Canadian Condo Market Slowdown: Impact On Investors

Table of Contents

Factors Contributing to the Canadian Condo Market Slowdown

Several interconnected factors have contributed to the current slowdown in the Canadian condo market. Understanding these is crucial for effective investment decision-making within the broader Canadian property market and housing market.

Increased Interest Rates

Rising interest rates represent a significant hurdle for both prospective condo buyers and investors. The increased cost of borrowing directly impacts affordability, leading to reduced buyer demand. This translates to lower sales volumes and potentially diminished rental yields for condo investors. Higher mortgage payments significantly affect the affordability of condos, reducing the pool of potential buyers.

- Analyze the impact of current interest rates on your investment strategy. Consider the long-term implications of higher borrowing costs on your cash flow and return on investment.

- Consider refinancing options to mitigate rising costs. Explore options to lower your monthly payments or extend your mortgage term to manage your expenses.

Over-Supply in Certain Markets

Certain major Canadian cities, notably Toronto and Vancouver, have witnessed a considerable surge in condo construction in recent years, resulting in an oversupply in some segments of the market. This surplus of available units puts downward pressure on prices and intensifies competition among sellers. This oversupply is particularly impactful on the property market in these specific high-demand areas.

- Research specific market conditions before investing in a particular area. Don't rely on broad generalizations; analyze local market data to identify areas with stronger underlying demand.

- Look for areas with strong, underlying demand despite the overall slowdown. Focus on locations with robust rental markets or those experiencing population growth.

Economic Uncertainty and Inflation

Global economic uncertainty and persistent high inflation are creating a climate of hesitancy among potential condo buyers. Consumers are exercising greater caution with their spending, leading to decreased demand for both owner-occupied and investment properties. This impacts the overall health of the Canadian housing market and affects investor confidence.

- Diversify your investment portfolio to mitigate risks. Don't concentrate all your investments in condos; consider other asset classes to spread your risk.

- Consider the long-term potential of the market rather than short-term fluctuations. A long-term perspective can help weather market downturns.

Strategies for Navigating the Condo Market Slowdown

The current slowdown demands a more strategic and cautious approach to condo investment in Canada. Adapting your investment strategy is key to navigating this challenging environment.

Due Diligence and Market Research

Thorough due diligence and comprehensive market research are paramount in the current climate. This includes a detailed analysis of market trends, vacancy rates, and rental yields in your target area. Understanding the local dynamics is critical for informed decision-making.

- Engage a qualified real estate professional experienced in the condo market. Their expertise can provide invaluable insights and guidance.

- Utilize online resources and market data to inform your decisions. Leverage data platforms and reputable market reports to enhance your research.

Long-Term Investment Perspective

A long-term investment perspective is essential. Focus on the long-term growth potential of the property and its ability to appreciate in value over time, rather than aiming for short-term gains.

- Factor in potential maintenance costs and property taxes. These ongoing expenses should be incorporated into your financial projections.

- Develop a long-term investment plan that accounts for market fluctuations. A well-defined plan will help you stay on track even during challenging market conditions.

Risk Mitigation and Diversification

Diversifying your investment portfolio across different asset classes and geographic locations is crucial for risk mitigation. This helps to reduce your exposure to any single market downturn.

- Consider investing in a REIT (Real Estate Investment Trust) for diversification. REITs provide exposure to a broader range of real estate assets.

- Don’t put all your eggs in one basket—spread your risk across different properties. Avoid over-concentrating your investments in a single building or location.

Opportunities Amidst the Slowdown

While the current market presents challenges, it also offers opportunities for savvy investors.

Negotiating Lower Prices

The slowdown creates a buyer's market, providing opportunities to negotiate more favourable purchase prices. Sellers may be more willing to compromise to secure a sale.

- Be prepared to walk away if the deal doesn’t meet your investment criteria. Don't overextend yourself to secure a deal.

- Leverage your negotiating skills to secure a better price. A well-prepared offer can help you get a good deal.

Increased Rental Demand (In Specific Niches)

While overall demand may have softened, certain condo types or locations could still experience robust rental demand. Targeting these niches can provide strong rental income.

- Identify and target specific renter demographics. Focus on properties that cater to high-demand renter groups.

- Research areas with high rental occupancy rates. These locations offer greater rental income stability.

Conclusion

The Canadian condo market slowdown presents both challenges and opportunities. By understanding the contributing factors, conducting thorough due diligence, adopting a long-term investment perspective, and diversifying your portfolio, investors can effectively navigate these changing market conditions. The key is to remain informed, adapt your strategy, and leverage the potential for negotiation in this dynamic market. Don't let the current Canadian condo market slowdown deter you; with careful planning and a strategic approach, you can still achieve success in the Canadian real estate investment market. Start your research today and explore the opportunities available in the current Canadian condo market.

Featured Posts

-

10 Of Europes Finest Shopping Experiences

Apr 25, 2025

10 Of Europes Finest Shopping Experiences

Apr 25, 2025 -

Brian Tyree Henry And Wagner Mouras Dope Thief Trailer A Look At Their Undercover Roles

Apr 25, 2025

Brian Tyree Henry And Wagner Mouras Dope Thief Trailer A Look At Their Undercover Roles

Apr 25, 2025 -

The Delhi Petrol Car Ban A Case Study For Urban Air Quality Improvement

Apr 25, 2025

The Delhi Petrol Car Ban A Case Study For Urban Air Quality Improvement

Apr 25, 2025 -

Cellnex Ceo Network Overhaul Complete By Years End Focusing On Uk Expansion

Apr 25, 2025

Cellnex Ceo Network Overhaul Complete By Years End Focusing On Uk Expansion

Apr 25, 2025 -

Leverage Rented I Pads For Effective Business Conference Networking

Apr 25, 2025

Leverage Rented I Pads For Effective Business Conference Networking

Apr 25, 2025

Latest Posts

-

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025 -

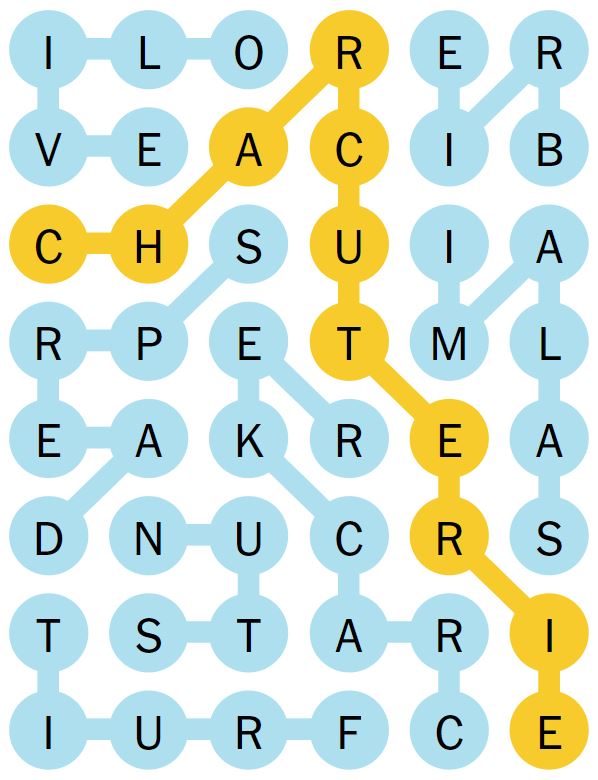

February 20th Nyt Strands Answers Game 354

May 10, 2025

February 20th Nyt Strands Answers Game 354

May 10, 2025 -

The Economic Fallout Of Trump Tariffs A Fox News Perspective

May 10, 2025

The Economic Fallout Of Trump Tariffs A Fox News Perspective

May 10, 2025 -

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025 -

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025