CoreWeave (CRWV): Jim Cramer's Controversial Pick And Its Implications For AI Infrastructure Investing

Table of Contents

Jim Cramer's CoreWeave (CRWV) Endorsement: Hype or Substance?

Jim Cramer's opinions carry significant weight, influencing the investment decisions of many. His endorsement of CoreWeave (CRWV) has undoubtedly boosted the company's visibility and potentially its stock price. But what’s the substance behind his recommendation?

Cramer often highlights CRWV's position at the forefront of the AI infrastructure boom, emphasizing its crucial role in powering the next generation of AI applications. He points to the increasing demand for GPU-powered cloud computing, a sector where CoreWeave excels.

However, it’s crucial to examine Cramer's rationale critically. While his enthusiasm is palpable, we need to consider:

- Specific quotes from Cramer regarding CRWV: Finding specific quotes from Cramer's shows on CRWV, and analyzing the context is essential for a fair assessment. Do his statements solely focus on growth potential, or does he also address potential risks?

- Analysis of Cramer's track record with similar investments: Has Cramer successfully predicted the success of similar investments in emerging tech sectors? Examining his past performance provides crucial context.

- Mention of any potential conflicts of interest: Transparency is vital. Any potential conflicts of interest related to Cramer's endorsement of CRWV must be considered.

CoreWeave's (CRWV) Business Model and Competitive Landscape

CoreWeave's business model centers around providing GPU-powered cloud computing specifically tailored for AI workloads. This specialization gives them a competitive edge, catering to the growing needs of AI developers and researchers. Their infrastructure is designed for scalability, enabling them to handle the massive computational demands of complex AI models.

However, CoreWeave faces stiff competition from industry giants like AWS, Google Cloud, and Microsoft Azure. These established players have vast resources and established market presence.

- Key features of CoreWeave's cloud computing services: These may include specific hardware offerings, software optimizations, and customer support tailored to AI development. Identifying unique selling points is crucial.

- Market share comparison with competitors: Analyzing CoreWeave’s market share relative to AWS, Google Cloud, and Azure will help to gauge its competitiveness.

- Potential future growth areas for CoreWeave: Expansion into new markets, development of new services, and strategic partnerships could significantly influence CoreWeave’s future growth.

Assessing the Risks of Investing in CoreWeave (CRWV)

Investing in CoreWeave, or any company in the rapidly evolving AI infrastructure sector, carries inherent risks:

- Market volatility: The AI infrastructure market is susceptible to significant price fluctuations, impacting CRWV’s stock price.

- Competition: The intense competition from established players poses a significant challenge to CoreWeave's growth.

- Financial performance: A thorough analysis of CRWV's financial statements – including revenue, profitability, and debt levels – is crucial to assess its financial health and stability.

Further considerations include:

- Analysis of CRWV's financial statements: This includes examining revenue growth, profitability margins, cash flow, and debt levels.

- Discussion of potential regulatory hurdles: Government regulations concerning data privacy and antitrust issues could impact CoreWeave’s operations.

- Assessment of the company's debt and equity structure: Understanding CRWV’s capital structure is essential for evaluating its financial risk profile.

CoreWeave (CRWV) and the Future of AI Infrastructure

The long-term prospects for the AI infrastructure market are promising. The widespread adoption of AI across various sectors fuels the demand for powerful computing resources, creating a favorable environment for companies like CoreWeave.

However, technological advancements could also disrupt the landscape. The emergence of new computing architectures or breakthroughs in AI algorithms could impact CoreWeave’s competitive advantage.

- Market projections for the AI infrastructure sector: Researching market forecasts helps to understand the potential growth trajectory of the sector.

- Technological trends that could impact CoreWeave: Examining emerging technologies and their potential impact on CoreWeave’s business model is crucial.

- Potential partnerships and collaborations for CoreWeave: Strategic partnerships could enhance CoreWeave’s market reach and technological capabilities.

Conclusion: Making Informed Decisions about CoreWeave (CRWV)

CoreWeave (CRWV) operates in a dynamic and promising sector, presenting both significant opportunities and substantial risks. While Jim Cramer's endorsement adds to the buzz surrounding the company, investors must conduct thorough due diligence before making any investment decisions. Understanding CoreWeave's business model, competitive landscape, and financial health is crucial. Remember, a balanced assessment, considering both the potential rewards and the inherent risks, is vital for making informed investment choices. Before investing in CoreWeave (CRWV) or any other AI infrastructure company, conduct extensive research into their financials and the broader market, and remember to diversify your investment portfolio.

Featured Posts

-

Elon Musk Prioritizes Tesla Leadership Signals Political Retreat

May 22, 2025

Elon Musk Prioritizes Tesla Leadership Signals Political Retreat

May 22, 2025 -

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025 -

Celebrating The Premier League 2024 25 Champions In Pictures

May 22, 2025

Celebrating The Premier League 2024 25 Champions In Pictures

May 22, 2025 -

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025 -

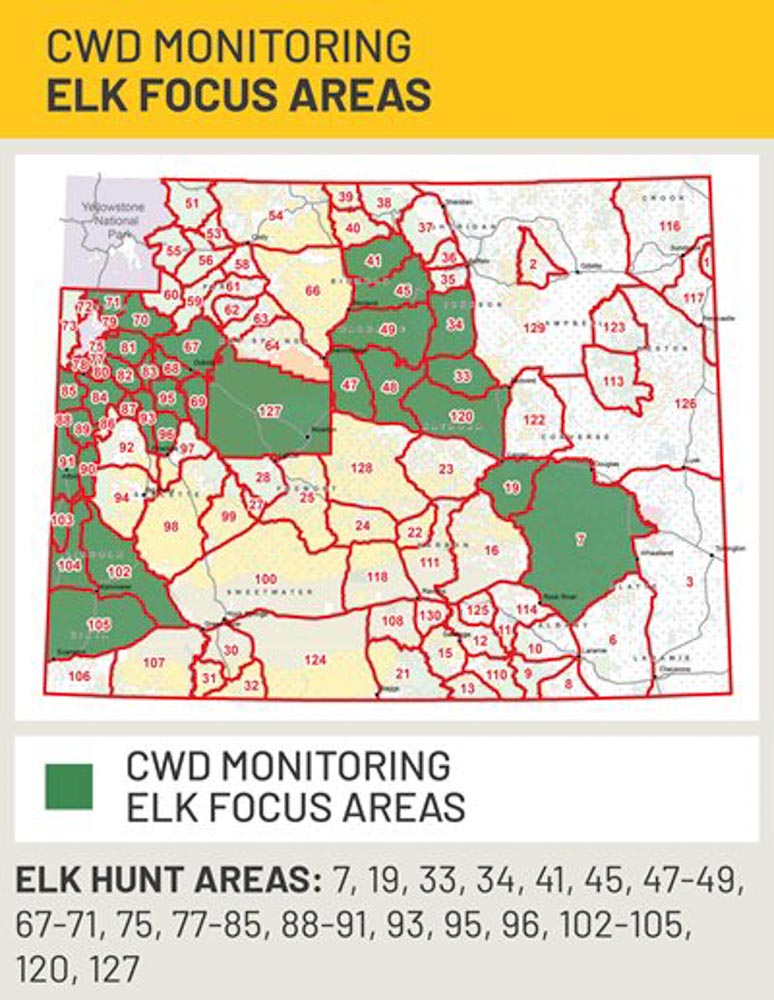

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025

Latest Posts

-

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025 -

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025 -

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025 -

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025