Broadcom's VMware Deal: AT&T Exposes A Staggering 1,050% Price Increase

Table of Contents

The Broadcom-VMware Merger: A Giant Leap for Broadcom, a Giant Step Back for AT&T?

The $61 billion acquisition of VMware by Broadcom, finalized in late 2022, marked a significant shift in the technology landscape. Broadcom, known for its semiconductor and infrastructure software, aimed to expand its reach into the enterprise software market, leveraging VMware's dominant position in virtualization and cloud computing.

- VMware's History: VMware, a pioneer in virtualization technology, had built a robust ecosystem of products and services, establishing itself as a leader in enterprise infrastructure management.

- Broadcom's Strategy: The acquisition perfectly aligned with Broadcom's strategy of expanding its software portfolio and strengthening its presence in the data center. VMware's vSphere, vSAN, and NSX products are highly complementary to Broadcom's existing offerings.

- Synergies and Benefits: Broadcom anticipates significant synergies from the merger, including increased market share, cross-selling opportunities, and potential cost reductions through operational efficiencies.

Initial market reaction to the merger was mixed. While some analysts praised the strategic fit, others expressed concerns about potential anti-competitive practices and increased pricing for VMware customers. AT&T's experience would soon highlight these concerns.

Dissecting AT&T's 1050% Price Increase: A Case Study in Post-Acquisition Pricing

AT&T's reported 1050% price hike for VMware services post-acquisition served as a stark warning to other businesses. This dramatic increase was not an isolated incident; it underscored potential risks for companies heavily reliant on VMware's infrastructure.

- AT&T's VMware Dependence: AT&T is a significant user of VMware solutions, integrating them into its vast network infrastructure.

- Pre- and Post-Acquisition Pricing: The comparison between pre- and post-acquisition pricing reveals a shocking disparity, transforming what was previously a manageable expense into a substantial burden.

- AT&T's Response: While the specifics of AT&T's response remain largely undisclosed, the sheer magnitude of the increase suggests significant internal deliberations and potential negotiations with Broadcom.

Several factors may explain this exorbitant increase:

- Increased Licensing Fees: Broadcom may have implemented significantly higher licensing fees for existing VMware products.

- Changes in SLAs: Alterations to service level agreements could have led to increased costs for AT&T.

- Removal of Discounts: Previous discounts or volume pricing agreements might have been discontinued after the acquisition.

Implications for Other VMware Customers: What to Expect Post-Acquisition

AT&T's experience is a cautionary tale. The potential for similar, albeit perhaps less extreme, price increases exists for other VMware clients across various industry sectors and customer sizes.

- Potential for Widespread Increases: Broadcom’s pricing strategy remains unclear, but the possibility of similar price adjustments across different customer segments is a real concern.

- Broadcom's Pricing Strategy: Analyzing Broadcom’s pricing strategy post-acquisition is crucial to anticipating future adjustments. Transparency regarding pricing models is vital for building trust with customers.

- Recommendations for VMware Users: Businesses relying on VMware should proactively review their contracts, understand their licensing agreements, and budget for potential future price increases. Negotiating favorable terms before renewal is critical.

Industry experts predict continued scrutiny of Broadcom's pricing practices, with potential regulatory investigations if patterns of excessive price increases emerge.

Navigating the New Landscape: Strategies for Managing VMware Costs

Businesses can take proactive steps to mitigate the risk of significant VMware cost increases.

- Negotiating with VMware: Direct negotiation with Broadcom/VMware is vital, aiming for transparent pricing and favorable contract terms.

- Exploring Alternatives: Investigating alternative virtualization solutions offers a degree of leverage and ensures options exist beyond VMware's products.

- Optimizing VMware Deployments: Efficient utilization of VMware resources, through optimization and consolidation, can minimize licensing costs.

Long-term financial planning must incorporate the possibility of VMware price increases. This includes budgeting for potential cost fluctuations and strategically planning for technology transitions or diversification.

Conclusion: Understanding the Broadcom VMware Deal's Impact on Pricing

The Broadcom-VMware acquisition has profoundly impacted pricing for VMware services, as demonstrated by AT&T's shocking 1050% price increase. This case highlights the potential for significant cost increases for other businesses relying on VMware solutions. It's crucial for organizations to understand the implications of this merger and proactively manage their VMware costs. Analyze your Broadcom VMware costs now, protect yourself from unexpected price hikes, and learn how to navigate the post-acquisition VMware landscape effectively. Don't wait for a similar dramatic price increase to impact your bottom line. Take control of your VMware spending today.

Featured Posts

-

Nhk 8

May 16, 2025

Nhk 8

May 16, 2025 -

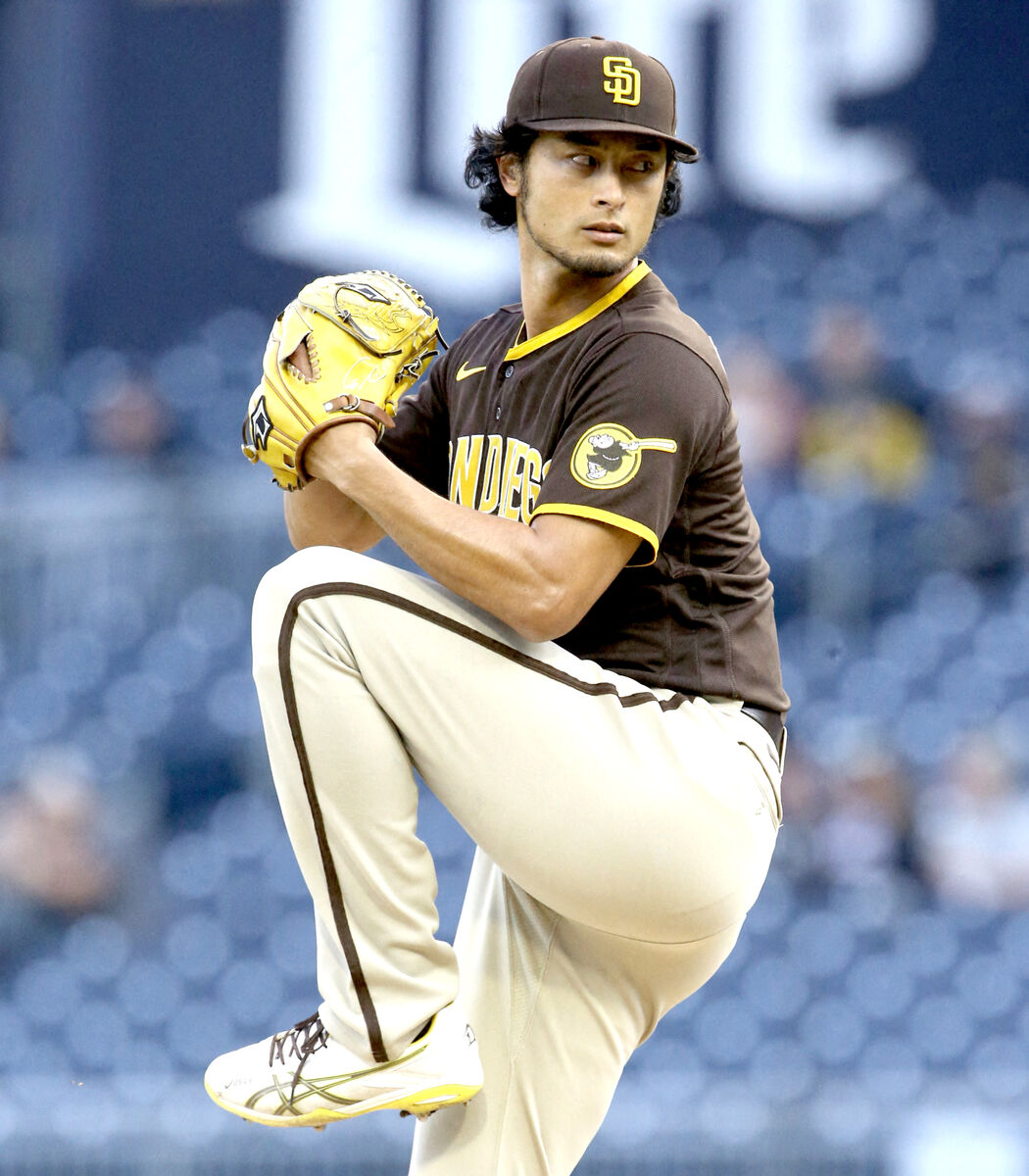

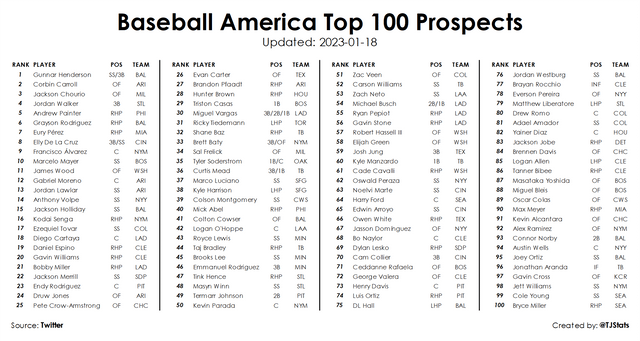

Dodgers Offseason Review Assessing The Teams Prospects For 2023

May 16, 2025

Dodgers Offseason Review Assessing The Teams Prospects For 2023

May 16, 2025 -

Venezia Vs Napoles Transmision En Directo

May 16, 2025

Venezia Vs Napoles Transmision En Directo

May 16, 2025 -

Is A Week Long Everest Climb With Anesthetic Gas Too Risky

May 16, 2025

Is A Week Long Everest Climb With Anesthetic Gas Too Risky

May 16, 2025 -

Trumps Use Of Aircraft To Grant Political Favors

May 16, 2025

Trumps Use Of Aircraft To Grant Political Favors

May 16, 2025

Latest Posts

-

Oakland Athletics News Muncy Makes Roster Second Base Debut

May 16, 2025

Oakland Athletics News Muncy Makes Roster Second Base Debut

May 16, 2025 -

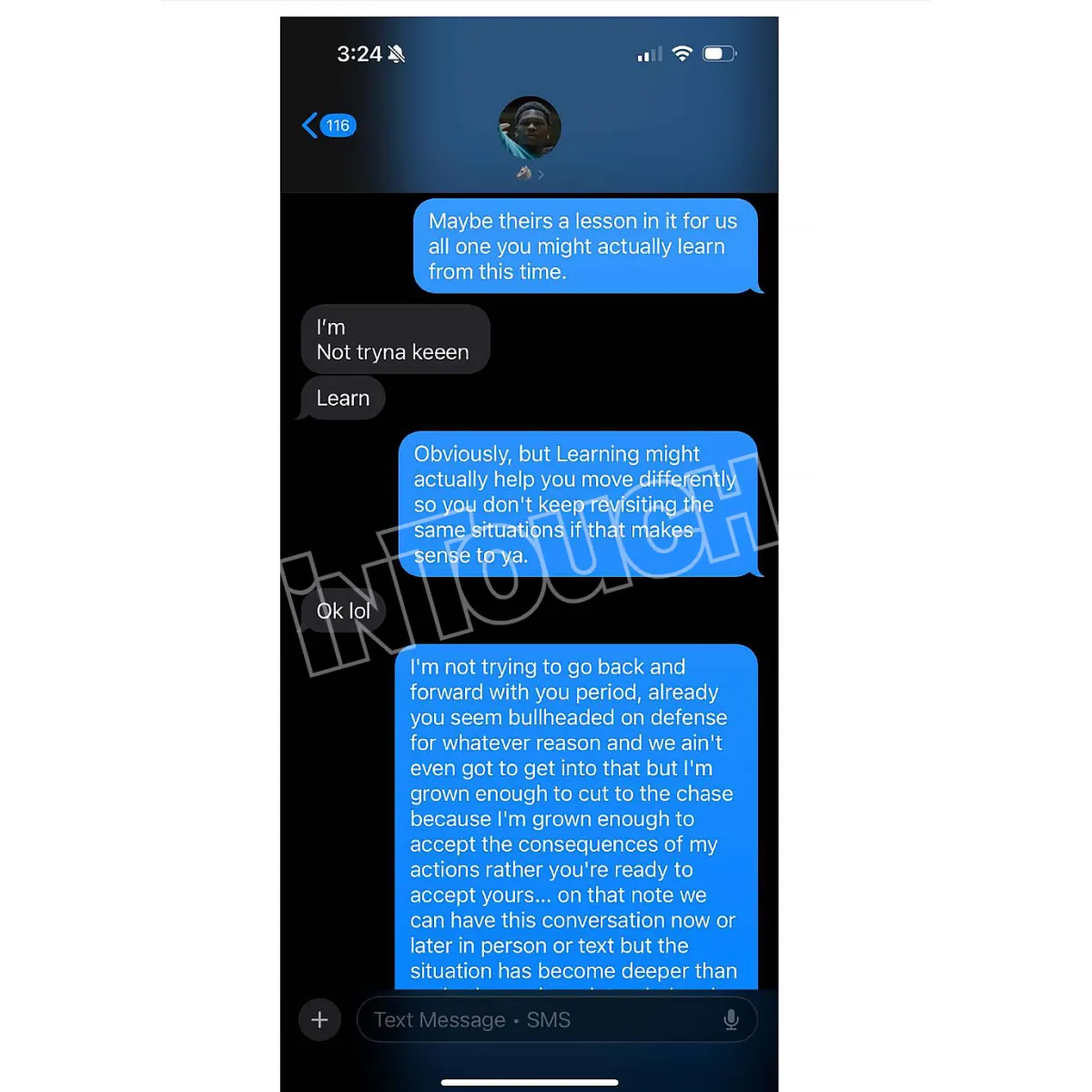

Anthony Edwards And The Twitter Firestorm Baby Mama Drama Explodes

May 16, 2025

Anthony Edwards And The Twitter Firestorm Baby Mama Drama Explodes

May 16, 2025 -

Anthony Edwards Baby Mama Drama Ignites Twitter

May 16, 2025

Anthony Edwards Baby Mama Drama Ignites Twitter

May 16, 2025 -

Anthony Edwards Baby Mama Controversy A Deep Dive

May 16, 2025

Anthony Edwards Baby Mama Controversy A Deep Dive

May 16, 2025 -

Custody Battle Anthony Edwards And His Baby Mamas Public Feud

May 16, 2025

Custody Battle Anthony Edwards And His Baby Mamas Public Feud

May 16, 2025