Cenovus CEO: MEG Acquisition Unlikely Amidst Focus On Organic Growth

Table of Contents

Cenovus's Stance on Organic Growth

Cenovus, a major player in the Canadian oil sands, has clearly stated its preference for internal expansion over external acquisitions. This commitment to organic growth represents a fundamental shift in their strategic approach.

Prioritizing Internal Expansion

Cenovus is focusing on maximizing the value of its existing assets and increasing production through operational efficiency and technological advancements. This internal expansion strategy involves several key initiatives:

- Technology Upgrades: Implementing advanced technologies to enhance oil recovery rates and reduce operating costs. This includes things like improved steam injection techniques and data analytics for predictive maintenance.

- Enhanced Oil Recovery (EOR) Initiatives: Investing in EOR projects to extract more oil from existing reservoirs, extending the lifespan of these assets and increasing overall production.

- Operational Efficiency Improvements: Streamlining operations, optimizing processes, and reducing waste to improve profitability and reduce the environmental footprint.

This strategy offers significant financial advantages compared to acquisitions. Organic growth minimizes the risks associated with integrating another company, avoids substantial debt burdens, and allows for a more controlled and predictable expansion. For example, projected cost savings from operational efficiency improvements could reach [Insert Projected Savings Percentage or Dollar Amount if available], contributing significantly to increased profitability. Production targets are set to increase by [Insert Production Target Percentage or Volume if available] within the next [Insert Timeframe].

Advantages of Organic Growth over Acquisitions

While acquisitions can offer rapid expansion, they also carry considerable risks. Cenovus's decision to focus on organic growth highlights several key advantages:

- Lower Risk: Avoiding the complexities and uncertainties inherent in mergers and acquisitions.

- Better Control: Maintaining complete control over the expansion process and ensuring alignment with the company's overall strategy.

- Improved Brand Image: Demonstrating a commitment to sustainable and responsible growth.

- Potential for Higher Returns on Investment: Generating higher returns by focusing on optimizing existing assets and implementing efficient strategies.

In contrast, acquisitions often involve significant integration challenges, potential cultural clashes, and the risk of overpaying for assets. The debt incurred from large acquisitions can also significantly impact a company's financial stability.

Challenges and Opportunities in the Canadian Oil Sands Market

The Canadian oil sands market presents both challenges and opportunities. Cenovus's organic growth strategy is designed to navigate this complex landscape effectively.

Current Market Conditions

The Canadian oil sands industry faces a dynamic market environment characterized by:

- Fluctuating Oil Prices: Oil prices are subject to global market forces and geopolitical events, creating uncertainty in the industry.

- Regulatory Landscape: Stringent environmental regulations and a focus on ESG (Environmental, Social, and Governance) factors are shaping the industry's operational practices.

- Environmental Concerns: Growing concerns about the environmental impact of oil sands extraction necessitate the adoption of sustainable practices and technologies.

Cenovus's Competitive Strategy

Cenovus aims to leverage its strengths to compete effectively in this challenging market:

- Technological Advancements: Investing in cutting-edge technologies to enhance efficiency and reduce environmental impact.

- Operational Efficiencies: Streamlining operations and improving productivity to lower costs and increase profitability.

- Strong Balance Sheet: Maintaining a strong financial position to weather market fluctuations and support long-term growth.

- Sustainable Practices: Adopting environmentally responsible practices to meet evolving regulatory requirements and societal expectations.

Financial Implications of Forgoing the MEG Acquisition

Cenovus's decision to forego the MEG acquisition has significant financial implications, shaping their capital allocation strategy and long-term growth projections.

Capital Allocation Strategy

Cenovus's capital allocation plan centers on its organic growth initiatives:

- Investments in Existing Assets: Allocating capital to enhance existing infrastructure and production capacity.

- Research and Development: Investing in research and development to improve technologies and operational efficiencies.

- Debt Reduction: Prioritizing debt reduction to strengthen the company's financial position.

- Shareholder Returns: Returning value to shareholders through dividends and share buybacks.

Long-Term Growth Projections

Cenovus projects sustained long-term growth based on its organic strategy. While specific financial forecasts are subject to market conditions, their commitment to operational efficiency and technological advancement points to a trajectory of increased production and profitability. This contrasts with the potential, yet uncertain, outcomes of a MEG acquisition, which would have introduced complexities and risks that could negatively impact long-term growth.

Conclusion

Cenovus's CEO has definitively stated that a Cenovus MEG acquisition is unlikely, reaffirming the company's commitment to a strategy focused on organic growth. This decision reflects a calculated approach that prioritizes reduced risk, improved control, and the potential for higher returns on investment. The key takeaways are the benefits of internal expansion, the understanding of the Canadian oil sands market challenges, and a clear financial plan built on a robust organic growth model. Stay informed on Cenovus's progress in achieving its organic growth targets by visiting their investor relations website. Learn more about Cenovus's commitment to the future of the Canadian oil sands industry through sustainable, organic growth.

Featured Posts

-

Osimhen El Factor Decisivo Para El Galatasaray Vision De Un Pundit Turco

May 27, 2025

Osimhen El Factor Decisivo Para El Galatasaray Vision De Un Pundit Turco

May 27, 2025 -

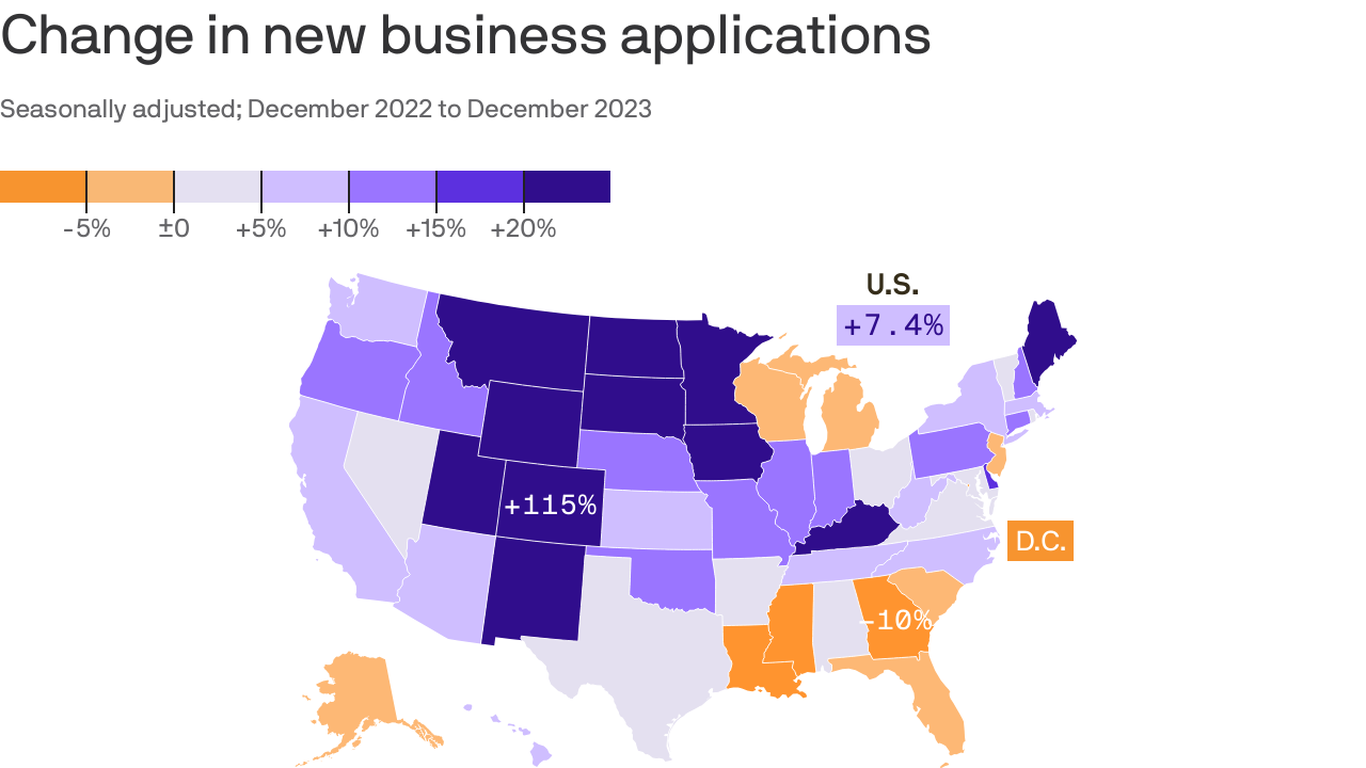

A Comprehensive Map Of The Countrys Rising Business Hotspots

May 27, 2025

A Comprehensive Map Of The Countrys Rising Business Hotspots

May 27, 2025 -

Almanacco Di Oggi 25 Maggio Cosa E Successo Compleanni E Proverbio

May 27, 2025

Almanacco Di Oggi 25 Maggio Cosa E Successo Compleanni E Proverbio

May 27, 2025 -

The Blake Lively Controversy Selena Gomezs Allegations And Taylor Swifts Response

May 27, 2025

The Blake Lively Controversy Selena Gomezs Allegations And Taylor Swifts Response

May 27, 2025 -

Where To Stream 1923 Season 2 Episode 4 Tonight Free

May 27, 2025

Where To Stream 1923 Season 2 Episode 4 Tonight Free

May 27, 2025