Canada's Economic Outlook: David Dodge Predicts Ultra-Low Growth

Dodge's Prediction and its Implications

David Dodge's prediction points towards a significant economic slowdown for Canada. While the exact figures vary depending on the source and interpretation, the core message remains consistent: Canada is facing a period of substantially lower growth than previously anticipated. The term "ultra-low" in this context signifies a growth rate considerably below the historical average and well below the levels needed to maintain robust economic performance and create substantial new jobs. The implications are far-reaching, affecting multiple sectors and impacting the lives of Canadian citizens.

-

Specific growth rate predicted by Dodge: While the precise number varies depending on the specific interview or publication, Dodge's warnings consistently point to growth rates significantly below 1%, possibly even dipping into negative territory (recession) in certain scenarios.

-

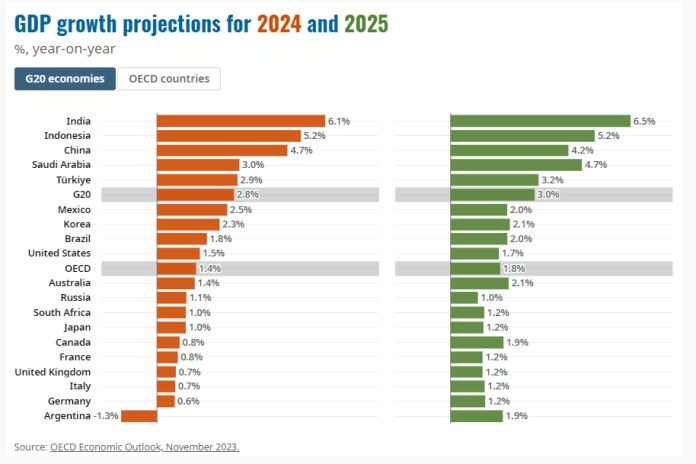

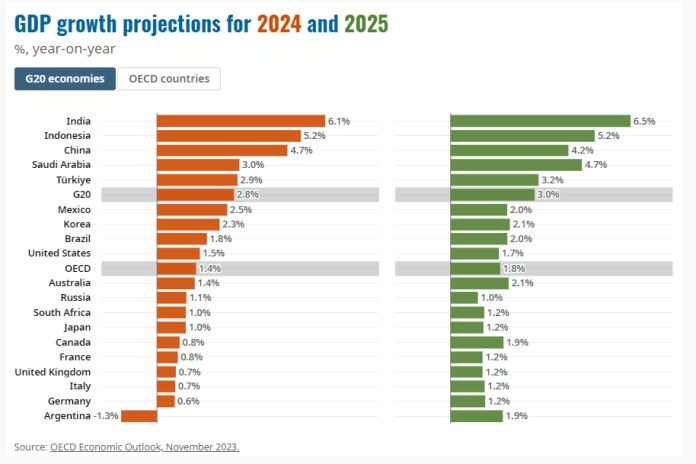

Comparison to previous growth forecasts: Previous forecasts were considerably more optimistic, projecting growth rates closer to 2% or even higher. Dodge's prediction represents a stark departure from these earlier, more buoyant expectations.

-

Potential impact on job market: Ultra-low growth almost certainly translates to slower job creation. Increased unemployment, particularly amongst vulnerable populations, is a serious concern.

-

Predicted impact on investment in various sectors: Businesses are likely to postpone or reduce investments in expansion and new projects in response to the uncertain economic climate. This could impact various sectors, from manufacturing to technology.

-

Likely effects on consumer confidence and spending: Concerns about job security and economic stability can lead to decreased consumer spending, further dampening economic activity.

Underlying Factors Contributing to Ultra-Low Growth

Several interconnected factors contribute to Dodge's pessimistic outlook on Canada's economic outlook. These factors are creating a perfect storm impacting growth.

-

Persistent high inflation and its impact: Stubbornly high inflation continues to erode purchasing power, forcing the Bank of Canada to maintain a tighter monetary policy stance.

-

The role of the Bank of Canada's interest rate policy: The Bank of Canada's aggressive interest rate hikes, designed to curb inflation, are also slowing down economic growth, potentially causing a recession. Higher interest rates increase borrowing costs for businesses and consumers.

-

Effects of global economic uncertainties on the Canadian economy: Global economic headwinds, including geopolitical instability and potential recessions in major economies, are exerting downward pressure on Canadian growth.

-

Analysis of the Canadian housing market and its potential for correction: A significant correction in the overheated Canadian housing market, if it occurs, could further dampen economic activity and consumer confidence.

Potential Mitigation Strategies and Government Response

Addressing Canada's ultra-low growth challenge requires a multi-pronged approach. Both fiscal and monetary policies will play crucial roles.

-

Potential fiscal stimulus packages: The government could consider targeted fiscal stimulus measures to boost aggregate demand, potentially focusing on infrastructure projects, tax cuts, or direct payments to vulnerable households.

-

Possible adjustments to the Bank of Canada's monetary policy: The Bank of Canada may need to carefully assess the trade-off between controlling inflation and supporting economic growth, potentially adjusting its interest rate policy if inflation cools sufficiently.

-

Other government interventions to stimulate economic growth: Regulatory reforms, investments in education and skills development, and policies aimed at promoting innovation and technological advancement could also play a role.

-

Analysis of the effectiveness of potential mitigation strategies: The effectiveness of these strategies depends on several factors including their timing, scale, and the overall global economic environment.

Long-Term Outlook and Uncertainty

The long-term consequences of ultra-low growth are significant and uncertain. While Canada possesses certain strengths, such as a diversified economy and a skilled workforce, sustained periods of low growth can lead to several problems.

-

Potential long-term consequences of sustained low growth: These include slower improvements in living standards, increased income inequality, and potential damage to long-term economic potential.

-

Areas of strength within the Canadian economy: Canada's resource sector, strong financial institutions, and innovative technology sectors offer some resilience against economic downturns.

-

Uncertainty surrounding future economic performance: Predicting the future economic performance is inherently challenging, given numerous interconnected variables and unpredictable global events.

-

Expert opinions on long-term growth potential: Economists hold diverse views on Canada’s long-term growth potential, reflecting the complexities and uncertainties involved.

Conclusion

David Dodge's prediction of ultra-low growth for Canada's economy highlights serious challenges. High inflation, aggressive interest rate hikes, global economic uncertainty, and a potential housing market correction all contribute to this bleak outlook. While the government and the Bank of Canada can employ various mitigation strategies—including fiscal stimulus and adjustments to monetary policy—the effectiveness of these measures remains uncertain. Understanding Canada's economic outlook is crucial. Stay informed about Canada's economic outlook and the latest developments concerning ultra-low growth and its potential impacts by following our website for regular updates and analysis. Understanding Canada's economic outlook is paramount for navigating the challenges ahead.

Macron Alerte Sur La Militarisation Possible De L Aide Humanitaire A Gaza Par Israel

Macron Alerte Sur La Militarisation Possible De L Aide Humanitaire A Gaza Par Israel

Au Dela De La Douleur Emmanuel Macron Profondement Emu Apres Avoir Rencontre Des Victimes De L Armee Israelienne

Au Dela De La Douleur Emmanuel Macron Profondement Emu Apres Avoir Rencontre Des Victimes De L Armee Israelienne

The Implications Of Fortnite Removing Game Modes A Player Perspective

The Implications Of Fortnite Removing Game Modes A Player Perspective

Internal Fighting Threatens Reform Uk An Analysis Of The Current Crisis

Internal Fighting Threatens Reform Uk An Analysis Of The Current Crisis