Colgate (CL) Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million

![Colgate (CL) Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million Colgate (CL) Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million](https://autolinq.de/image/colgate-cl-q-quarter-earnings-tariff-hikes-slash-profits-by-200-million.jpeg)

Table of Contents

Tariff Impact on Colgate's Q3 Performance

The substantial impact of tariffs on Colgate's Q3 financial results is undeniable. Increased import costs for raw materials, a key component in Colgate's extensive product line, directly contributed to the $200 million profit shortfall. The company's supply chain, spanning numerous countries, left it particularly vulnerable to fluctuating tariff rates. This situation highlights the increasing importance of supply chain diversification and risk management strategies for companies in the consumer staples sector.

- Quantifiable Impact: While Colgate didn't explicitly break down the tariff impact on each product line, analysts estimate that the oral care segment, Colgate's flagship, bore the brunt of the increased costs due to its reliance on imported ingredients.

- Mitigation Strategies: Colgate attempted to mitigate these increased costs through a combination of price increases and cost-cutting measures. However, the effectiveness of these strategies was limited, as evidenced by the substantial profit decline. The company acknowledged challenges in passing on all increased costs to consumers due to price sensitivity in various markets.

- Geopolitical Factors: The escalating trade tensions between certain nations further exacerbated the situation, leading to unpredictable tariff increases and complicating Colgate's ability to forecast and manage its expenses effectively. The geopolitical landscape significantly impacts the pricing of raw materials and the overall stability of the supply chain.

Overall Financial Performance Beyond Tariffs

While tariffs played a significant role in Colgate's Q3 performance, it's crucial to analyze the broader financial picture. Despite the tariff-related challenges, Colgate’s overall revenue showed modest growth, demonstrating the underlying strength of its brands. However, the substantial tariff impact significantly eroded the bottom line, impacting net income and earnings per share (EPS).

- Key Financial Figures: Colgate reported Q3 revenue of [Insert Actual Revenue Figure], compared to [Insert Previous Quarter Revenue] and [Insert Same Quarter Last Year Revenue]. EPS came in at [Insert Actual EPS], significantly lower than [Insert Previous Quarter EPS] and [Insert Same Quarter Last Year EPS]. The operating margin also experienced a considerable decrease, reflecting the pressure from increased input costs.

- Product Category Performance: The oral care segment, although impacted by tariffs, continued to be the primary revenue driver. However, the personal care segment experienced [Insert Performance Details – growth or decline, reasons].

- Market Share: While preliminary data suggests slight changes in market share in certain regions, the overall impact requires further analysis. More in-depth studies will be necessary to determine whether competitors experienced similar tariff impacts or benefited from more effective mitigation strategies.

Investor Reactions and Future Outlook for CL Stock

The release of Colgate's Q3 earnings report triggered a negative reaction in the stock market. The CL stock price experienced a [Insert Percentage] decline immediately following the announcement. Investor sentiment shifted towards cautious optimism, with many analysts expressing concern about the ongoing impact of tariffs and global trade uncertainties.

- Stock Market Reaction: The immediate post-earnings drop reflects investor concerns regarding the sustainability of Colgate's profitability in the face of persistent tariff headwinds.

- Analyst Ratings and Price Targets: Analyst ratings have been revised downwards, with several firms lowering their price targets for CL stock, reflecting the uncertainty surrounding future earnings. The consensus seems to indicate a wait-and-see approach until there is more clarity on the tariff situation.

- Long-Term Implications: The long-term outlook for Colgate depends largely on the resolution of trade disputes and the company's ability to adapt its pricing strategies and supply chain to mitigate future tariff impacts. This includes exploring opportunities for sourcing raw materials from more geographically diverse regions.

- Management Commentary: [Insert details on management’s statements regarding future plans and outlook. ]

Conclusion

Colgate's Q3 earnings report clearly demonstrated the significant negative impact of escalating tariffs on the company's profitability. While the overall revenue showed modest growth, the $200 million loss attributed to tariffs overshadowed the positive aspects of the report. Investor reactions were negative, leading to a decline in the CL stock price. The future performance of Colgate (CL) stock hinges on successfully navigating the complexities of global trade and implementing effective strategies to mitigate future tariff impacts.

Call to Action: Stay informed about the ongoing impact of tariffs and other global economic factors on Colgate's performance by regularly reviewing future earnings reports and financial news related to Colgate (CL) stock. Understanding the complexities of Colgate’s financial situation is crucial for investors. Continue to follow our analysis of Colgate’s financial results and other relevant market developments to make informed investment decisions.

![Colgate (CL) Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million Colgate (CL) Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million](https://autolinq.de/image/colgate-cl-q-quarter-earnings-tariff-hikes-slash-profits-by-200-million.jpeg)

Featured Posts

-

Interfax Confirms Trump Envoy Witkoff In Moscow

Apr 26, 2025

Interfax Confirms Trump Envoy Witkoff In Moscow

Apr 26, 2025 -

Food Dye Ban Dr Sanjay Gupta Answers Your Questions

Apr 26, 2025

Food Dye Ban Dr Sanjay Gupta Answers Your Questions

Apr 26, 2025 -

Michael Cliffords Daughter The 5 Seconds Of Summer Guitarists Views On Nepotism

Apr 26, 2025

Michael Cliffords Daughter The 5 Seconds Of Summer Guitarists Views On Nepotism

Apr 26, 2025 -

Andrew Cuomo And Chelsea Handler A Date That Never Happened

Apr 26, 2025

Andrew Cuomo And Chelsea Handler A Date That Never Happened

Apr 26, 2025 -

Royal Netherlands Navy Enhances Marine Security With Fugro Damen Partnership

Apr 26, 2025

Royal Netherlands Navy Enhances Marine Security With Fugro Damen Partnership

Apr 26, 2025

Latest Posts

-

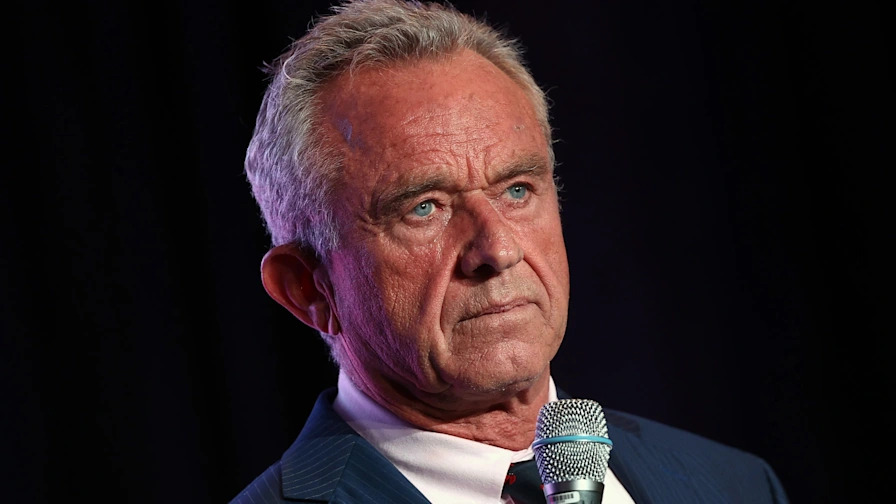

Analysis The Cdcs Choice Of A Discredited Misinformation Agent For Vaccine Study

Apr 27, 2025

Analysis The Cdcs Choice Of A Discredited Misinformation Agent For Vaccine Study

Apr 27, 2025 -

Concerns Raised Over Cdc Vaccine Study Hires Misinformation Background

Apr 27, 2025

Concerns Raised Over Cdc Vaccine Study Hires Misinformation Background

Apr 27, 2025 -

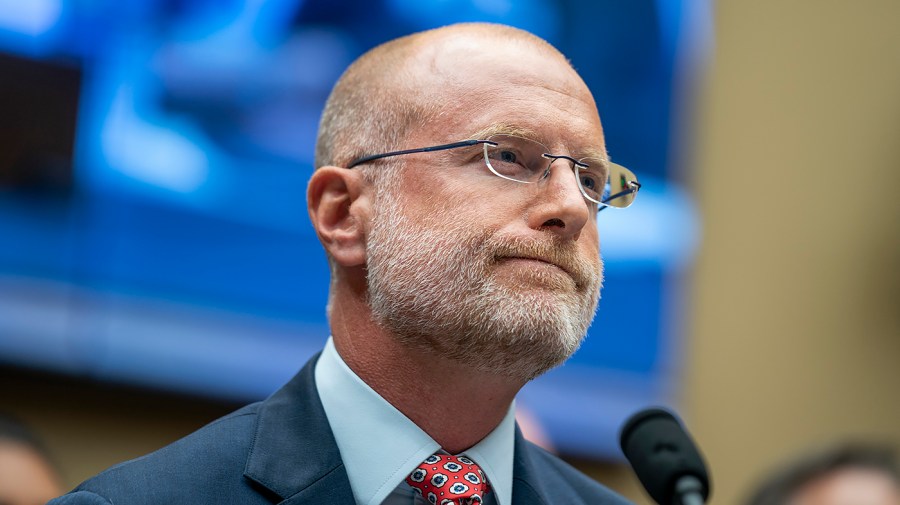

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025 -

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025