Buffett's Apple Investment: A Masterclass In Value Investing

Table of Contents

The Genesis of Buffett's Apple Investment

From Skepticism to Conviction

Initially, Warren Buffett expressed skepticism towards technology stocks, often viewing them as volatile and difficult to value. His traditional focus on established businesses with tangible assets seemed at odds with the intangible nature of many tech companies. However, Apple presented a compelling exception. The shift in Buffett's perspective towards Apple stemmed from a deeper understanding of its unique business model and its powerful brand.

- Berkshire Hathaway's initial investment in Apple began in 2016, gradually increasing its holdings over subsequent years. This was driven by a recognition of Apple’s remarkable brand loyalty and its ability to generate significant recurring revenue through its services ecosystem.

- Apple's pricing power, its ability to command premium prices for its products due to strong brand recognition and a loyal customer base, was another key factor. This resonated deeply with Buffett's value investing principles, which emphasize the importance of durable competitive advantages.

- The inherent predictability of Apple's cash flows and its potential for future growth, factors central to value investing, solidified the investment decision. The company's strong position in a rapidly growing market played a major role in the valuation.

Analyzing Apple's Intrinsic Value Through a Value Investing Lens

Understanding Buffett's Valuation Methodology

Buffett's investment approach centers on the concept of intrinsic value—the true underlying worth of a company, independent of its market price. He seeks a "margin of safety," purchasing assets significantly below their intrinsic value to mitigate risk. Discounted cash flow analysis (DCF) plays a crucial role, projecting future cash flows and discounting them back to their present value.

- In assessing Apple's intrinsic value, Buffett likely considered its projected future earnings, its impressive growth potential in various sectors like services and wearables, and the enduring strength of its brand as a significant competitive advantage.

- The long-term perspective is paramount in value investing. Market fluctuations are seen as temporary deviations from intrinsic value, not as indicators of a company's true worth. Buffett's patience in holding Apple stock underscores this.

- The concept of "moats," referring to sustainable competitive advantages that protect a company from competitors, is vital to Buffett’s approach. Apple possesses robust moats, including its strong brand, its vast ecosystem of loyal customers, and the high switching costs associated with transitioning to alternative platforms.

The Long-Term Perspective and Patience

The Power of Holding

Buffett's Apple Investment is a testament to the power of long-term holding. Berkshire Hathaway's patience in maintaining its position in Apple has yielded exceptional returns, significantly outperforming many short-term trading strategies.

- Apple's stock price has experienced substantial growth since Berkshire Hathaway's initial investment, demonstrating the rewards of a long-term investment horizon. This is central to Warren Buffett's success.

- Short-term trading strategies often focus on short-term price movements, neglecting the fundamental value of companies. These strategies are highly susceptible to market volatility and rarely yield the same returns as long-term value investing.

- Weathering market fluctuations is a critical component of value investing. Holding onto quality investments during periods of uncertainty can lead to significant gains in the long run, as demonstrated by the success of Buffett's Apple Investment.

Lessons Learned from Buffett's Apple Investment

Key Takeaways for Value Investors

Buffett's Apple Investment offers invaluable lessons for individuals seeking to achieve long-term investment success through value investing principles.

- Thorough due diligence is paramount. Before investing, deeply understand a company's fundamentals, its financial statements, its business model, and its competitive landscape. This is crucial in identifying strong companies like Apple was for Buffett.

- Identify companies with enduring competitive advantages (moats). Look for businesses with strong brands, loyal customer bases, and sustainable business models, which provide resilience against competition.

- Develop a long-term investment horizon and cultivate the discipline to stick to your investment strategy. Avoid impulsive decisions driven by short-term market fluctuations; focus on the long-term potential of quality investments.

Conclusion

Buffett's Apple Investment serves as a powerful case study illustrating the principles of successful value investing. By carefully analyzing Apple's intrinsic value, focusing on long-term growth, and exercising patience, Berkshire Hathaway achieved substantial returns. The investment highlights the importance of thorough due diligence, identifying companies with durable competitive advantages, and adopting a long-term investment strategy. Mastering Buffett's Apple Investment strategy requires a deep understanding of value investing principles, including the identification of strong moats and the ability to assess intrinsic value accurately. Unlocking value investing with Buffett's Apple example empowers you to make informed investment decisions and pursue your own path to long-term financial success. Further explore value investing principles to refine your approach and build a strong portfolio.

Featured Posts

-

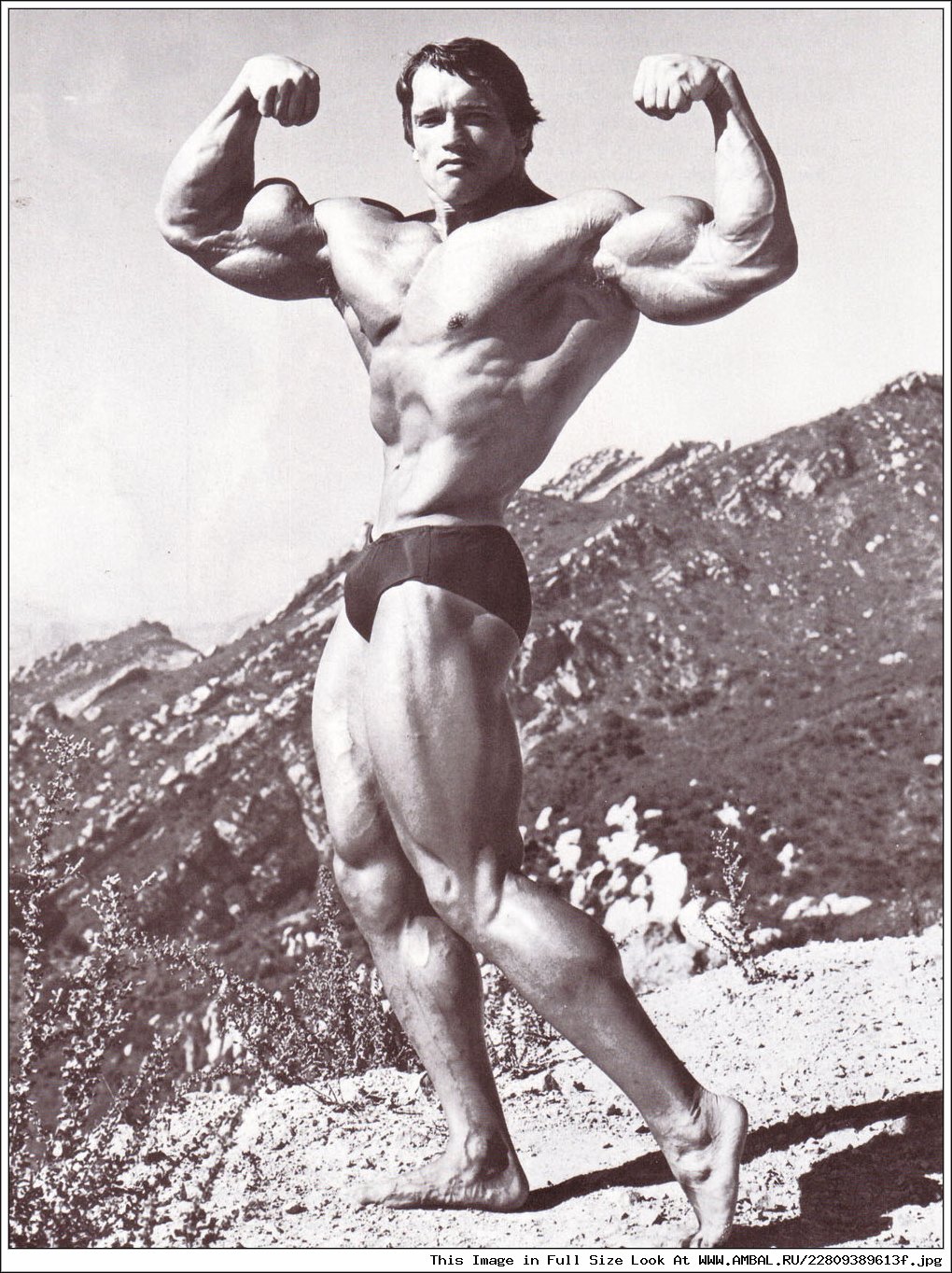

Arnold Schwarzenegger Supports Son Patricks Nude Scenes

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Scenes

May 06, 2025 -

Finding Quality On A Budget Affordable Options

May 06, 2025

Finding Quality On A Budget Affordable Options

May 06, 2025 -

Greg Abel The Man Set To Lead Berkshire Hathaway After Buffett

May 06, 2025

Greg Abel The Man Set To Lead Berkshire Hathaway After Buffett

May 06, 2025 -

The Challenges Of Chinas Automotive Market A Look At Bmw Porsche And Others

May 06, 2025

The Challenges Of Chinas Automotive Market A Look At Bmw Porsche And Others

May 06, 2025 -

Aussie Dollar Vs Kiwi Dollar Traders Bet On Aud Strength

May 06, 2025

Aussie Dollar Vs Kiwi Dollar Traders Bet On Aud Strength

May 06, 2025

Latest Posts

-

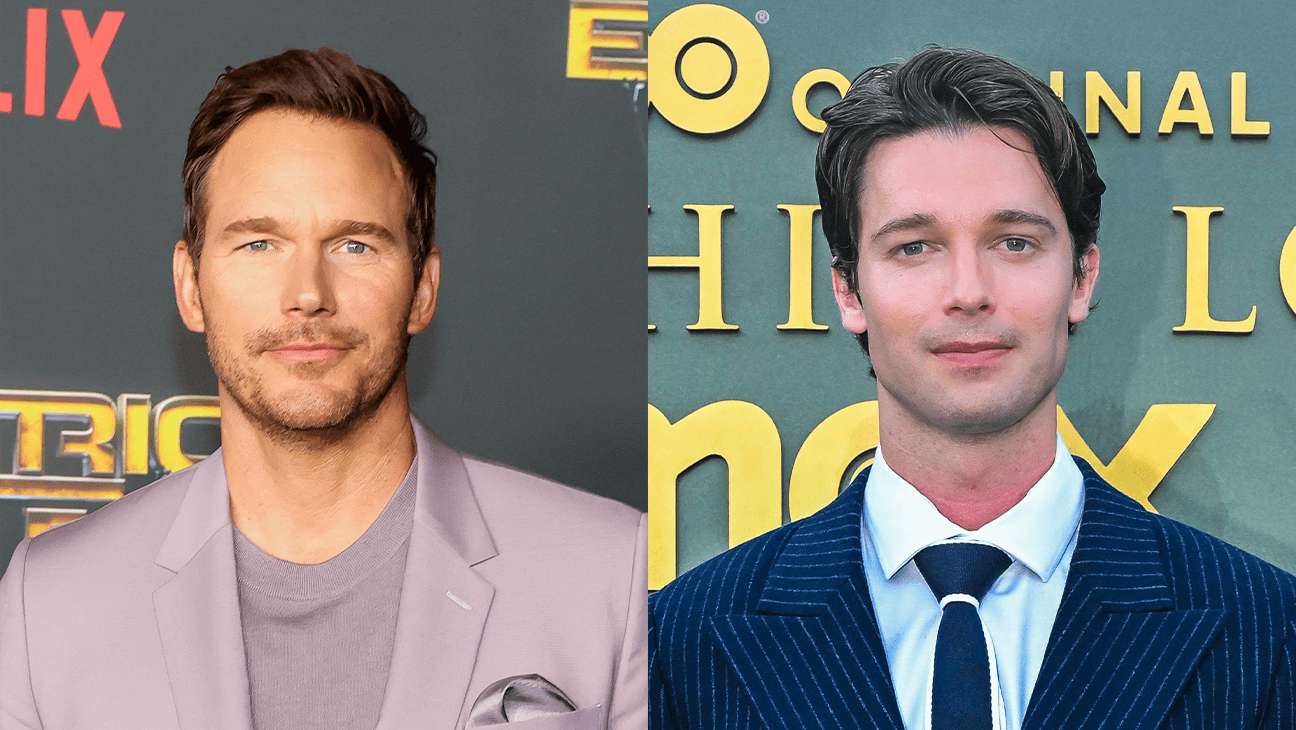

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

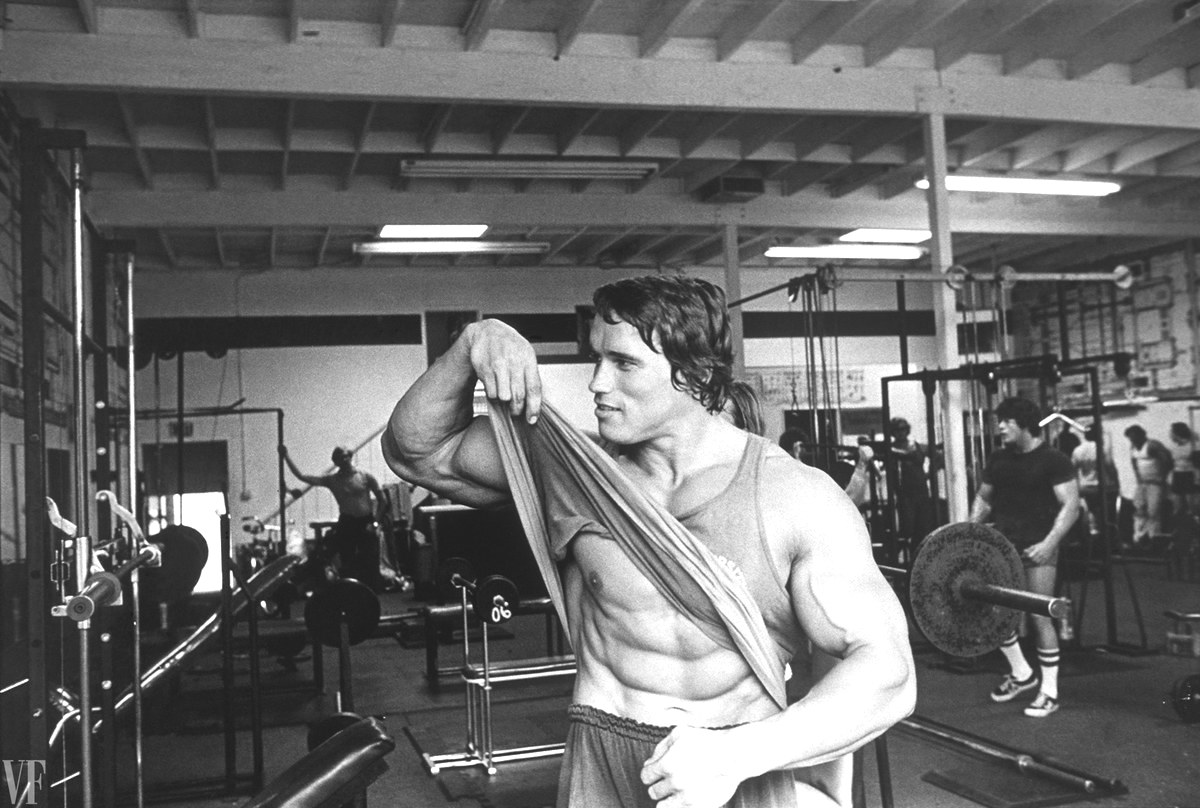

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025