Canadians And 10-Year Mortgages: A Look At The Low Adoption Rate

Table of Contents

The Perceived Risks of 10-Year Mortgages in Canada

Many Canadians hesitate to commit to a 10-year mortgage due to several perceived risks. Understanding these concerns is crucial for making an informed decision.

Interest Rate Volatility and Prepayment Penalties

A major deterrent is the fear of rising interest rates. A 10-year mortgage locks you into a specific rate for a decade. If rates rise significantly during that period, you're stuck with your initial rate, potentially paying more than someone who opted for a shorter-term mortgage and refinanced at a lower rate. Furthermore, hefty prepayment penalties are a significant concern. If unforeseen circumstances force you to sell your home or refinance before the term ends, these penalties can be substantial, impacting your finances considerably.

- Higher interest rate risk compared to shorter terms: The longer the term, the greater the chance of interest rates fluctuating against you.

- Substantial prepayment charges: These penalties vary significantly between lenders and can be a significant financial burden. Some lenders offer options to reduce penalties, but these often come with conditions.

- Potential impact on financial flexibility: A 10-year mortgage significantly reduces your financial flexibility compared to a shorter-term mortgage.

The specifics of prepayment penalties differ considerably between lenders. Some may charge a percentage of the outstanding principal, while others might use an interest rate differential calculation. It's vital to thoroughly review the terms and conditions of any 10-year mortgage before signing.

Long-Term Financial Commitment

Committing to a mortgage for ten years represents a significant long-term financial commitment. This can be daunting, especially during uncertain economic times.

- Difficulty predicting long-term financial needs: Life throws curveballs. Job loss, unexpected medical expenses, or family changes can significantly impact your financial situation, making a long-term mortgage commitment challenging.

- Potential changes in lifestyle or income: Your financial circumstances and needs may evolve over ten years. What seemed manageable initially might become a strain later.

- Reduced flexibility compared to shorter-term mortgages: Shorter-term mortgages offer greater flexibility to adapt to changing financial situations through refinancing or renewal options.

Alternatives, such as regularly renewing shorter-term mortgages, offer more flexibility but potentially at the cost of higher overall interest paid. Carefully assess your long-term financial stability and future needs before committing to a 10-year mortgage.

The Benefits of Choosing a 10-Year Mortgage in Canada

Despite the perceived risks, 10-year mortgages offer several compelling benefits that should not be ignored.

Lower Interest Rates (Potentially)

One of the primary advantages is the potential for securing a lower interest rate compared to shorter-term mortgages. While not guaranteed, lenders often offer slightly lower rates for longer terms to compensate for the reduced risk of early repayment.

- Comparison of average interest rates for 10-year vs. shorter-term mortgages: While rates fluctuate, historical data often shows a slight difference in favor of longer-term mortgages. Consult with a mortgage broker for the most up-to-date information.

- Potential for substantial interest savings over the term: Even a small difference in interest rate can translate into significant savings over a decade.

- Importance of securing a favorable rate: Shop around and compare offers from different lenders to secure the best possible rate for your 10-year mortgage.

Researching and comparing current interest rates for various mortgage terms is crucial. While no one can predict the future, understanding historical trends can help you make an informed decision.

Financial Stability and Predictability

A fixed rate for ten years provides significant financial stability and predictability. This is a major benefit for many Canadians seeking financial peace of mind.

- Reduced financial stress from predictable monthly payments: Knowing exactly how much you'll pay each month for ten years significantly reduces financial stress.

- Easier long-term financial planning: With predictable housing costs, you can more effectively plan for other significant financial goals, such as retirement savings or education funds.

- Increased financial stability: This predictability contributes to overall financial stability and reduces the likelihood of unexpected financial strain.

Locking in a predictable payment for a long period offers a sense of security, especially beneficial for long-term financial goals like retirement planning.

Factors Influencing the Low Adoption Rate of 10-Year Mortgages in Canada

The low adoption rate of 10-year mortgages in Canada is likely influenced by a combination of factors.

Lack of Awareness and Understanding

Many Canadians may simply be unaware of the potential benefits of 10-year mortgages or misunderstand the risks involved.

- Limited marketing and promotion of 10-year mortgages: Compared to shorter-term options, 10-year mortgages may receive less marketing attention.

- Lack of consumer education on the nuances of long-term mortgages: Understanding the intricacies of prepayment penalties and interest rate fluctuations is crucial for making informed decisions.

- Misconceptions surrounding prepayment penalties: Many may overestimate the severity or frequency of needing to break their mortgage early.

Improved consumer education initiatives are vital in increasing awareness and understanding of the benefits and potential drawbacks of 10-year mortgages in Canada.

The Role of the Canadian Housing Market

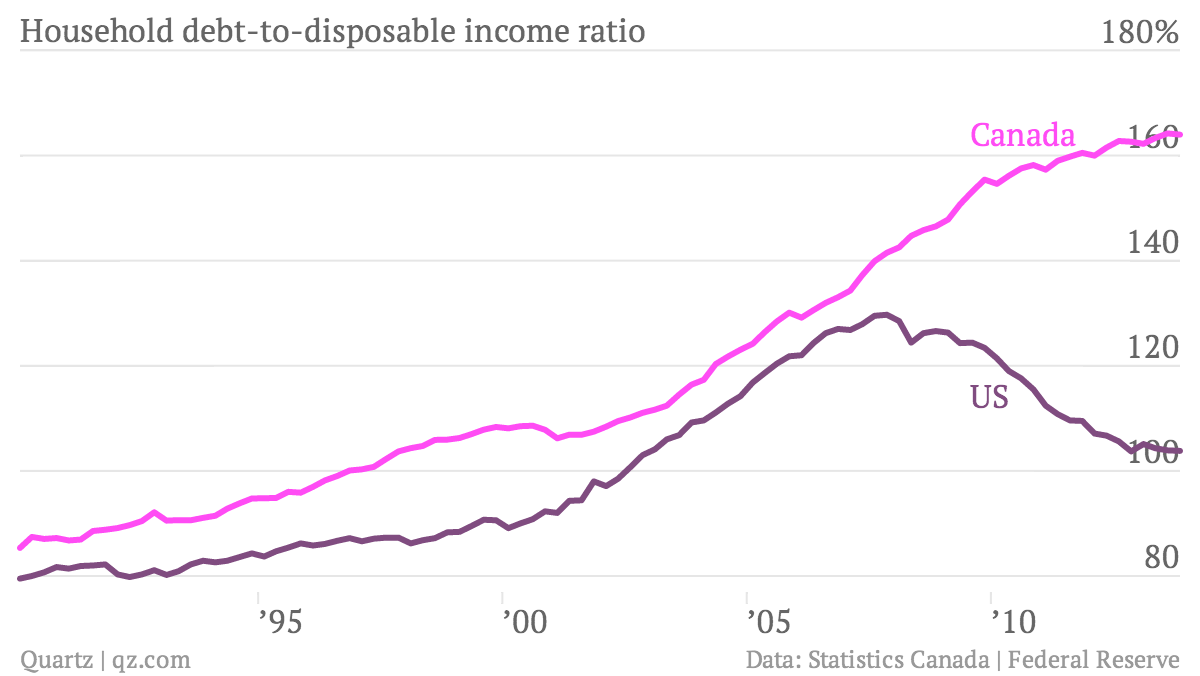

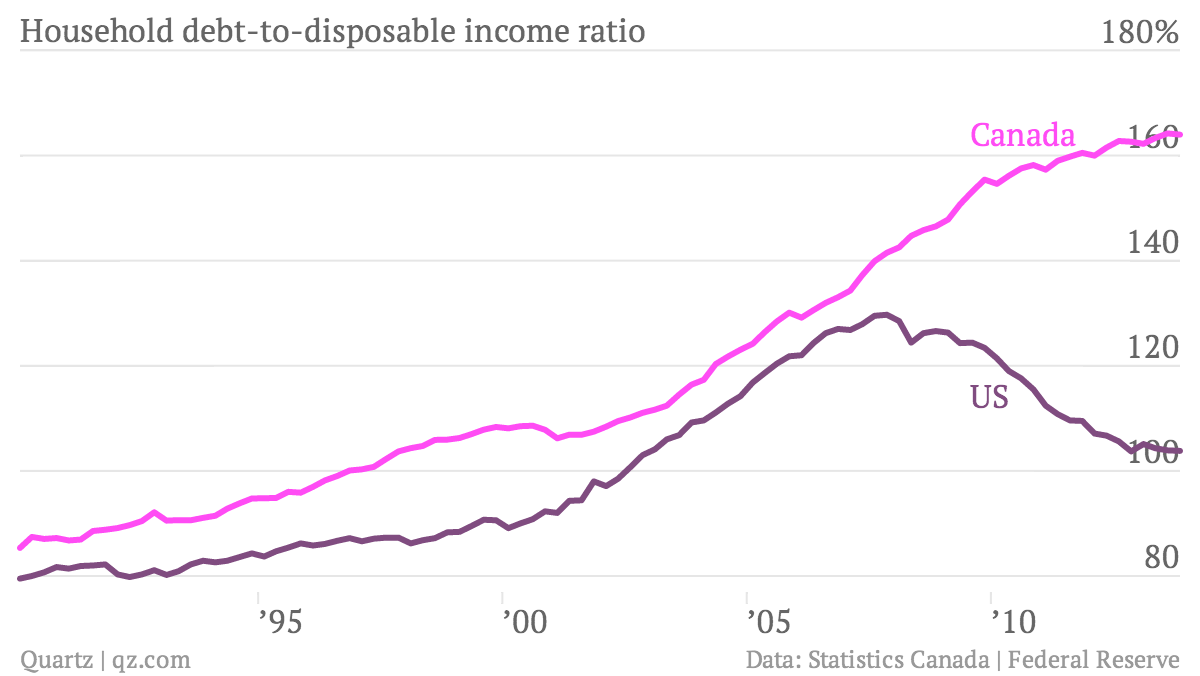

The Canadian housing market, with its high prices and volatility, plays a significant role in mortgage term decisions.

- Impact of high housing costs on affordability: High housing prices may make even a lower interest rate on a 10-year mortgage unaffordable for some.

- The effect of market fluctuations on borrower confidence: Uncertainty in the housing market can make committing to a long-term mortgage seem risky.

- The role of lender policies and mortgage products: Lender policies and available mortgage products can also influence the popularity of different mortgage terms.

Understanding broader economic trends in Canada and how they impact the housing market is vital when considering a long-term mortgage commitment.

Conclusion

While the adoption rate of 10-year mortgages in Canada remains relatively low due to perceived risks such as interest rate volatility and prepayment penalties, the potential for long-term savings and financial stability shouldn't be overlooked. Understanding the benefits, such as lower interest rates and increased financial predictability, is crucial. Before making a decision, Canadians should carefully weigh the advantages and disadvantages of a 10-year mortgage against shorter-term options, considering their individual financial circumstances and risk tolerance. For more information on finding the right mortgage for your needs, consult with a financial advisor and explore various 10-year mortgage options available in Canada. Consider the long-term financial implications and explore the advantages of 10-year mortgages in Canada to determine if it's the right choice for your financial future.

Featured Posts

-

Lindsey Buckingham And Mick Fleetwood Back Together In The Studio

May 04, 2025

Lindsey Buckingham And Mick Fleetwood Back Together In The Studio

May 04, 2025 -

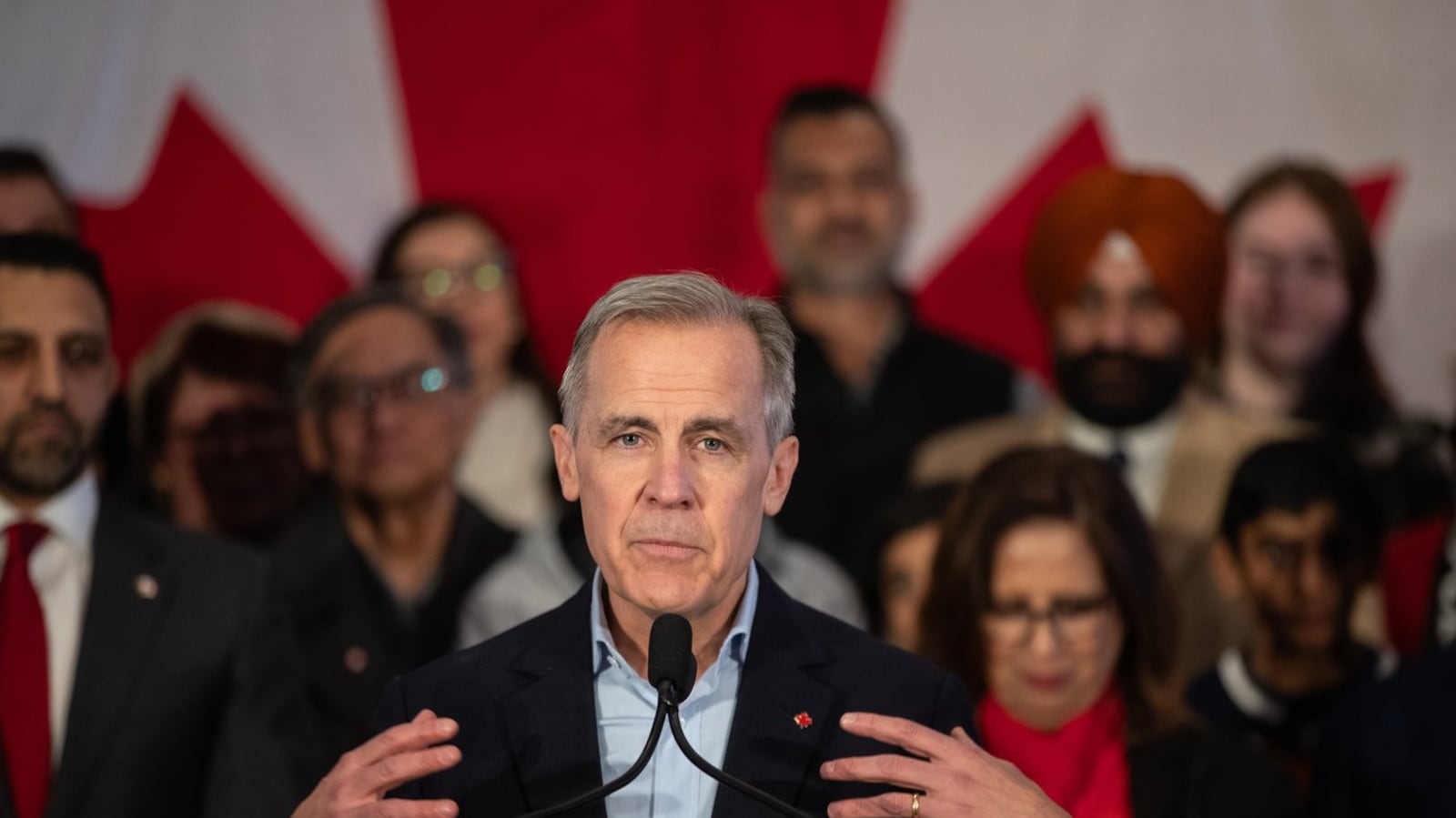

White House Meeting Mark Carney And Trump To Discuss Key Issues

May 04, 2025

White House Meeting Mark Carney And Trump To Discuss Key Issues

May 04, 2025 -

Blake Lively And Anna Kendrick A Simple Favor Premiere

May 04, 2025

Blake Lively And Anna Kendrick A Simple Favor Premiere

May 04, 2025 -

Bredli Kuper I Leonardo Di Kaprio Istoriya Ikh Slozhnykh Otnosheniy

May 04, 2025

Bredli Kuper I Leonardo Di Kaprio Istoriya Ikh Slozhnykh Otnosheniy

May 04, 2025 -

The Count Of Monte Cristo A Comprehensive Review

May 04, 2025

The Count Of Monte Cristo A Comprehensive Review

May 04, 2025