Canadian Economic Forecast: OECD Projects Stagnant Growth For 2025, Recession Avoided

Table of Contents

Stagnant Growth Projections for the Canadian Economy in 2025

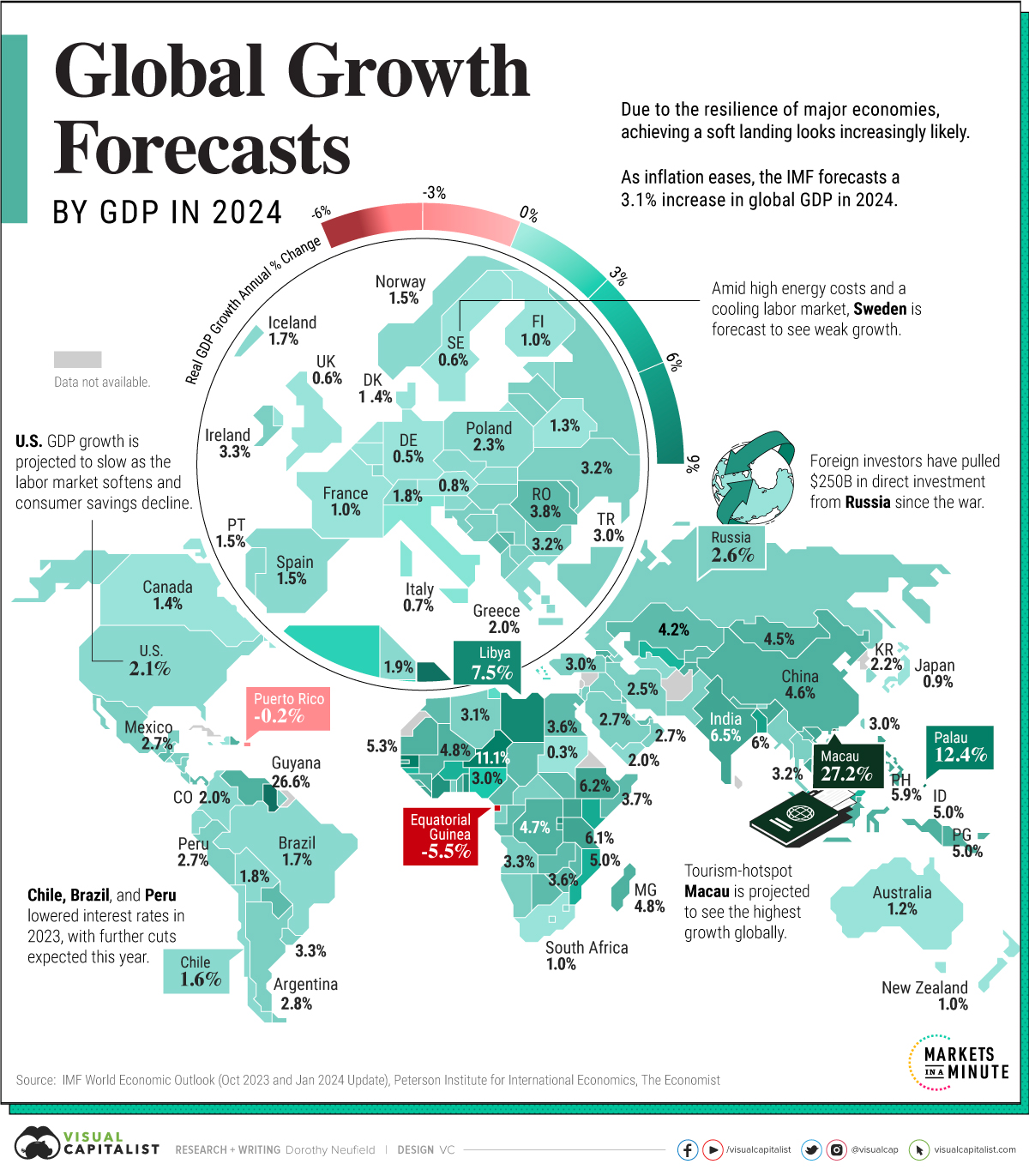

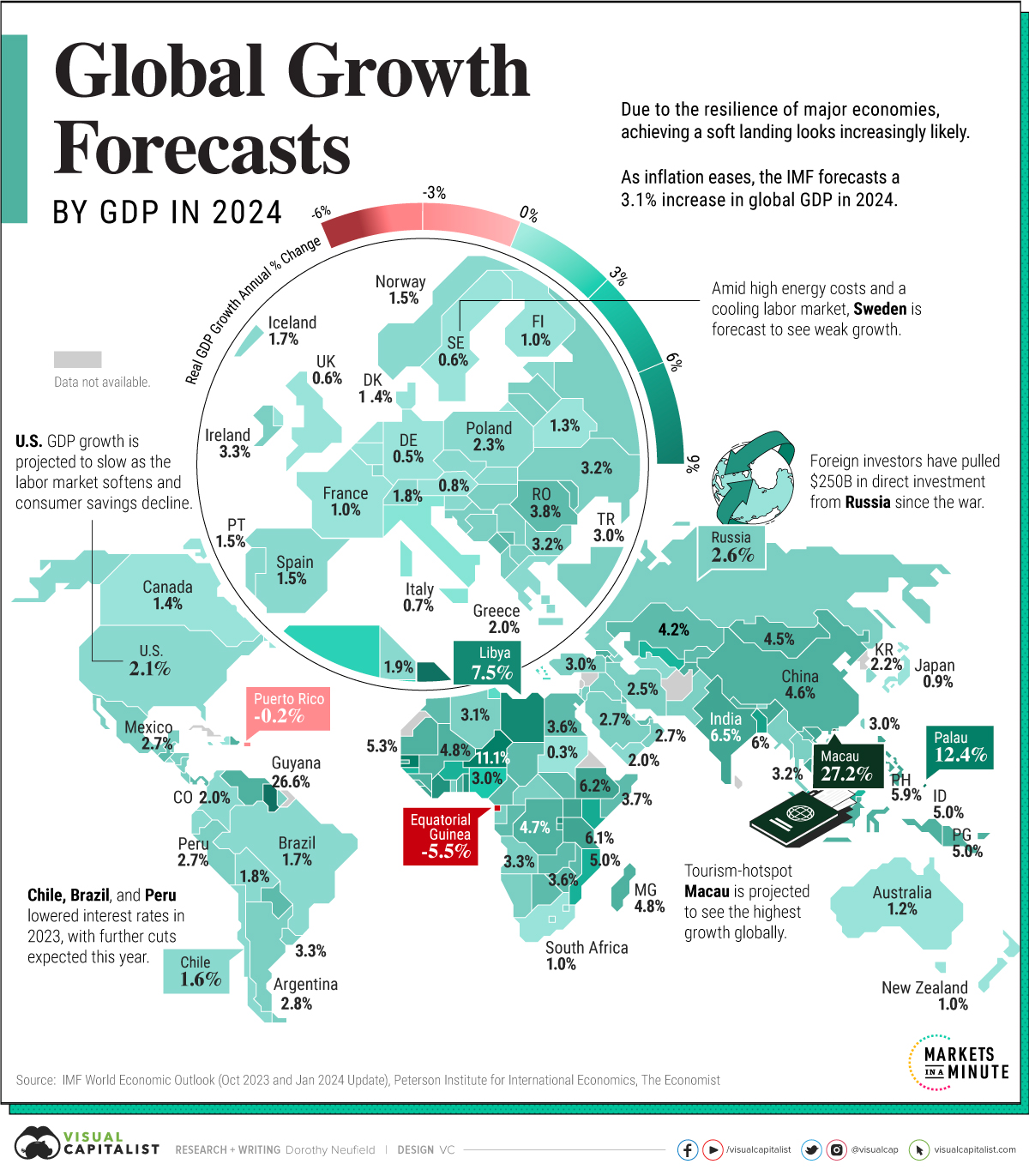

The OECD projects minimal GDP growth for Canada in 2025, significantly lower than previous projections. This sluggish growth, characterized by economic stagnation, is attributed to several interconnected factors: persistent inflation, rising interest rates, and weakening global demand.

-

The Numbers: The OECD projects a GDP growth rate of [insert projected percentage from OECD report here] for 2025. This is a stark contrast to the [insert previous year's growth rate] and represents a considerable slowdown in the Canadian economy. This low economic growth signals a period of relative economic inactivity.

-

Comparison to Previous Years: Comparing this prediction to Canada's GDP growth in previous years reveals a significant deceleration. For example, in [Year], Canada experienced [Growth Percentage]% growth, showcasing the considerable shift in the Canadian GDP forecast for 2025.

Impact on Key Economic Sectors

This stagnant growth will undoubtedly impact various sectors of the Canadian economy.

-

Canadian Real Estate: The slowdown will likely lead to a cooling of the real estate market, with potential price corrections and reduced transaction volumes. Higher interest rates will make mortgages more expensive, impacting affordability and demand.

-

Canadian Employment: The impact on the job market could be significant, with potential slowdowns in hiring and wage growth. Certain sectors more sensitive to economic fluctuations might experience job losses. Monitoring Canadian employment rates and the unemployment rate will be critical.

-

Inflation Canada & Consumer Spending Canada: While inflation may gradually decrease, stagnant economic growth could still put pressure on consumer spending as disposable income remains constrained. This interplay between inflation Canada and consumer spending Canada will determine the overall health of the economy.

Factors Contributing to the Stagnant Growth Forecast

Several key factors contribute to the OECD's pessimistic, yet recession-avoiding, forecast for Canadian economic growth in 2025.

-

Inflation Canada: Persistent inflation continues to erode purchasing power and stifle consumer spending. High inflation rates force the Bank of Canada to implement restrictive monetary policies, impacting borrowing costs.

-

Interest Rates Canada: The Bank of Canada's efforts to combat inflation through raising interest rates have increased borrowing costs for businesses and consumers, reducing investment and spending. These higher interest rates Canada are directly impacting the Canadian GDP forecast.

-

Global Economy: The global economic slowdown, influenced by geopolitical instability and ongoing supply chain disruptions, exerts downward pressure on Canadian exports and overall economic activity. The Canadian economy remains highly intertwined with global markets.

-

Supply Chain Issues: Lingering supply chain disruptions continue to impact production costs and availability of goods, contributing to inflationary pressures and hindering economic expansion. The resolution of these issues is crucial for bolstering future economic growth.

Recession Avoided – But for How Long?

Despite the projected stagnant growth, the OECD believes a full-blown recession in 2025 is unlikely. This is partly due to the resilience shown by the Canadian economy in recent years and the relatively strong labour market.

-

Canadian Economic Resilience: Canada's diversified economy and robust financial system offer a degree of protection against severe economic downturns. However, this resilience is not guaranteed and is contingent upon several factors.

-

Economic Uncertainty: However, several uncertainties remain. A further escalation of global geopolitical tensions, a more severe-than-anticipated inflation surge, or a significant drop in commodity prices could easily alter this outlook. The future economic outlook Canada requires constant monitoring.

-

Government Policies: The effectiveness of government policies in mitigating economic risks will also play a crucial role in determining the future trajectory of the Canadian economy. Fiscal policies aimed at supporting growth and alleviating inflationary pressures will be important. The Canadian recession risk is a continuously evolving factor.

Opportunities and Challenges for Canadian Businesses

Navigating this period of stagnant growth presents both challenges and opportunities for Canadian businesses.

-

Challenges: Businesses face challenges including decreased consumer spending, tighter credit conditions, and increased input costs due to inflation. Adapting to this climate will require strategic decision-making.

-

Opportunities: Opportunities still exist for businesses that can adapt to the changing economic landscape. Focusing on efficiency, innovation, and strategic investments can yield positive results. Identifying niche markets and developing robust supply chain resilience can also provide competitive advantages.

-

Economic Strategy Canada: Developing a robust economic strategy Canada for businesses that includes diversification, operational efficiency, and a focus on sustainable practices is critical for long-term success.

Conclusion

The OECD's forecast for the Canadian economy in 2025 points to stagnant growth, avoiding a recession—for now. Persistent inflation, rising interest rates, and global uncertainties remain significant headwinds. However, understanding the nuances of the Canadian economic forecast is crucial for navigating this period successfully.

Call to Action: Stay informed about the evolving Canadian economic landscape by regularly reviewing updated forecasts and analyses. Understanding the Canadian economic forecast, including variations in predictions, is essential for both businesses and individuals to make informed decisions and navigate this period of economic uncertainty effectively. Continue to monitor the Canadian economic forecast closely for future updates.

Featured Posts

-

Top 5 Smartphones Avec Une Batterie Longue Duree

May 28, 2025

Top 5 Smartphones Avec Une Batterie Longue Duree

May 28, 2025 -

Roland Garros A Day Of Contrasts Nadals Exit And Sabalenkas Ascent

May 28, 2025

Roland Garros A Day Of Contrasts Nadals Exit And Sabalenkas Ascent

May 28, 2025 -

Garnacho Transfer Saga Manchester Uniteds E60 Million Valuation

May 28, 2025

Garnacho Transfer Saga Manchester Uniteds E60 Million Valuation

May 28, 2025 -

Semarang And Jawa Tengah Update Prakiraan Cuaca 22 April Hujan Siang

May 28, 2025

Semarang And Jawa Tengah Update Prakiraan Cuaca 22 April Hujan Siang

May 28, 2025 -

Ingilizlerin Osimhen Inadi 45 Milyon Euroluk Yildiz Icin Transfer Savasi

May 28, 2025

Ingilizlerin Osimhen Inadi 45 Milyon Euroluk Yildiz Icin Transfer Savasi

May 28, 2025

Latest Posts

-

Alastqlal Msyrt Ndal Wtarykh Mjd

May 29, 2025

Alastqlal Msyrt Ndal Wtarykh Mjd

May 29, 2025 -

57 Nike Air Max Excee Shoes Limited Time Sale

May 29, 2025

57 Nike Air Max Excee Shoes Limited Time Sale

May 29, 2025 -

Revolve Nike Sneaker Sale Prices Starting At 39

May 29, 2025

Revolve Nike Sneaker Sale Prices Starting At 39

May 29, 2025 -

Nike Air Max Excee Sale Get Yours For Under 57

May 29, 2025

Nike Air Max Excee Sale Get Yours For Under 57

May 29, 2025 -

Nike Air Max Dn8 First Look And Release Details

May 29, 2025

Nike Air Max Dn8 First Look And Release Details

May 29, 2025