Can Trump's Tariffs Replace Income Taxes? 4 Key Complications

Table of Contents

The Problem of Revenue Volatility with Tariffs

Replacing a stable revenue stream like income tax with the unpredictable revenue generated by tariffs is a risky proposition. The inherent volatility of tariff revenue makes it an unreliable foundation for government budgeting and spending.

Unpredictable Global Trade

Global trade is inherently volatile. Fluctuations in international relations, economic downturns, and unforeseen events (like pandemics) dramatically impact tariff revenue. This makes reliable budgeting nearly impossible.

- Dependence on specific import volumes: Tariff revenue is directly tied to the volume of imported goods. A decrease in imports, for any reason, directly translates to lower tariff revenue.

- Vulnerability to retaliatory tariffs from other countries: Imposing high tariffs often provokes retaliatory measures from other nations, reducing export opportunities and potentially offsetting any gains from increased tariffs on imports. This creates a tit-for-tat scenario that can harm the overall economy.

- Difficulty predicting long-term import trends: Accurately forecasting import volumes years in advance is nearly impossible. Economic shifts, technological advancements, and changing consumer preferences all play a role, making long-term financial planning based on tariff revenue extremely challenging.

Difficulty in Forecasting Tariff Revenue

Accurately predicting tariff revenue is extremely difficult. Unlike income tax, which has established collection mechanisms and historical data, tariff revenue is heavily dependent on external factors outside government control.

- Complexity of global supply chains: Modern supply chains are intricate and global. Tracing the origin and value of imported goods to accurately assess tariff implications is a complex and time-consuming process.

- Difficulty in assessing the impact of tariffs on import volumes: It's challenging to predict how businesses and consumers will respond to new tariffs. Will they absorb higher prices, switch to domestically produced goods, or find alternative sources of supply? The answer isn't always clear.

- Potential for tariff evasion and smuggling: High tariffs create incentives for illegal activities like smuggling and underreporting of imported goods, resulting in significant revenue loss for the government.

Regressive Nature of Tariffs

A significant drawback of relying on tariffs as the primary source of government revenue is their regressive nature. This means they disproportionately burden lower-income households.

Disproportionate Impact on Low-Income Households

Tariffs are a regressive tax because low-income households spend a larger percentage of their income on imported goods. Replacing income tax with tariffs would significantly exacerbate income inequality.

- Higher prices for essential goods (e.g., food, clothing): Tariffs increase the cost of imported goods, including essential items like food and clothing. This impact is felt most keenly by low-income individuals and families who have less disposable income to absorb price increases.

- Limited ability for low-income earners to absorb increased costs: Low-income individuals have fewer options for adjusting their spending habits when faced with higher prices. They may be forced to cut back on essential goods and services, impacting their standard of living.

- Widening the gap between the rich and the poor: The regressive nature of tariffs exacerbates income inequality, as wealthier individuals are less affected by price increases on imported goods than their lower-income counterparts.

Lack of Progressive Taxation

Unlike a progressive income tax system (where higher earners pay higher rates), tariffs are broadly applied to all imports, regardless of the consumer's income level. This makes them a less equitable method of funding government services.

- No consideration of individual financial capacity: Tariffs don't differentiate between high-income and low-income consumers. Everyone pays the same increased price for imported goods, regardless of their ability to absorb the cost.

- Inability to target revenue generation towards specific societal goals: Unlike income taxes, which can be structured to fund specific programs (e.g., education, healthcare), tariffs generate revenue in a less targeted manner.

- Potential for social unrest due to unfair distribution of the tax burden: The regressive nature of tariffs could lead to social unrest and political instability as the burden of funding the government falls disproportionately on lower-income households.

Administrative and Enforcement Challenges

Effectively collecting tariff revenue requires a robust and well-funded system, which presents significant administrative and enforcement challenges.

Complexity of Customs and Border Protection

Efficiently collecting tariff revenue requires a large and well-trained Customs and Border Protection (CBP) agency. This is expensive and susceptible to corruption.

- Increased workload and staffing needs: Implementing a tariff-based system would significantly increase the workload and staffing needs of the CBP, requiring substantial investment in personnel and infrastructure.

- Potential for bottlenecks and delays at ports of entry: Increased scrutiny and processing of imported goods can lead to bottlenecks and delays at ports of entry, disrupting supply chains and increasing costs for businesses.

- Increased risk of smuggling and fraudulent activity: High tariffs incentivize smuggling and fraudulent activities, requiring increased enforcement efforts to minimize revenue loss.

International Trade Disputes

Implementing significant tariffs often leads to retaliatory measures from other countries, escalating into trade wars.

- Potential for trade sanctions and boycotts: Other countries may retaliate by imposing their own tariffs or trade sanctions, harming exports and overall economic growth.

- Increased costs for businesses relying on imported goods: Businesses that rely on imported goods will face increased costs, potentially leading to job losses and reduced competitiveness.

- Negative effects on international relations: Trade wars can strain diplomatic relations and undermine international cooperation on other important issues.

Limited Revenue Generation Potential

High tariffs distort market mechanisms, ultimately limiting their revenue-generating potential.

Economic Distortion

High tariffs distort market mechanisms, leading to inefficiencies, reduced competition, and higher prices for consumers. This ultimately limits the potential revenue that can be generated through tariffs.

- Reduced consumer purchasing power: Higher prices for imported goods reduce consumer purchasing power, leading to decreased demand and potentially lower overall economic growth.

- Stifled economic growth due to reduced trade: Trade wars and retaliatory tariffs restrict trade flows, negatively impacting economic growth and international cooperation.

- Increased reliance on domestic producers, potentially at higher costs: High tariffs can lead to increased reliance on domestic producers, potentially at higher costs and reduced quality.

Dependence on Specific Industries

Tariff revenue is heavily dependent on the specific goods being imported and the volume of imports. This creates vulnerability if key import sectors decline or shift.

- Increased vulnerability to global market fluctuations: Changes in global market dynamics can drastically affect tariff revenue if the economy is heavily reliant on tariffs from a limited number of import sources.

- Difficulty in diversifying revenue streams: Over-reliance on tariffs makes the economy vulnerable to shocks in specific sectors, creating difficulties in budget planning.

- Need for constant adaptation and adjustment of tariff rates: The government would need to constantly monitor import trends and adjust tariff rates to maintain revenue, creating instability and uncertainty.

Conclusion

Replacing income taxes with tariffs, as suggested during the Trump administration, is a highly impractical idea due to several key complications. The inherent volatility of tariff revenue, the regressive nature of tariffs, significant administrative challenges, and limited revenue generation potential make this a flawed approach to funding government operations. While tariffs can play a role in trade policy, they are not a viable substitute for a comprehensive and equitable tax system like income tax. Further research into sustainable and efficient taxation methods is crucial, moving beyond simplistic proposals like completely replacing income taxes with Trump's tariffs.

Featured Posts

-

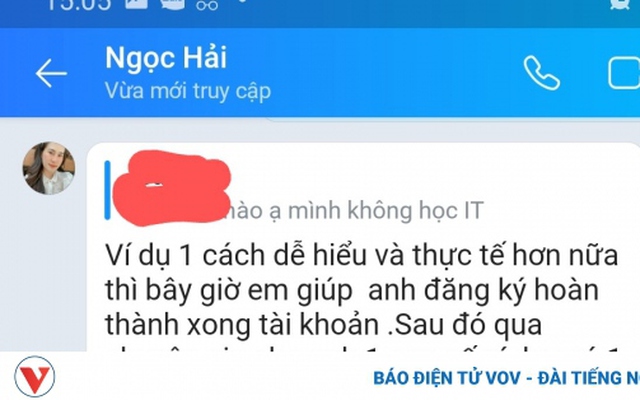

Dung De Tien Mat Tat Mang Huong Dan Dau Tu An Toan Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025

Dung De Tien Mat Tat Mang Huong Dan Dau Tu An Toan Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025 -

Assam Government To Crack Down On Aadhaar Cardholders Outside Nrc

May 01, 2025

Assam Government To Crack Down On Aadhaar Cardholders Outside Nrc

May 01, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

May 01, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

May 01, 2025 -

86 80 Win Arizona Defeats Short Handed Texas Tech In Big 12 Semis

May 01, 2025

86 80 Win Arizona Defeats Short Handed Texas Tech In Big 12 Semis

May 01, 2025 -

Kad Sam Se Vratio Neispricana Prica O Zdravku Colicu I Njegovoj Prvoj Ljubavi

May 01, 2025

Kad Sam Se Vratio Neispricana Prica O Zdravku Colicu I Njegovoj Prvoj Ljubavi

May 01, 2025

Latest Posts

-

Cleveland Guardians Comeback Win Bibees Resilience Shines

May 01, 2025

Cleveland Guardians Comeback Win Bibees Resilience Shines

May 01, 2025 -

Cleveland Guardians Beat New York Yankees Bibees Strong Performance

May 01, 2025

Cleveland Guardians Beat New York Yankees Bibees Strong Performance

May 01, 2025 -

Arqam Jwanka Hl Hy Sbb Traje Adae Alnsr

May 01, 2025

Arqam Jwanka Hl Hy Sbb Traje Adae Alnsr

May 01, 2025 -

Yankees Fall To Guardians Bibees Resilience Leads To Victory

May 01, 2025

Yankees Fall To Guardians Bibees Resilience Leads To Victory

May 01, 2025 -

Alnsr W Jwanka Drast Larqam Mthyrt Lljdl

May 01, 2025

Alnsr W Jwanka Drast Larqam Mthyrt Lljdl

May 01, 2025