Climate Risk: A Growing Factor In Home Loan Applications

Table of Contents

Understanding Climate Risk and its Impact on Property Value

Climate risk encompasses a wide range of threats that can significantly devalue properties. These risks aren't just about immediate damage; they also affect long-term desirability and insurability. Let's examine some key threats:

- Flooding: Rising sea levels and increased rainfall are leading to more frequent and severe flooding events, impacting coastal communities and even inland areas previously considered safe. This damage can be catastrophic, rendering properties uninhabitable and dramatically reducing their value.

- Wildfires: The increasing intensity and frequency of wildfires pose a significant threat to properties in fire-prone regions. The destruction caused by wildfires extends beyond immediate property damage, impacting air quality, infrastructure, and overall community desirability for years to come.

- Extreme Heat: Prolonged periods of extreme heat can damage infrastructure, increase energy costs, and decrease the overall livability of a region, negatively affecting property values.

- Drought: Prolonged droughts can lead to water scarcity, impacting landscaping, agriculture, and even the structural integrity of buildings, thereby reducing property values.

These climate risks directly impact property values in several ways:

- Increased Insurance Premiums: Properties in high-risk zones face significantly higher insurance premiums, making them less attractive to potential buyers.

- Decreased Desirability: The perception of climate risk can significantly impact buyer demand, leading to lower sale prices for properties located in vulnerable areas.

- Potential for Damage: The risk of direct damage from climate-related events – flooding, fire, or extreme weather – further reduces a property's value.

The Intergovernmental Panel on Climate Change (IPCC) and major insurance companies like Allianz and Munich Re have published extensive reports detailing the escalating financial risks associated with climate change and its impact on real estate. These reports consistently highlight the growing need for incorporating climate risk assessments into property valuations.

How Lenders are Assessing Climate Risk in Home Loan Applications

Lenders are adapting to this new reality by incorporating climate risk into their underwriting processes. This involves a more nuanced and sophisticated approach to assessing the risk profile of each property.

- Advanced Mapping and Modeling Techniques: Lenders are increasingly utilizing high-resolution flood maps, climate change models, and property-specific risk assessments to determine the likelihood of future climate-related damage.

- Stringent Underwriting Criteria: Properties located in high-risk zones are now subject to more stringent underwriting criteria, including higher down payments, stricter loan terms, and potentially higher interest rates.

- Loan Denials: In extreme cases, lenders may refuse to provide a loan for properties deemed to be at excessively high risk of climate-related damage.

The Role of Disclosure in Climate Risk Assessment

Transparent disclosure of climate-related risks is paramount. Both buyers and lenders need access to accurate and complete information to make informed decisions.

- Seller's Disclosure: Sellers have a legal and ethical obligation to disclose any known climate-related issues affecting the property.

- Lender's Responsibility: Lenders have a responsibility to conduct thorough due diligence and accurately assess the climate risks associated with each property.

- Legal Repercussions: Failure to disclose relevant climate-related information can lead to significant legal repercussions for both sellers and lenders.

Strategies for Mitigating Climate Risk When Applying for a Home Loan

Navigating the complexities of climate risk when applying for a home loan requires careful planning and proactive measures.

- Thorough Property Inspection: Conduct a comprehensive property inspection focusing specifically on climate-related vulnerabilities.

- Researching Historical Climate Data: Investigate the historical climate data for the area, paying close attention to flood history, wildfire risk, and extreme weather events.

- Exploring Insurance Options: Secure comprehensive flood insurance and other climate-related coverage to mitigate potential financial losses.

- Choosing Climate-Resilient Properties: Consider properties with features that enhance their resilience to climate-related threats, such as elevated foundations or fire-resistant materials.

Conclusion:

Climate risk is no longer a peripheral consideration in the home loan process; it's a central factor impacting property values, lending practices, and the overall stability of the real estate market. Understanding and addressing climate risk is essential for both lenders and borrowers. By conducting thorough due diligence, engaging with lenders who understand and actively address climate risk, and proactively managing climate risk in their home buying decisions, prospective homeowners can navigate this changing landscape more effectively. To successfully navigate the complexities of assessing climate risk, consult with a financial advisor or a mortgage professional experienced in managing climate risk. They can guide you through the process of understanding climate risk and help you find the right home loan that aligns with your individual needs and circumstances.

Featured Posts

-

The Assault On Clean Energy Challenges To Growth And Development

May 20, 2025

The Assault On Clean Energy Challenges To Growth And Development

May 20, 2025 -

Eurovision 2024 Louanes Song Revealed

May 20, 2025

Eurovision 2024 Louanes Song Revealed

May 20, 2025 -

Festival Da Cunha Em Manaus Shows Cultura E Vivencias Amazonicas

May 20, 2025

Festival Da Cunha Em Manaus Shows Cultura E Vivencias Amazonicas

May 20, 2025 -

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025 -

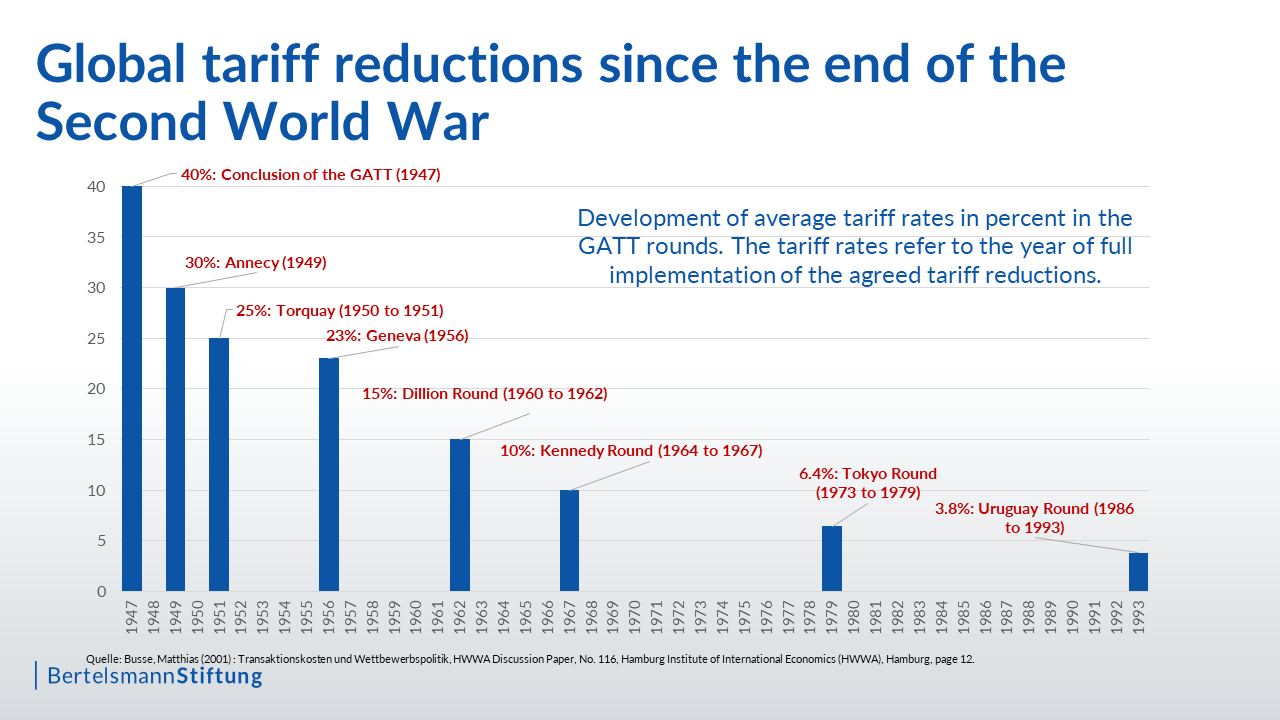

Fp Video Understanding And Responding To Global Tariff Changes

May 20, 2025

Fp Video Understanding And Responding To Global Tariff Changes

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025