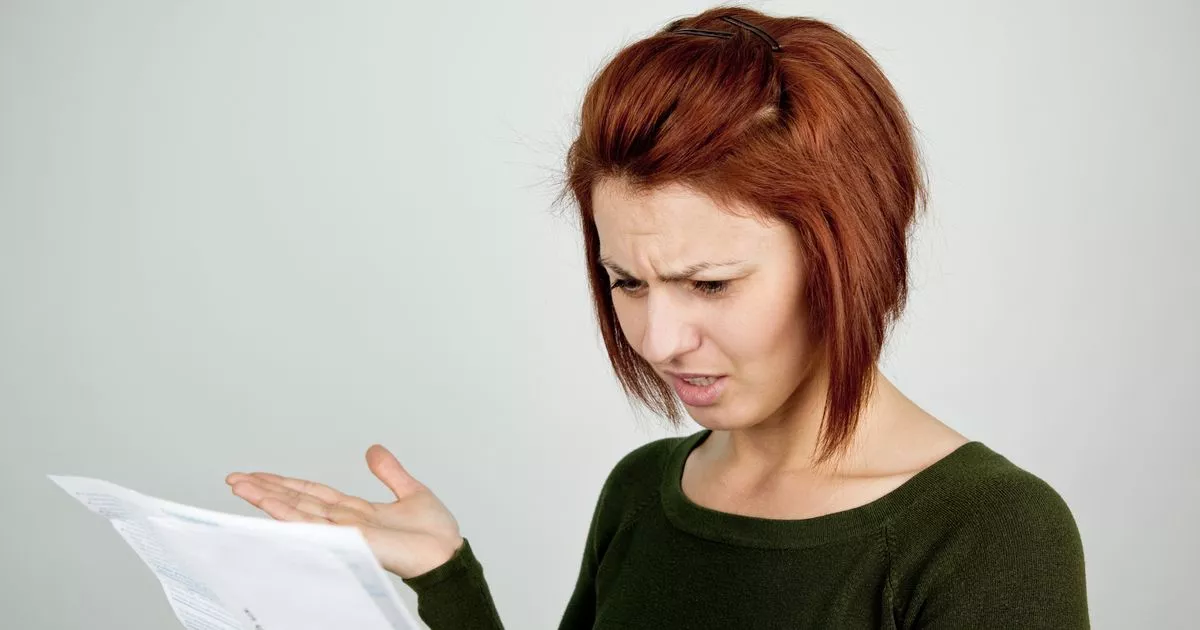

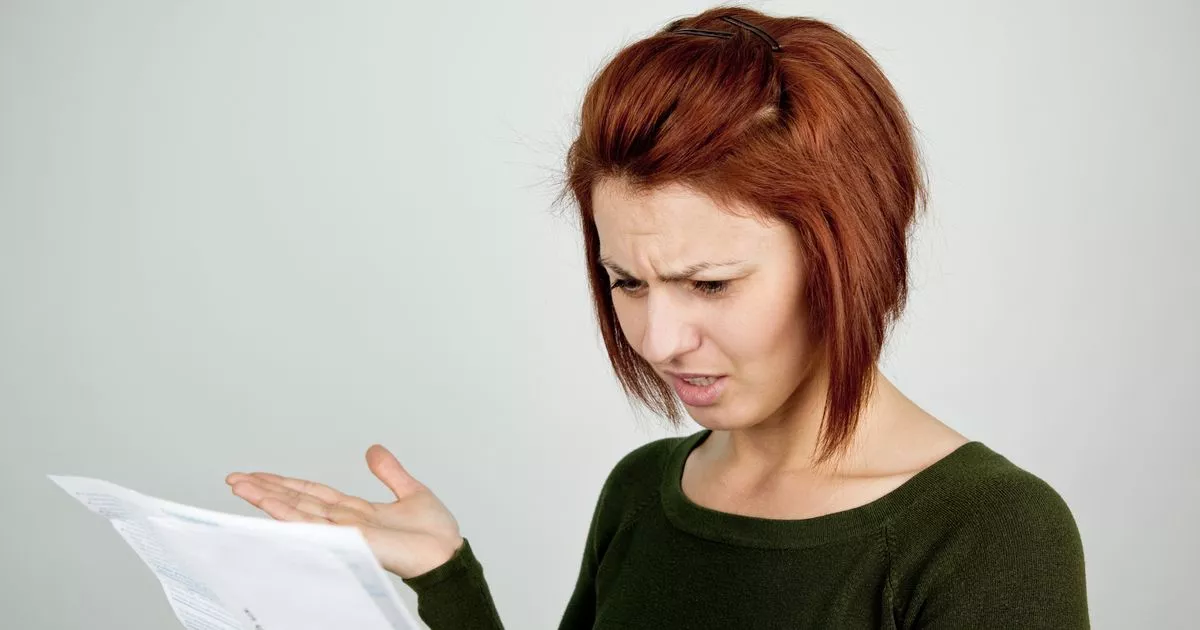

Claim Your HMRC Refund: A Simple Payslip Check Could Reveal Thousands Owed

Table of Contents

Understanding Your Payslip: The Key to Finding Your HMRC Refund

Your payslip is a treasure trove of information, often containing clues to potential HMRC refunds. Carefully reviewing your payslips is the crucial first step. Inconsistencies or unexpected deductions could indicate an underpayment or tax code error that entitles you to an HMRC refund.

Common indicators on your payslip that might signal a problem include:

- Unexpectedly high tax deductions: If your tax deductions seem significantly higher than previous years or what you'd expect based on your income, investigate further.

- Inconsistent income tax calculations: Look for any irregularities or unexplained changes in your tax calculations from one payslip to another.

- Missing tax relief: Ensure all applicable tax reliefs are being applied correctly.

Here's what to specifically look for:

- Check your tax code: Is it accurate for your current circumstances? A wrong tax code is a frequent cause of overpayment and potential HMRC refunds.

- Compare your tax deductions: Compare your current tax deductions to those from previous years or to expected amounts based on your income. Significant differences could indicate a problem.

- Look for unexplained deductions: Are there any deductions that you don't recognise or understand? This could point to an issue that needs further investigation.

Common Reasons for HMRC Refunds

Several reasons can lead to an HMRC refund. Understanding these common scenarios can help you identify if you're eligible for a refund.

- Incorrect tax code: Your tax code determines how much income tax is deducted from your pay. An incorrect tax code, often resulting from a change in circumstances, can lead to significant overpayments. For example, if you're still on a tax code reflecting a higher income after a job change, you're likely overpaying.

- Changes in circumstances: Life events like marriage, divorce, the birth of a child, job loss, or starting a new job can affect your tax code and entitlement to tax credits. Failing to update your details with HMRC promptly can lead to overpayment.

- Overpaid tax: Several scenarios can lead to overpaid tax. For instance, if you've paid tax on income that's exempt or you've claimed tax relief incorrectly, you might be entitled to a refund.

- Unclaimed tax relief: Many people are unaware of the various tax reliefs available. These include marriage allowance, childcare costs tax relief, and others. Checking your eligibility for these reliefs could significantly increase your HMRC refund.

How to Claim Your HMRC Refund: A Step-by-Step Guide

Claiming your HMRC refund is relatively straightforward. Here's a step-by-step guide:

- Gather necessary documentation: You'll need your P60, payslips from the relevant period, and any other supporting documentation that might be relevant to your claim, such as proof of marriage or childcare expenses.

- Access the HMRC online portal: The easiest way to claim is through the official HMRC online portal. You'll need your Government Gateway user ID and password. If you don't have one, you'll need to register.

- Follow the instructions carefully: The HMRC website provides clear instructions on how to submit your claim. Follow these instructions meticulously to ensure your claim is processed efficiently.

- Submit your claim: Once you've completed the online form, submit your claim. Keep a copy of your submission for your records.

- What to expect after submitting the claim: HMRC typically processes claims within several weeks. You'll receive notification once a decision has been made.

Seeking Professional Help: When to Consult a Tax Advisor

While claiming an HMRC refund is often straightforward, some situations may benefit from professional help.

- Complex tax situations: If your tax affairs are complex, involving multiple income sources or intricate tax relief claims, seeking guidance from a tax advisor is advisable.

- Difficulties understanding HMRC's processes: If you're struggling to navigate HMRC's processes or understand the requirements for claiming a refund, a tax advisor can provide invaluable assistance.

- Significant discrepancies in your payslips: If you've identified significant discrepancies in your payslips that you're unable to resolve on your own, professional help can ensure you claim everything you're entitled to.

- Need for assistance with tax relief claims: Claiming certain tax reliefs can be complicated. A tax advisor can help you navigate the process and maximize your potential tax savings.

Don't Miss Out on Your HMRC Refund

Checking your payslips for potential discrepancies is crucial. Common reasons for HMRC refunds include incorrect tax codes, changes in circumstances, overpaid tax, and unclaimed reliefs. Claiming a refund is relatively easy through the HMRC online portal. Don't leave money on the table – start your HMRC refund claim today by reviewing your payslips! [Link to HMRC Website]

Featured Posts

-

El Regreso Fallido De Schumacher Conversacion Reveladora Antes De 2010

May 20, 2025

El Regreso Fallido De Schumacher Conversacion Reveladora Antes De 2010

May 20, 2025 -

Extreme Price Hike At And T Details 1050 V Mware Cost Increase After Broadcom Deal

May 20, 2025

Extreme Price Hike At And T Details 1050 V Mware Cost Increase After Broadcom Deal

May 20, 2025 -

Man United News Journalists Worrying Matheus Cunha Update

May 20, 2025

Man United News Journalists Worrying Matheus Cunha Update

May 20, 2025 -

Bbc To Produce Tv Series Based On Agatha Christies Endless Night

May 20, 2025

Bbc To Produce Tv Series Based On Agatha Christies Endless Night

May 20, 2025 -

Biarritz Decouvrir Les Nouvelles Tables Et Chefs

May 20, 2025

Biarritz Decouvrir Les Nouvelles Tables Et Chefs

May 20, 2025

Latest Posts

-

Nyt Crossword April 25 2025 Answers And Solutions

May 20, 2025

Nyt Crossword April 25 2025 Answers And Solutions

May 20, 2025 -

Ginger Zee Responds To Aging Criticism

May 20, 2025

Ginger Zee Responds To Aging Criticism

May 20, 2025 -

Flavio Cobolli Claims First Atp Championship In Bucharest

May 20, 2025

Flavio Cobolli Claims First Atp Championship In Bucharest

May 20, 2025 -

Sabalenka And Zverev Top Seeds Dominate Early Rounds In Madrid

May 20, 2025

Sabalenka And Zverev Top Seeds Dominate Early Rounds In Madrid

May 20, 2025 -

Bucharest Open Flavio Cobolli Secures Maiden Atp Title

May 20, 2025

Bucharest Open Flavio Cobolli Secures Maiden Atp Title

May 20, 2025