Check Today's Personal Loan Interest Rates: Find The Perfect Loan

Table of Contents

Understanding Personal Loan Interest Rates

What are Personal Loan Interest Rates?

Personal loan interest rates represent the cost of borrowing money. They're typically expressed as an Annual Percentage Rate (APR), which includes the interest rate plus any fees associated with the loan. Understanding APR is crucial because it reflects the true cost of borrowing. Interest rates can be fixed, meaning they remain the same throughout the loan term, or variable, meaning they can fluctuate based on market conditions.

Several key factors influence your personal loan interest rate:

- Credit Score: A higher credit score usually translates to a lower interest rate. Lenders see you as a lower risk.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates.

- Loan Term: Shorter loan terms typically have higher interest rates but result in less overall interest paid. Longer terms have lower rates but mean you pay more interest over time.

Example: Let's say you borrow $10,000. A loan with a 5% APR will cost you significantly less in interest over the life of the loan compared to a loan with a 12% APR.

Types of Personal Loans and Their Rates

Personal loans come in various forms, and the interest rates vary accordingly:

- Unsecured Personal Loans: These loans don't require collateral, making them easier to qualify for but often carrying higher interest rates due to the increased risk for the lender. Average rates can range from 8% to 36%, depending on your creditworthiness.

- Secured Personal Loans: These loans require collateral (like a car or savings account). This lowers the risk for the lender, resulting in potentially lower interest rates. Rates could range from 6% to 24%.

- Debt Consolidation Loans: Used to consolidate multiple debts into a single loan. Interest rates vary depending on factors like your credit score and the total debt amount.

How to Check Today's Personal Loan Interest Rates

Online Comparison Tools

Several reputable online platforms allow you to compare personal loan interest rates from multiple lenders simultaneously. These tools save you valuable time and effort. They typically present you with offers tailored to your specific financial situation.

- Benefits: Quickly compare rates, save time, find the best offers.

- Examples: (Insert links to reputable comparison websites here, if appropriate. Ensure compliance with any advertising guidelines.)

Visiting Lender Websites Directly

Checking interest rates directly on lender websites provides detailed information about specific loan products. However, you'll need to visit multiple sites individually.

- Pros: Access detailed loan information, understand specific terms and conditions.

- Cons: Time-consuming, potential for bias as each lender highlights their own advantages.

- Examples: (Insert links to major lenders' websites here, if appropriate.)

Consulting with a Financial Advisor

A financial advisor can offer personalized guidance, considering your unique financial situation to recommend the best loan options.

- Pros: Personalized advice, expertise in financial planning, help navigating complex situations.

- Cons: May involve fees for their services.

Factors Affecting Your Personal Loan Interest Rate

Credit Score

Your credit score is a major factor in determining your personal loan interest rate. A higher credit score (700 and above) typically signifies lower risk, resulting in lower interest rates. Conversely, a lower credit score (below 650) will likely lead to higher interest rates or even loan rejection.

- Example: A borrower with a 750 credit score might qualify for a personal loan with a 6% APR, while a borrower with a 600 credit score might face an APR of 15% or higher.

Debt-to-Income Ratio (DTI)

Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, impacts your loan approval chances and interest rate. A lower DTI indicates you have more available income to service the loan, making you a less risky borrower.

- Example: A DTI of 30% or less is generally favorable. A higher DTI may result in higher interest rates or loan denial.

Loan Amount and Term

The amount you borrow and the loan term directly influence the interest rate. Larger loan amounts generally come with slightly higher rates, while longer loan terms usually mean you'll pay more interest overall, even if the initial interest rate is lower.

Lender Type

Different lenders offer varying interest rates. Banks often have competitive rates for borrowers with good credit, while credit unions may offer slightly lower rates for members. Online lenders can provide convenience but might have higher rates for certain borrowers.

Securing the Best Personal Loan Interest Rate

Shop Around and Compare

Comparing offers from multiple lenders is crucial to secure the best personal loan interest rates. Don't settle for the first offer you receive.

Improve Your Credit Score

Before applying, take steps to improve your credit score if possible. Paying bills on time and reducing credit utilization are effective strategies.

Negotiate with Lenders

Don't be afraid to negotiate with lenders. If you have a strong credit score and other favorable financial factors, you might be able to negotiate a lower interest rate.

Consider Pre-qualification

Pre-qualification allows you to check your eligibility and see potential interest rates without impacting your credit score.

Conclusion

Checking today's personal loan interest rates is essential for securing the best financing options. By understanding the factors that influence rates, using online comparison tools, and negotiating with lenders, you can significantly reduce the overall cost of your loan. Remember to shop around, compare offers from different lenders, and consider your credit score and debt-to-income ratio to get the best personal loan rates. Don't delay your financial goals! Check today's personal loan interest rates now and find the perfect loan to fit your needs. Start comparing rates and secure the best financing for your future!

Featured Posts

-

Mondays Metro Detroit Weather Chilly Morning Sunny Afternoon

May 28, 2025

Mondays Metro Detroit Weather Chilly Morning Sunny Afternoon

May 28, 2025 -

Ice Cube To Star In And Write Last Friday Movie

May 28, 2025

Ice Cube To Star In And Write Last Friday Movie

May 28, 2025 -

Hujan Di Jawa Timur Ramalan Cuaca 6 Mei 2024

May 28, 2025

Hujan Di Jawa Timur Ramalan Cuaca 6 Mei 2024

May 28, 2025 -

Jannik Sinner French Open Preparation Following Doping Ban

May 28, 2025

Jannik Sinner French Open Preparation Following Doping Ban

May 28, 2025 -

The Jacob Wilson Breakout Fact Or Fiction Poll Results Revealed

May 28, 2025

The Jacob Wilson Breakout Fact Or Fiction Poll Results Revealed

May 28, 2025

Latest Posts

-

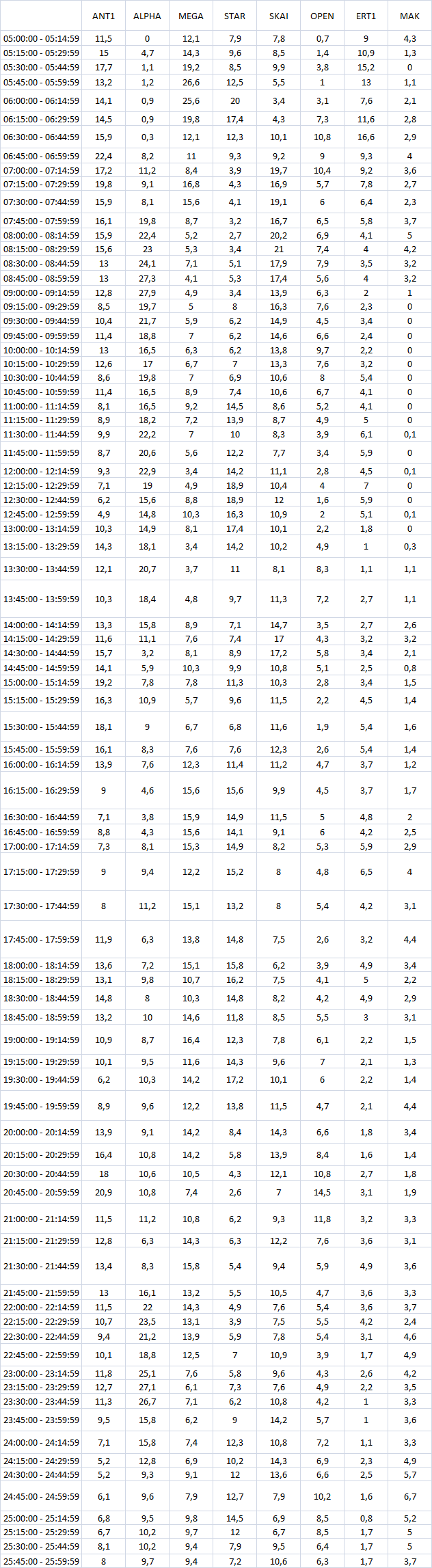

Pasxalines Tileoptikes Metadoseis 2024 E Thessalia Gr

May 30, 2025

Pasxalines Tileoptikes Metadoseis 2024 E Thessalia Gr

May 30, 2025 -

Kalyteros Odigos Gia Tis Tileoptikes Metadoseis Toy Pasxa

May 30, 2025

Kalyteros Odigos Gia Tis Tileoptikes Metadoseis Toy Pasxa

May 30, 2025 -

Manitoba And Nunavuts Kivalliq Hydro Fibre Link Forging A New Economic Partnership

May 30, 2025

Manitoba And Nunavuts Kivalliq Hydro Fibre Link Forging A New Economic Partnership

May 30, 2025 -

Dorean Online Metadoseis Pasxa E Thessalia Gr

May 30, 2025

Dorean Online Metadoseis Pasxa E Thessalia Gr

May 30, 2025 -

Plires Programma Tileoptikon Metadoseon 19 4 M Savvato

May 30, 2025

Plires Programma Tileoptikon Metadoseon 19 4 M Savvato

May 30, 2025