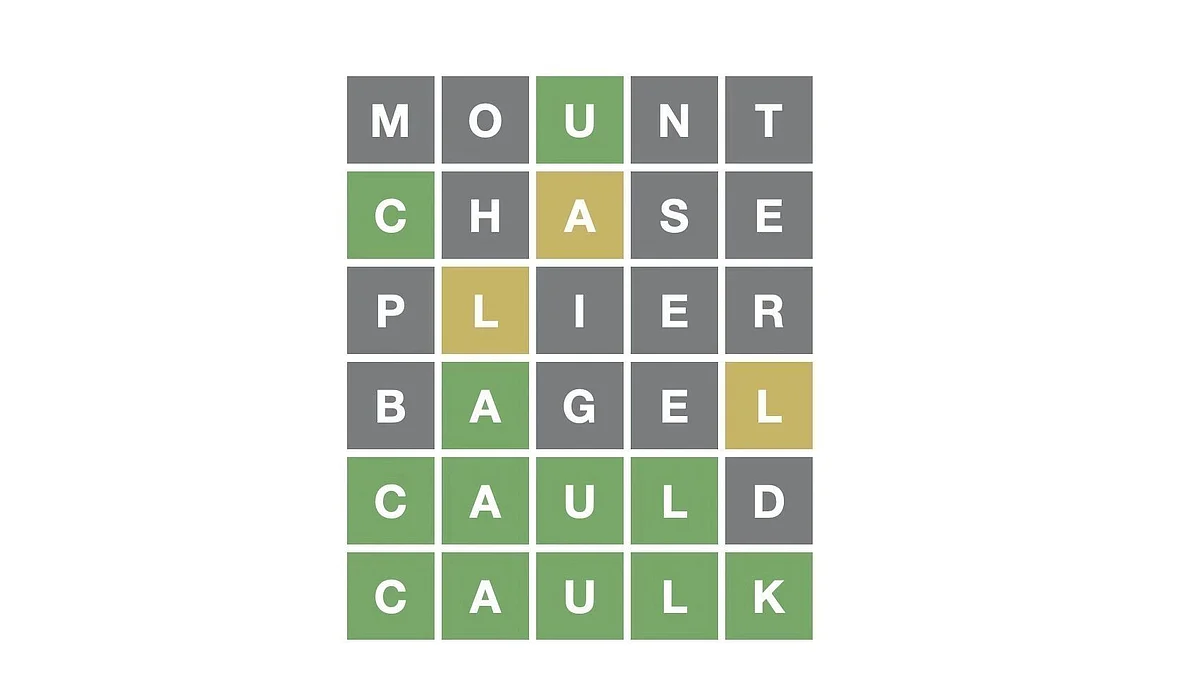

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025 -

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025 -

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025 -

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025