China's Lithium Tech Export Curbs: Positive Implications For Eramet, Says CEO

Table of Contents

China's Growing Influence on the Lithium Market and its Recent Export Controls

China's dominance in lithium refining and processing is undeniable. For years, it has controlled a substantial portion of the global supply chain, processing lithium ore into the battery-grade chemicals needed for lithium-ion batteries. The recent export curbs target specific lithium technologies, including crucial chemicals and processing equipment vital for battery manufacturing. These restrictions aren't arbitrary; they stem from China's strategic goals:

- Securing Domestic Supply: China aims to prioritize its own burgeoning EV industry and ensure sufficient battery materials for its domestic manufacturers.

- Strategic Resource Control: Limiting exports allows China to exert greater control over the global supply chain and potentially leverage its position in international negotiations.

The reasons behind this strategic shift are multifaceted:

- Increased demand for electric vehicles globally: The worldwide transition to electric mobility fuels an unprecedented surge in lithium demand.

- China's strategic push for domestic battery manufacturing: China is aggressively developing its domestic battery industry, aiming for self-sufficiency and global leadership.

- Potential for supply chain disruptions for companies reliant on Chinese imports: Companies heavily dependent on Chinese lithium imports now face significant uncertainty and potential production bottlenecks.

Eramet's Position and Potential Benefits from China's Export Restrictions

Eramet, with its established lithium mining and processing operations, is well-positioned to capitalize on China's export restrictions. The reduced competition from Chinese companies, hindered by export controls, creates a significant opportunity for Eramet to expand its market share. Eramet's strategy to leverage this situation includes:

- Increased production: Eramet can ramp up its production to meet the growing demand left unfulfilled by Chinese restrictions.

- New investments: The company can invest in expanding its processing capabilities and exploring new lithium resources.

- Market expansion: Eramet can target new markets in Europe and other regions, where demand for battery materials is high.

Eramet's existing strengths contribute to its advantageous position:

- Eramet's geographic diversification in lithium sourcing: Unlike companies heavily reliant on Chinese imports, Eramet sources lithium from diverse locations, mitigating supply chain risks.

- Eramet's investments in upstream lithium processing capabilities: Eramet’s vertically integrated approach allows greater control over the production process and ensures a consistent supply of high-quality battery materials.

- Potential for increased market share in Europe and other regions: The European Union, for example, is actively promoting domestic battery production, creating a lucrative market for companies like Eramet.

Geopolitical Implications and the Restructuring of the Global Lithium Supply Chain

China's actions have profound geopolitical implications, forcing a reassessment of the global battery supply chain. The restrictions are prompting other countries to:

- Increase their lithium production and processing capacity: Countries like Australia and nations in South America are investing heavily in lithium mining and refining, aiming to fill the gap left by China's export curbs.

- Implement government incentives and policies supporting domestic battery production: Governments worldwide are recognizing the strategic importance of securing domestic battery production and are offering substantial incentives to attract investment in the sector.

These developments are likely to:

- Increase interest in lithium mining and refining in other countries (e.g., Australia, South America): We're seeing a surge in investment and exploration activities in these regions.

- Lead to the formation of new trade alliances and partnerships: Countries are actively seeking to create more resilient and diversified supply chains, leading to new collaborations.

- Impact the price of lithium and lithium-ion batteries: While initially causing price fluctuations, the long-term impact on pricing remains to be seen.

CEO's Statements and Analysis

Eramet's CEO has publicly commented on the positive implications of China's export curbs, stating (insert direct quote from Eramet CEO here). This statement underscores Eramet's confidence in its ability to capitalize on the shifting market dynamics. Key insights from the CEO's comments include:

- (Summarize key points from the CEO's statement using bullet points).

Conclusion: Navigating the Shifting Sands of the Lithium Market – Opportunities for Eramet and Beyond

China's lithium technology export restrictions present both challenges and opportunities. While disrupting existing supply chains, these curbs are accelerating the diversification and strengthening of the global lithium-ion battery supply chain. Companies like Eramet, with their geographically diversified sourcing and vertically integrated operations, are particularly well-positioned to thrive in this new landscape. The importance of resilience and diversification in the global lithium supply chain cannot be overstated. Stay informed on how China's lithium export curbs are reshaping the global lithium-ion battery supply chain and how companies like Eramet are adapting to this new landscape.

Featured Posts

-

Mission Impossible 7 Trailer Analysis What They Learned From Previous Films

May 14, 2025

Mission Impossible 7 Trailer Analysis What They Learned From Previous Films

May 14, 2025 -

Eurovision 2025 Anne Marie Davids Israel Concert And Positive Comments

May 14, 2025

Eurovision 2025 Anne Marie Davids Israel Concert And Positive Comments

May 14, 2025 -

Trade War Uncertainty Halts Tech Company Ipo Plans

May 14, 2025

Trade War Uncertainty Halts Tech Company Ipo Plans

May 14, 2025 -

Exploring The Meaning Behind Dont Hate The Playaz

May 14, 2025

Exploring The Meaning Behind Dont Hate The Playaz

May 14, 2025 -

Tommy Fury Challenges Jake Paul To A Rematch Hours After Saying No

May 14, 2025

Tommy Fury Challenges Jake Paul To A Rematch Hours After Saying No

May 14, 2025

Latest Posts

-

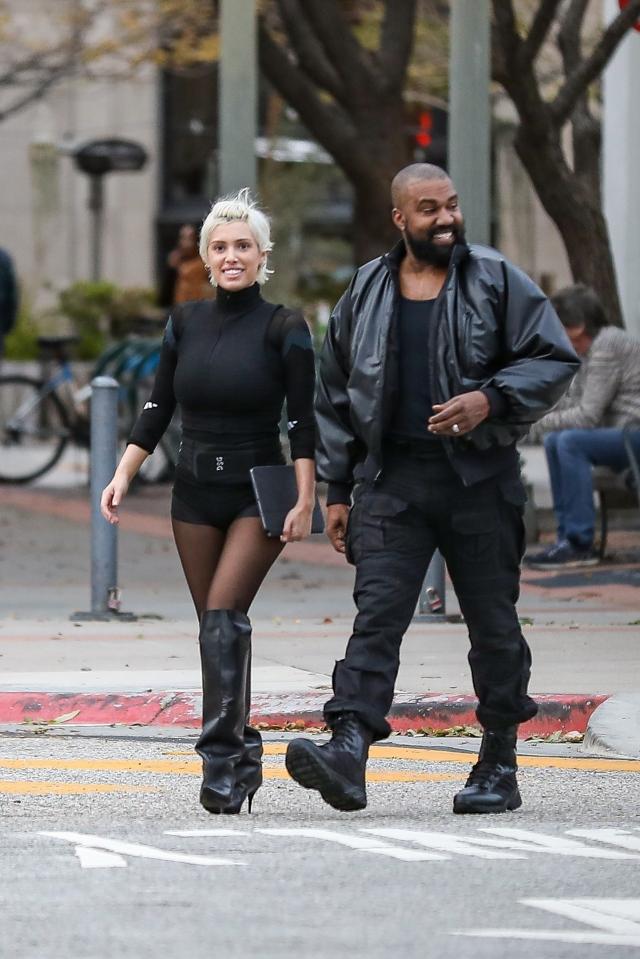

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025 -

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025 -

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025 -

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025