Comparing MicroStrategy And Bitcoin Investments For Potential In 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has made a bold strategic move by accumulating a massive amount of Bitcoin. This strategy, spearheaded by CEO Michael Saylor, positions the company as a significant player in the cryptocurrency market. Understanding MicroStrategy's business model and its substantial Bitcoin holdings is crucial for anyone considering investing in its stock.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business focuses on providing business analytics and mobile software. However, its recent pivot towards Bitcoin has dramatically altered its profile. The company's rationale behind this significant Bitcoin acquisition strategy centers on the belief in Bitcoin as a long-term store of value and a hedge against inflation.

- Quantifying MicroStrategy's Bitcoin Holdings: As of [Insert Most Recent Date and Amount], MicroStrategy holds approximately [Insert Number] Bitcoins, representing a substantial portion of its overall assets. This makes it one of the largest corporate holders of Bitcoin globally.

- Impact of Bitcoin Price Fluctuations on MicroStrategy Stock: The price of Bitcoin directly impacts MicroStrategy's financial statements and, consequently, its stock price (MSFT). A significant increase in Bitcoin's value boosts MicroStrategy's balance sheet, while a sharp decline can negatively affect its stock performance.

- Analyzing MicroStrategy's Financial Performance: Investors need to carefully analyze MicroStrategy's financial reports to understand how its Bitcoin holdings influence its overall profitability and financial health. While Bitcoin's appreciation can boost profits, potential write-downs due to price drops must also be considered.

- Potential Risks Associated with MicroStrategy's Bitcoin Strategy: MicroStrategy's heavy reliance on Bitcoin exposes it to significant volatility. Regulatory changes affecting cryptocurrencies or a prolonged bear market could significantly impact the company's valuation.

Direct Bitcoin Investment: Risks and Rewards

Investing directly in Bitcoin offers the potential for high rewards but comes with substantial risks. This section explores both sides of this high-stakes investment.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile. Factors influencing its price include: market sentiment, regulatory announcements, technological advancements, and macroeconomic conditions.

- Factors Influencing Bitcoin's Price: News about institutional adoption, regulatory developments (or lack thereof), and even tweets from influential figures can trigger significant price swings.

- Historical Price Volatility and Future Scenarios: Bitcoin's history shows periods of dramatic price increases followed by steep corrections. Predicting future price movements is exceptionally challenging, making risk management crucial.

- Potential for High Returns but Also Significant Losses: While Bitcoin has historically shown remarkable growth potential, the possibility of significant losses remains a very real concern.

Bitcoin's Long-Term Potential

Despite its volatility, many investors believe in Bitcoin's long-term potential as a digital asset and store of value.

- Limited Supply and Increasing Adoption: Bitcoin's limited supply of 21 million coins and growing adoption by individuals and institutions are key arguments for its long-term value proposition.

- Potential Regulatory Changes and Their Impact: Regulatory clarity (or lack thereof) in different jurisdictions significantly impacts Bitcoin's price and accessibility.

- Bitcoin's Role in a Decentralized Financial System: Bitcoin's potential role within a decentralized financial system (DeFi) is another factor driving its appeal among long-term investors.

Comparing Investment Approaches: MicroStrategy vs. Direct Bitcoin

Choosing between MicroStrategy stock and direct Bitcoin investment depends heavily on your risk tolerance and investment goals.

Risk Tolerance and Investment Goals

- Comparing Risk Profiles: Investing directly in Bitcoin carries significantly higher volatility than investing in MicroStrategy stock, which offers some diversification through its core business operations.

- Potential Returns and Downsides: While both offer potential for substantial returns, direct Bitcoin investment exposes you to higher risk of significant losses. MicroStrategy’s performance is partially cushioned by its other business activities, but still heavily reliant on Bitcoin’s price.

- Diversification Benefits: Investing in MicroStrategy offers some diversification, while direct Bitcoin investment is highly concentrated.

Transaction Costs and Accessibility

- Brokerage Fees vs. Cryptocurrency Exchange Fees: Buying MicroStrategy stock involves standard brokerage fees, while purchasing Bitcoin directly incurs cryptocurrency exchange fees, which can vary significantly.

- Complexities of Self-Custody for Bitcoin: Direct Bitcoin ownership requires understanding and managing the risks of self-custody, including potential security breaches and loss of private keys.

Conclusion

Investing in either MicroStrategy or Bitcoin presents unique opportunities and risks. MicroStrategy offers a less volatile entry point into the Bitcoin market, while direct investment offers potentially higher rewards but with greater risk. The decision hinges on your risk tolerance, investment timeline, and financial goals. Understanding the nuances of both MicroStrategy and Bitcoin investments is crucial for making informed decisions. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions concerning MicroStrategy and Bitcoin investments in 2025 or any other year.

Featured Posts

-

Bitcoin Madenciligi Son Durak Mi

May 09, 2025

Bitcoin Madenciligi Son Durak Mi

May 09, 2025 -

Deutsche Banks Strategic Investment In Defense Finance A New Deals Team Takes Shape

May 09, 2025

Deutsche Banks Strategic Investment In Defense Finance A New Deals Team Takes Shape

May 09, 2025 -

8 Cagr Wireless Mesh Network Market Growth Analysis And Forecast

May 09, 2025

8 Cagr Wireless Mesh Network Market Growth Analysis And Forecast

May 09, 2025 -

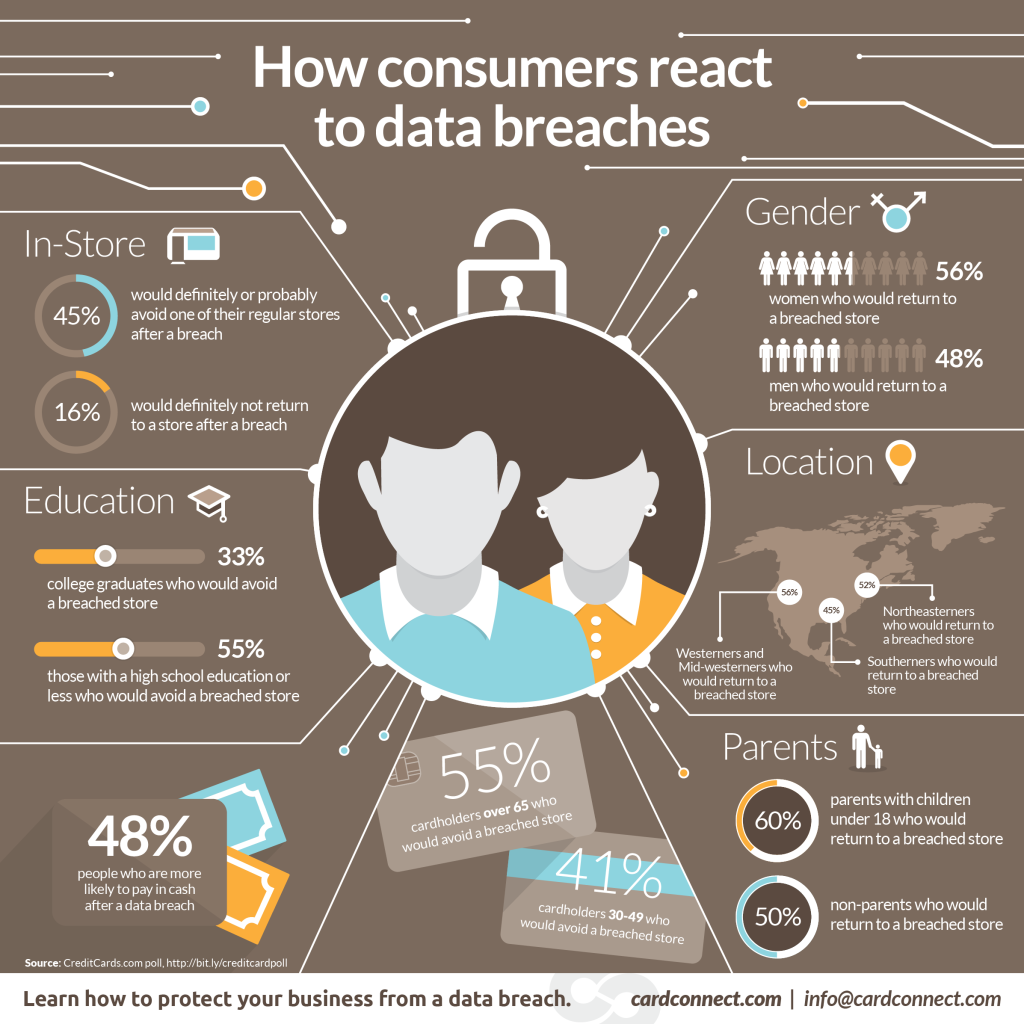

Data Breach Costs T Mobile 16 Million A Three Year Timeline Of Security Lapses

May 09, 2025

Data Breach Costs T Mobile 16 Million A Three Year Timeline Of Security Lapses

May 09, 2025 -

Working Parents And Daycare Weighing The Pros And Cons

May 09, 2025

Working Parents And Daycare Weighing The Pros And Cons

May 09, 2025