Bundestag Elections And Their Ripple Effect On The Dax

Table of Contents

Understanding the German Political Landscape and its Influence on the DAX

The German political landscape is diverse, with several major parties vying for power, each with distinct economic platforms. Their approaches to fiscal policy, taxation, regulation, and social welfare significantly impact business sentiment and investment decisions. The composition of the resulting government, often a coalition, further shapes the economic direction of the country.

The Major Political Parties and Their Economic Platforms

The major players in German politics typically include:

- CDU/CSU (Christian Democratic Union/Christian Social Union): Generally favors fiscal conservatism, a business-friendly environment, and controlled government spending. They often emphasize tax cuts for businesses and lower regulations to stimulate economic growth.

- SPD (Social Democratic Party): Prioritizes social welfare programs, investments in infrastructure, and a stronger role for the state in the economy. They typically advocate for higher taxes on higher earners to fund social programs.

- Greens (Bündnis 90/Die Grünen): Focus on environmental protection, renewable energy, and sustainable economic policies. Their policies often involve significant investments in green technologies and stricter environmental regulations.

- FDP (Free Democratic Party): Champions free markets, deregulation, and fiscal responsibility. They typically advocate for lower taxes and reduced government intervention in the economy.

- AfD (Alternative for Germany): Holds Eurosceptic and nationalist views, and their economic policies are less clearly defined compared to other major parties but often involve skepticism towards European Union regulations and spending.

Coalition Governments and their Impact on Market Stability

Germany frequently forms coalition governments. The combination of parties and their resulting policy compromises significantly influence market stability. Coalition negotiations themselves can create uncertainty, leading to market fluctuations as investors wait for clarity on the new government's economic agenda.

- A coalition dominated by the Greens might lead to increased investments in renewable energy but could also result in higher costs for energy-intensive industries.

- A grand coalition (CDU/CSU and SPD) often results in more centrist policies, offering greater predictability but potentially less dramatic reform.

Analyzing Past Election Cycles and Their Effects on the DAX

Examining historical data from previous Bundestag elections reveals valuable insights into the market's reaction to political shifts. Analyzing the DAX's performance before, during, and after past elections helps identify trends and predict potential responses to upcoming elections.

Historical Data and Market Reactions

While past performance is not indicative of future results, analyzing previous election cycles offers crucial context. For example, the 2017 election led to a period of relative stability in the DAX, while the formation of the grand coalition in 2013 was initially met with a positive market response.

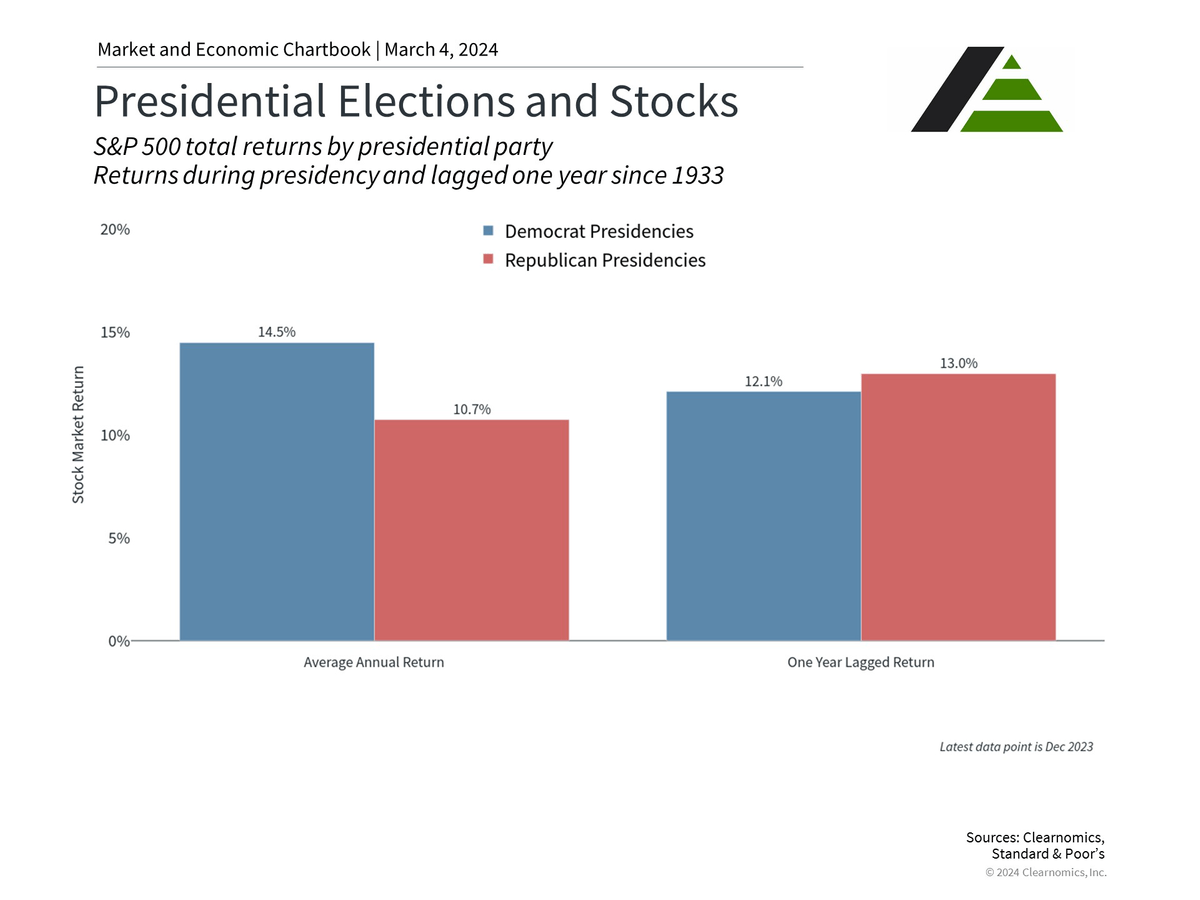

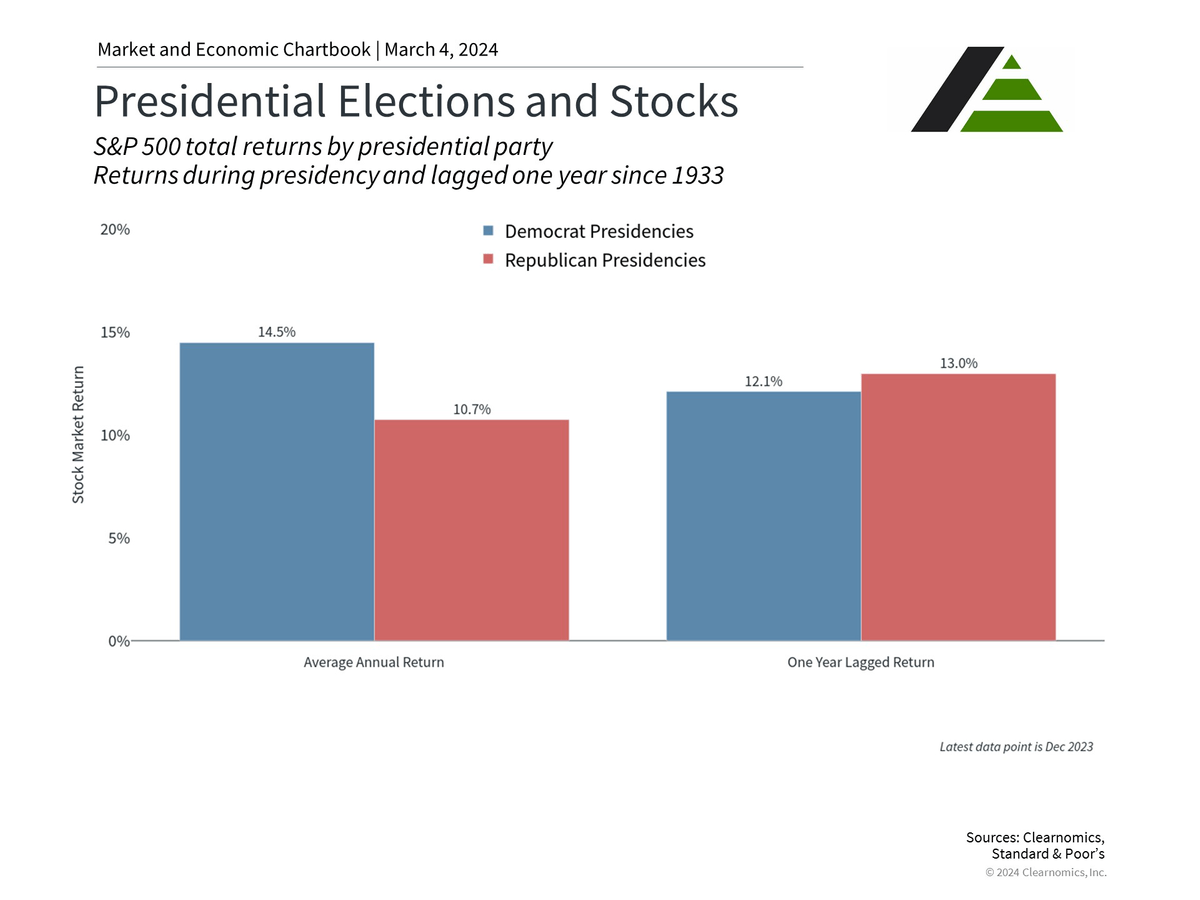

(Include charts and graphs illustrating DAX performance around previous Bundestag elections)

Identifying Key Market Indicators

Several key economic indicators are highly sensitive to political changes and directly influence investor sentiment regarding the DAX:

- GDP Growth: Government spending policies and tax reforms directly impact economic growth, affecting corporate profits and investor confidence.

- Inflation: Fiscal policies, including government spending and taxation, significantly impact inflation. High inflation erodes purchasing power and negatively affects investment returns.

- Unemployment: Government policies aimed at job creation or welfare programs affect unemployment rates, influencing consumer spending and overall economic health.

Developing an Investment Strategy in the Face of Election Uncertainty

Navigating the uncertainty surrounding Bundestag elections requires a well-defined investment strategy that accounts for political risks. Diversification and active monitoring are crucial elements.

Risk Assessment and Portfolio Diversification

Reducing exposure to sectors particularly sensitive to policy changes is vital. Diversifying across different asset classes (stocks, bonds, real estate) reduces overall portfolio risk and lessens the impact of negative political developments.

- Investors might consider reducing exposure to sectors heavily regulated by the government, such as energy or automotive if specific party platforms hint at stricter regulations.

- International diversification can help mitigate risks associated with solely focusing on German assets.

Monitoring Market Sentiment and News

Staying informed about market sentiment and reacting to breaking news is essential. This involves utilizing reputable financial news sources, analyst reports, and even social media sentiment analysis to gauge the market's response to political developments.

- Follow reputable financial news outlets specializing in German economics and politics.

- Monitor analyst reports and ratings from major investment banks.

Conclusion

Bundestag elections exert a significant influence on the German economy and the DAX. Understanding the political landscape, the platforms of major parties, and the historical impact of previous elections is crucial for informed investment decisions. A well-diversified investment strategy and active monitoring of market sentiment are vital tools for navigating the uncertainty surrounding the Bundestag elections and their ripple effects on the DAX. To develop a robust investment plan, further research into the specific economic policies of the leading parties and utilizing reliable market analysis tools is highly recommended. Stay informed about the Bundestag elections and their potential impact on your DAX investments.

Featured Posts

-

Ariana Grandes Style Evolution Hair Tattoos And Professional Image

Apr 27, 2025

Ariana Grandes Style Evolution Hair Tattoos And Professional Image

Apr 27, 2025 -

Kanopy A Comprehensive Guide To Free Movies And Shows

Apr 27, 2025

Kanopy A Comprehensive Guide To Free Movies And Shows

Apr 27, 2025 -

Pne Ag Aktuelle Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Aktuelle Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

From Scatological Documents To Podcast An Ai Powered Transformation

Apr 27, 2025

From Scatological Documents To Podcast An Ai Powered Transformation

Apr 27, 2025 -

Ai And Human Ingenuity Insights From Microsofts Head Of Design

Apr 27, 2025

Ai And Human Ingenuity Insights From Microsofts Head Of Design

Apr 27, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 28, 2025

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 28, 2025 -

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025 -

Lab Owners Guilty Plea Falsified Covid Test Results During Pandemic

Apr 28, 2025

Lab Owners Guilty Plea Falsified Covid Test Results During Pandemic

Apr 28, 2025 -

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 28, 2025

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 28, 2025