Competition Heats Up: Lutnick's FMX Enters Treasury Futures Market

Table of Contents

FMX's Strategic Entry and Market Impact

FMX's foray into the treasury futures market represents a strategic move leveraging its cutting-edge technology and expertise in algorithmic trading. Unlike traditional brokerage firms, FMX's business model is built on speed, efficiency, and data-driven decision-making. This approach holds the potential to significantly alter the existing market structure.

- Advanced technology and algorithms for high-frequency trading: FMX utilizes sophisticated algorithms capable of executing thousands of trades per second, giving them a significant speed advantage in a market where milliseconds can make a difference. This high-frequency trading (HFT) capability is a key differentiator.

- Access to sophisticated data analytics and market insights: FMX's data analytics capabilities allow them to identify and capitalize on subtle market inefficiencies, providing an edge in pricing and risk management. This deep data analysis contributes to more informed and profitable trading strategies.

- Potential for increased market liquidity and efficiency: By increasing the number of participants and the speed of transactions, FMX's entry could boost market liquidity, making it easier for buyers and sellers to find each other and potentially reducing price volatility. Improved market efficiency translates into lower transaction costs for all market participants.

- Impact on existing players and potential market consolidation: The arrival of a powerful new competitor like FMX will undoubtedly pressure established players to adapt and innovate. This increased competition could lead to market consolidation as smaller firms struggle to compete with FMX's technological and operational advantages. The treasury futures trading landscape is poised for significant change.

Lutnick's Influence and Industry Experience

Mark Lutnick's extensive experience and reputation in the financial industry are significant factors in assessing FMX's potential success. His leadership and strategic vision have been instrumental in building successful financial firms in the past, and this experience will undoubtedly be brought to bear on FMX's operations in the treasury futures market.

- Lutnick's track record of building successful financial firms: Lutnick has a proven history of identifying and capitalizing on market opportunities, leading to the growth and success of his previous ventures. This established track record provides a strong foundation for FMX's entry.

- His network of contacts and industry influence: Lutnick's extensive network of contacts within the financial industry provides invaluable access to information, resources, and potential partnerships. This network can significantly facilitate FMX's market penetration and growth.

- Potential strategic partnerships and collaborations: FMX's entry could spur strategic partnerships with other financial institutions, potentially leading to increased market share and access to new technologies and resources. These collaborations could accelerate FMX's growth and impact.

- Reputation and potential impact on investor confidence: Lutnick's strong reputation and established track record can attract investors and build confidence in FMX's potential for success, facilitating capital acquisition and expansion in this highly competitive marketplace. Investor confidence is crucial for sustained growth.

The Current State of the Treasury Futures Market

The treasury futures market is a large and complex market characterized by significant trading volume and considerable volatility. Understanding the current market dynamics is crucial for assessing FMX's prospects.

- Key players and their market share: Several major players currently dominate the treasury futures market, each with its own established client base and trading strategies. FMX will need to compete directly with these established firms to gain significant market share.

- Recent market volatility and trends: Recent market trends, including interest rate fluctuations and macroeconomic events, have significantly impacted treasury futures trading. Understanding these trends is crucial for formulating successful trading strategies.

- Regulatory landscape and its influence: The regulatory environment governing the treasury futures market is complex and subject to change. Navigating these regulatory requirements will be essential for FMX's long-term success. Regulatory compliance is paramount.

- Technological advancements shaping the market: Technological advancements, such as the increased use of algorithmic trading and high-frequency trading, are constantly reshaping the treasury futures market. FMX is well-positioned to leverage these advancements to its advantage.

Opportunities and Challenges for FMX

While FMX's entry presents considerable opportunities, it also faces significant challenges in establishing itself within the existing market structure.

- Competition from established players: FMX will face fierce competition from established players with deep market expertise and extensive client networks. Differentiating itself through technology and service will be crucial.

- Regulatory hurdles and compliance requirements: Navigating the complex regulatory landscape of the treasury futures market will require substantial resources and expertise. Maintaining regulatory compliance is non-negotiable.

- Managing risk and mitigating potential losses: The treasury futures market is inherently volatile, and managing risk is crucial for preventing substantial losses. Sophisticated risk management systems will be essential.

- Attracting and retaining talent: Attracting and retaining highly skilled traders, analysts, and technology professionals is essential for FMX's success. Competition for top talent in this industry is fierce.

Conclusion

FMX's entry into the treasury futures market marks a significant turning point, injecting new competition and innovative technologies into an already dynamic landscape. Mark Lutnick's leadership and FMX's advanced technological capabilities pose a considerable challenge to established players and promise to reshape market dynamics. The potential for increased market liquidity and efficiency, along with the competitive pressures this entry creates, is substantial. While significant opportunities exist, FMX will also need to overcome considerable challenges, including regulatory hurdles and competition from established market leaders.

Call to Action: Stay informed about the evolving dynamics of the treasury futures market and the impact of FMX's entry. Follow [your website/publication] for further updates and analysis on this exciting development in the world of treasury futures trading. Learn more about the implications of Lutnick's FMX in the treasury futures market and how it will impact your trading strategies.

Featured Posts

-

Confortos Dodgers Journey A Hernandez Esque Resurgence

May 18, 2025

Confortos Dodgers Journey A Hernandez Esque Resurgence

May 18, 2025 -

Osama Bin Laden Charting The Fall Of The Worlds Most Wanted Terrorist

May 18, 2025

Osama Bin Laden Charting The Fall Of The Worlds Most Wanted Terrorist

May 18, 2025 -

High Stock Market Valuations Bof As Reassuring Analysis For Investors

May 18, 2025

High Stock Market Valuations Bof As Reassuring Analysis For Investors

May 18, 2025 -

96 Rotten Tomatoes Romance Drama On Netflix Loses Top 10 Spot To True Crime

May 18, 2025

96 Rotten Tomatoes Romance Drama On Netflix Loses Top 10 Spot To True Crime

May 18, 2025 -

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025

Latest Posts

-

Zaufanie Polakow Ranking Ib Ri S Dla Onetu Pelny Raport

May 18, 2025

Zaufanie Polakow Ranking Ib Ri S Dla Onetu Pelny Raport

May 18, 2025 -

Najnowszy Ranking Zaufania Ib Ri S Dla Onetu Analiza Wynikow

May 18, 2025

Najnowszy Ranking Zaufania Ib Ri S Dla Onetu Analiza Wynikow

May 18, 2025 -

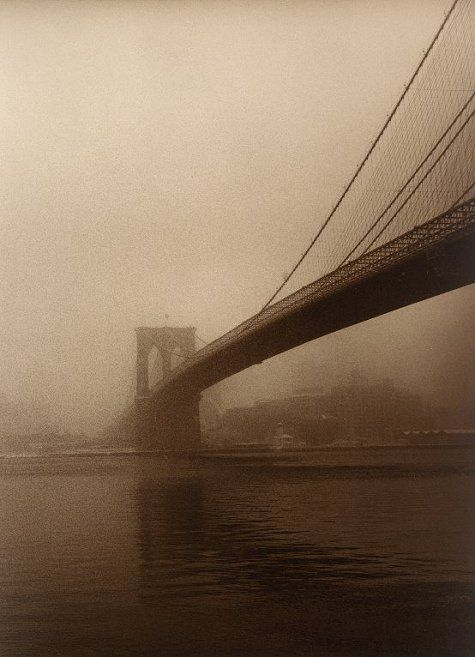

A New Perspective On The Brooklyn Bridge Barbara Menschs Work

May 18, 2025

A New Perspective On The Brooklyn Bridge Barbara Menschs Work

May 18, 2025 -

The Brooklyn Bridge A Historical Account By Barbara Mensch

May 18, 2025

The Brooklyn Bridge A Historical Account By Barbara Mensch

May 18, 2025 -

Barbara Mensch Chronicling The Construction Of The Brooklyn Bridge

May 18, 2025

Barbara Mensch Chronicling The Construction Of The Brooklyn Bridge

May 18, 2025