Condo Market Cooling: Are Canadian Investors Losing Interest?

Table of Contents

Rising Interest Rates and Their Impact on Condo Investment

The Bank of Canada's recent interest rate hikes have had a direct and substantial impact on the affordability of condo purchases. Higher interest rates translate to increased borrowing costs, significantly affecting the financial viability of condo investments for many Canadians.

-

Increased borrowing costs reduce purchasing power: With higher mortgage rates, potential buyers can afford less, reducing demand and potentially impacting property values. This is particularly true for investors relying heavily on financing.

-

Higher mortgage payments affect rental yields and profitability: Increased mortgage payments directly eat into the rental income generated by a condo, reducing the overall return on investment (ROI). This makes it harder for investors to achieve their desired profit margins.

-

Impact on investor cash flow and return on investment (ROI): The combination of higher purchase prices and increased mortgage payments puts pressure on investor cash flow, making it challenging to meet financial obligations and achieve a positive ROI.

-

Comparison of interest rates over the past few years: A comparison of interest rates from 2021 to the present day reveals a sharp increase, illustrating the significant shift in the cost of borrowing and its impact on the condo market. For example, a five-year fixed rate mortgage might have been 2% in early 2021 but is now significantly higher, affecting affordability.

The impact of these rate increases is undeniable. Data from the Canadian Real Estate Association (CREA) and other reliable sources would show a clear correlation between rising interest rates and a decrease in condo sales and transaction volumes across major Canadian cities.

The Overbuilding Factor in Major Canadian Cities

Several major Canadian cities, including Toronto, Vancouver, and Montreal, have witnessed a significant increase in condo construction in recent years. This oversupply, in certain areas, is contributing to the cooling market.

-

Analyze the supply and demand dynamics in these markets: While demand exists, the rapid pace of new condo completions has outstripped demand in some segments of the market, leading to an imbalance.

-

Highlight regions with potential oversupply and their impact on property values: Specific neighbourhoods within these cities are experiencing a higher concentration of unsold inventory, putting downward pressure on prices.

-

Discuss the implications of unsold inventory on investor confidence: High levels of unsold condos can negatively impact investor confidence, leading to hesitancy and potentially further price declines.

-

Mention specific examples of new condo projects facing delays or cancellations: News reports and industry sources often highlight projects experiencing delays or even cancellations due to softening market conditions and financing challenges.

The overbuilding phenomenon is a significant factor in the cooling condo market and highlights the importance of thorough due diligence before making any investment decisions.

Shifting Investor Sentiment and Market Trends

Investor sentiment towards condo investments in Canada is demonstrably shifting. The combination of economic uncertainty and the challenges mentioned above is leading investors to reassess their strategies.

-

Analyze data showing decreased condo sales and investment activity: Data from market research firms and real estate boards show a clear decline in condo sales and investor activity in several major cities.

-

Discuss alternative investment options gaining popularity among investors: Investors are increasingly exploring alternative investment vehicles, such as stocks, bonds, or other real estate asset classes, seeking greater stability and return.

-

Highlight the influence of economic uncertainty on investor behaviour: The overall economic climate, including inflation and potential recessionary fears, plays a significant role in shaping investor behaviour and risk tolerance.

-

Mention any government regulations impacting the condo market: Changes in government policies and regulations relating to foreign investment or mortgage stress tests can significantly influence market dynamics.

This shift in investor sentiment underscores the dynamic and ever-changing nature of the Canadian real estate market.

The Role of Rental Yields in Investor Decisions

Rental yields are a crucial factor influencing condo investment decisions. Changes in rental rates and vacancy levels directly impact the attractiveness of condo properties as investments.

-

Discuss the correlation between rental income and mortgage payments: A key consideration for investors is the relationship between the rental income generated and the monthly mortgage payments. A positive cash flow is essential for a profitable investment.

-

Examine the impact of vacancy rates on rental yields: High vacancy rates can significantly reduce rental income and negatively affect overall returns.

-

Compare rental yields in different Canadian cities: Rental yields vary considerably across different Canadian cities, with some areas offering more attractive returns than others.

A graph illustrating rental yield trends in major Canadian cities over the past few years would provide a visual representation of this important metric and help investors make informed decisions.

Conclusion

The Canadian condo market is undoubtedly experiencing a period of cooling, driven by a confluence of factors: rising interest rates, overbuilding in certain areas, and a shift in investor sentiment. While this presents challenges for some investors, it also offers opportunities for those with a long-term perspective and a thorough understanding of market dynamics. Careful due diligence, a focus on rental yields, and a realistic assessment of risk are paramount for navigating this changing landscape.

Call to Action: Stay informed about the evolving Canadian condo market to make strategic investment decisions. Learn more about navigating the current climate and identifying profitable opportunities in the cooling condo market. Continue your research on condo market investment in Canada to make well-informed decisions and capitalize on potential opportunities.

Featured Posts

-

Uk Eurovision Entry A Candid Admission Before The Contest

Apr 25, 2025

Uk Eurovision Entry A Candid Admission Before The Contest

Apr 25, 2025 -

Bayerns Six Point Bundesliga Lead A Closer Look At The St Pauli Victory

Apr 25, 2025

Bayerns Six Point Bundesliga Lead A Closer Look At The St Pauli Victory

Apr 25, 2025 -

Understanding Cool Sculpting Complications Lessons From Linda Evangelistas Experience

Apr 25, 2025

Understanding Cool Sculpting Complications Lessons From Linda Evangelistas Experience

Apr 25, 2025 -

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi I Politikov

Apr 25, 2025

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi I Politikov

Apr 25, 2025 -

Tramp Ta Viyna V Ukrayini Evolyutsiya Yogo Pozitsiyi

Apr 25, 2025

Tramp Ta Viyna V Ukrayini Evolyutsiya Yogo Pozitsiyi

Apr 25, 2025

Latest Posts

-

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025 -

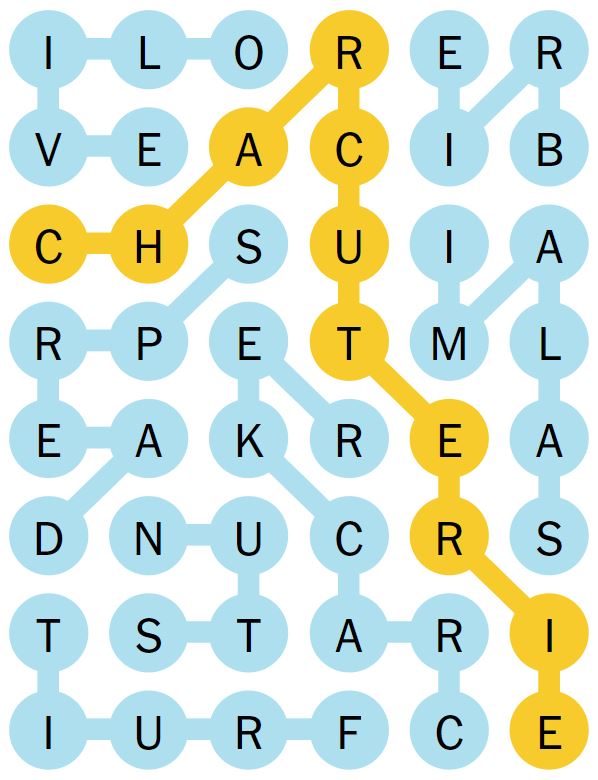

February 20th Nyt Strands Answers Game 354

May 10, 2025

February 20th Nyt Strands Answers Game 354

May 10, 2025 -

The Economic Fallout Of Trump Tariffs A Fox News Perspective

May 10, 2025

The Economic Fallout Of Trump Tariffs A Fox News Perspective

May 10, 2025 -

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025 -

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025