Cabinet Invests €750 Million In Green Home Loans, Leveraging EU Funding

Table of Contents

Details of the €750 Million Green Home Loan Scheme

This ambitious €750 million Green Home Loans scheme is a joint initiative funded by the Irish Cabinet and the European Union. The funding aims to support Irish homeowners in undertaking energy-efficient renovations and upgrades to their properties. The target audience is broad, encompassing homeowners across various income brackets, although specific eligibility criteria may apply.

The scheme covers a wide range of home improvements designed to enhance energy efficiency and reduce carbon emissions. These include:

- Insulation: Upgrading attic, wall, and floor insulation to significantly reduce heat loss.

- Renewable Energy Systems: Installing solar panels, heat pumps, or wind turbines to generate clean energy.

- Energy-Efficient Windows and Doors: Replacing outdated windows and doors with double or triple-glazed alternatives.

- Improved Heating Systems: Upgrading to more efficient boilers or installing smart thermostats.

Regional Variations and Conditions: While the core elements of the scheme are nationwide, certain regional variations may exist regarding eligibility criteria or specific grant amounts. Detailed information will be available on the relevant government websites. Applicants must meet specific criteria, which may include proof of homeownership and a valid energy performance certificate (EPC).

Benefits of Utilizing Green Home Loans

The benefits of availing of these Green Home Loans extend far beyond just financial savings. This initiative offers a compelling package of advantages for both homeowners and the environment.

Financial Advantages:

- Reduced Energy Bills: Significant savings on annual energy costs, often amounting to hundreds of euros per year, depending on the improvements undertaken.

- Increased Property Value: Energy-efficient homes are highly sought after, leading to a potential increase in property value, making it a worthwhile long-term investment.

Environmental Benefits:

- Reduced Carbon Footprint: Contributing to Ireland's national commitment to reducing greenhouse gas emissions and combating climate change.

- Sustainable Living: Promoting environmentally conscious practices and contributing to a greener future.

Long-Term Advantages:

- Improved Home Comfort: Enhanced insulation and efficient heating systems lead to a more comfortable and healthier living environment.

- Energy Independence: Generating your own renewable energy can reduce reliance on fossil fuels, providing a degree of energy independence.

Applying for Green Home Loans: A Step-by-Step Guide

The application process for Green Home Loans is designed to be straightforward and accessible.

Step-by-Step Application:

- Gather Required Documents: This includes proof of identity, proof of residency, your EPC, and quotes from qualified contractors for the proposed improvements.

- Complete the Application Form: The application form can be found on the official government website. Ensure all information is accurate and complete.

- Submit Your Application: Submit your completed application form and supporting documents online or by mail, depending on the specified procedure.

- Review and Approval: Your application will be reviewed, and you will be notified of the outcome.

Required Documents:

- Valid Photo ID

- Proof of Residency

- Energy Performance Certificate (EPC)

- Contractor Quotes for Proposed Works

Support Services: Government agencies and independent energy consultants are available to provide guidance and support throughout the application process. Contact information for these services can be found on the relevant government websites.

The Role of EU Funding in Green Initiatives

The EU's commitment to sustainable development and its significant contribution to this Green Home Loans scheme are noteworthy. This funding is part of a broader European initiative promoting energy efficiency and renewable energy across member states.

EU Programs: Specific EU programs contributing to this initiative include [Insert relevant EU program names here].

Impact of EU Funding: EU funding makes these green home improvements significantly more accessible to homeowners, accelerating the transition to a more sustainable future. This collaboration between the EU and Ireland demonstrates a commitment to collective action on climate change.

Conclusion

The €750 million investment in Green Home Loans presents a unique opportunity for Irish homeowners to upgrade their homes sustainably, reaping significant financial and environmental benefits. From reduced energy bills and increased property value to a reduced carbon footprint and improved home comfort, the advantages are compelling. The application process is straightforward, with ample support services available to guide you. Don't miss out on this chance to improve your home and contribute to a greener Ireland. Learn more and apply for your Green Home Loans today! [Link to relevant government website].

Featured Posts

-

Understanding The 2024 South Korean Presidential Election Candidates And Platforms

May 28, 2025

Understanding The 2024 South Korean Presidential Election Candidates And Platforms

May 28, 2025 -

Masyn Winns Homer Powers Cardinals Sweep Of Diamondbacks

May 28, 2025

Masyn Winns Homer Powers Cardinals Sweep Of Diamondbacks

May 28, 2025 -

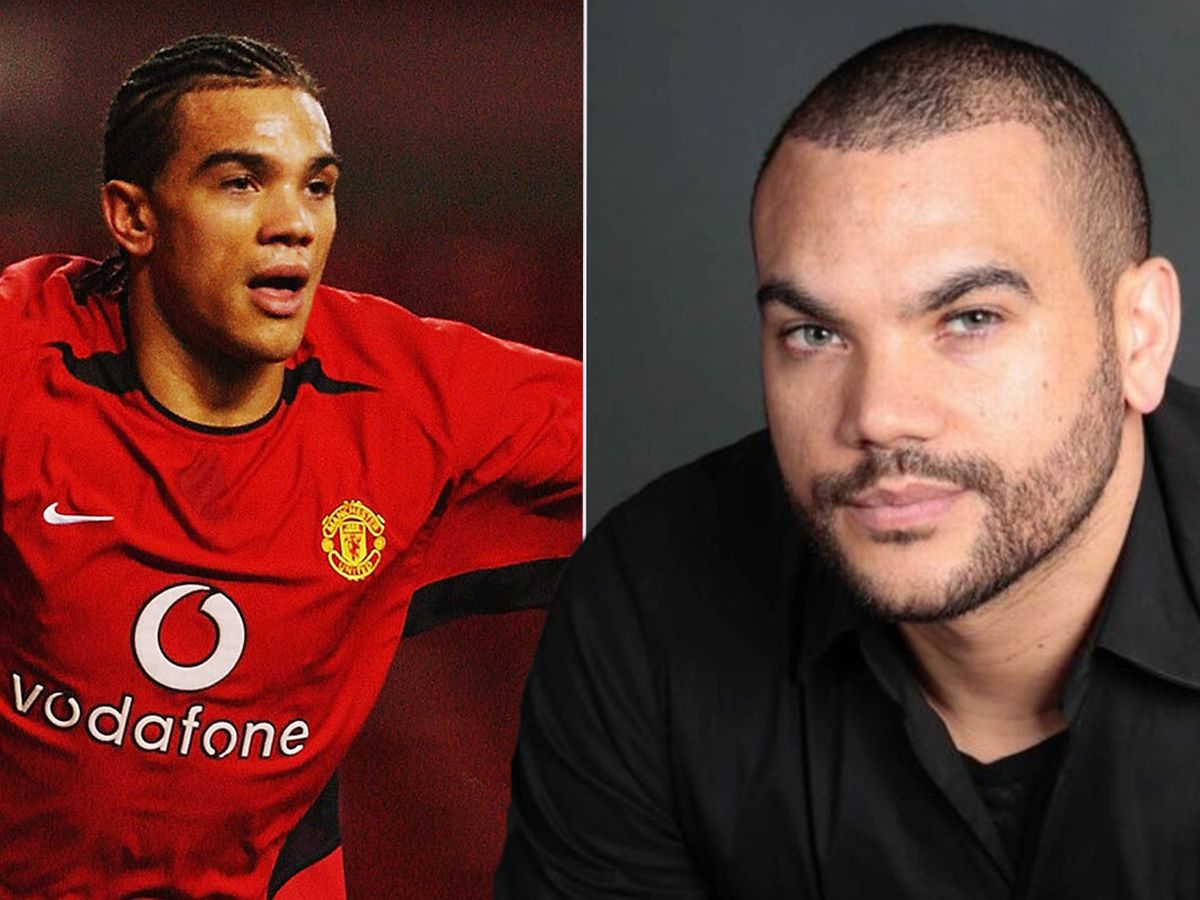

Alejandro Garnacho Transfer News Latest Updates On Chelseas Bid

May 28, 2025

Alejandro Garnacho Transfer News Latest Updates On Chelseas Bid

May 28, 2025 -

Adanali Ronaldodan Ronaldonun Cok Cirkinsin Soezlerine Yanit

May 28, 2025

Adanali Ronaldodan Ronaldonun Cok Cirkinsin Soezlerine Yanit

May 28, 2025 -

Kodam Udayana Dukung Gerakan Bali Bersih Sampah Inisiatif Dan Dampaknya

May 28, 2025

Kodam Udayana Dukung Gerakan Bali Bersih Sampah Inisiatif Dan Dampaknya

May 28, 2025

Latest Posts

-

Governments Commitment To A Strongest G7 Economy King Charles Iiis Perspective

May 29, 2025

Governments Commitment To A Strongest G7 Economy King Charles Iiis Perspective

May 29, 2025 -

Strengthening The Uk Economy King Charles Iiis Backing Of Governments G7 Aim

May 29, 2025

Strengthening The Uk Economy King Charles Iiis Backing Of Governments G7 Aim

May 29, 2025 -

At And T Challenges Broadcoms Extreme Price Increase On V Mware

May 29, 2025

At And T Challenges Broadcoms Extreme Price Increase On V Mware

May 29, 2025 -

G7 Economic Leadership King Charles Iiis Support For Governments Strategy

May 29, 2025

G7 Economic Leadership King Charles Iiis Support For Governments Strategy

May 29, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

May 29, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

May 29, 2025