Chinese Plastics Industry: Navigating The Risks Of US Sanctions On Iran Trade

Table of Contents

H2: Understanding the Impact of US Sanctions on Iran's Plastics Sector

US sanctions on Iran have profoundly impacted its plastics sector, creating ripple effects throughout global supply chains. Iran, with its substantial petrochemical resources, plays a significant role in the global plastics market. However, sanctions have severely hampered its ability to participate fully.

- Sanctions and Financial Restrictions: US sanctions significantly restrict Iran's access to the international banking system, making international trade transactions incredibly difficult. This severely limits Iran's ability to import necessary equipment and export its finished plastic goods.

- Petrochemical Supply Disruptions: Sanctions target Iranian petrochemical exports, which are crucial raw materials for plastic production. This reduces the availability of key feedstocks like polyethylene and polypropylene, impacting global production capacities. This shortage drives up prices and creates supply chain uncertainty.

- Reduced Iranian Plastic Production and Exports: Consequently, Iran's plastic production and exports have significantly decreased. This reduction affects various global supply chains, particularly those reliant on Iranian-produced plastics and petrochemicals.

- Market Shifts and Increased Competition: The decreased Iranian plastic exports have created increased demand from alternative suppliers. While this might benefit certain competitors, it also generates uncertainty and necessitates a reassessment of sourcing strategies for businesses worldwide.

H2: Risks for Chinese Companies Involved in Iran Plastic Trade

Chinese companies involved in plastics trade with Iran face substantial risks stemming from US sanctions. Non-compliance can lead to severe consequences with far-reaching repercussions.

- Financial Penalties: Chinese companies engaging in transactions deemed to violate US sanctions face the risk of substantial financial penalties from the US government. These penalties can be crippling, impacting the financial health and stability of the involved businesses.

- Reputational Damage: Involvement in activities that violate US sanctions can cause severe reputational damage, impacting the company's credibility and ability to attract future business partners and investors. The negative publicity can be devastating to long-term growth.

- Legal Consequences and Litigation: Non-compliance can lead to complex legal challenges and protracted litigation, resulting in substantial legal fees and potential losses. Navigating international legal systems can be costly and time-consuming.

- Transactions with Sanctioned Entities: Transactions involving sanctioned entities or individuals, even unknowingly, can lead to severe consequences, highlighting the importance of comprehensive due diligence.

- Financing Challenges: Securing financing for transactions related to Iran has become increasingly difficult due to the heightened risk profile associated with such ventures.

H3: Specific Examples of Sanctions-Related Risks

Secondary sanctions imposed by the US can impact entities that conduct business with sanctioned Iranian individuals or companies, even if the transaction itself is not directly related to Iran. For example:

- Using sanctioned banks: A Chinese company using a bank that has been sanctioned by OFAC (Office of Foreign Assets Control) for conducting business with Iran could face penalties, regardless of the transaction's nature.

- Shipping through sanctioned ports: Shipping goods through ports designated as sanctioned by the US government can result in penalties for all parties involved in the shipment.

- Transactions with sanctioned individuals or entities: Even indirect transactions with individuals or entities listed on OFAC's Specially Designated Nationals and Blocked Persons List (SDN List) can trigger sanctions violations.

H2: Strategies for Mitigating Risks and Ensuring Compliance

Proactive risk management is paramount for Chinese companies involved in or considering trade with Iran. A multi-faceted approach is essential to ensure compliance.

- Thorough Due Diligence: Conducting comprehensive due diligence on all Iranian business partners is crucial. This involves verifying their identities, assessing their business activities, and screening them against sanctioned entity lists.

- Robust Compliance Programs: Implementing robust compliance programs that thoroughly screen transactions and partners against sanctioned entity lists is essential. This includes regular updates and training for personnel.

- Seeking Legal Counsel: Seeking legal counsel specializing in international sanctions compliance is highly recommended. Experts can advise on navigating complex regulations and mitigating potential risks.

- Alternative Trade Finance Solutions: Exploring alternative trade finance solutions can mitigate financial risks associated with transactions involving Iran. This includes securing financing from institutions not subject to US jurisdiction.

- Technology-Driven Tools: Utilizing technology-driven tools for sanctions screening and compliance monitoring improves efficiency and accuracy, reducing the risk of unintentional violations.

- Supply Chain Diversification: Diversifying sourcing and reducing reliance on Iranian suppliers strengthens resilience to supply chain disruptions and sanctions-related risks.

H2: The Future of Chinese-Iranian Plastics Trade

The future of Chinese-Iranian plastics trade hinges on several factors, including potential shifts in US foreign policy towards Iran and global geopolitical dynamics.

- Geopolitical Shifts and Sanctions Relaxation: Any potential relaxation of US sanctions on Iran could significantly alter the landscape, potentially increasing trade opportunities. However, this remains highly uncertain.

- Alternative Trading Partners: Both China and Iran are likely to seek alternative trading partners to reduce reliance on potentially volatile relationships. This will shape future market dynamics.

- Long-Term Implications for Chinese Competitiveness: Navigating sanctions and diversifying supply chains will influence the long-term competitiveness of the Chinese plastics industry in the global market.

3. Conclusion:

The US sanctions on Iran present substantial challenges and risks for the Chinese plastics industry. Understanding these risks, implementing robust compliance programs, conducting thorough due diligence, and staying abreast of evolving geopolitical factors are critical for mitigating potential penalties and reputational damage. Diversifying supply chains and exploring alternative trading partners are vital for navigating this complex environment and ensuring the long-term sustainability of business operations. By adopting a proactive risk management approach, Chinese companies can successfully navigate this challenging landscape and maintain a strong presence in the global plastics market. Learn more about mitigating risks in the Chinese plastics industry and US sanctions on Iran trade today!

Zayavlenie Ovechkina Vozvraschenie V Moskovskoe Dinamo

Zayavlenie Ovechkina Vozvraschenie V Moskovskoe Dinamo

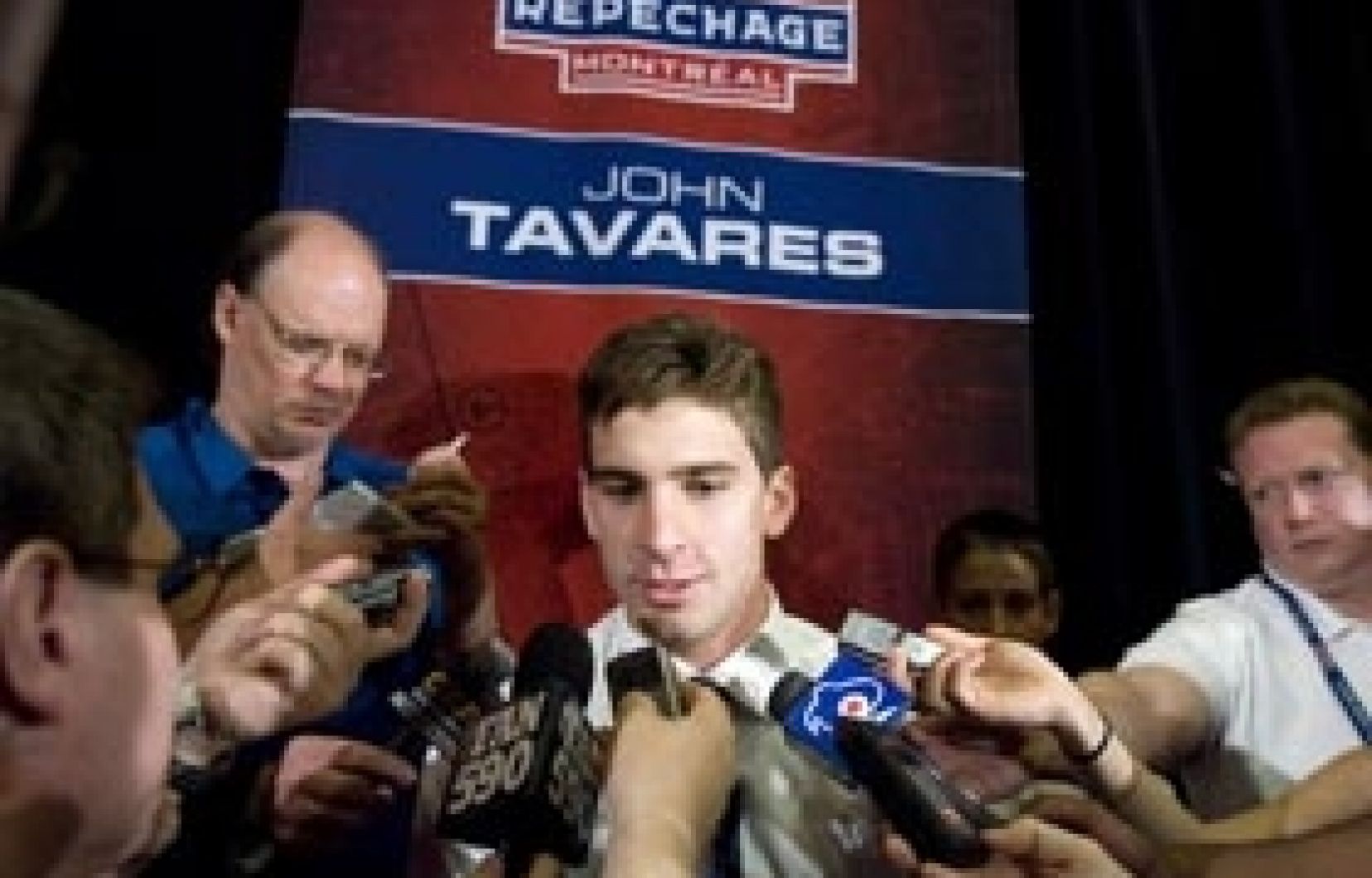

Impact De La Decentralisation Du Repechage Sur La Lnh

Impact De La Decentralisation Du Repechage Sur La Lnh

Iyqaf Tyar Ajnby Albwlysaryw Twdh Mlabsat Alhadtht

Iyqaf Tyar Ajnby Albwlysaryw Twdh Mlabsat Alhadtht

Is John Wick 5 Really Over A Look At The Latest News

Is John Wick 5 Really Over A Look At The Latest News

Goaltenders Wish A Signed Ovechkin Jersey After Historic Save

Goaltenders Wish A Signed Ovechkin Jersey After Historic Save