Can Uber Stock Withstand A Recession? Expert Opinions

Table of Contents

Uber's Business Model and Recession Resistance

Uber's multifaceted business model is a key factor in evaluating its recession resistance. Unlike companies reliant on a single product or service, Uber boasts diversified revenue streams, potentially offering a buffer against economic hardship.

Analyzing Uber's Revenue Streams

Uber's revenue is derived from several key areas, mitigating its vulnerability to a downturn in any single sector:

- Ride-sharing: This remains a core segment, although its sensitivity to economic downturns is a valid concern.

- Uber Eats: The food delivery segment has demonstrated strong growth and may prove relatively resilient during a recession, as people may opt for home delivery over restaurant dining.

- Freight: Uber Freight, targeting the logistics industry, offers another avenue for revenue diversification, potentially less susceptible to consumer spending fluctuations.

The precise percentage contribution of each revenue stream varies, but the diversification itself represents a significant advantage. Historically, companies with diversified revenue models have often shown greater resilience during economic downturns compared to those with a singular focus. Further research into Uber's financial reports across previous economic cycles could reveal valuable insights into its past performance. Analyzing revenue diversification and its impact on financial stability during previous downturns is crucial for forecasting future performance.

Pricing Power and Demand Elasticity

Uber's ability to adjust pricing strategies in response to changing consumer behavior is another critical factor. During a recession, consumers are more price-sensitive, impacting the demand elasticity of ride-sharing and food delivery services.

- Past Pricing Adjustments: Uber has historically implemented dynamic pricing, adjusting fares based on demand. This strategy might become more nuanced during a recession, balancing the need to maintain profitability with the need to attract price-conscious customers.

- Increased Promotions: Expect an increase in promotional offers and discounts to stimulate demand and maintain market share.

- Impact on Profitability: While promotions may boost volume, they will likely compress profit margins. This necessitates careful cost-cutting measures to maintain overall profitability.

Understanding Uber's pricing strategies and how they respond to demand fluctuations is crucial for assessing the company's resilience during a recession. The interplay between cost-cutting measures and maintaining market share will be key to its success.

Expert Opinions on Uber's Recession Preparedness

Gaining insights from leading financial analysts provides further context for evaluating Uber's recession readiness.

Analyst Predictions and Stock Ratings

Analyst forecasts on Uber's stock performance vary, reflecting differing perspectives on its resilience.

- Range of Predicted Stock Performance: Some analysts express cautious optimism, citing Uber's diversification, while others predict a more significant impact from a potential recession.

- Specific Ratings and Target Prices: We must consult recent research reports from reputable financial institutions for the latest ratings and target prices, as these figures are constantly evolving.

- Reasoning Behind Predictions: Analysts' reasoning usually includes factors such as expected revenue growth, profit margins, and competitive pressures.

It's important to consult multiple sources and critically assess the underlying assumptions in each analyst's prediction. Stock market predictions are inherently uncertain, and relying solely on one source would be imprudent.

Competitive Landscape and Market Share

Uber's competitive position relative to Lyft, DoorDash, and other players significantly impacts its resilience.

- Market Share Analysis: Analyzing Uber's market share in ride-sharing and food delivery is essential. A dominant market share could buffer against competitive pressures during a downturn.

- Competitive Advantages and Disadvantages: Identifying Uber's key competitive advantages (e.g., brand recognition, technology) and disadvantages (e.g., regulatory hurdles, driver relations) is vital.

- Potential for Consolidation: Recessions can sometimes accelerate industry consolidation. The possibility of mergers or acquisitions within the ride-sharing and delivery sectors warrants consideration.

Understanding Uber's competitive advantage and its ability to maintain or expand its market dominance in a challenging economic environment is crucial for a comprehensive assessment of its stock's resilience.

Macroeconomic Factors Influencing Uber's Stock

Beyond Uber's internal factors, macroeconomic conditions significantly impact its stock performance.

Inflation and Fuel Prices

Rising inflation and fuel costs directly affect Uber's operational expenses and profitability.

- Fuel Price Sensitivity: The cost of fuel is a significant expense for Uber drivers, influencing their earnings and potentially impacting the supply of drivers.

- Passing Costs to Consumers: Uber's ability to pass increased fuel costs on to consumers through higher fares will influence its profitability. However, this could negatively affect demand during a recession.

- Impact on Driver Earnings: Rising fuel prices can reduce driver earnings, potentially leading to a decrease in the number of drivers available on the platform.

The impact of inflationary pressures and fuel cost fluctuations on Uber's operational efficiency is a critical factor to consider.

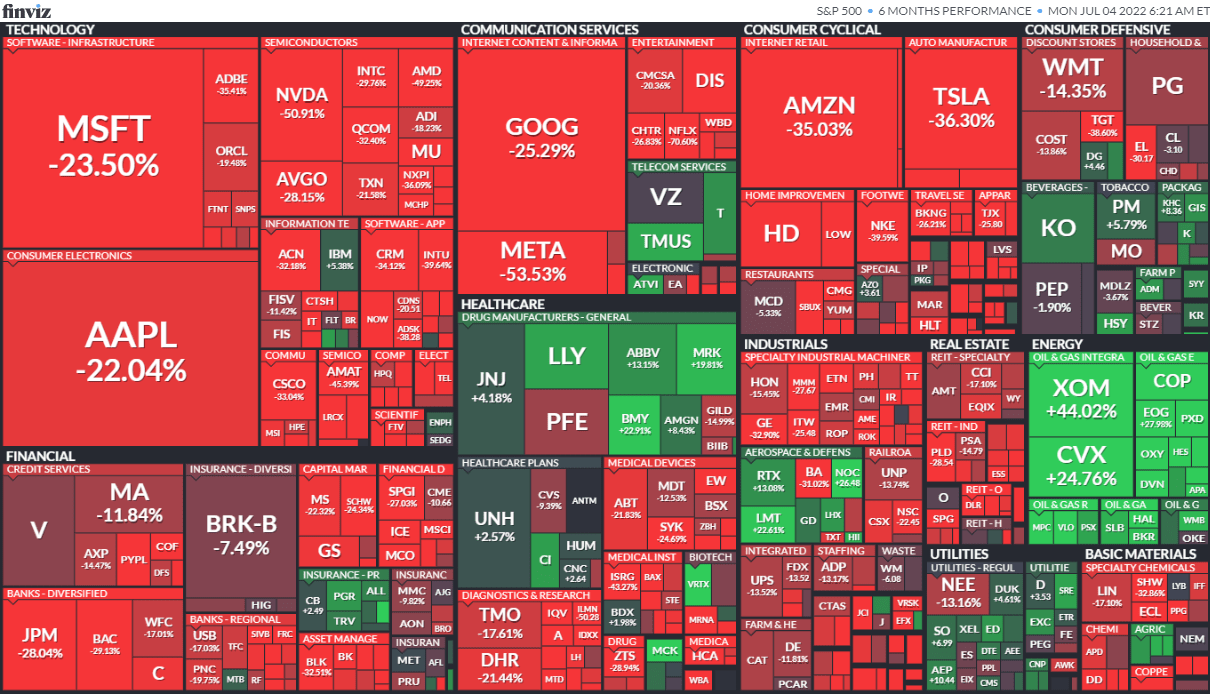

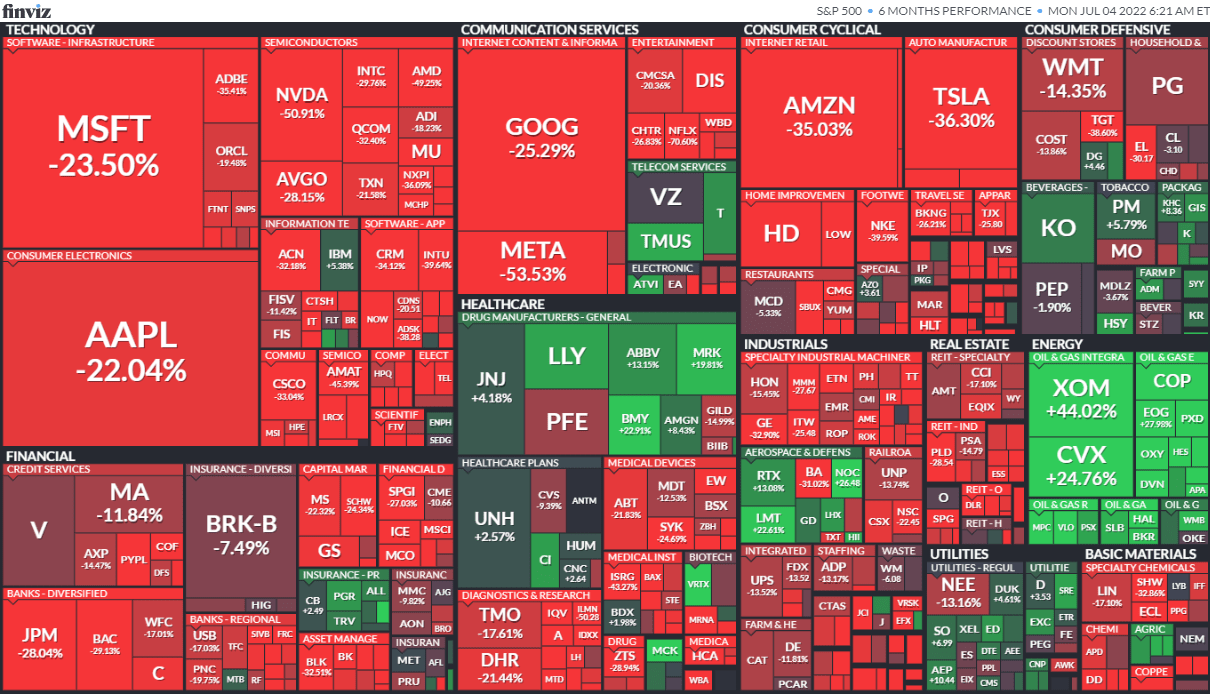

Interest Rates and Investment Sentiment

Changes in interest rates and overall investor sentiment significantly influence Uber's stock valuation.

- Interest Rate Sensitivity: Rising interest rates increase Uber's borrowing costs, impacting its ability to invest in expansion and innovation.

- Investor Confidence in the Tech Sector: Overall investor sentiment towards the tech sector has a direct impact on Uber's stock price. Negative sentiment can lead to sell-offs.

- Potential for Capital Investment: Lower interest rates might encourage further capital investment and expansion but may not offset negative investor sentiment in times of economic turmoil.

Understanding the sensitivity of Uber’s valuation to interest rate changes and shifts in investor sentiment is critical for a complete picture of its recession-proofing capabilities.

Conclusion

Assessing whether Uber stock can withstand a recession requires a nuanced understanding of its business model, expert opinions, and the prevailing macroeconomic environment. While Uber's revenue diversification offers a degree of protection, factors like inflation, fuel prices, interest rates, and competitive pressures significantly influence its prospects. The analysis reveals that multiple perspectives and factors must be considered when evaluating the risk of investing in Uber during economically challenging times. Remember, this analysis is not a financial recommendation. Before making any investment decisions related to Uber stock or other recession-proof stocks, conduct thorough research and consider consulting with a qualified financial advisor to understand the potential impact of a recession on your investment portfolio. Further reading on "recession-proof stocks" and analyzing "Uber stock performance during economic downturns" will broaden your perspective.

Featured Posts

-

Spring Breakout 2025 Rosters Team Lineups And Key Players

May 18, 2025

Spring Breakout 2025 Rosters Team Lineups And Key Players

May 18, 2025 -

Sejour Au Lioran L Attrait D Onet Le Chateau

May 18, 2025

Sejour Au Lioran L Attrait D Onet Le Chateau

May 18, 2025 -

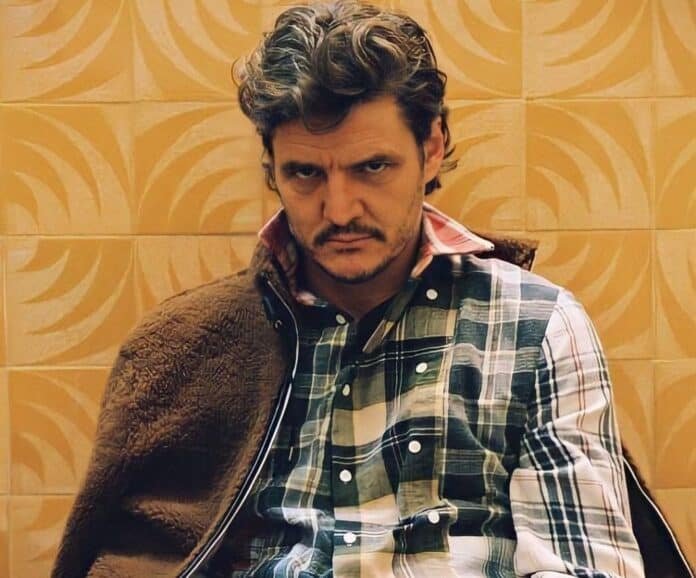

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025 -

Spring Breakout Tournament 2025 Roster Predictions And Team Previews

May 18, 2025

Spring Breakout Tournament 2025 Roster Predictions And Team Previews

May 18, 2025 -

Five Boro Bike Tour A Detailed Look At The Route And Logistics

May 18, 2025

Five Boro Bike Tour A Detailed Look At The Route And Logistics

May 18, 2025

Latest Posts

-

The Internets Latest Obsession Pedro Pascal In Fantasy

May 18, 2025

The Internets Latest Obsession Pedro Pascal In Fantasy

May 18, 2025 -

Internet Buzz Pedro Pascals Latest Fantasy Performance

May 18, 2025

Internet Buzz Pedro Pascals Latest Fantasy Performance

May 18, 2025 -

Pedro Pascals Colorful Fantasy Role Takes The Internet By Storm

May 18, 2025

Pedro Pascals Colorful Fantasy Role Takes The Internet By Storm

May 18, 2025 -

Pedro Pascal Conquering The Internet Once More With Vibrant Fantasy

May 18, 2025

Pedro Pascal Conquering The Internet Once More With Vibrant Fantasy

May 18, 2025 -

Is Pedro Pascals Jawline Change Due To Surgery Or Weight Loss

May 18, 2025

Is Pedro Pascals Jawline Change Due To Surgery Or Weight Loss

May 18, 2025