Check Your Payslip: Millions Entitled To HMRC Tax Refunds

Table of Contents

Understanding Your Payslip and Tax Codes

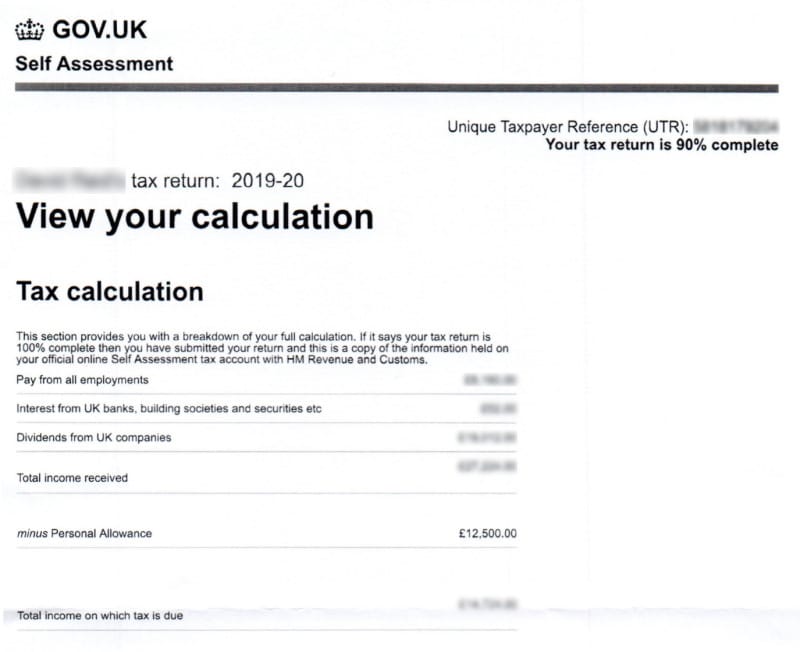

Understanding your payslip is the first step towards identifying a potential HMRC tax refund. This seemingly complex document holds the key to uncovering whether you've overpaid tax.

Deciphering Your Tax Code

Your tax code, a seemingly cryptic combination of numbers and letters (e.g., 1257L, BR), determines how much income tax is deducted from your salary. It reflects your personal tax allowance and other relevant factors.

- Common tax code misunderstandings: Many people misunderstand their tax code, leading to overpayment. A common misconception is believing the code represents the amount of tax you owe. It doesn’t. It dictates the amount of tax-free income you are entitled to.

- How to find your tax code on your payslip: Your tax code is usually clearly displayed on your payslip, often alongside your gross pay and tax deducted.

- What to do if your tax code is incorrect: If you believe your tax code is incorrect, contact HMRC immediately. An incorrect code can significantly impact the amount of tax deducted, potentially leading to overpayment or underpayment.

Identifying Potential Overpayment Indicators

Several indicators on your payslip can signal a potential tax overpayment. Careful scrutiny is key.

- Discrepancies between tax deducted and expected tax liability: Compare the tax deducted from your payslip with your estimated tax liability based on your income and allowances. Significant discrepancies warrant further investigation.

- Checking for incorrect tax codes or emergency tax deductions: An incorrect tax code or prolonged emergency tax deductions (often applied when HMRC lacks sufficient information about your income) can lead to significant overpayments. Ensure your tax code reflects your current circumstances.

- Payslip sections to scrutinize: Focus on sections detailing your gross pay, tax deducted, National Insurance contributions, and your net pay (take-home pay). Compare these figures year-on-year to identify any unusual patterns.

Common Reasons for Tax Overpayments

Several scenarios can result in overpaying tax. Understanding these scenarios can help you identify potential refunds.

- Changes in circumstances: Life events like marriage, divorce, starting a new job, changes in income, moving house, or taking maternity leave can significantly impact your tax code and potentially lead to overpayment if not reported to HMRC promptly.

- How these changes affect tax codes and potential for overpayment: These events often necessitate updates to your tax code. Failure to update your information with HMRC can result in incorrect tax deductions and subsequent overpayments.

How to Check Your Payslip for Tax Refund Eligibility

Now that you understand the basics, let's look at how to actively check your payslips for potential HMRC tax refunds.

Step-by-Step Guide to Reviewing Your Payslip

Checking your payslips for potential tax overpayments involves a systematic approach.

- Comparing yearly tax deducted with estimated tax liability: Calculate your estimated tax liability for the tax year using online tax calculators or seek professional advice. Compare this with the total tax deducted throughout the year, as shown on your payslips.

- Using online tax calculators to verify: Many free online tax calculators can help estimate your tax liability, providing a benchmark for comparison with your payslips.

- Keeping records of payslips for several years: HMRC allows claims for several years back, so retain your payslips for at least four years.

Gathering Necessary Documentation

To successfully claim a tax refund, you need to compile specific documents.

- Payslips for the relevant tax year(s): These are crucial for demonstrating the tax deducted.

- P60 forms: Your P60 summarises your earnings and tax deducted for the tax year.

- Proof of address: This verifies your identity and address.

- Bank details: HMRC needs your bank details to process the refund.

Using HMRC Online Services

HMRC’s online services streamline the process.

- Accessing online accounts: Create or access your online HMRC account to view your tax summaries and manage your tax affairs.

- Checking tax summaries: Your online account provides access to detailed summaries of your tax payments and deductions.

- Submitting a claim online: Many HMRC tax refund claims can be submitted online through your account.

- Tracking the status of a claim: You can track the progress of your claim online.

Making Your HMRC Tax Refund Claim

Once you’ve identified a potential overpayment, it’s time to claim your refund.

Understanding the HMRC Claim Process

The claim process involves several key steps.

- Completing the necessary forms: Download and accurately complete the relevant HMRC forms.

- Providing supporting documentation: Submit all necessary documentation as outlined above.

- Responding to HMRC queries: HMRC might contact you for clarification. Respond promptly and provide any additional information required.

- Expected processing times: Be aware that processing times can vary.

Seeking Professional Help

For complex situations, professional help is invaluable.

- Complex tax situations: A tax advisor can assist with complex tax calculations and ensure you claim everything you're entitled to.

- Significant tax overpayments: If you believe you're owed a substantial amount, professional advice is recommended.

- Need for clarification on tax codes: A tax advisor can clarify any uncertainties regarding your tax code.

- Appeals against HMRC decisions: If HMRC rejects your claim, a tax advisor can help you navigate the appeals process.

Conclusion

Millions of pounds in unclaimed tax refunds are waiting to be collected. Don't let your hard-earned money go unclaimed. Check your payslip today and ensure you're not overpaying tax. By following the steps outlined in this article, you can confidently assess your tax situation and submit a claim for your HMRC tax refund. If you need further assistance, consult a tax professional. Take control of your finances – check your payslip now!

Featured Posts

-

Msc Et Cote D Ivoire Terminal Succes Avec L Arrivee Du Diletta A Abidjan

May 20, 2025

Msc Et Cote D Ivoire Terminal Succes Avec L Arrivee Du Diletta A Abidjan

May 20, 2025 -

Darren Ferguson Celebrates Peterboroughs Record Breaking Efl Trophy Win

May 20, 2025

Darren Ferguson Celebrates Peterboroughs Record Breaking Efl Trophy Win

May 20, 2025 -

Affaire Aramburu Recherche Active Des Auteurs Du Meurtre

May 20, 2025

Affaire Aramburu Recherche Active Des Auteurs Du Meurtre

May 20, 2025 -

Dont Ignore These Hmrc Child Benefit Messages Key Information Inside

May 20, 2025

Dont Ignore These Hmrc Child Benefit Messages Key Information Inside

May 20, 2025 -

Nyt Mini Crossword Answers March 8 2024

May 20, 2025

Nyt Mini Crossword Answers March 8 2024

May 20, 2025

Latest Posts

-

Metas Defense Takes Center Stage As Ftc Monopoly Trial Evolves

May 20, 2025

Metas Defense Takes Center Stage As Ftc Monopoly Trial Evolves

May 20, 2025 -

Ftcs Monopoly Trial Against Meta A Shift In Strategy

May 20, 2025

Ftcs Monopoly Trial Against Meta A Shift In Strategy

May 20, 2025 -

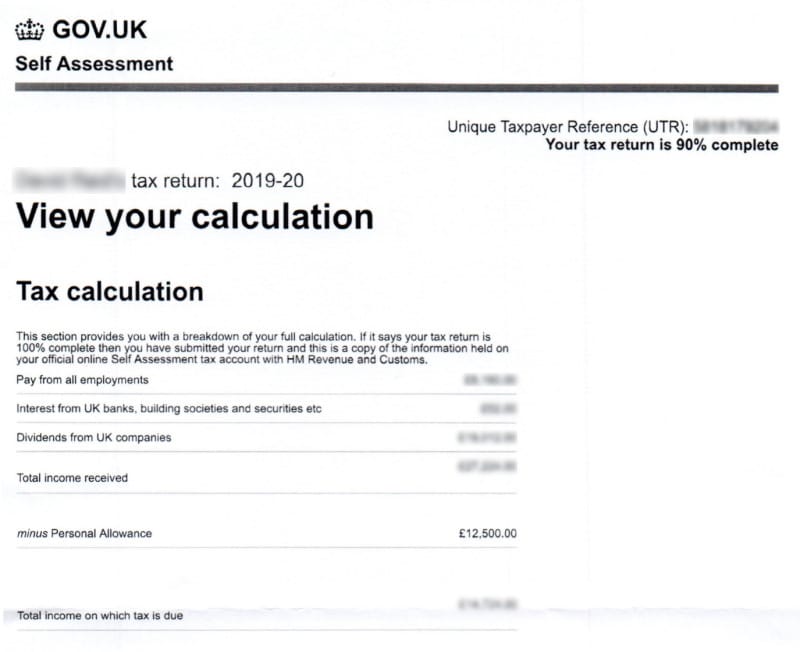

The Buy Canadian Movement How Tariffs Affect The Beauty Industrys Growth

May 20, 2025

The Buy Canadian Movement How Tariffs Affect The Beauty Industrys Growth

May 20, 2025 -

Kahnawake Casino Dispute 220 Million Lawsuit Filed Against Mohawk Council And Grand Chief

May 20, 2025

Kahnawake Casino Dispute 220 Million Lawsuit Filed Against Mohawk Council And Grand Chief

May 20, 2025 -

Canada Posts Future Report Recommends Eliminating Daily Home Mail Delivery

May 20, 2025

Canada Posts Future Report Recommends Eliminating Daily Home Mail Delivery

May 20, 2025