China's Lithium Export Restrictions: A Boon For Eramet?

Table of Contents

China's Dominance in the Lithium Market and the Rationale Behind Export Restrictions

China currently holds a dominant position in lithium processing and refining, controlling a substantial portion of the global capacity. This dominance stems from significant investments in lithium-ion battery production and the rapid growth of its electric vehicle (EV) sector. The rationale behind China's decision to restrict lithium exports is multifaceted. Primarily, it aims to secure a stable domestic supply of lithium to fuel its ambitious EV industry goals. This move also reflects a broader strategy of strategic resource control, ensuring China's continued leadership in the burgeoning clean energy sector.

- China's Control: Estimates suggest China holds over 60% of global lithium processing capacity.

- Key Industries: The Chinese demand for lithium is driven by its massive EV manufacturing sector, energy storage systems, and other emerging technologies.

- Geopolitical Implications: The export restrictions have sparked concerns about potential supply chain disruptions and have introduced an element of geopolitical uncertainty into the lithium market. This has implications for international trade relations and the global energy transition.

Eramet's Position and Potential to Fill the Gap

Eramet, a major French mining and metallurgy group, is well-positioned to capitalize on China's export restrictions. Unlike many competitors heavily reliant on Chinese supply chains, Eramet boasts geographic diversification in its lithium projects and operations. This strategic advantage allows it to offer a more secure and stable source of lithium to the global market.

- Key Projects: Eramet's significant lithium projects, including its Wari Wari project in Argentina and other investments in various stages of development, showcase its commitment to expanding its lithium production capacity.

- Strategic Partnerships: Eramet actively engages in strategic partnerships and collaborations, further strengthening its position in the global lithium market.

- Production Capacity: Eramet has the potential to significantly increase its lithium production, directly responding to the increased global demand created by the reduced Chinese supply.

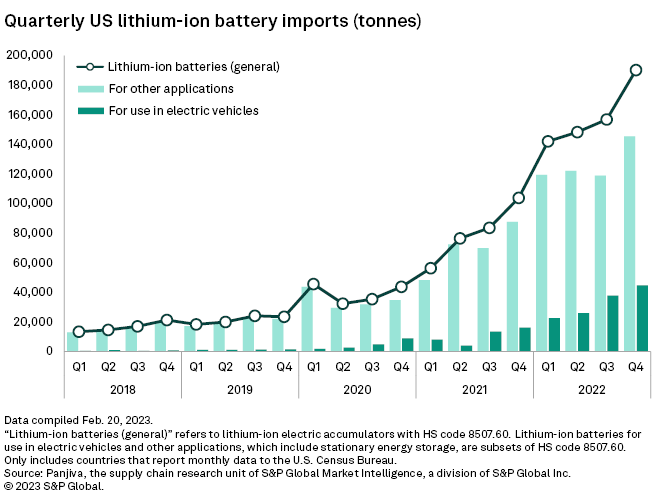

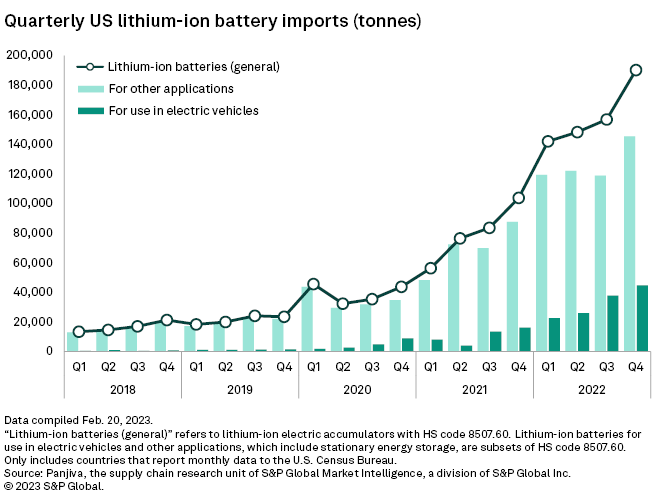

Increased Demand and Price Volatility

The restricted supply of lithium from China has already led to increased price volatility in the global market. This price surge is further fueled by the ever-growing demand for lithium-ion batteries, primarily driven by the explosive growth of the EV industry worldwide.

- Demand Growth: The global demand for lithium is projected to increase exponentially over the next decade, creating a massive opportunity for producers.

- Price Volatility Impact: Fluctuating lithium prices pose significant challenges for battery manufacturers, who struggle with production cost predictability, and for consumers facing potential price increases for electric vehicles.

- Eramet's Advantage: Eramet is well-placed to profit from higher prices, potentially enhancing its profitability and accelerating its expansion plans.

Geopolitical Implications and Diversification of the Lithium Supply Chain

China's export restrictions are accelerating efforts to diversify the global lithium supply chain, reducing the reliance on a single dominant player. This shift is encouraging investment in lithium mining and processing in other major lithium-producing countries like Australia, Chile, and Argentina.

- Investment Opportunities: The current scenario provides significant investment opportunities in lithium projects outside of China, boosting economic activity in these regions.

- Challenges of Diversification: Diversifying the lithium supply chain faces various challenges, including infrastructure development, regulatory hurdles, and environmental concerns.

- New Trade Agreements: The global geopolitical landscape is likely to see the emergence of new trade agreements and partnerships to ensure a more stable and secure lithium supply.

Eramet's Sustainable Lithium Practices and ESG Considerations

Eramet is committed to sustainable and responsible lithium mining practices. The increasing focus on Environmental, Social, and Governance (ESG) factors within the lithium industry makes this commitment a key competitive advantage.

- Environmental Initiatives: Eramet actively implements initiatives to minimize its environmental impact throughout its operations, enhancing its brand image and attracting responsible investors.

- Social Responsibility: Eramet prioritizes community engagement and social responsibility in the regions where it operates, building trust and long-term sustainability.

- Investor Focus on ESG: Investors increasingly prioritize ESG factors in their investment decisions, making sustainable practices crucial for attracting capital and securing future growth.

Conclusion

China's lithium export restrictions present a complex scenario for the global lithium market. While creating uncertainty, they also pave the way for companies like Eramet to expand their market share and become major players in meeting global lithium demands. Eramet's strategic geographic diversification, sustainable practices, and commitment to ESG principles position it uniquely to benefit from this evolving market landscape.

Call to Action: Learn more about how Eramet is strategically navigating China's lithium export restrictions and shaping the future of the lithium supply chain. Stay informed about the latest developments in China's lithium export restrictions and their impact on major players like Eramet to understand the changing dynamics of the battery metals market.

Featured Posts

-

Analyzing The Business Strategies Of Sean Diddy Combs A Case Study

May 14, 2025

Analyzing The Business Strategies Of Sean Diddy Combs A Case Study

May 14, 2025 -

Lindts New Chocolate Paradise Opens In Central London

May 14, 2025

Lindts New Chocolate Paradise Opens In Central London

May 14, 2025 -

Igloo Cooler Amputation Risk Prompts Nationwide Walmart Recall

May 14, 2025

Igloo Cooler Amputation Risk Prompts Nationwide Walmart Recall

May 14, 2025 -

Is Vince Vaughn Italian Fact Checking His Background

May 14, 2025

Is Vince Vaughn Italian Fact Checking His Background

May 14, 2025 -

Us Ipo In The Works Exclusive News On Travel Tech Company Navans Financial Backing

May 14, 2025

Us Ipo In The Works Exclusive News On Travel Tech Company Navans Financial Backing

May 14, 2025

Latest Posts

-

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025 -

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025 -

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025 -

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025