College Costs: Fewer Parents Stressed, But Student Loans Still A Factor

Table of Contents

Decreasing Parental Stress: Positive Trends in College Affordability

While the sticker price of college continues to rise, several factors are contributing to a decrease in parental stress surrounding higher education costs. These positive trends offer a glimmer of hope for families planning for their children's future.

Increased Financial Aid and Grants

The expansion of federal and state grant programs has made college more accessible for many students. Merit-based scholarships are also increasingly available, rewarding academic achievement and other talents. Furthermore, many universities offer their own institutional aid programs, supplementing federal and state funding.

- Examples of specific grant programs: Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), state-specific grant programs.

- Statistics on aid increases: While precise figures vary by state and institution, reports consistently show increases in the overall amount of financial aid disbursed annually. Research current statistics from the National Center for Education Statistics (NCES) for the most up-to-date data.

Growth of Income-Based Repayment Plans

The introduction and expansion of income-driven repayment (IDR) plans have significantly eased the burden of student loans for many graduates. These plans link monthly payments to a borrower's income and family size, making repayment more manageable.

- Different income-driven repayment plans: Income-Driven Repayment (IDR), Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE).

- Benefits for borrowers: Lower monthly payments, potential loan forgiveness after 20-25 years (depending on the plan), greater financial flexibility.

Rising Awareness of Financial Planning for College

There’s a growing emphasis on proactive financial planning for college, empowering families to better manage higher education costs.

-

College savings plans (529 plans): Tax-advantaged savings vehicles designed specifically to help families save for college expenses.

-

Financial literacy programs for families: Increased availability of resources and programs focused on educating families about saving, budgeting, and applying for financial aid.

-

Early college planning and budgeting: The importance of starting early to maximize savings opportunities and explore all available financial aid resources cannot be overstated.

-

Tips for saving for college: Start saving early, even small amounts add up over time. Utilize 529 plans and other tax-advantaged accounts. Explore scholarships and grants diligently. Create a realistic college budget.

-

Resources for financial planning: The U.S. Department of Education website, college financial aid offices, and independent financial advisors offer valuable resources.

The Persistent Challenge of Student Loan Debt

Despite positive trends in affordability, the persistent challenge of student loan debt remains a significant factor in the higher education landscape. The high level of student loan debt continues to impact graduates' financial well-being and long-term prospects.

High Levels of Student Loan Debt

The total amount of student loan debt in the United States is staggering. Rising tuition costs, combined with increasing reliance on borrowing to finance college, have contributed to this escalating problem.

- Statistics on student loan debt: Consult the Federal Reserve and the Department of Education for the latest data on total student loan debt and average debt per borrower.

- Average debt per student: This figure varies significantly depending on the type of institution attended (public vs. private) and the student's degree program.

The Impact of Student Loan Debt on Graduates

The weight of student loan debt can significantly impact graduates' lives, affecting their career choices, financial stability, and even mental health.

- Challenges graduates face: Difficulty saving for a down payment on a home, delaying major life decisions like marriage and starting a family, limiting career options due to the need to prioritize high-paying jobs.

- Impact on career choices and financial stability: Graduates may accept less fulfilling jobs solely based on salary to manage debt repayment. This can have long-term consequences on their career trajectories and overall financial well-being.

- Mental health implications: The stress of significant student loan debt can contribute to anxiety, depression, and other mental health challenges.

Strategies for Managing Student Loan Debt

There are several strategies graduates can use to manage their student loan debt effectively.

- Repayment strategies: Refinancing (to potentially lower interest rates), consolidation (to simplify repayment), and exploring income-driven repayment plans.

- Budgeting and financial planning: Creating a realistic budget that includes loan repayment, tracking spending, and exploring avenues to increase income.

- Resources for student loan borrowers: The National Foundation for Credit Counseling (NFCC), the U.S. Department of Education's website, and other non-profit organizations offer valuable guidance and support.

Conclusion

While positive trends in financial aid and repayment options have lessened parental stress regarding college costs, the significant burden of student loan debt remains a major concern for students and families. Understanding these competing forces is crucial for navigating the complexities of higher education financing.

Call to Action: Learn more about managing college costs and exploring available financial aid options to plan effectively for your future. Don't let the challenges of college costs prevent you from pursuing your educational goals. Research available resources and strategies for minimizing student loan debt and maximizing your financial aid opportunities. Proactive planning and informed decision-making are key to successfully navigating the financial landscape of higher education.

Featured Posts

-

Former Fbi Director Comey Faces Criticism Deletes Instagram Post

May 17, 2025

Former Fbi Director Comey Faces Criticism Deletes Instagram Post

May 17, 2025 -

Jalen Brunson Injury Update Playing Sunday After Month Long Absence

May 17, 2025

Jalen Brunson Injury Update Playing Sunday After Month Long Absence

May 17, 2025 -

Tesla Suocena S Prosvjednicima U Berlinu Analiza Situacije

May 17, 2025

Tesla Suocena S Prosvjednicima U Berlinu Analiza Situacije

May 17, 2025 -

Top 10 Prematurely Cancelled Tv Series A Fans Lament

May 17, 2025

Top 10 Prematurely Cancelled Tv Series A Fans Lament

May 17, 2025 -

Celtics Vs Pistons Prediction Will Boston Win Again In Detroit

May 17, 2025

Celtics Vs Pistons Prediction Will Boston Win Again In Detroit

May 17, 2025

Latest Posts

-

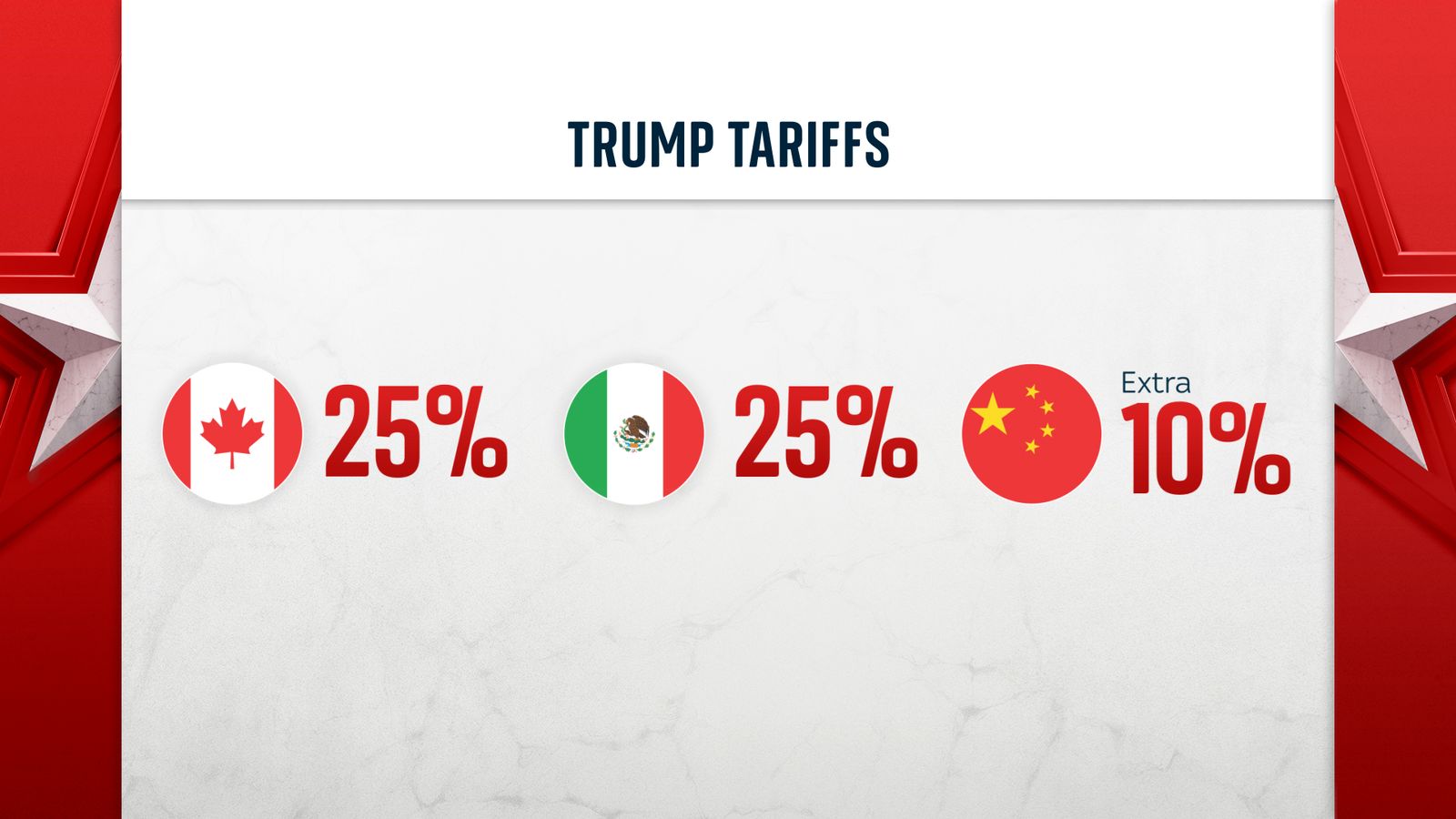

Dutch Viewpoint Against Eu Countermeasures To Trumps Tariffs

May 18, 2025

Dutch Viewpoint Against Eu Countermeasures To Trumps Tariffs

May 18, 2025 -

The Netherlands And The Trump Tariffs A Nations Resistance To Retaliation

May 18, 2025

The Netherlands And The Trump Tariffs A Nations Resistance To Retaliation

May 18, 2025 -

Analysis Dutch Opposition To Eu Response To Trump Import Duties

May 18, 2025

Analysis Dutch Opposition To Eu Response To Trump Import Duties

May 18, 2025 -

Public Opinion In The Netherlands No Retaliation On Trump Tariffs

May 18, 2025

Public Opinion In The Netherlands No Retaliation On Trump Tariffs

May 18, 2025 -

Poll Most Dutch Against Eu Retaliation On Trumps Import Tariffs

May 18, 2025

Poll Most Dutch Against Eu Retaliation On Trumps Import Tariffs

May 18, 2025