Canadian Dollar Strengthens Following Trump-Carney Deal Speculation

Table of Contents

The Trump-Carney Deal Speculation and its Impact

While the specifics of the speculated deal between Trump and Poloz remain largely undisclosed, market sentiment suggests it revolved around positive economic collaborations between the US and Canada. The nature of the potential agreement wasn't explicitly defined, but the mere speculation fueled a wave of optimism. The perceived potential for improved US-Canada relations significantly impacted investor confidence.

- Positive market sentiment: The prospect of a cooperative agreement between the two nations fostered a positive outlook, boosting investor confidence in the Canadian economy. This positive sentiment directly translated into increased demand for the Canadian dollar.

- Reduced uncertainty about future trade policies: Uncertainty surrounding trade policies often negatively impacts currency values. The speculated deal suggested a reduction in this uncertainty, making the Canadian dollar a more attractive investment.

- Increased investment flows into Canada: A more stable and predictable trade environment encourages foreign investment, further strengthening demand for the Canadian dollar.

- Fueling the Speculation: Although no concrete evidence of a formal agreement materialized, hints of positive discussions between the two leaders, perhaps through press statements or informal channels, were enough to trigger the speculation and subsequent market reaction.

Analyzing the USD/CAD Exchange Rate Fluctuation

The speculation surrounding the Trump-Carney deal led to a noticeable shift in the USD/CAD exchange rate. While precise numbers would require referencing specific dates and market data, we can illustrate the impact: The Canadian dollar appreciated significantly against the US dollar, meaning fewer Canadian dollars were needed to buy one US dollar.

- Graph showing the USD/CAD exchange rate: (Insert a chart here showing the USD/CAD exchange rate fluctuation during the period of speculation. This would significantly enhance the article's visual appeal and informativeness.) This chart would clearly show the upward trend in the CAD's value against the USD.

- Percentage change in the CAD value against the USD: (Insert a percentage here reflecting the appreciation of the CAD against the USD. For example: "The CAD appreciated by X% against the USD during the period of speculation.")

- Comparison to other major currencies: (Compare the performance of the CAD against other major currencies during the same period to highlight its relative strength. This provides context and strengthens the analysis.)

- Volatility of the CAD: The currency trading market is inherently volatile, and the USD/CAD pair experienced a period of increased volatility surrounding this speculation. This volatility creates both opportunities and risks for currency traders.

Impact on Canadian Businesses and Exports

A stronger Canadian dollar, while beneficial in some ways, presents both advantages and disadvantages for Canadian businesses, especially exporters.

- Reduced competitiveness of Canadian exports: A stronger CAD makes Canadian goods and services more expensive for US buyers, potentially reducing demand and impacting export revenues. This is particularly true for businesses heavily reliant on US markets.

- Impact on profits: Canadian exporters might see reduced profit margins due to decreased demand and higher costs of production compared to competitors in countries with weaker currencies.

- Increased imports: Conversely, a stronger CAD makes imports cheaper, which could benefit Canadian consumers but might also negatively impact domestic producers competing with imported goods.

- Sectoral Impact: The impact varies significantly across sectors. For example, resource-based industries (energy, agriculture) might be disproportionately affected due to their reliance on global commodity prices and export markets.

Other Contributing Factors to the Canadian Dollar's Strength

While the Trump-Carney deal speculation played a significant role, other factors contributed to the Canadian dollar's appreciation.

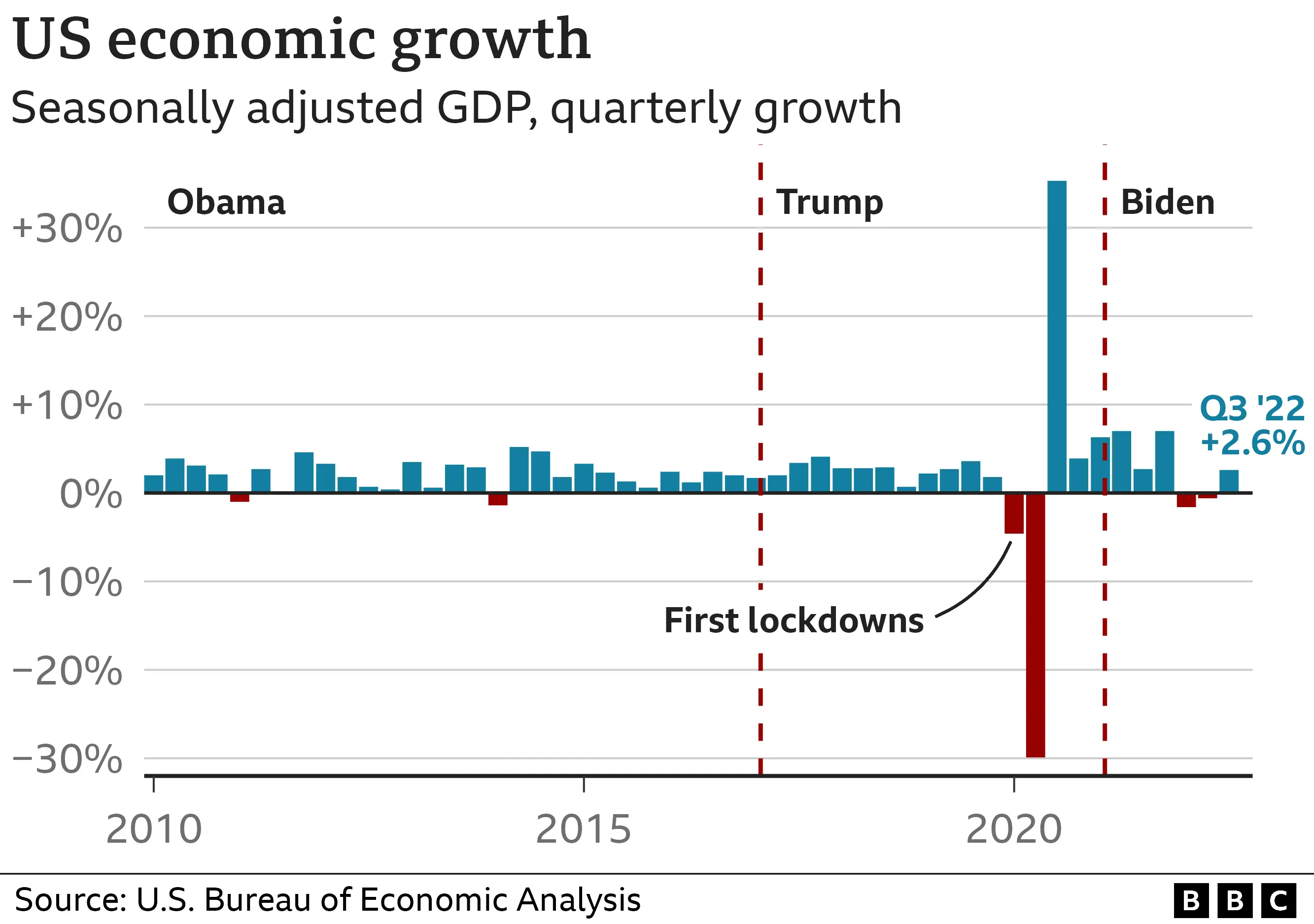

- Canadian economic performance: Strong GDP growth and low unemployment rates can boost investor confidence and strengthen the currency.

- Interest rate differentials: Higher interest rates in Canada compared to the US can attract foreign investment, increasing demand for the CAD.

- Commodity prices: Canada is a major commodity exporter. Higher prices for oil and natural gas, for example, can positively influence the Canadian dollar's value.

- Global economic conditions: Global economic factors also influence the Canadian dollar. Strong global growth tends to benefit the CAD, while global uncertainty can weaken it.

Conclusion

The strengthening of the Canadian dollar following speculation surrounding a potential Trump-Carney deal underscores the complex interplay between political developments, economic indicators, and currency exchange rates in the forex market. The USD/CAD exchange rate reacted significantly to this speculation, highlighting the sensitivity of currency markets to even unsubstantiated rumors. While the deal itself may have been largely symbolic, its impact on market sentiment, investment flows, and the resulting fluctuation in the USD/CAD exchange rate were tangible. A stronger Canadian dollar presents a mixed bag for Canadian businesses, impacting their competitiveness and profitability. Understanding the intricate factors influencing the Canadian dollar is crucial for navigating the complexities of the forex market.

Call to Action: Stay informed about fluctuations in the Canadian dollar and the multifaceted factors that influence its value. Monitor the USD/CAD exchange rate regularly, and consider consulting with a financial advisor for personalized advice on currency trading and managing your exposure to currency risk. Understanding the dynamics of the Canadian dollar strengthens your ability to make informed financial decisions in today's globalized economy.

Featured Posts

-

The Us Console Market A Comparative Analysis Of Ps 5 And Xbox Series X S Sales

May 02, 2025

The Us Console Market A Comparative Analysis Of Ps 5 And Xbox Series X S Sales

May 02, 2025 -

A Robust Poll Data System The Cornerstone Of Fair Elections

May 02, 2025

A Robust Poll Data System The Cornerstone Of Fair Elections

May 02, 2025 -

Joe Biden And The Economy Assessing The Impact Of His Presidency

May 02, 2025

Joe Biden And The Economy Assessing The Impact Of His Presidency

May 02, 2025 -

The Merrie Monarch Festival Exploring Pacific Island Heritage Through Dance

May 02, 2025

The Merrie Monarch Festival Exploring Pacific Island Heritage Through Dance

May 02, 2025 -

Exclusive Which A Lister Wants Access To Melissa Gorgas Beach House

May 02, 2025

Exclusive Which A Lister Wants Access To Melissa Gorgas Beach House

May 02, 2025