Canadian Dollar Value Increases Following Trump's Statement

Table of Contents

Trump's Statement and its Market Impact

Former President Trump's statement, while not explicitly targeting the Canadian economy, contained remarks perceived as potentially positive for US-Canada relations. Specifically, his comments on the importance of a strong bilateral trade relationship, made on [Date of Statement], were interpreted by many market analysts as signaling a potential easing of trade tensions between the two countries.

- Specific wording: While the exact wording needs to be cited (insert quote here from reliable news source), the overall tone suggested a more conciliatory approach to trade negotiations, impacting investor sentiment.

- Immediate market response: The USD/CAD exchange rate reacted almost instantaneously. Within minutes of the statement's release at approximately [Time of Statement], the Canadian dollar appreciated by [Percentage Increase] against the US dollar.

- Visual representation: [Insert chart or graph here showing USD/CAD exchange rate fluctuation around the time of the statement. Source should be cited]. This visual clearly demonstrates the immediate impact of Trump's statement on currency markets.

Analyzing the Factors Contributing to the Canadian Dollar's Rise

While Trump's statement played a role, several other factors contributed to the Canadian dollar's appreciation. It wasn't solely a reaction to political rhetoric; rather, it was a confluence of economic and geopolitical events.

- Positive economic indicators in Canada: Robust employment numbers, exceeding expectations in [Month, Year], coupled with consistently positive GDP growth, painted a picture of economic strength, making the Canadian dollar more attractive to investors. Rising commodity prices further bolstered this positive sentiment.

- Weakening of the US dollar: Internal economic factors within the US, such as [Specific US economic factor, e.g., rising inflation, weakening manufacturing data], contributed to a decline in the US dollar's value, indirectly strengthening the Canadian dollar.

- Investor sentiment: Positive investor sentiment towards the Canadian economy, compared to perceived uncertainties in the US market, led to increased demand for the Canadian dollar.

- Geopolitical factors: [Mention any relevant geopolitical factors, e.g., global events impacting investor confidence in other currencies, which might have indirectly strengthened the CAD].

The Role of Commodity Prices

Canada's economy is heavily reliant on commodity exports, including oil and lumber. Fluctuations in global commodity prices significantly impact the Canadian dollar's value.

- Specific commodity price movements: A rise in global oil prices, for instance, directly benefits Canada's energy sector, boosting export revenue and increasing demand for the Canadian dollar. Similarly, increased demand for lumber positively impacted the currency. [Insert specific data on commodity price changes and their correlation with USD/CAD exchange rate].

- Impact on Canadian export industries: The rise in the Canadian dollar can have a double-edged sword effect. While it benefits importers by lowering the cost of goods, it can make Canadian exports more expensive in international markets, potentially impacting export-oriented industries.

Short-Term and Long-Term Implications for the Canadian Economy

The strengthening Canadian dollar has both positive and negative implications for the Canadian economy in the short and long term.

- Impact on exports and imports: A stronger Canadian dollar makes Canadian exports less competitive internationally, potentially impacting export volumes. Conversely, imports become cheaper, potentially benefiting consumers but potentially harming domestic industries.

- Effects on inflation: Lower import costs can contribute to lower inflation, benefiting consumers. However, reduced export revenue might indirectly impact inflation depending on the specific goods and services involved.

- Implications for tourism: A stronger Canadian dollar makes travel to Canada more expensive for international tourists, potentially impacting the tourism sector.

- Influence on foreign investment: The stronger Canadian dollar may make investments in Canada less attractive to foreign investors, as their returns, when converted back to their home currency, would be diminished.

Trading Strategies in Response to the Fluctuation

Currency fluctuations create opportunities and risks for traders and investors.

- Hedging currency risk: Businesses involved in international trade can use hedging strategies to mitigate the risks associated with currency fluctuations. These strategies include forward contracts, futures contracts, and options contracts.

- Diversification: Diversifying investment portfolios across different asset classes and currencies can help reduce overall risk exposure.

- Disclaimer: This information is for educational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

Former President Trump's statement, combined with positive Canadian economic indicators, a weakening US dollar, and fluctuating commodity prices, contributed to a significant rise in the Canadian dollar's value. This fluctuation has short-term and long-term implications for various sectors of the Canadian economy. Understanding the interplay of these factors is crucial for navigating the complexities of the Canadian and global markets.

Call to Action: Stay informed about fluctuations in the Canadian dollar value. Follow our blog for the latest updates on the USD/CAD exchange rate and its impact on the Canadian economy. Understanding the factors influencing the Canadian dollar is crucial for investors and businesses alike. Monitor the Canadian dollar's value closely to make informed decisions.

Featured Posts

-

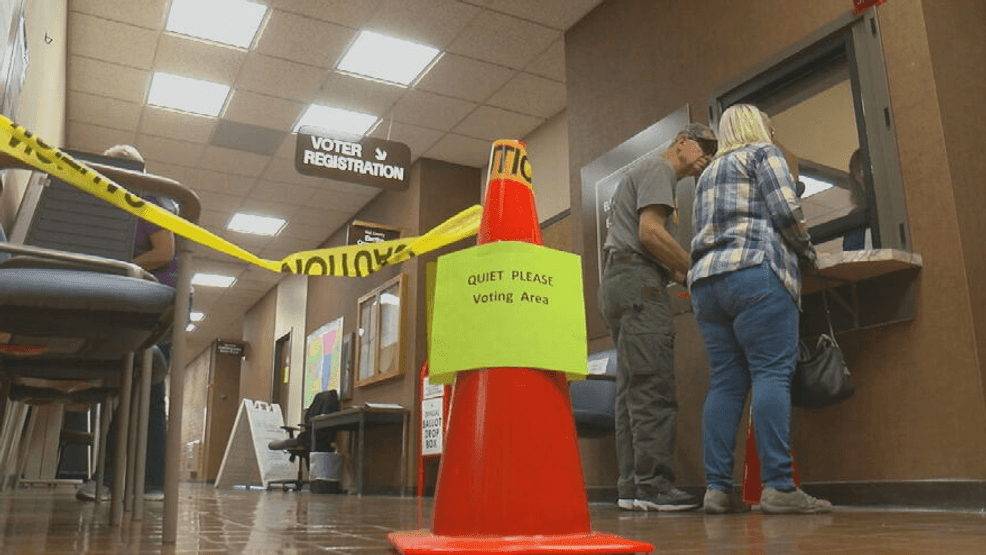

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 03, 2025

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 03, 2025 -

Jw 24 Ynashd Slah Kf En Almghamrat Alwde Hsas Llghayt

May 03, 2025

Jw 24 Ynashd Slah Kf En Almghamrat Alwde Hsas Llghayt

May 03, 2025 -

Dac San Trai Cay Loai Qua Xua Gio Duoc Dan Thanh Pho Ua Chuong 60 000d Kg

May 03, 2025

Dac San Trai Cay Loai Qua Xua Gio Duoc Dan Thanh Pho Ua Chuong 60 000d Kg

May 03, 2025 -

Unrecognizable Harry Potters Crabbes Transformation

May 03, 2025

Unrecognizable Harry Potters Crabbes Transformation

May 03, 2025 -

Dual Sense Ps 5 Controller Colors A Complete 2025 Buying Guide

May 03, 2025

Dual Sense Ps 5 Controller Colors A Complete 2025 Buying Guide

May 03, 2025