Can XRP's Rise To Fourth-Largest Crypto Make You Rich?

Table of Contents

- XRP's Technological Advantages and Market Position

- Analyzing the Volatility and Risks of Investing in XRP

- The Ripple Effect: How Ripple's Actions Influence XRP's Price

- Strategies for Investing in XRP (and mitigating risk)

- Comparing XRP's Potential Returns with Other Cryptocurrencies

- Conclusion: Can XRP Make You Rich? The Verdict

XRP distinguishes itself as a digital asset designed for fast and efficient cross-border payments. Unlike Bitcoin's slow transaction times and Ethereum's comparatively high fees, XRP boasts lightning-fast transaction speeds and remarkably low costs, making it an attractive option for financial institutions seeking streamlined international transactions. This article will explore whether this potential translates to significant returns for investors.

XRP's Technological Advantages and Market Position

XRP's primary function is as a bridge currency, facilitating seamless transactions between different currencies. This role is particularly beneficial for international payments, where traditional methods often involve high fees and lengthy processing times. Its speed and low transaction costs give it a competitive edge over other cryptocurrencies like Bitcoin and Ethereum. This efficiency has attracted the attention of numerous financial institutions and payment providers, leading to increased adoption and potentially fueling further price growth.

- Faster transaction speeds than Bitcoin: XRP transactions are settled in a matter of seconds, compared to Bitcoin's minutes or even hours.

- Lower transaction fees than Ethereum: The cost of sending XRP is significantly lower than Ethereum's gas fees, making it more cost-effective for high-volume transactions.

- Integration with RippleNet for cross-border payments: RippleNet, Ripple's network for financial institutions, utilizes XRP to streamline international payments, further driving adoption.

- Strategic partnerships with major banks: Ripple has established partnerships with several major banks globally, boosting XRP's credibility and potential for mainstream acceptance.

Analyzing the Volatility and Risks of Investing in XRP

While the potential for high returns is alluring, it's crucial to acknowledge the inherent volatility of the cryptocurrency market and the specific risks associated with XRP. The cryptocurrency market is known for its dramatic price swings, and XRP is no exception. Furthermore, XRP faces regulatory uncertainty stemming from ongoing legal battles with the Securities and Exchange Commission (SEC).

- High price fluctuations: XRP's price can experience significant daily fluctuations, leading to substantial gains or losses.

- Regulatory risks and legal challenges: The SEC lawsuit against Ripple creates considerable uncertainty regarding XRP's regulatory status, potentially impacting its price.

- Market manipulation potential: Like any cryptocurrency, XRP is susceptible to market manipulation, which can cause sudden and unpredictable price movements.

- Importance of diversification in a crypto portfolio: Never put all your eggs in one basket. Diversifying your investments across multiple cryptocurrencies and asset classes is crucial to mitigate risk.

The Ripple Effect: How Ripple's Actions Influence XRP's Price

It's vital to understand the close relationship between Ripple (the company) and XRP (the cryptocurrency). Ripple's actions, partnerships, and legal battles significantly influence investor sentiment and, consequently, XRP's price. Positive developments, such as new partnerships or technological advancements, tend to boost XRP's value, while negative news, such as regulatory setbacks, can cause price drops. The ongoing legal case is a prime example of how Ripple's actions directly impact XRP's market performance.

Strategies for Investing in XRP (and mitigating risk)

Investing in XRP, like any cryptocurrency, requires a well-defined strategy and a clear understanding of your risk tolerance. Various approaches exist, each with its own advantages and disadvantages.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can reduce the impact of volatility.

- Long-term investment strategy: Holding XRP for an extended period can potentially yield higher returns, but it also exposes you to greater risk.

- Diversification across multiple cryptocurrencies and asset classes: Diversifying your portfolio reduces the overall risk associated with investing in a single cryptocurrency.

- Setting stop-loss orders: Stop-loss orders automatically sell your XRP if the price falls below a predetermined level, limiting potential losses.

Comparing XRP's Potential Returns with Other Cryptocurrencies

Comparing XRP's performance to other leading cryptocurrencies, such as Bitcoin and Ethereum, provides valuable context. While XRP has shown periods of substantial growth, its historical performance is highly variable compared to the more established cryptocurrencies. Factors influencing XRP's future price include increased adoption by financial institutions, positive regulatory outcomes, and further technological developments within the Ripple ecosystem.

- Historical price charts and performance analysis of XRP, Bitcoin, and Ethereum: Analyzing past price trends can help assess XRP's historical volatility and potential for future growth.

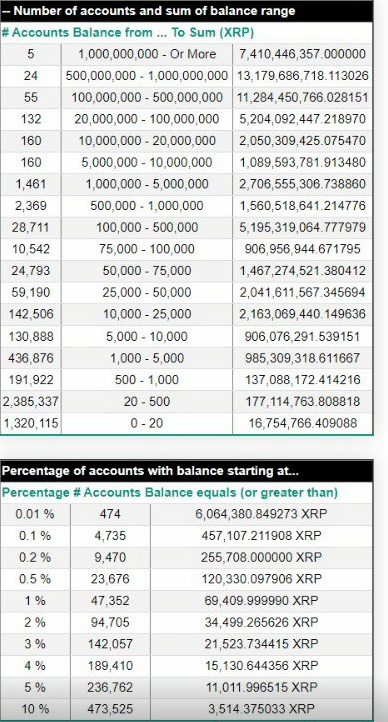

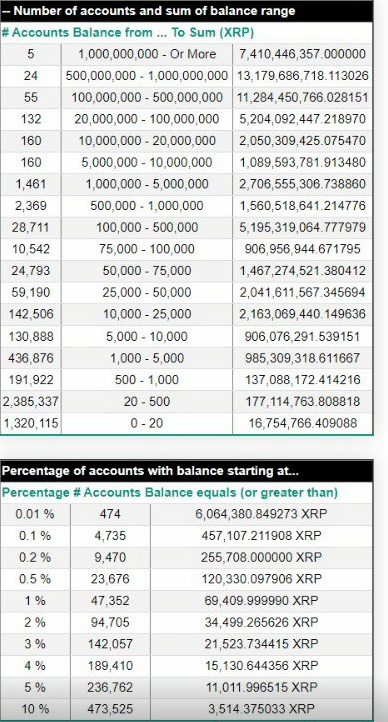

- Comparison of market capitalization and potential growth: Market capitalization offers insight into the overall value of XRP relative to other cryptocurrencies.

- Factors influencing future price projections (adoption, regulation, technology): Future price predictions depend heavily on these external factors.

Conclusion: Can XRP Make You Rich? The Verdict

Whether XRP can make you rich depends on various factors, including market conditions, regulatory developments, and your investment strategy. While XRP offers technological advantages and potential for significant returns, it’s crucial to acknowledge the inherent volatility and risks. Responsible investing involves thorough research, diversification, and a realistic understanding of your risk tolerance. Before investing in XRP, or any cryptocurrency, conduct comprehensive research and consider consulting a financial advisor. Learn more about XRP investing and explore the potential of XRP, but always weigh the risks and rewards carefully. Remember that past performance is not indicative of future results.

Kampen Start Kort Geding Tegen Enexis Stroomnetaansluiting Centraal

Kampen Start Kort Geding Tegen Enexis Stroomnetaansluiting Centraal

Maines Post Election Audit What To Expect

Maines Post Election Audit What To Expect

Pakstan Myn Kshmyrywn Ky Ykjhty Ka Dn Ahtjaj Awr Tqrybat

Pakstan Myn Kshmyrywn Ky Ykjhty Ka Dn Ahtjaj Awr Tqrybat

Lotto 6aus49 Zahlen Und Gewinnklassen Vom 12 April 2025

Lotto 6aus49 Zahlen Und Gewinnklassen Vom 12 April 2025

Tulsa Storm Damage Report Assisting The National Weather Service

Tulsa Storm Damage Report Assisting The National Weather Service