Compare Guaranteed Approval Payday Loans For Bad Credit: Direct Lenders

Table of Contents

Facing a financial emergency with bad credit? Securing a loan can feel impossible, but "guaranteed approval payday loans" offer a potential solution. This article compares options from direct lenders, helping you navigate the process and find the best fit for your situation. We'll explore the benefits, risks, and crucial factors to consider when searching for a guaranteed approval payday loan with bad credit.

Understanding Guaranteed Approval Payday Loans for Bad Credit

What are Guaranteed Approval Payday Loans?

The term "guaranteed approval payday loans" implies a higher likelihood of approval compared to traditional loans. However, it's crucial to understand the nuances. While these loans are designed for borrowers with bad credit, "guaranteed" doesn't mean automatic approval without any checks. Responsible lenders still assess your application, verifying your income and ability to repay. The "guarantee" usually refers to a more lenient approval process than traditional loans, making it easier to qualify even with a low credit score. These loans differ from traditional payday loans which often have stricter eligibility requirements and from other bad credit loans such as personal loans which typically involve a longer application process and higher credit score requirements.

- Key Features: Short repayment terms (typically 2-4 weeks), small loan amounts, quick application and funding process.

- Eligibility Criteria: Generally less stringent than traditional loans, focusing more on income verification than credit history. However, requirements can vary significantly between lenders.

- Potential Interest Rates: These loans often carry high interest rates compared to other loan types.

Direct Lenders vs. Brokers:

When searching for a guaranteed approval payday loan, you'll encounter two main avenues: direct lenders and brokers. Understanding the difference is crucial for making an informed decision.

Direct Lenders: These are financial institutions that provide loans directly to borrowers.

Brokers: These intermediaries connect borrowers with multiple lenders, increasing your chances of finding a suitable loan.

- Direct Lenders:

- Pros: Potentially more transparent fees, simpler application process, direct communication with the lender.

- Cons: May offer fewer loan options than brokers.

- Brokers:

- Pros: Access to a wider range of lenders and loan options, potentially better interest rates due to competition.

- Cons: May charge additional fees, potentially less transparency, added complexity in the application process.

It's vital to research the lender's reputation and legitimacy, regardless of whether you use a direct lender or a broker. Check for licensing and online reviews to avoid scams and predatory lending practices.

Finding Reputable Direct Lenders for Guaranteed Approval Payday Loans

Research and Comparison Tools:

Comparing multiple lenders is essential to secure the best terms and interest rates for your guaranteed approval payday loan. Don't settle for the first offer you find.

- Utilize online comparison tools: Many websites offer tools to compare payday loan offers from various lenders. These tools can save you valuable time and effort.

- Things to compare:

- Annual Percentage Rate (APR)

- Fees (originations fees, late payment fees)

- Repayment terms

- Customer reviews and ratings

Checking Lender Legitimacy:

Before applying for a loan, verify the lender's legitimacy to protect yourself from scams and predatory lending practices.

- Check for licensing: Ensure the lender is licensed and authorized to operate in your state or region.

- Read independent customer reviews: Look for reviews on independent websites, not just the lender's website.

- Check the Better Business Bureau (BBB) rating: The BBB offers ratings and reviews of businesses, which can provide insights into a lender's reputation.

Factors Affecting Approval and Interest Rates

Credit Score's Influence:

While guaranteed approval payday loans cater to borrowers with bad credit, your credit score still influences the terms and interest rates. A higher score, even if it's considered "bad," may result in more favorable terms. Consider strategies to improve your credit score, even temporarily, before applying.

Income and Employment Verification:

Lenders verify your income and employment to assess your ability to repay the loan. Stable income is crucial for approval. If you have irregular income, be prepared to provide documentation to demonstrate your ability to repay the loan.

Loan Amount and Repayment Terms:

The loan amount you request impacts the repayment terms and interest rates. Borrow only what you can comfortably afford to repay within the short timeframe. Avoid overborrowing, which can lead to a debt cycle.

The Risks and Responsibilities of Payday Loans

High Interest Rates and Fees:

Payday loans typically come with significantly higher interest rates and fees compared to traditional loans. These costs can quickly escalate if you're unable to repay on time.

Debt Cycle Risks:

The short repayment terms of payday loans can lead to a debt cycle. If you can't repay the loan on time, you might need to roll it over into another loan, incurring additional fees and interest, making it harder to get out of debt.

Responsible Borrowing:

Before applying for a guaranteed approval payday loan, create a realistic repayment plan. Borrow only what's absolutely necessary and explore alternative solutions if possible. Understand all fees and interest rates before signing any agreement.

Conclusion:

Choosing a guaranteed approval payday loan from a direct lender requires careful consideration. By comparing lenders, understanding the risks, and borrowing responsibly, you can increase your chances of finding a suitable solution to your financial needs. Remember to always thoroughly research potential lenders and read the terms and conditions before signing any agreement.

Call to Action: Start your search for the right guaranteed approval payday loan today! Compare offers from reputable direct lenders and make an informed decision. Remember, responsible borrowing is key.

Featured Posts

-

Marlins Edge Nats Return To 500

May 28, 2025

Marlins Edge Nats Return To 500

May 28, 2025 -

Update Cuaca Bandung Perkiraan Hujan Siang Hari 22 April 2024

May 28, 2025

Update Cuaca Bandung Perkiraan Hujan Siang Hari 22 April 2024

May 28, 2025 -

Cuaca Jawa Barat Besok 7 Mei Info Lengkap Dan Antisipasi Hujan

May 28, 2025

Cuaca Jawa Barat Besok 7 Mei Info Lengkap Dan Antisipasi Hujan

May 28, 2025 -

Ice Cube Reportedly Inks Deal For New Friday Movie

May 28, 2025

Ice Cube Reportedly Inks Deal For New Friday Movie

May 28, 2025 -

Urgent E1 Million Lotto Jackpot Winners Location Revealed Act Now

May 28, 2025

Urgent E1 Million Lotto Jackpot Winners Location Revealed Act Now

May 28, 2025

Latest Posts

-

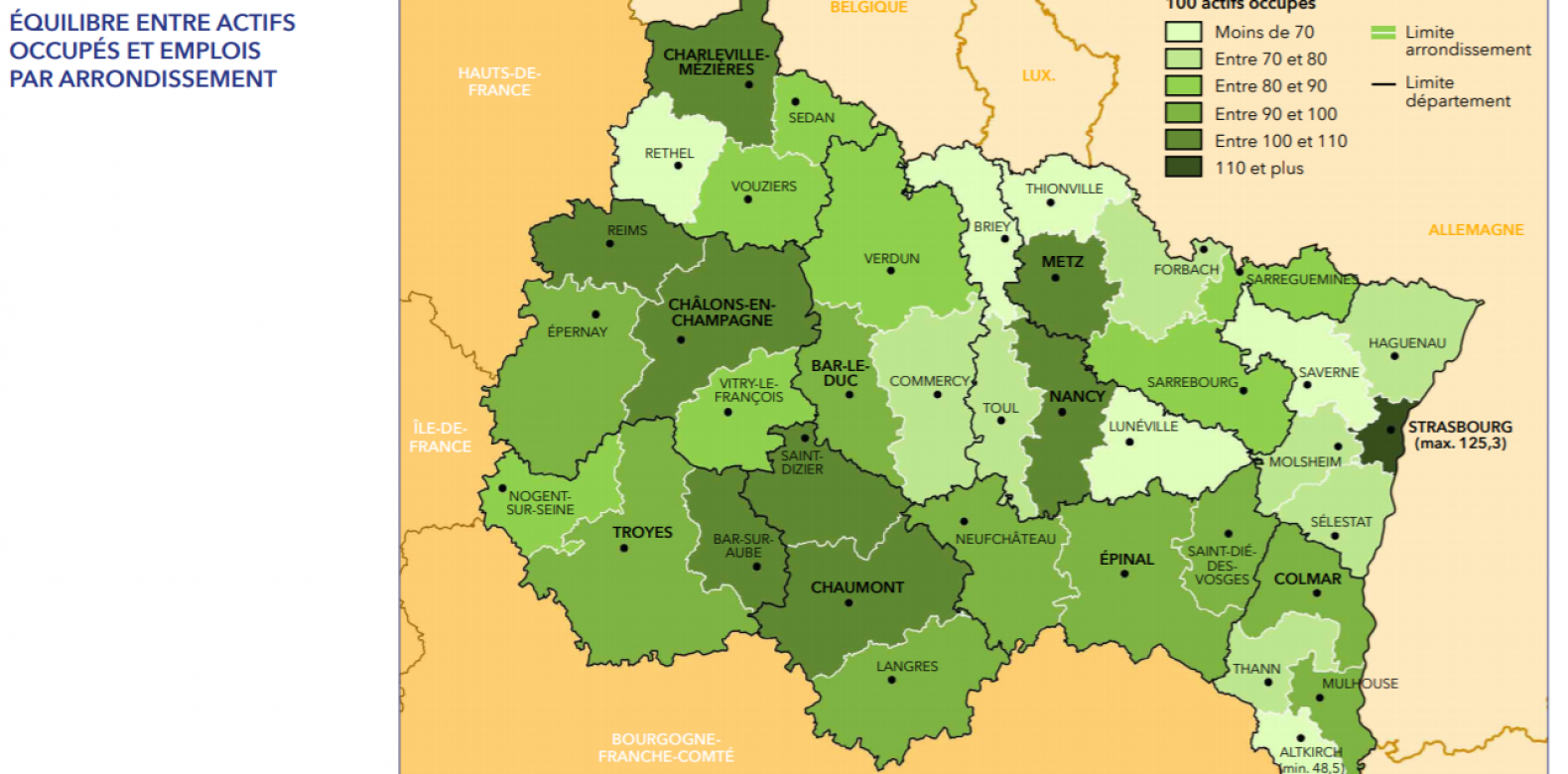

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025 -

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025