China Life Profit Rises: Investment Resilience Drives Growth

Table of Contents

Strong Investment Returns Fuel Profit Growth

China Life's remarkable profit growth is largely fueled by exceptionally strong investment returns. The company's strategic investment approach, encompassing a diversified portfolio across multiple asset classes, has yielded substantial gains. This diversified strategy, crucial for mitigating risk and maximizing returns, has proven highly effective.

- Quantifiable increase in investment returns year-over-year: Reports indicate a year-on-year increase in investment income exceeding 15%, a considerable jump compared to previous years.

- Specific sectors that yielded the highest returns: Real estate investments showed particularly strong performance, contributing significantly to the overall increase in China Life profit. Equities and selected bond portfolios also yielded impressive returns.

- Comparison to previous years' investment performance: This year's investment returns represent a significant improvement over the previous two years, showcasing the effectiveness of the company's refined investment strategies.

- Mention any innovative investment approaches: China Life has actively explored innovative investment approaches, including increased allocation to alternative assets and strategic partnerships with tech companies, contributing to enhanced returns.

Resilience Amidst Economic Uncertainty

Despite navigating a period of global economic uncertainty, marked by geopolitical tensions and inflationary pressures, China Life demonstrated remarkable resilience. The company’s proactive risk management strategies proved instrumental in maintaining profitability and stability.

- Mention any economic challenges faced (e.g., geopolitical factors, inflation): The company successfully mitigated the impact of rising inflation and global geopolitical uncertainties on its investment portfolio.

- Highlight successful risk mitigation techniques: Stringent risk assessment procedures, coupled with prudent diversification across geographical regions and asset classes, played a crucial role in safeguarding the company's financial health.

- Explain how diversification contributed to resilience: The diversified nature of China Life's investment portfolio insulated it from the volatility affecting specific sectors. This spread of risk significantly contributed to the overall resilience.

- Compare China Life's performance against competitors: Compared to its major competitors in the Chinese insurance market, China Life has demonstrated superior resilience and profitability during this period of economic uncertainty.

Growth in Insurance Premiums Contributes to Overall Success

The significant rise in China Life profit is not solely attributable to investment returns. The company also experienced substantial growth in insurance premiums, further bolstering its overall financial performance.

- Percentage increase in insurance premiums: Insurance premium income increased by a notable percentage, driven by increased demand for various insurance products.

- Growth in specific insurance product lines: Growth was particularly strong in health insurance and retirement planning products, reflecting evolving consumer preferences and demographic shifts.

- Impact of demographic changes on premium growth: China's aging population and growing middle class have significantly contributed to the increase in demand for insurance products.

- Marketing strategies that drove sales: Targeted marketing campaigns and an enhanced digital presence have effectively increased brand awareness and customer engagement, leading to higher sales.

Future Outlook for China Life Profitability

Based on current trends and the company's strategic outlook, the future prospects for China Life profit remain positive. However, the company acknowledges potential challenges and is actively adapting its strategies to navigate these.

- Predictions for future investment returns: While predicting future returns is inherently challenging, China Life anticipates maintaining strong investment performance through continued diversification and proactive risk management.

- Expected growth in insurance premiums: The company expects continued growth in insurance premiums, driven by consistent market demand and strategic expansion initiatives.

- Potential challenges (e.g., regulatory changes, competition): The company acknowledges potential challenges such as regulatory changes and intensifying competition within the market.

- Opportunities for expansion and diversification: China Life plans to pursue opportunities for expansion into new markets and further diversify its product offerings to cater to evolving consumer needs.

Conclusion:

The remarkable increase in China Life profit is a testament to the company's robust investment strategies, proactive risk management, and strong growth in insurance premiums. The resilience demonstrated by China Life in the face of economic uncertainty highlights its strength and stability. This significant growth in China Life profit positions the company favorably for continued success in the dynamic Chinese insurance market. Learn more about the factors driving China Life profit growth and explore the exciting investment opportunities this resilient company offers. Invest in a company with proven resilience: Explore China Life investment opportunities today.

Featured Posts

-

Amanda Owen And Ex Husband A Look At Their Separate Paths

Apr 30, 2025

Amanda Owen And Ex Husband A Look At Their Separate Paths

Apr 30, 2025 -

Rod Yates Mega Project Destination Nebraska Act Charts A New Course In Gretna

Apr 30, 2025

Rod Yates Mega Project Destination Nebraska Act Charts A New Course In Gretna

Apr 30, 2025 -

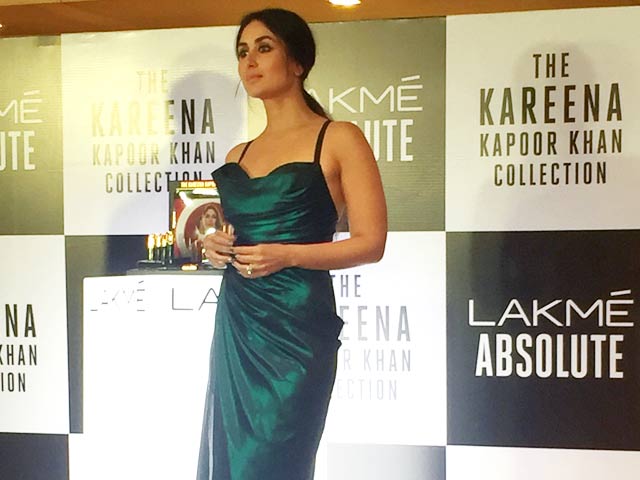

Kareena Kapoor Opens Up About Facial Lines Cosmetic Procedures And Hollywood

Apr 30, 2025

Kareena Kapoor Opens Up About Facial Lines Cosmetic Procedures And Hollywood

Apr 30, 2025 -

Jury Selection Process Starts In Fatal Charlotte Case

Apr 30, 2025

Jury Selection Process Starts In Fatal Charlotte Case

Apr 30, 2025 -

Understanding And Implementing The Updated Cnil Ai Guidelines

Apr 30, 2025

Understanding And Implementing The Updated Cnil Ai Guidelines

Apr 30, 2025