Can Ripple's Growth Continue? Analyzing XRP's Future Value.

Table of Contents

- Ripple's Current Market Position and Adoption

- XRP's Role in Cross-Border Payments

- Competition and Market Share

- Regulatory Landscape and Legal Challenges

- The SEC Lawsuit and its Implications

- Global Regulatory Scrutiny of Cryptocurrencies

- Technological Advancements and Future Developments

- Ripple's Ongoing Development and Innovation

- The Future of Blockchain Technology and its Impact on XRP

- Predicting XRP's Future Value: Factors to Consider

- Supply and Demand Dynamics

- Overall Market Sentiment and Crypto Market Trends

- Conclusion

Ripple's Current Market Position and Adoption

Ripple's success hinges on the adoption of its technology, RippleNet, and the utility of its native cryptocurrency, XRP.

XRP's Role in Cross-Border Payments

RippleNet is a real-time gross settlement system (RTGS) designed to facilitate faster and cheaper international money transfers. Its use of XRP streamlines the process, reducing transaction times and fees compared to traditional methods like SWIFT.

- Major Banks Using RippleNet: Several major banks, including Santander, SBI Remit, and MoneyGram, utilize RippleNet for cross-border payments. This adoption signifies significant validation of Ripple's technology within the established financial system.

- Transaction Speed and Cost Advantages: RippleNet boasts significantly faster transaction speeds compared to traditional banking systems, often completing transfers in seconds or minutes. The lower transaction costs also contribute to its attractiveness for financial institutions seeking to reduce operational expenses.

- Growth of RippleNet's Transaction Volume: The volume of transactions processed through RippleNet continues to increase, demonstrating growing demand for its services and indirectly impacting XRP's utility as a bridge currency within the network. While precise figures are not always publicly available, various reports indicate substantial year-on-year growth.

Competition and Market Share

While RippleNet holds a prominent position, it faces competition from other blockchain payment solutions and traditional systems like SWIFT.

- Comparison to Competitors: RippleNet's strengths lie in its speed, cost-effectiveness, and adoption by established financial institutions. However, competitors offer different approaches and functionalities, creating a dynamic competitive landscape. Factors like scalability, regulatory compliance, and overall network effects play crucial roles.

- Market Share Analysis: Accurately determining Ripple's precise market share within the broader cross-border payments market is challenging due to the lack of comprehensive, publicly available data. However, its presence among major financial institutions underscores its significant market penetration.

- Potential Threats and Opportunities: Emerging technologies, evolving regulations, and the competitive landscape present both threats and opportunities for Ripple. Adaptability and continuous innovation will be critical to maintaining its competitive edge.

Regulatory Landscape and Legal Challenges

The regulatory environment significantly impacts XRP's price and future growth.

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple Labs alleging the sale of unregistered securities has significantly impacted XRP's price and market sentiment.

- Key Arguments: The SEC argues that XRP is a security, while Ripple maintains that it's a currency. The outcome of the case will have profound implications for XRP's legal standing and future trajectory.

- Expert Opinions: Legal experts offer differing opinions on the likely outcome, highlighting the complexity of the case and its implications for the broader cryptocurrency regulatory landscape.

- Potential Impact of a Ruling: A favorable ruling could lead to a significant surge in XRP's price and adoption, while an unfavorable ruling could result in a prolonged period of uncertainty and potentially lower prices.

Global Regulatory Scrutiny of Cryptocurrencies

Global regulatory changes concerning cryptocurrencies further impact XRP's future.

- Key Regulatory Developments: Different jurisdictions are adopting diverse approaches to regulating cryptocurrencies, creating a complex and evolving regulatory environment.

- Effect on XRP Adoption and Price: Clear and consistent regulations could promote broader adoption of XRP and potentially stabilize its price. However, stringent or unclear regulations could hinder adoption and negatively affect XRP's value.

Technological Advancements and Future Developments

Ripple's ongoing development and innovation are key factors influencing XRP's future.

Ripple's Ongoing Development and Innovation

Ripple continues to invest in research and development, aiming to improve RippleNet's capabilities.

- Technological Improvements: Future upgrades might include enhancements to scalability, speed, security, and interoperability with other blockchain networks and financial systems.

- Impact on XRP's Utility and Value: These improvements could significantly increase XRP's utility as a medium of exchange and potentially drive up demand, thereby increasing its value.

The Future of Blockchain Technology and its Impact on XRP

The evolution of blockchain technology will significantly influence XRP's relevance.

- Emerging Technologies Like CBDCs: The rise of Central Bank Digital Currencies (CBDCs) could present both challenges and opportunities for XRP. Potential collaborations or integration with CBDC systems could enhance XRP's functionality and expand its reach.

- Long-Term Potential of Ripple's Technology: The long-term success of Ripple's technology depends on its ability to adapt to evolving technological landscapes and maintain its competitive edge within the constantly developing fintech sector.

Predicting XRP's Future Value: Factors to Consider

Several factors contribute to XRP's future price.

Supply and Demand Dynamics

The interplay of supply and demand is crucial in determining XRP's value.

- Market Capitalization and Circulating Supply: The current market capitalization and circulating supply of XRP influence its price. Changes in these metrics directly affect its value.

- Potential Future Supply Changes: Any significant changes to XRP's supply, such as burning mechanisms or new coin releases, will directly impact its price.

Overall Market Sentiment and Crypto Market Trends

The broader cryptocurrency market and macroeconomic conditions significantly affect XRP's price.

- Historical Price Correlations: XRP's price often correlates with the price of Bitcoin and other major cryptocurrencies, making the overall market sentiment a crucial factor.

- Impact of Bitcoin's Price Movements: Significant movements in Bitcoin's price often influence the entire cryptocurrency market, including XRP.

- Macroeconomic Factors: Global economic conditions and investor sentiment can significantly impact the cryptocurrency market and XRP's price.

Conclusion

The future of XRP remains uncertain, influenced by a complex interplay of factors. While RippleNet's adoption shows promise, the SEC lawsuit poses a significant challenge. Technological advancements and broader market trends also play crucial roles. Understanding these dynamics is essential for any assessment of XRP's potential.

Call to Action: While the future of XRP remains uncertain, understanding the factors affecting its value is crucial for investors. Continue your research into Ripple and XRP, staying informed about regulatory updates and technological advancements to make informed decisions about your investment strategy. Learn more about Ripple and XRP's potential by exploring further resources [link to relevant resources].

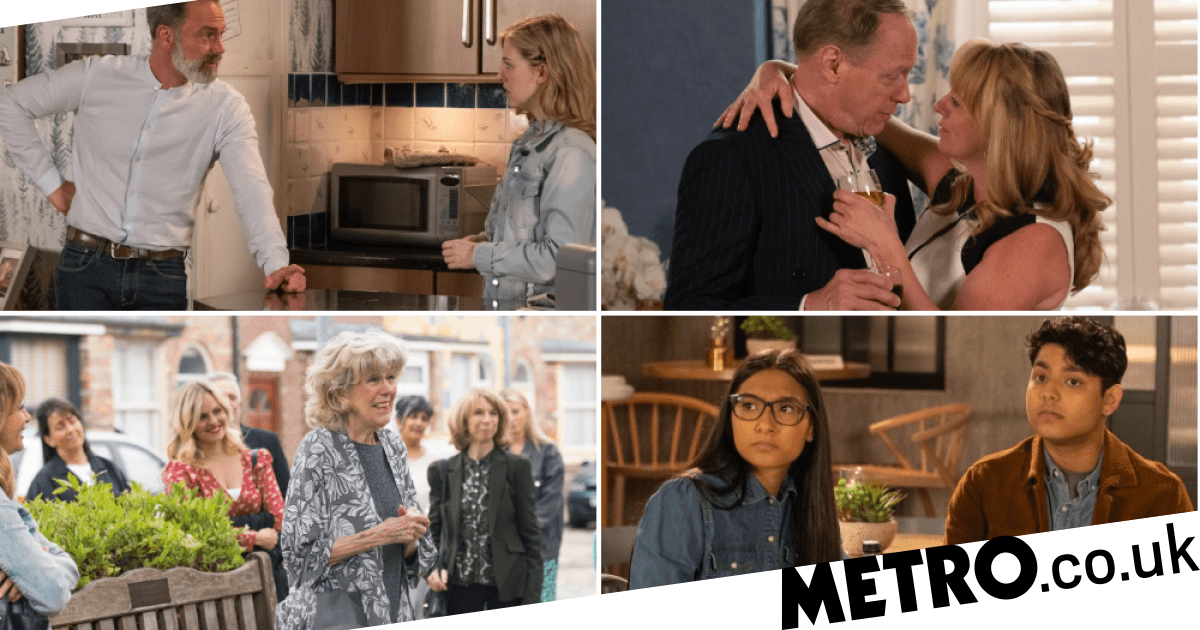

Coronation Street Shock Exit For Popular Character Imminent

Coronation Street Shock Exit For Popular Character Imminent

Panoramas Chris Kaba Episode Formal Complaint Filed By Police Watchdog

Panoramas Chris Kaba Episode Formal Complaint Filed By Police Watchdog

Police Watchdogs Ofcom Complaint Chris Kaba Panorama Episode Scrutinised

Police Watchdogs Ofcom Complaint Chris Kaba Panorama Episode Scrutinised

Ofcom Complaint Filed Over Chris Kaba Panorama Police Watchdogs Action

Ofcom Complaint Filed Over Chris Kaba Panorama Police Watchdogs Action

Panoramas Chris Kaba Episode A Police Watchdogs Ofcom Challenge

Panoramas Chris Kaba Episode A Police Watchdogs Ofcom Challenge