Conquering Lack Of Funds: Practical Steps To Improve Your Financial Situation

Table of Contents

Creating a Realistic Budget and Tracking Expenses

Understanding your spending habits is the first crucial step in conquering lack of funds. Before you can improve your financial situation, you need to know where your money is going. This involves meticulous expense tracking and the creation of a realistic budget.

Understanding Your Spending Habits

Analyzing your current spending patterns reveals areas for potential savings. Effective methods include:

- Utilize budgeting apps or spreadsheets: Many free and paid apps (Mint, YNAB, Personal Capital) simplify expense tracking. Spreadsheets offer similar functionality and allow for greater customization.

- Categorize expenses (needs vs. wants): Distinguishing between essential expenses (needs like rent, groceries, utilities) and non-essential expenses (wants like entertainment, dining out) provides valuable insight into your spending habits. This categorization helps you prioritize and identify areas for potential cuts.

- Identify recurring expenses and potential savings opportunities: Review your bank and credit card statements to identify regular expenses. Can you negotiate lower rates for services like internet or insurance? Are there subscription services you no longer use? These small changes can add up to significant savings over time.

Developing a Realistic Budget

A realistic budget aligns with your income and financial goals. Consider the following:

- Allocate funds for essential expenses: Prioritize essential expenses, ensuring you have enough money to cover these needs before allocating funds to other categories.

- Include savings goals: Establish both short-term (emergency fund) and long-term (retirement, down payment) savings goals. Allocate a specific amount to savings each month, treating it as a non-negotiable expense.

- Track progress regularly and adjust the budget as needed: Regularly review your budget to ensure you're staying on track. Life circumstances change, so be prepared to adjust your budget accordingly. This proactive approach is essential for effective financial planning and overcoming lack of funds.

Increasing Your Income Streams

Increasing your income is another powerful strategy to combat lack of funds. Exploring additional income opportunities and negotiating a raise can significantly improve your financial situation.

Exploring Additional Income Opportunities

Supplementing your current income opens up possibilities for faster debt repayment and increased savings. Consider these options:

- Freelancing or gig work: Online platforms like Upwork and Fiverr offer opportunities for various skills. Local opportunities might include pet-sitting, house-sitting, or tutoring.

- Part-time jobs or side hustles: A part-time job can provide a consistent stream of extra income. Side hustles, like selling crafts or providing a service, can be tailored to your interests and skills.

- Renting out unused assets: If you have a spare room, consider renting it out on Airbnb. Similarly, renting out your car when not in use can generate extra income.

- Investing in income-generating assets: Consider investments that provide passive income, such as dividend-paying stocks or rental properties (requiring more capital and management).

Negotiating a Raise or Seeking a Better-Paying Job

Actively pursuing higher earning potential is crucial for long-term financial stability.

- Research industry salary standards: Understand the average salary for your role and experience level to determine a fair raise request.

- Highlight your achievements and contributions: Prepare a compelling case demonstrating your value to the company when negotiating a raise.

- Update your resume and actively search for higher-paying jobs: If a raise isn't feasible, explore opportunities at other companies that offer better compensation and benefits.

Reducing Debt and Managing Credit

High-interest debt significantly exacerbates lack of funds. Effectively managing and reducing debt is crucial for long-term financial health.

Prioritizing Debt Repayment

Develop a strategic plan to tackle your debt.

- Consider debt consolidation or balance transfer options: Consolidating high-interest debts into a lower-interest loan can simplify repayment and potentially save you money. Balance transfers to credit cards with 0% APR offers can provide temporary relief.

- Explore debt management programs: Credit counseling agencies can help you create a debt management plan and negotiate with creditors.

- Prioritize paying down high-interest debts first (snowball or avalanche method): The snowball method focuses on paying off the smallest debt first for motivation, while the avalanche method prioritizes the debt with the highest interest rate for maximum savings.

Improving Credit Score

A good credit score is essential for securing favorable loan terms and interest rates.

- Pay bills on time: On-time payments are the most significant factor affecting your credit score.

- Keep credit utilization low: Avoid maxing out your credit cards; aim to keep your credit utilization ratio below 30%.

- Monitor your credit report for errors: Regularly check your credit report (AnnualCreditReport.com) for inaccuracies that could negatively impact your score.

Building an Emergency Fund and Long-Term Savings

Financial security requires both short-term and long-term planning.

Establishing an Emergency Fund

An emergency fund acts as a safety net, preventing unexpected expenses from derailing your financial progress.

- Aim for 3-6 months' worth of living expenses: This amount provides a buffer to cover unexpected job loss, medical bills, or home repairs.

- Automate savings to ensure consistent contributions: Set up automatic transfers from your checking account to your savings account each month.

- Choose a high-yield savings account: Maximize your savings growth by selecting a high-yield savings account offering a competitive interest rate.

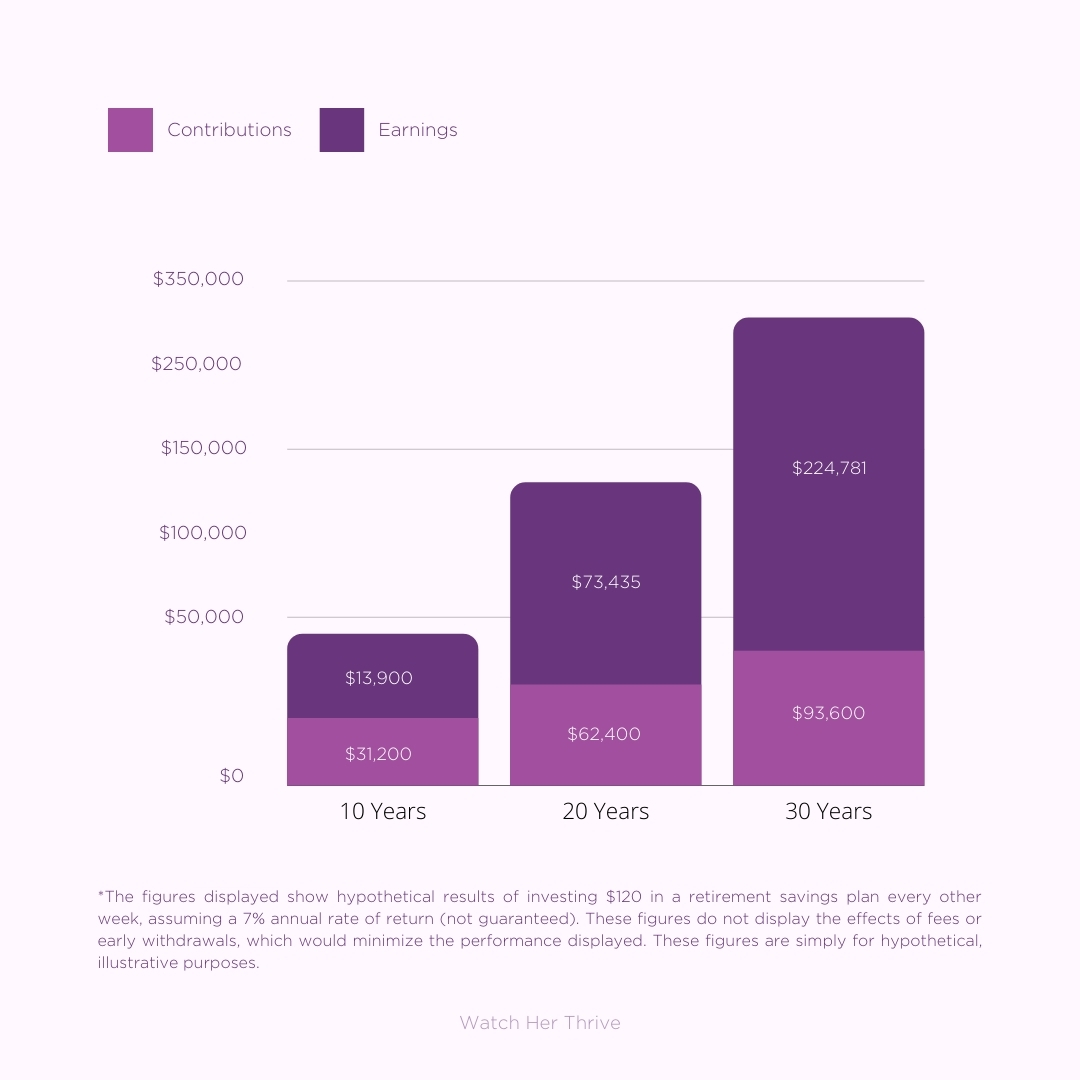

Planning for Long-Term Financial Goals

Setting and achieving long-term financial goals ensures your financial well-being in the future.

- Develop a long-term savings and investment plan: Consider your retirement goals, education expenses, or homeownership aspirations.

- Consider various investment options (retirement accounts, mutual funds): Diversify your investments to mitigate risk and maximize returns.

- Consult with a financial advisor for personalized guidance: A financial advisor can provide tailored advice based on your individual circumstances and goals.

Conclusion

Overcoming lack of funds requires a multi-faceted approach. By implementing the strategies outlined—creating a budget, increasing income, managing debt, and building savings—you can significantly improve your financial situation. Start conquering your lack of funds today! Begin by creating a simple budget and tracking your expenses. Take control of your finances and build a brighter financial future, leaving your money worries behind and tackling any financial challenges head-on.

Featured Posts

-

Political Fallout In Saskatchewan Analyzing The Impact Of Recent Remarks By Federal Leader

May 21, 2025

Political Fallout In Saskatchewan Analyzing The Impact Of Recent Remarks By Federal Leader

May 21, 2025 -

Proposed Restrictions For Kartels Trinidad Concert Age Limits And Song Bans Under Review

May 21, 2025

Proposed Restrictions For Kartels Trinidad Concert Age Limits And Song Bans Under Review

May 21, 2025 -

Abn Amro Ziet Forse Toename Occasionverkoop Impact Van Groeiend Autobezit

May 21, 2025

Abn Amro Ziet Forse Toename Occasionverkoop Impact Van Groeiend Autobezit

May 21, 2025 -

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025 -

Explore Provence On Foot A Self Guided Itinerary From Mountains To Mediterranean

May 21, 2025

Explore Provence On Foot A Self Guided Itinerary From Mountains To Mediterranean

May 21, 2025

Latest Posts

-

Antiques Roadshow Arrest Follows Shocking National Treasure Revelation

May 21, 2025

Antiques Roadshow Arrest Follows Shocking National Treasure Revelation

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Couple Charged With Trafficking National Treasure

May 21, 2025

Jaw Dropping Antiques Roadshow Find Couple Charged With Trafficking National Treasure

May 21, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 21, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 21, 2025 -

Breaking The Trans Australia Run An Imminent Challenge

May 21, 2025

Breaking The Trans Australia Run An Imminent Challenge

May 21, 2025