Canadian Dollar Performance: Mixed Results Against Major Currencies

Table of Contents

Recent CAD Performance Against the US Dollar (USD/CAD)

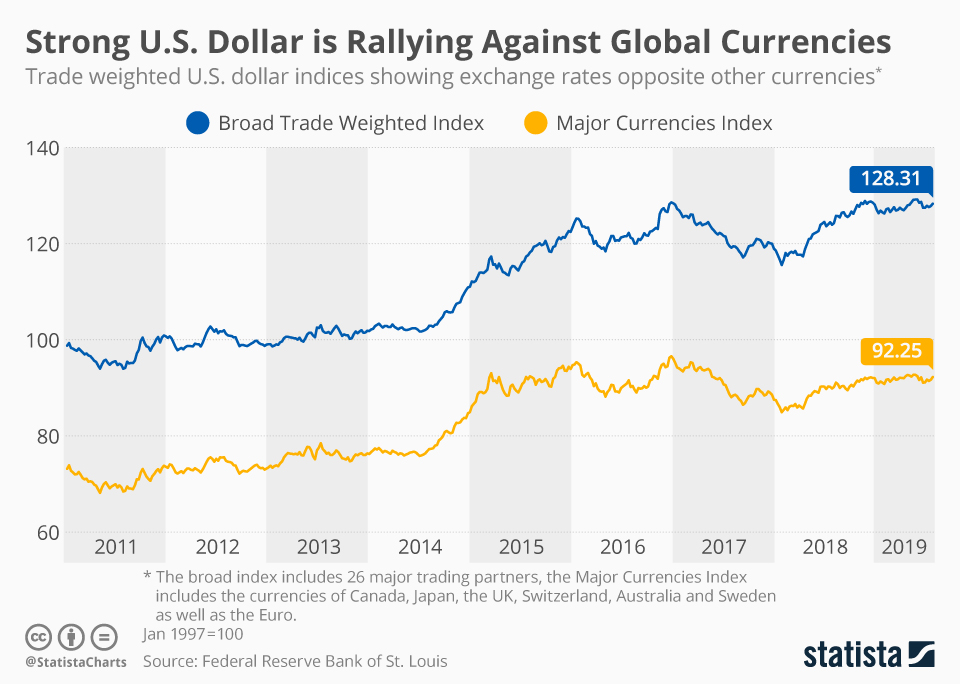

The USD/CAD exchange rate has seen considerable movement in recent times. Several factors contribute to this volatility:

-

Interest Rate Differentials: The interest rate differential between the Bank of Canada (BoC) and the US Federal Reserve (Fed) significantly impacts the USD/CAD pair. When the BoC raises interest rates more aggressively than the Fed, the CAD tends to appreciate against the USD, attracting foreign investment seeking higher returns. Conversely, a lower BoC interest rate compared to the Fed can weaken the CAD.

-

Oil Prices: Canada is a major exporter of crude oil. Fluctuations in global oil prices directly impact the Canadian economy and the CAD. Higher oil prices generally strengthen the CAD, while lower prices weaken it. This is because increased oil revenue boosts the Canadian economy and increases demand for the CAD.

-

Canada-US Trade Balance: The trade balance between Canada and the US plays a crucial role. A trade surplus (Canada exporting more than it imports) tends to strengthen the CAD, while a trade deficit weakens it. This reflects the overall flow of goods and services between the two countries.

[Insert chart/graph visualizing recent USD/CAD performance here]

CAD Performance Against the Euro (EUR/CAD) and British Pound (GBP/CAD)

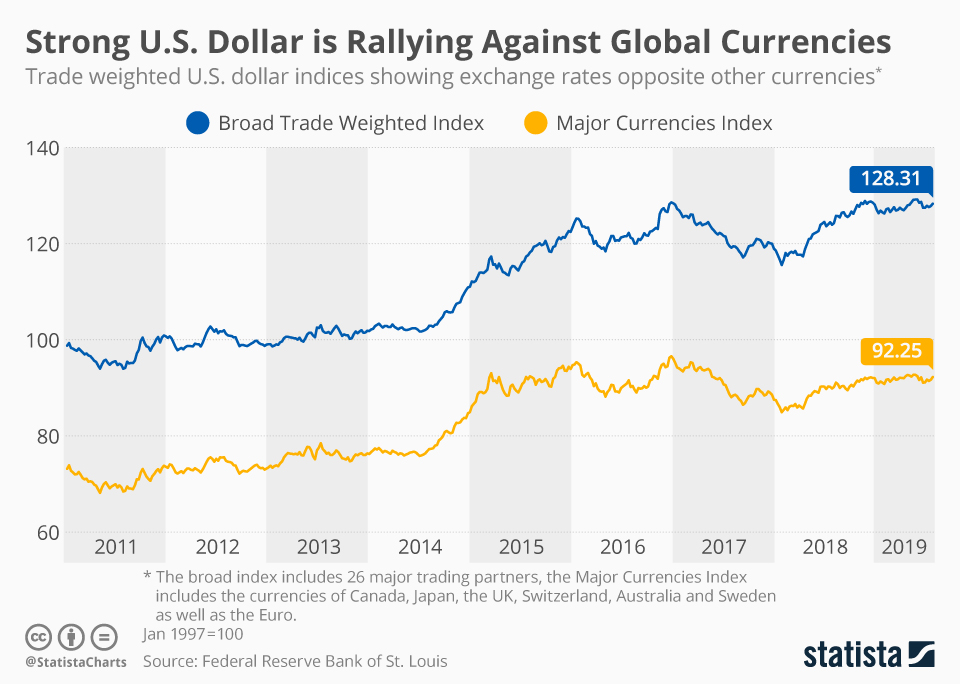

The Canadian dollar's performance against the EUR and GBP is also influenced by various factors:

-

Global Economic Outlook: The overall health of the global economy significantly impacts these currency pairs. A strong global economic outlook generally benefits all major currencies, including the CAD, while a weak outlook can lead to increased volatility and potential weakening.

-

Monetary Policies of ECB and BoE: The monetary policies of the European Central Bank (ECB) and the Bank of England (BoE) play a significant role. Their decisions on interest rates and quantitative easing influence the value of the EUR and GBP, respectively, impacting their exchange rates with the CAD.

-

Geopolitical Events: Geopolitical events in the Eurozone and the UK can create uncertainty and volatility in the EUR/CAD and GBP/CAD exchange rates. Political instability or major international conflicts can significantly impact investor sentiment and currency values.

[Insert charts/graphs visualizing recent EUR/CAD and GBP/CAD performance here]

Key Economic Indicators Influencing Canadian Dollar Strength

Several key economic indicators significantly influence the strength of the Canadian dollar:

-

GDP Growth Rate: A strong GDP growth rate indicates a healthy economy, attracting foreign investment and boosting demand for the CAD.

-

Inflation Rates: High inflation erodes purchasing power and can weaken the CAD. The BoC's response to inflation through interest rate adjustments significantly impacts the currency's value.

-

Employment Figures: Strong employment figures signal a healthy economy, supporting the CAD. High unemployment rates, on the other hand, tend to weaken it.

-

Trade Data: Export and import figures reveal the health of the Canadian economy and its trade relationships. A positive trade balance generally strengthens the CAD.

-

Consumer Confidence Indices: High consumer confidence indicates optimism in the economy, contributing to a stronger CAD.

Understanding the Impact of Global Events

Global events introduce significant uncertainty and volatility to the Canadian dollar:

-

Geopolitical Risks: Geopolitical instability in various parts of the world can negatively impact investor sentiment, leading to a weaker CAD as investors seek safer havens.

-

Global Market Volatility: Periods of high global market volatility often lead to increased risk aversion, causing investors to move away from riskier assets like the CAD.

-

Supply Chain Disruptions: Major disruptions to global supply chains can negatively affect the Canadian economy and weaken the CAD.

Conclusion

The Canadian dollar's recent performance has been a mixed bag, influenced by a complex interplay of domestic economic factors and global events. Interest rate differentials, oil prices, trade balances, and global economic outlook significantly impact the CAD's exchange rates against major currencies. Monitoring key economic indicators like GDP growth, inflation, and employment, along with global events and monetary policies, is crucial for understanding and predicting future CAD performance. Stay updated on Canadian dollar performance to make informed decisions regarding currency trading and international investments. Monitor the CAD exchange rate closely and learn more about CAD trading strategies to navigate the dynamic foreign exchange market effectively.

Featured Posts

-

The Burden Of 2025 Michelle Obama And Taraji P Henson On Black Womens Mental Well Being

Apr 25, 2025

The Burden Of 2025 Michelle Obama And Taraji P Henson On Black Womens Mental Well Being

Apr 25, 2025 -

United Kingdom Eurovision 2025 Introducing Remember Monday

Apr 25, 2025

United Kingdom Eurovision 2025 Introducing Remember Monday

Apr 25, 2025 -

Bundesliga Bayern Wins But St Pauli Match Highlights Room For Improvement

Apr 25, 2025

Bundesliga Bayern Wins But St Pauli Match Highlights Room For Improvement

Apr 25, 2025 -

Tramp I Ukrayina Vid Pochatku Viyni Do Sogodni Analiz Zayav

Apr 25, 2025

Tramp I Ukrayina Vid Pochatku Viyni Do Sogodni Analiz Zayav

Apr 25, 2025 -

South Africa Coalition Government Survives Tax Hike Vote

Apr 25, 2025

South Africa Coalition Government Survives Tax Hike Vote

Apr 25, 2025

Latest Posts

-

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025 -

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 10, 2025

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 10, 2025 -

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 10, 2025

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 10, 2025 -

Harry Styles London Outing The Seventies Stache Makes A Statement

May 10, 2025

Harry Styles London Outing The Seventies Stache Makes A Statement

May 10, 2025 -

Harry Styles Sports A Retro Mustache In London

May 10, 2025

Harry Styles Sports A Retro Mustache In London

May 10, 2025