Breaking Stock Market News: Tax Bill Passed, Bond Sell-Off, Bitcoin Surge

Table of Contents

Tax Bill Passage and Market Reactions

The newly passed tax bill includes several key provisions impacting corporations and individuals. These changes, although intended to stimulate economic growth, have created uncertainty and triggered varied reactions in the market. Understanding the tax bill impact is crucial for investors.

- Details of the Tax Bill: (Insert specific details of the passed tax bill here, including corporate tax rate changes, individual tax bracket adjustments, and any significant changes to deductions or credits. Use concrete numbers and examples.) For instance, the lowered corporate tax rate from 35% to 21% is expected to…

- Immediate Market Response: The announcement of the tax bill's passage initially caused a (describe the immediate reaction - e.g., sharp rise or fall) in major indexes like the Dow Jones Industrial Average and the S&P 500. Specific sectors, such as technology and financials, showed (describe sector-specific reactions - e.g., disproportionate gains or losses) reflecting their unique sensitivities to the changes.

- Long-Term Implications: The long-term implications of this tax reform are complex and subject to debate. Economists predict varying effects on economic growth, inflation, and consumer spending. (Include citations to reputable economic sources and analyses.)

- Expert Opinions: Leading financial experts are divided on the long-term effects. Some analysts believe the tax cuts will boost economic growth, while others express concern about increased national debt and potential inflation. (Include quotes from reputable financial analysts and economists.)

- Tax-Loss Harvesting Strategies: Investors may now consider tax-loss harvesting strategies to offset capital gains from previous years. This involves selling losing investments to generate tax losses that can reduce their overall tax liability. (Provide a brief explanation of tax-loss harvesting and its implications).

Bond Market Sell-Off: Understanding the Correlation

The passage of the tax bill, coupled with expectations of future interest rate hikes by the central bank, fueled a significant bond sell-off. Understanding this market correlation is essential.

- Inverse Relationship: Bond prices and interest rates share an inverse relationship. When interest rates rise, the value of existing bonds with lower interest rates falls, leading to a sell-off.

- Rising Interest Rates: The anticipated increase in interest rates, partly driven by the expected inflationary effects of the tax bill, has put downward pressure on bond prices.

- Yield Curve Analysis: The yield curve, which plots the yields of bonds with different maturities, is a valuable indicator of future economic conditions. A steepening yield curve can signal expectations of future interest rate increases. (Explain different yield curve shapes and their interpretations.)

- Impact on Bond Types: The sell-off affected various bond types, including government bonds and corporate bonds, though the impact varies depending on factors like credit quality and maturity.

- Portfolio Management Strategies: Investors with significant bond holdings need to reassess their fixed income strategies. Options include diversifying into different bond types, adjusting portfolio duration, or considering alternative investments.

Bitcoin's Unexpected Surge Amidst Market Uncertainty

Amidst the market turmoil, Bitcoin experienced a surprising surge. This Bitcoin surge raises questions about its role as a potential "safe haven" asset and its long-term viability.

- Bitcoin and Market Turmoil: The increase in Bitcoin's price appears to be partly driven by investors seeking alternative assets during periods of uncertainty and volatility in traditional markets.

- Safe Haven Asset?: While gold is traditionally considered a safe haven asset, some investors are exploring cryptocurrencies like Bitcoin as a hedge against traditional market risks. This role is still under debate.

- Factors Driving the Surge: Several factors might be contributing to the Bitcoin surge, including increased institutional investment, regulatory developments in certain countries, and speculation. (Discuss these factors in detail.)

- Risks and Rewards: Investing in Bitcoin carries significant risks due to its inherent volatility and regulatory uncertainty. However, the potential rewards have attracted many investors seeking high returns.

- Performance Comparison: (Compare Bitcoin's performance during this period against traditional assets like stocks and bonds to illustrate its divergence.)

Conclusion

Today's breaking stock market news highlights the interconnectedness of various asset classes. The passage of the tax bill, the subsequent bond sell-off, and the unexpected Bitcoin surge underscore the need for diversified and well-informed investment strategies. Investors must carefully consider the potential impact of these events on their portfolios. Understanding the complexities of the tax bill, interest rate fluctuations, and the volatile nature of cryptocurrencies is crucial for navigating this dynamic market environment.

Call to Action: Stay informed on all the latest breaking stock market news and develop a robust investment strategy tailored to your risk tolerance. Monitor the impact of the new tax bill and potential future market movements to effectively manage your portfolio. Learn more about navigating market volatility and adapting your investment plan to changing economic conditions. Don't let market volatility catch you off guard – take control of your financial future.

Featured Posts

-

Predicciones Astrologicas Horoscopo Semanal 1 Al 7 De Abril De 2025

May 23, 2025

Predicciones Astrologicas Horoscopo Semanal 1 Al 7 De Abril De 2025

May 23, 2025 -

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025 -

Pivdenniy Mist Aktualniy Stan Remontu Ta Maybutni Plani

May 23, 2025

Pivdenniy Mist Aktualniy Stan Remontu Ta Maybutni Plani

May 23, 2025 -

Usa Film Festival In Dallas A Celebration Of Cinema With Free Screenings

May 23, 2025

Usa Film Festival In Dallas A Celebration Of Cinema With Free Screenings

May 23, 2025 -

Can You Still Negotiate After A Best And Final Job Offer

May 23, 2025

Can You Still Negotiate After A Best And Final Job Offer

May 23, 2025

Latest Posts

-

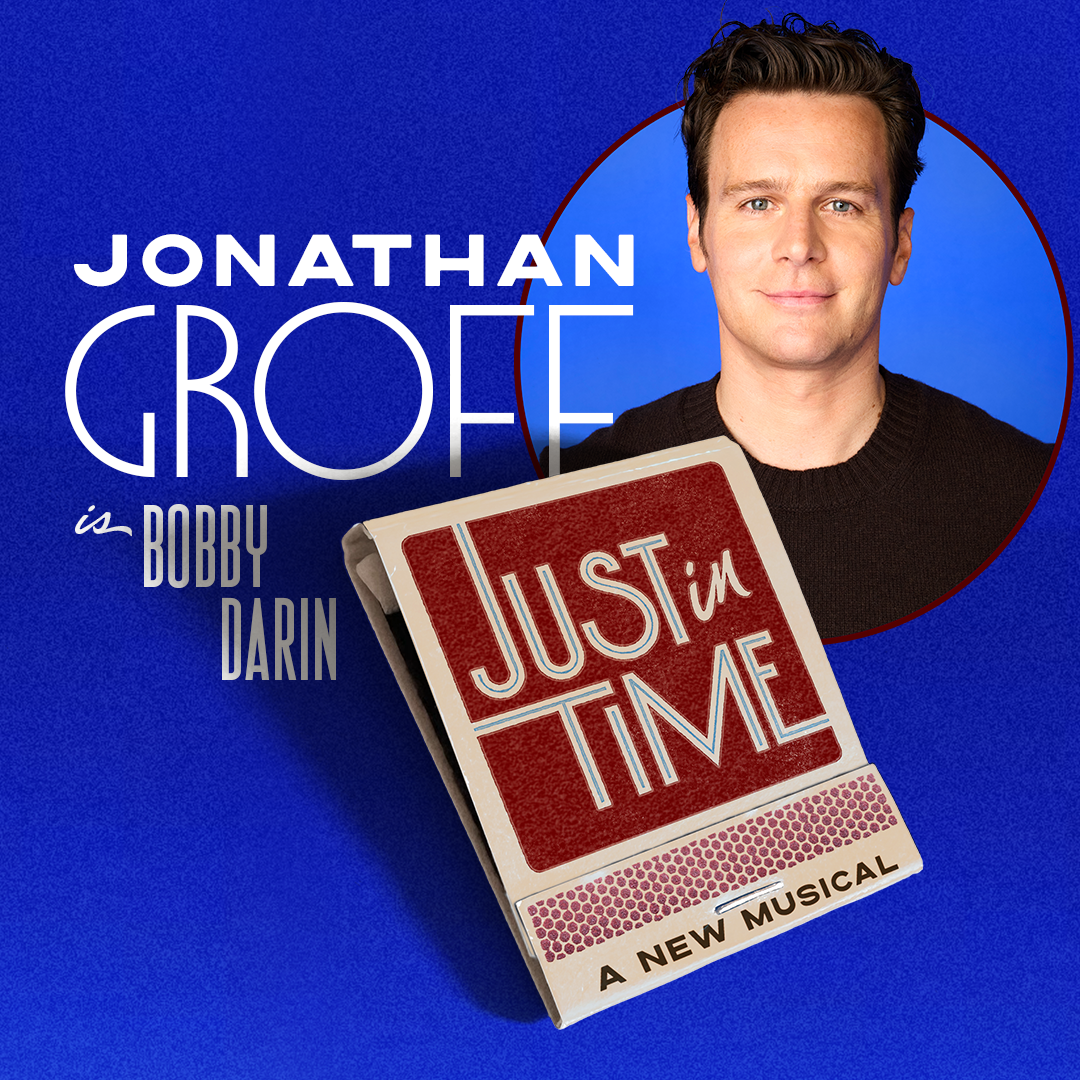

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Actor Jonathan Groff Opens Up About His Past Experiences With Asexuality

May 23, 2025

Actor Jonathan Groff Opens Up About His Past Experiences With Asexuality

May 23, 2025 -

Jonathan Groff Discusses His Asexual Identity In New Interview

May 23, 2025

Jonathan Groff Discusses His Asexual Identity In New Interview

May 23, 2025