Cobalt Market Reaction: Analyzing Congo's Export Ban And Future Quota

Table of Contents

Congo's Export Ban: Immediate Market Impact

Price Volatility and Speculation

Announcements of potential cobalt export bans from the DRC have immediately triggered significant price fluctuations in the cobalt market. The uncertainty surrounding supply has led to increased speculation and a surge in prices.

- Increased prices: Cobalt prices have experienced sharp increases, impacting downstream industries.

- Investor uncertainty: Investors are hesitant, leading to market volatility and reduced investment in cobalt-related projects.

- Hedging strategies: Buyers are employing hedging strategies to mitigate risks associated with price volatility.

The role of speculation is undeniable. Market sentiment, driven by news and rumors regarding the export ban, significantly influences price movements, creating a highly reactive cobalt market. This highlights the need for transparency and clear communication from the DRC government to stabilize the market.

Supply Chain Disruptions

An export ban would severely disrupt global cobalt supply chains, with cascading effects across multiple industries.

- Impact on battery manufacturers: Battery manufacturers face production delays and increased input costs.

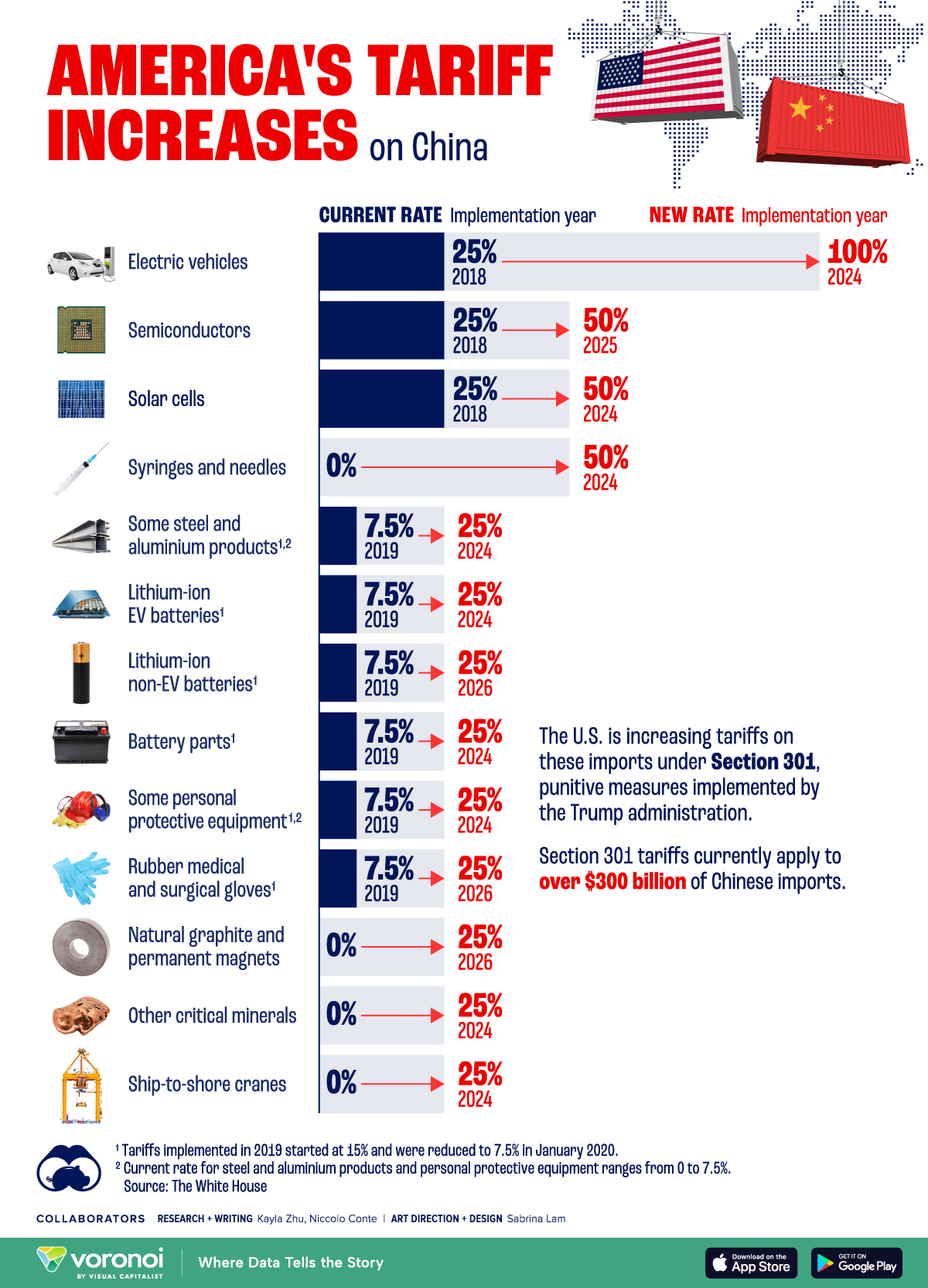

- Delays in EV production: The automotive industry could experience delays in EV production due to cobalt shortages.

- Search for alternative cobalt sources: Companies are actively seeking alternative cobalt sources to diversify their supply chains and mitigate risks.

Geographic diversification is becoming a crucial strategy for companies seeking to reduce their reliance on the DRC. This involves exploring alternative sources in Australia, Canada, and other regions, though these sources often come with their own challenges in terms of production capacity and sustainability.

Analyzing the Rationale Behind Congo's Actions

Government Revenue and Resource Control

The DRC government's consideration of export restrictions stems from a desire to increase government revenue and gain greater control over its natural resources.

- Government's desire for increased domestic processing: The DRC aims to develop its domestic cobalt processing industry, adding value to its raw materials before export.

- Potential for job creation: Domestic processing can create jobs and stimulate economic growth within the country.

- Taxation policies: The government seeks to implement more effective taxation policies to capture a larger share of the cobalt revenue.

The DRC's decision-making is influenced by complex political and economic factors. Balancing the need for economic development with responsible resource management presents a significant challenge for the government.

Environmental Concerns and Sustainable Mining Practices

Environmental concerns surrounding cobalt mining in the DRC are a significant factor influencing the government's actions. Promoting sustainable mining practices is crucial for the long-term health of the environment and the country's reputation.

- Environmental regulations: The DRC is under increasing pressure to implement stricter environmental regulations to minimize the environmental impact of cobalt mining.

- Responsible sourcing initiatives: International organizations and companies are pushing for responsible sourcing initiatives to ensure ethical and sustainable cobalt procurement.

- International pressure for ethical mining: The OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas plays a key role in shaping international standards for ethical cobalt mining.

The adoption of sustainable mining practices and adherence to international standards are essential for ensuring the long-term viability of the cobalt market and protecting the environment.

Future Cobalt Quotas and Market Stabilization

The Potential for Quotas and Their Market Effect

The implementation of future cobalt quotas could significantly impact market stability and price volatility.

- Predictability of supply: Clearly defined quotas can increase the predictability of cobalt supply, reducing uncertainty.

- Potential for price stabilization: Stable supply can contribute to more stable prices, benefiting both producers and consumers.

- Long-term investment implications: A more stable and transparent cobalt market can attract long-term investment in the sector.

Transparent quota systems, clearly communicated to market participants, are crucial for fostering trust and reducing speculation.

Diversification and Alternative Technologies

Mitigating the risks associated with Congo's supply requires diversification and the exploration of alternative technologies.

- Development of cobalt-free batteries: Research and development efforts are focused on developing batteries that require less or no cobalt.

- Increased recycling efforts: Recycling cobalt from end-of-life batteries can significantly increase supply and reduce reliance on mining.

- Exploration of alternative sources: Continued exploration and development of cobalt resources in other countries are vital for supply chain diversification.

The feasibility and timeline for these alternatives vary, but they are crucial for ensuring the long-term security and sustainability of the cobalt market.

Conclusion

Congo's potential export ban and future cobalt quotas present significant challenges and opportunities for the cobalt market. The immediate impact includes price volatility and supply chain disruptions. However, the DRC's actions are also driven by a desire for increased revenue, resource control, and sustainable mining practices. Future quotas, if implemented transparently, could improve market stability. Diversification of supply sources and the development of alternative technologies are crucial for mitigating future risks. Staying informed about the evolving cobalt market is crucial for businesses involved in the EV, battery, and related industries. Continuously monitor announcements regarding Congo's policies, and actively explore strategies to navigate the challenges and opportunities presented by the fluctuating cobalt market. Understanding the dynamics of the Cobalt Market is essential for long-term success in this critical sector.

Featured Posts

-

Crystal Palace Vs Nottingham Forest Sigue El Partido En Directo

May 16, 2025

Crystal Palace Vs Nottingham Forest Sigue El Partido En Directo

May 16, 2025 -

Auto Dealers Double Down On Resistance To Ev Mandates

May 16, 2025

Auto Dealers Double Down On Resistance To Ev Mandates

May 16, 2025 -

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

May 16, 2025

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

May 16, 2025 -

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 16, 2025

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 16, 2025 -

Androids Design Language Overhaul Key Features

May 16, 2025

Androids Design Language Overhaul Key Features

May 16, 2025

Latest Posts

-

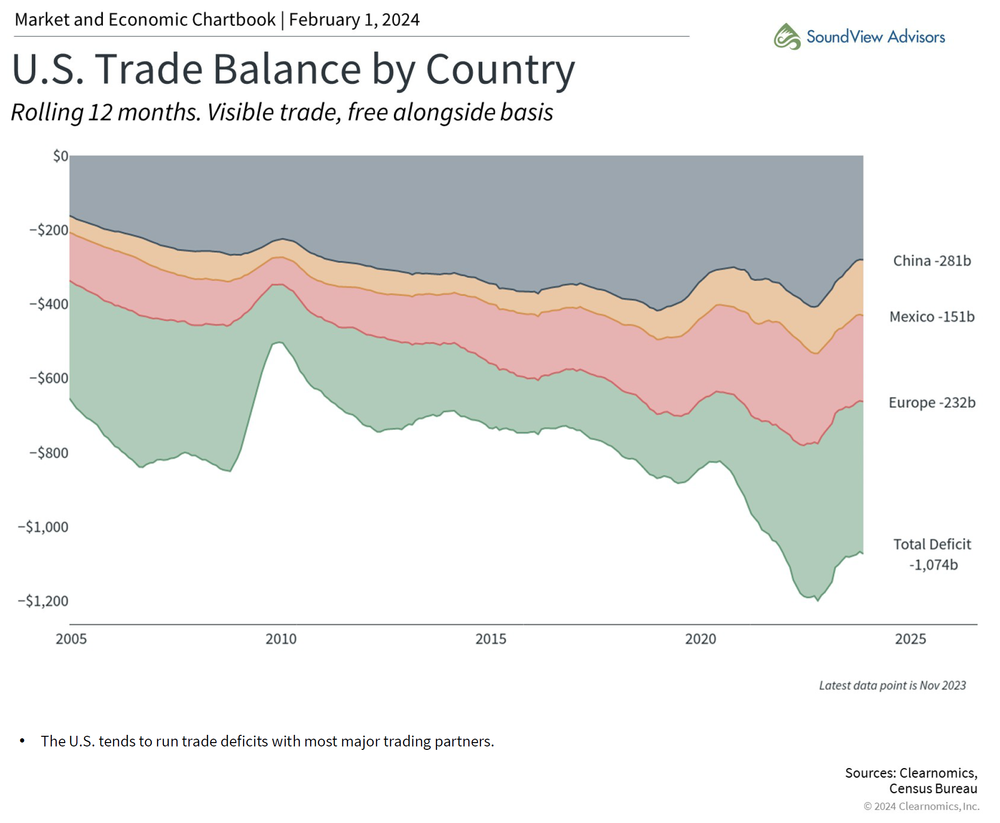

Expert Insights Assessing Trumps Claims On Us Canada Trade

May 16, 2025

Expert Insights Assessing Trumps Claims On Us Canada Trade

May 16, 2025 -

Ontario Government To Make Gas Tax Cut Permanent Highway 407 East Tolls Next

May 16, 2025

Ontario Government To Make Gas Tax Cut Permanent Highway 407 East Tolls Next

May 16, 2025 -

Is Jimmy Butler Playing For The Warriors Today Latest Update

May 16, 2025

Is Jimmy Butler Playing For The Warriors Today Latest Update

May 16, 2025 -

Analyzing Trumps Statements Us Dependence On Canadian Imports

May 16, 2025

Analyzing Trumps Statements Us Dependence On Canadian Imports

May 16, 2025 -

Is Trump Right Us Dependence On Canadian Goods An Expert Assessment

May 16, 2025

Is Trump Right Us Dependence On Canadian Goods An Expert Assessment

May 16, 2025