Buffett Rejects Trump Tariff Claims: Reports Deemed Inaccurate

Table of Contents

Buffett's Public Statements on Tariffs

Warren Buffett, renowned for his insightful commentary on the economy and his long-term investment approach, directly addressed the claims surrounding the impact of Trump's tariffs on Berkshire Hathaway and his investment decisions. He consistently refuted any direct, causal link between specific tariffs and his company's performance.

-

Lack of Direct Correlation: Buffett's statements consistently emphasized the complexities of the global economy. He argued that attributing Berkshire Hathaway's performance solely or primarily to tariff impacts was an oversimplification. The company's success, he maintained, stemmed from a long-term strategy based on diverse investments and sound business practices.

-

Absence of Public Panic: Despite the heated debate surrounding the tariffs, Buffett showed no signs of altering his long-term investment strategy. This suggested he did not view the tariffs as a major, immediate threat to the US economy, contrasting with some of the more alarmist reporting in the media.

-

Focus on Fundamentals: Buffett repeatedly stressed the importance of focusing on the fundamentals of individual businesses and the overall health of the American economy, rather than short-term reactions to trade policy changes. This underscores his belief that long-term value creation is far less susceptible to the fluctuating effects of tariffs.

Keywords: Buffett quotes, Berkshire Hathaway, investment strategy, tariff impact analysis.

Analysis of Inaccurate Reports

Several news outlets and financial analysts published reports directly linking Buffett's investment decisions or Berkshire Hathaway's financial results to the impact of specific Trump tariffs. These reports often presented a correlation as causation, a misleading simplification of a complex economic phenomenon.

-

Oversimplification of Causality: Many reports failed to account for numerous other factors influencing Berkshire Hathaway's performance and the broader US economy, such as fluctuations in the global market, technological advancements, and domestic economic policies.

-

Exaggerated Impact: Some reports dramatically exaggerated the potential negative effects of the tariffs on Berkshire Hathaway's portfolio. These reports often lacked the nuance and context necessary for a balanced assessment of the situation.

-

Media Bias and Misinformation: The spread of such inaccurate reporting highlights the importance of media literacy and critical consumption of financial news. Misinformation can significantly impact investor confidence and distort public understanding of economic realities.

-

Consequences of Inaccurate Reporting: The dissemination of inaccurate information regarding tariffs and their impact can lead to flawed investment decisions, unnecessary market volatility, and a general erosion of public trust in financial reporting.

Keywords: misinformation, media bias, financial news accuracy, fact-checking, reliable sources.

The Broader Economic Context

The Trump-era tariffs were part of a larger trade policy shift, generating significant debate regarding their ultimate impact on the US economy. The effects were multifaceted and not easily summarized.

-

Complexities of International Trade: International trade is an intricate web of interconnected factors, including supply chains, global demand, currency exchange rates, and geopolitical stability. Attributing economic outcomes solely to tariffs overlooks this complexity.

-

Balanced Perspective: While some sectors experienced challenges due to tariffs, others benefited from increased domestic demand. The overall net effect remains a subject of ongoing economic analysis. A complete picture demands a thorough examination of multiple data points and economic models.

-

Distorting Public Understanding: Inaccurate reporting on tariffs can distort public understanding of complex economic issues, fostering simplistic and potentially misleading conclusions. A more nuanced approach is required for informed policy discussions and responsible financial decision-making.

Keywords: global trade, economic analysis, trade policy, US economy, economic impact of tariffs.

Debunking the Myths: Buffett's Rejection of Inaccurate Tariff Claims

In conclusion, Warren Buffett's public statements strongly refute the inaccurate claims linking his investment strategies and Berkshire Hathaway's performance directly to the impact of Trump's tariffs. Our analysis of several reports reveals an oversimplification of complex economic realities, often exaggerating the negative effects and failing to consider other influential factors. The dissemination of misinformation highlights the critical need for careful fact-checking and reliance on reliable sources, particularly when analyzing intricate issues like international trade and economic policy. Stay informed about the impact of trade policies, learn to identify inaccurate reporting on tariffs, and seek out trustworthy sources of information on Buffett’s statements on tariffs to understand the nuances of the Buffett-Trump tariff debate.

Featured Posts

-

U S Employment Situation 177 000 Jobs Added Unemployment Rate Holds At 4 2

May 04, 2025

U S Employment Situation 177 000 Jobs Added Unemployment Rate Holds At 4 2

May 04, 2025 -

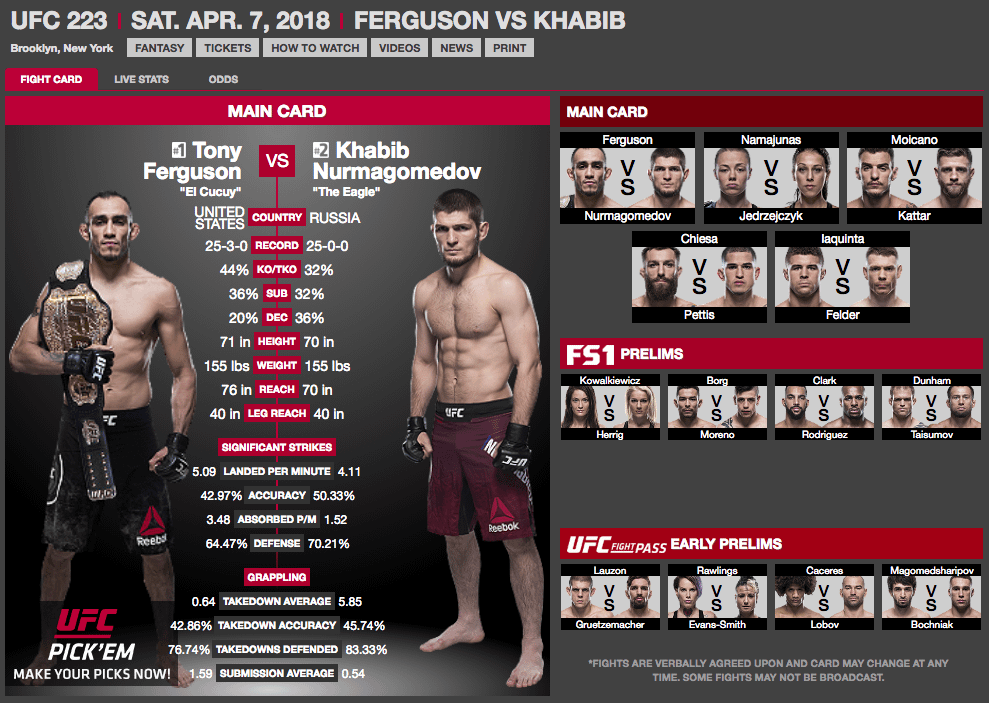

Ufc Des Moines Betting Preview Best Mma Bets Today

May 04, 2025

Ufc Des Moines Betting Preview Best Mma Bets Today

May 04, 2025 -

Official Ufc 314 Bout Order Main Event And Undercard Details

May 04, 2025

Official Ufc 314 Bout Order Main Event And Undercard Details

May 04, 2025 -

Investigation Into Death Threat Afghan Migrants Journey To The United Kingdom And Alleged Threat Against Nigel Farage

May 04, 2025

Investigation Into Death Threat Afghan Migrants Journey To The United Kingdom And Alleged Threat Against Nigel Farage

May 04, 2025 -

Bakole Vs Ajagba Heavyweight Showdown Joins Canelo Alvarezs May 3rd Card

May 04, 2025

Bakole Vs Ajagba Heavyweight Showdown Joins Canelo Alvarezs May 3rd Card

May 04, 2025