Chime's US IPO Filing: A Look At The Digital Banking Startup's Revenue Growth

Table of Contents

Chime's Business Model and Revenue Streams

Chime's revenue model is primarily fee-based, unlike traditional banks that rely heavily on interest income. Their success hinges on several key revenue streams:

- Interchange fees from debit card transactions: This is a significant portion of Chime's revenue, generated each time a Chime debit card is used for purchases. The company benefits from the high transaction volume among its large customer base.

- Subscription fees for premium services (Chime Plus, Chime Premium): Chime offers subscription tiers, providing enhanced features like early direct deposit, fee reimbursements, and overdraft protection. These subscriptions contribute a growing portion of their overall revenue.

- Potential future revenue streams (loans, investments): Chime is expanding its offerings, exploring opportunities in lending and investment products. These could significantly diversify their revenue sources in the future.

However, Chime's significant reliance on debit card interchange fees presents a risk. Changes in interchange fee regulations or a decrease in debit card usage could negatively impact their revenue growth. Understanding this dependency is crucial for assessing the long-term stability of Chime's financial model. Careful consideration of Chime's revenue model, specifically its Chime fees and Chime subscription services, is vital for potential investors. The efficacy of the Chime debit card in driving revenue needs continuous monitoring.

Analyzing Chime's Revenue Growth Trajectory

Chime has demonstrated impressive year-over-year revenue growth. While precise figures are subject to change pending the IPO filing, publicly available information showcases a strong upward trend. (Note: Insert charts and graphs illustrating revenue growth here, if available from public filings. Include data points and comparisons to competitors).

- Specific revenue figures from recent financial reports (if available): Include any publicly accessible data points illustrating growth.

- Growth rate comparison with traditional banks and other fintech competitors: Show how Chime's growth stacks up against established players and other digital banking startups.

- Highlight key periods of accelerated growth and explain the reasons behind them: Pinpoint specific timeframes where growth was particularly strong and analyze contributing factors (e.g., successful marketing campaigns, new product launches).

This analysis of Chime's revenue growth, Chime financial performance, and Chime year-over-year growth highlights the company’s potential, but careful scrutiny is needed to determine its sustainability.

Factors Driving Chime's Revenue Growth

Several key factors contribute to Chime's remarkable success:

- Large and growing customer base, particularly among younger demographics: Chime has effectively tapped into a significant market segment, attracting millions of users with its accessible and user-friendly platform.

- Effective marketing and branding strategies: Their marketing campaigns have resonated well with their target audience, creating strong brand recognition and loyalty.

- Focus on financial inclusion and accessibility: Chime's services cater to underserved populations, providing banking access to individuals who may not be served by traditional banks.

- Technological innovation and user-friendly mobile app: Chime's technologically advanced and intuitive mobile app provides a seamless user experience, driving user engagement and satisfaction.

Analyzing Chime's customer base, Chime marketing, Chime technology, and Chime user experience is crucial for understanding the factors behind its success and predicting future growth.

Challenges and Risks Facing Chime's Future Revenue Growth

Despite its impressive growth, Chime faces several challenges that could impact its future revenue:

- Increasing competition from other digital banks and fintech companies: The digital banking landscape is becoming increasingly crowded, with new competitors constantly emerging.

- Regulatory changes and compliance costs: Changes in financial regulations could increase compliance costs and potentially limit Chime's operations.

- Potential economic downturn and its impact on consumer spending: A recession could reduce consumer spending, impacting transaction volumes and subscription rates.

- Dependence on interchange fees and potential fee reductions: Chime's reliance on interchange fees makes it vulnerable to potential reductions in these fees.

Understanding Chime competition, Chime regulation, and Chime risk factors is vital for a complete picture of the company's prospects.

Conclusion

Chime's impressive revenue growth, driven by a strong business model, effective marketing, and technological innovation, positions it as a major player in the digital banking sector. However, its reliance on interchange fees and the competitive landscape present risks. Understanding Chime's revenue model and growth trajectory is critical for investors evaluating its potential. Stay informed about the latest developments regarding Chime's US IPO and its continued revenue growth. Follow [link to relevant news source or Chime's investor relations page] to stay updated. Understanding Chime's IPO and its revenue growth is vital for investors looking to capitalize on the opportunities and risks presented by this dynamic digital banking company.

Featured Posts

-

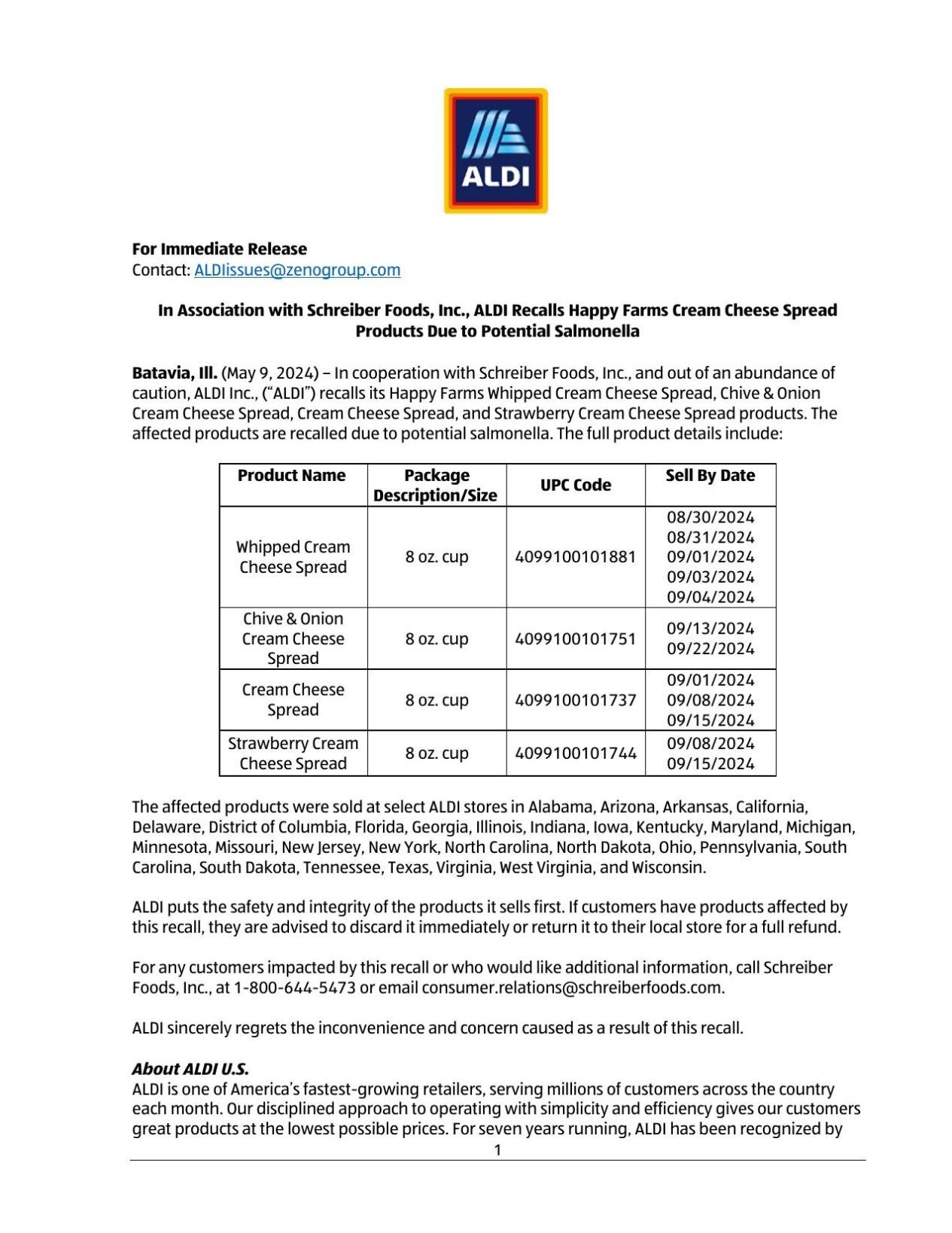

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025 -

Watch Captain America Brave New World Online Now

May 14, 2025

Watch Captain America Brave New World Online Now

May 14, 2025 -

Recall Alert Wegmans Braised Beef With Vegetables Safety Information

May 14, 2025

Recall Alert Wegmans Braised Beef With Vegetables Safety Information

May 14, 2025 -

Box Office Disaster Snow Whites Opening Weekend Numbers

May 14, 2025

Box Office Disaster Snow Whites Opening Weekend Numbers

May 14, 2025 -

Yevrobachennya 2024 Data Lokatsiya Spisok Uchasnikiv Ta Ukrayinskiy Vikonavets

May 14, 2025

Yevrobachennya 2024 Data Lokatsiya Spisok Uchasnikiv Ta Ukrayinskiy Vikonavets

May 14, 2025

Latest Posts

-

Your Guide To The Cast And Characters Of Nonna

May 14, 2025

Your Guide To The Cast And Characters Of Nonna

May 14, 2025 -

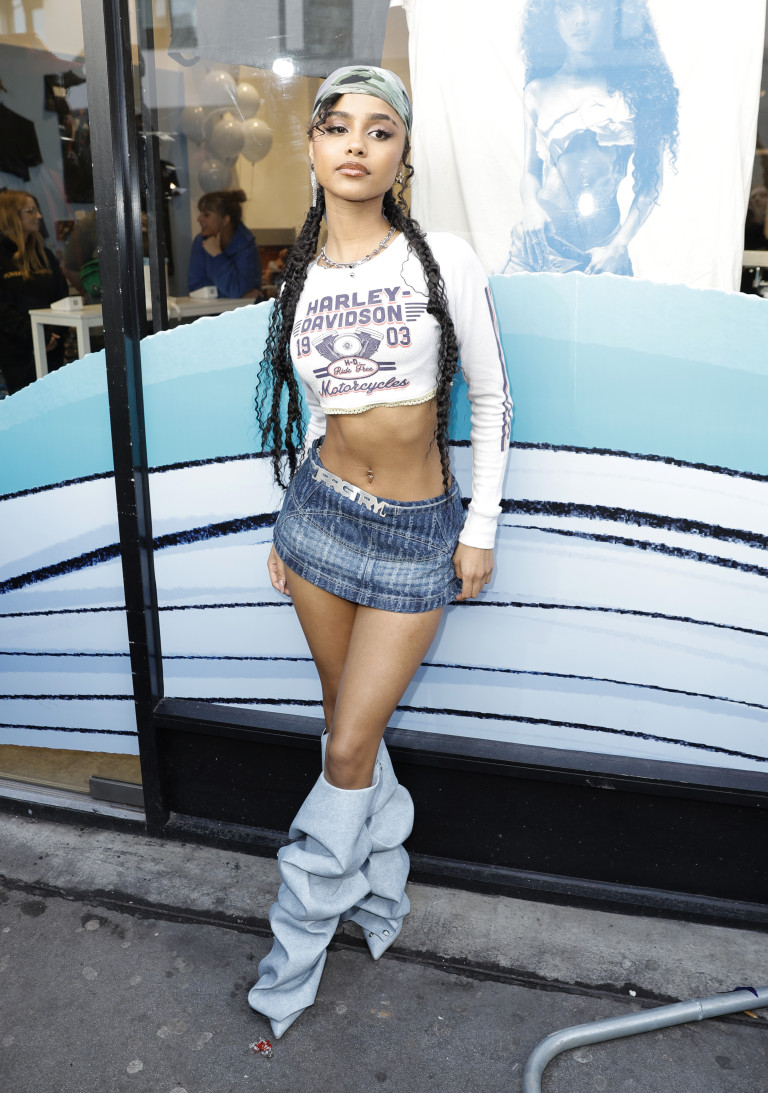

Chanel Through Tylas Eyes A Fashion Icons Perspective

May 14, 2025

Chanel Through Tylas Eyes A Fashion Icons Perspective

May 14, 2025 -

New Yorks Hidden Culinary Treasure A Unique Dining Experience

May 14, 2025

New Yorks Hidden Culinary Treasure A Unique Dining Experience

May 14, 2025 -

Nonna Cast And Character Guide Meet The Family

May 14, 2025

Nonna Cast And Character Guide Meet The Family

May 14, 2025 -

Exploring Tylas Chanel Style Iconic Pieces And Personal Interpretation

May 14, 2025

Exploring Tylas Chanel Style Iconic Pieces And Personal Interpretation

May 14, 2025