Chainalysis' Acquisition Of Alterya: A Strategic Move In Blockchain And AI

Table of Contents

Enhancing Chainalysis' Blockchain Analytics Capabilities

Alterya's acquisition is a game-changer for Chainalysis, dramatically enhancing its already robust blockchain analytics capabilities. Alterya brings unparalleled expertise in data integration and transformation, allowing Chainalysis to process and analyze complex blockchain data with unprecedented speed and efficiency. This translates to:

- Improved data processing speed and efficiency: The integration of Alterya's technology will significantly reduce the time required to analyze large volumes of blockchain data, providing faster insights into cryptocurrency transactions.

- Enhanced ability to identify and track illicit cryptocurrency transactions: By leveraging Alterya's data transformation capabilities, Chainalysis can improve its ability to identify and track suspicious activities, including money laundering and terrorist financing. This strengthens cryptocurrency forensics and risk assessment.

- More comprehensive insights into cryptocurrency markets and trends: Access to more refined data will enable deeper analysis of cryptocurrency markets, offering more accurate predictions and insights for investors and businesses.

- Strengthened capabilities for real-time analysis and threat detection: Real-time transaction monitoring becomes significantly more effective, allowing for proactive threat detection and response. This is crucial for mitigating risks associated with blockchain technology.

Leveraging AI for Advanced Cryptocurrency Investigations

Alterya's strength lies in its advanced AI and machine learning capabilities, which will seamlessly integrate with Chainalysis' existing platform. This integration will dramatically improve the accuracy and efficiency of cryptocurrency investigations. Key improvements include:

- Automation of investigative processes, leading to increased efficiency: AI-powered automation will streamline investigative workflows, freeing up human analysts to focus on more complex cases.

- Improved accuracy in identifying suspicious activities: Machine learning algorithms can identify subtle patterns and anomalies that might be missed by human analysts, leading to more accurate fraud detection.

- Enhanced pattern recognition for uncovering complex money laundering schemes: AI can help uncover intricate money laundering schemes involving multiple transactions and entities, improving the effectiveness of anti-money laundering (AML) efforts.

- Development of more sophisticated predictive models for future risk assessment: By analyzing historical data, AI can build predictive models that identify potential future risks, allowing for proactive risk mitigation strategies. This includes improved know your customer (KYC) processes.

Strengthening Regulatory Compliance Solutions

The acquisition significantly strengthens Chainalysis' position as a leading provider of regulatory compliance solutions for cryptocurrency businesses. The combined expertise empowers businesses to navigate the increasingly complex regulatory landscape with greater confidence. Specifically:

- More robust compliance tools for meeting AML/KYC requirements: Chainalysis will offer even more comprehensive tools to help businesses meet stringent anti-money laundering and know your customer regulations.

- Enhanced reporting capabilities for regulatory bodies: Improved reporting functionalities will streamline the process of submitting required information to regulatory bodies, reducing compliance burdens.

- Improved risk management strategies for cryptocurrency exchanges and financial institutions: The integration of Alterya’s technology provides more robust risk management tools, allowing for proactive identification and mitigation of potential risks.

- Streamlined compliance processes, reducing operational costs: Automation and improved efficiency will result in reduced operational costs associated with compliance, benefiting businesses of all sizes.

Market Implications and Competitive Advantage

Chainalysis' Acquisition of Alterya has significant market implications. It solidifies Chainalysis’ position as an industry leader in blockchain analytics and AI-driven compliance solutions. The acquisition significantly expands its market share and gives it a substantial competitive advantage by offering a more comprehensive and technologically advanced solution. This combined strength positions Chainalysis to further dominate the market, driving innovation within the broader blockchain technology ecosystem. This strengthens its position as a key player in market analysis and driving blockchain technology forward.

Conclusion

Chainalysis' acquisition of Alterya represents a transformative moment in the blockchain and AI space. The combined strengths of these two companies deliver significant advancements in blockchain analytics, AI-powered investigations, and regulatory compliance solutions. The increased efficiency, accuracy, and comprehensive insights offered will be invaluable for businesses, law enforcement agencies, and regulatory bodies alike. To learn more about how Chainalysis' enhanced solutions, powered by the integration with Alterya, can benefit your organization, visit the Chainalysis website or contact their sales team. The Chainalysis and Alterya merger marks a pivotal step forward, shaping the future of blockchain technology and regulatory compliance for years to come.

Featured Posts

-

Hegseths Leaked Signal Messages Wife And Brother Involved In Military Discussions

Apr 22, 2025

Hegseths Leaked Signal Messages Wife And Brother Involved In Military Discussions

Apr 22, 2025 -

Secret Service Ends Probe Into Cocaine Found At White House

Apr 22, 2025

Secret Service Ends Probe Into Cocaine Found At White House

Apr 22, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025 -

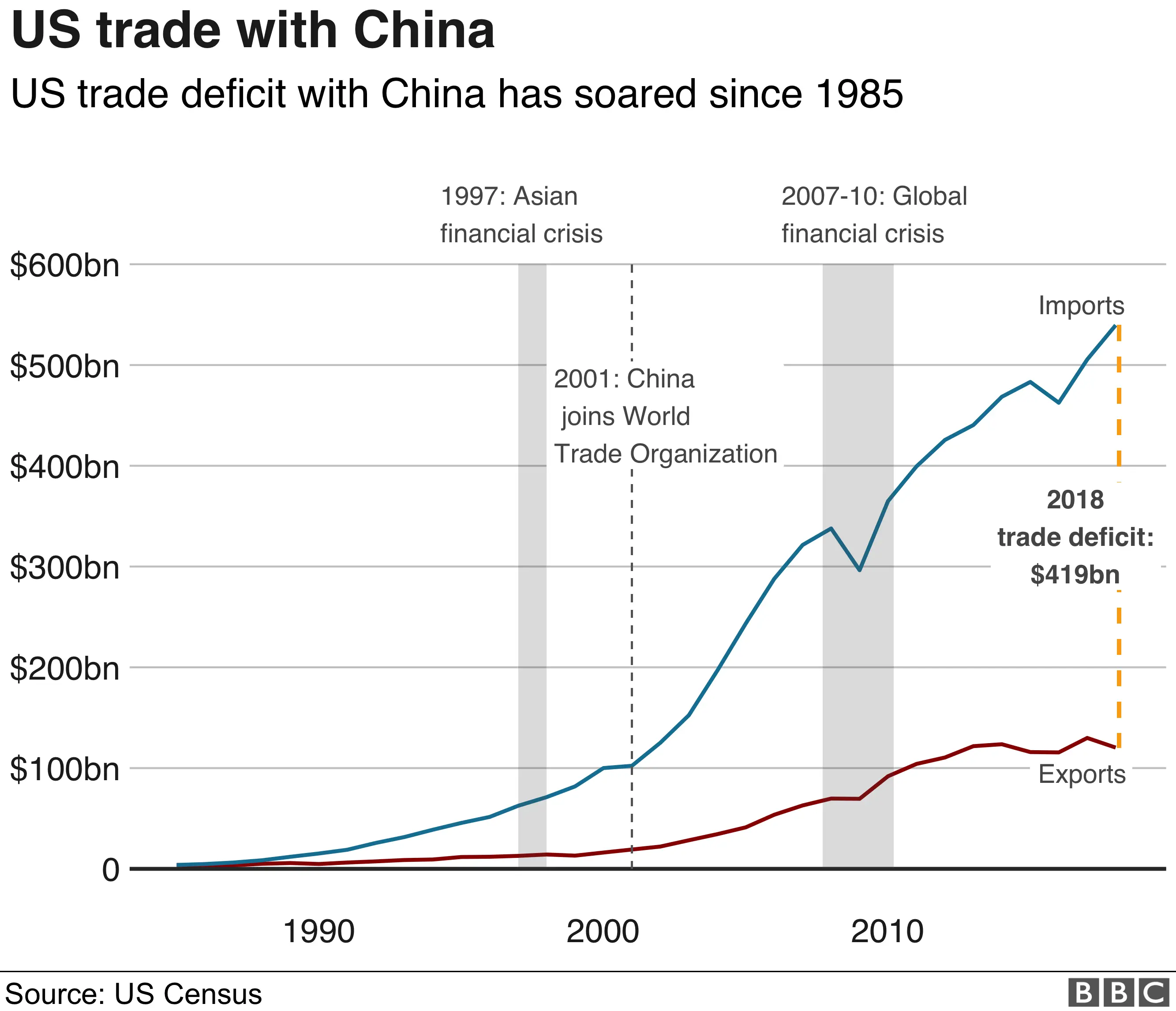

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025

Latest Posts

-

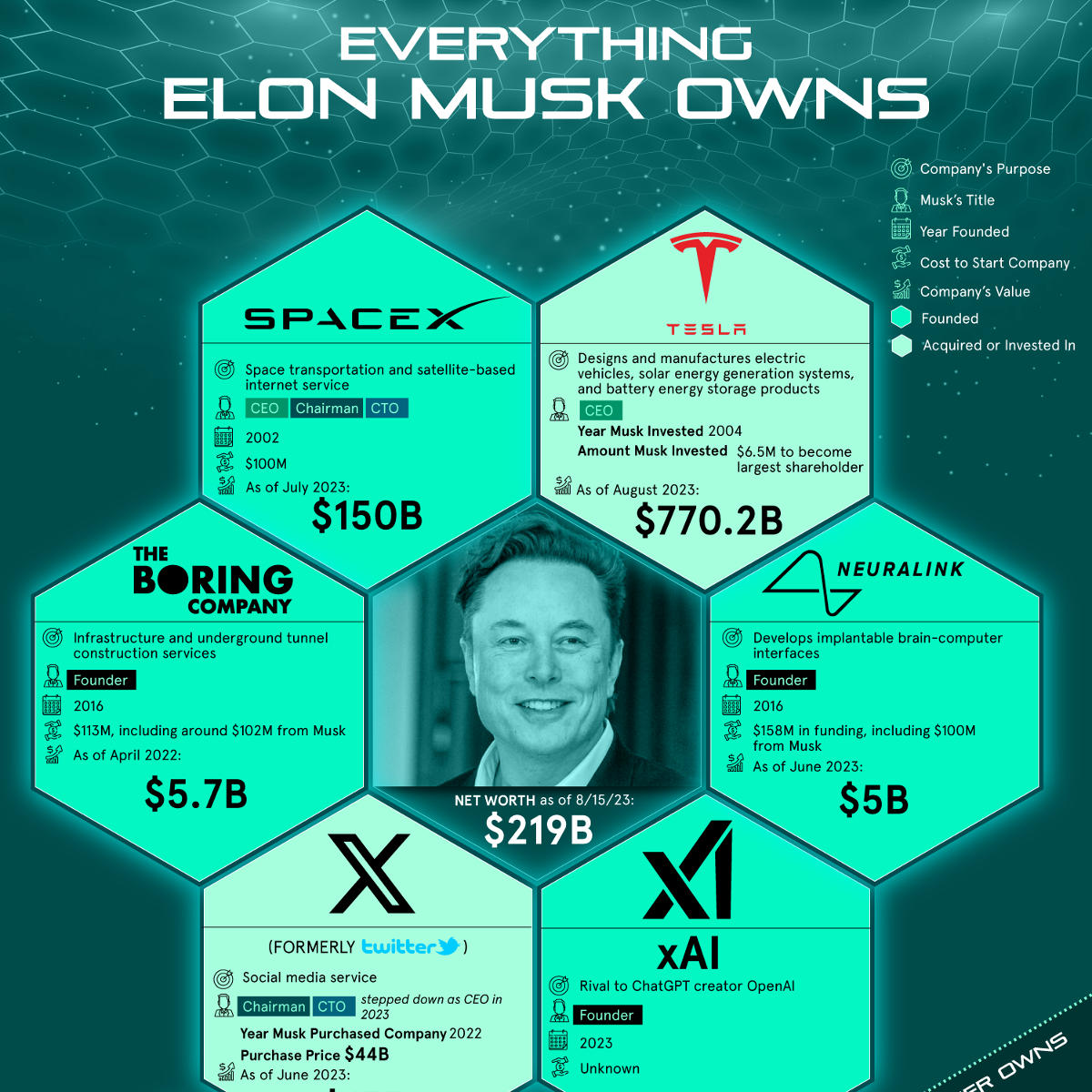

Elon Musks Financial Empire How He Built His Business Dynasty

May 10, 2025

Elon Musks Financial Empire How He Built His Business Dynasty

May 10, 2025 -

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025 -

Post Liberation Day Assessing The Financial Losses Of Trumps Billionaire Circle

May 10, 2025

Post Liberation Day Assessing The Financial Losses Of Trumps Billionaire Circle

May 10, 2025 -

The Economic Impact Of Liberation Day Tariffs On Trumps Billionaire Network

May 10, 2025

The Economic Impact Of Liberation Day Tariffs On Trumps Billionaire Network

May 10, 2025 -

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025