BRB Acquires Banco Master: Reshaping Brazil's Banking Landscape

Table of Contents

BRB's Strategic Rationale Behind the Banco Master Acquisition

BRB's acquisition of Banco Master is a strategic maneuver driven by several key objectives aimed at strengthening its position within the Brazilian banking sector. The acquisition motives can be understood through several lenses: market expansion in Brazil, achieving synergies, and gaining a significant competitive advantage.

-

Increased market share in key Brazilian regions: Banco Master's strong presence in specific regions complements BRB's existing network, allowing for immediate expansion and broader market reach. This strategic move allows BRB to tap into new customer segments and solidify its position as a major player in the Brazilian financial market.

-

Access to Banco Master's existing customer base and infrastructure: This acquisition provides BRB with immediate access to a substantial customer base and pre-existing infrastructure, including branches, technology, and personnel. This significantly reduces the time and investment typically required for organic growth.

-

Diversification of BRB's product and service offerings: By integrating Banco Master's services, BRB can diversify its product portfolio, catering to a wider range of customer needs and enhancing its competitiveness.

-

Potential cost synergies and operational efficiencies: Mergers often lead to economies of scale, allowing for the streamlining of operations and a reduction in redundant costs. BRB anticipates realizing substantial cost synergies post-integration.

-

Strengthening of BRB's position as a major player in the Brazilian banking sector: This acquisition positions BRB as a more formidable competitor, enhancing its overall market influence and bargaining power.

Impact on the Brazilian Banking Sector and Consumers

The BRB-Banco Master merger will undoubtedly reshape the Brazilian banking sector, impacting both competition and consumers.

-

Increased competition among Brazilian banks: The combined entity will present a more powerful competitor, potentially intensifying competition and driving innovation within the sector. Other banks may need to adapt their strategies to maintain their market share.

-

Potential changes in interest rates and fees for consumers: While the immediate impact is uncertain, the merger could influence interest rates and fees offered to consumers. Increased competition might lead to better rates for borrowers, but this is not guaranteed. Careful monitoring of these aspects will be essential for consumers.

-

Broader access to financial services in underserved areas: Banco Master's existing footprint in underserved regions could translate to enhanced access to financial services for these communities, promoting financial inclusion and economic development.

-

Potential job implications for Banco Master employees: Mergers often involve restructuring, which may lead to job losses or reassignments for some Banco Master employees. The specifics will depend on the integration plan.

-

Regulatory scrutiny and approval processes: The acquisition will be subject to rigorous regulatory scrutiny by Brazilian authorities, ensuring compliance with all relevant banking regulations and ensuring a smooth transition.

Potential Synergies and Challenges in the Integration Process

The successful integration of BRB and Banco Master hinges on overcoming several challenges while harnessing potential synergies.

-

Combining different IT systems and technologies: Integrating disparate IT systems and technologies can be a complex and costly undertaking, requiring significant investment in time and resources. Compatibility issues and data migration are key challenges.

-

Integrating diverse corporate cultures and operational processes: Merging two distinct corporate cultures presents significant challenges. Harmonizing operational processes, management styles, and employee expectations requires careful planning and execution.

-

Managing potential employee redundancies: The integration process might result in redundancies, requiring careful management to minimize negative impacts and maintain employee morale.

-

Addressing any regulatory hurdles or compliance issues: Meeting all regulatory compliance requirements is critical for a smooth transition. Navigating the complexities of Brazilian banking regulations requires meticulous attention to detail.

-

Achieving anticipated synergies within the projected timeframe: Realizing the projected synergies within a reasonable timeframe is essential for the success of the merger. Efficient integration and effective management are crucial for meeting this goal.

Long-Term Implications for the Brazilian Economy

The BRB-Banco Master acquisition carries significant long-term implications for the Brazilian economy.

-

Potential boost to economic activity through increased lending and investment: The combined entity's increased financial capacity could potentially lead to a boost in lending and investment, stimulating economic growth and job creation.

-

Strengthened financial stability within the Brazilian banking system: A stronger and more consolidated banking system can contribute to enhanced financial stability, reducing systemic risks within the Brazilian economy.

-

Impacts on the overall competitive landscape of the Brazilian economy: This merger will undoubtedly affect the competitive landscape, potentially leading to increased efficiency and innovation in the financial sector.

-

Potential implications for foreign investment in Brazil's banking sector: The acquisition might influence foreign investor perceptions of the Brazilian banking market, impacting future foreign direct investment flows.

Conclusion

The BRB acquisition of Banco Master represents a landmark event in Brazil's financial sector, signaling a potential shift in the competitive landscape and offering both challenges and opportunities. The success of this merger will depend on effective integration and strategic management of the combined entity. Careful consideration of the potential synergies and challenges will be critical in determining the ultimate impact on the Brazilian economy.

Call to Action: Stay tuned for further updates on the evolving impact of the BRB acquisition of Banco Master and how it continues to reshape Brazil's banking landscape. Follow us for in-depth analysis and insights into the BRB and Banco Master merger and its influence on the Brazilian financial market.

Featured Posts

-

90 Let Sergeyu Yurskomu Pamyati Geniya Paradoksov

May 24, 2025

90 Let Sergeyu Yurskomu Pamyati Geniya Paradoksov

May 24, 2025 -

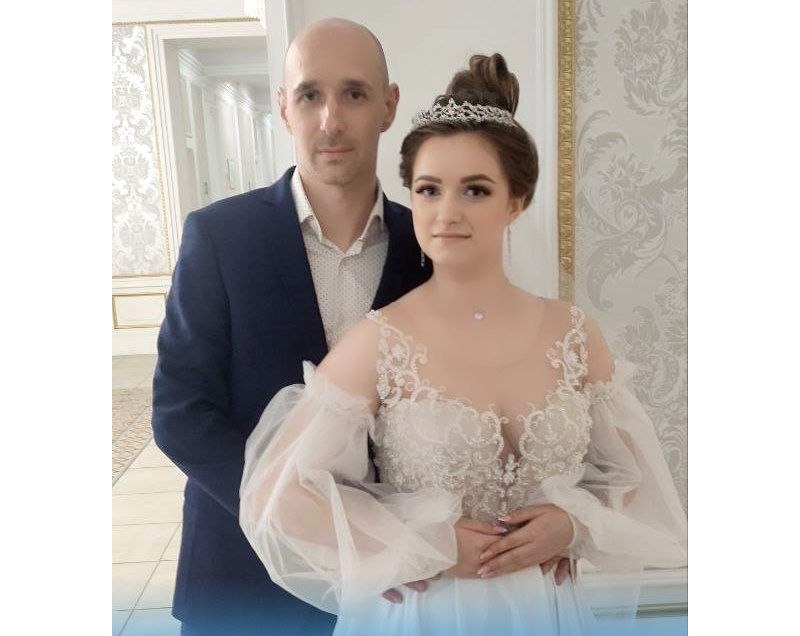

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

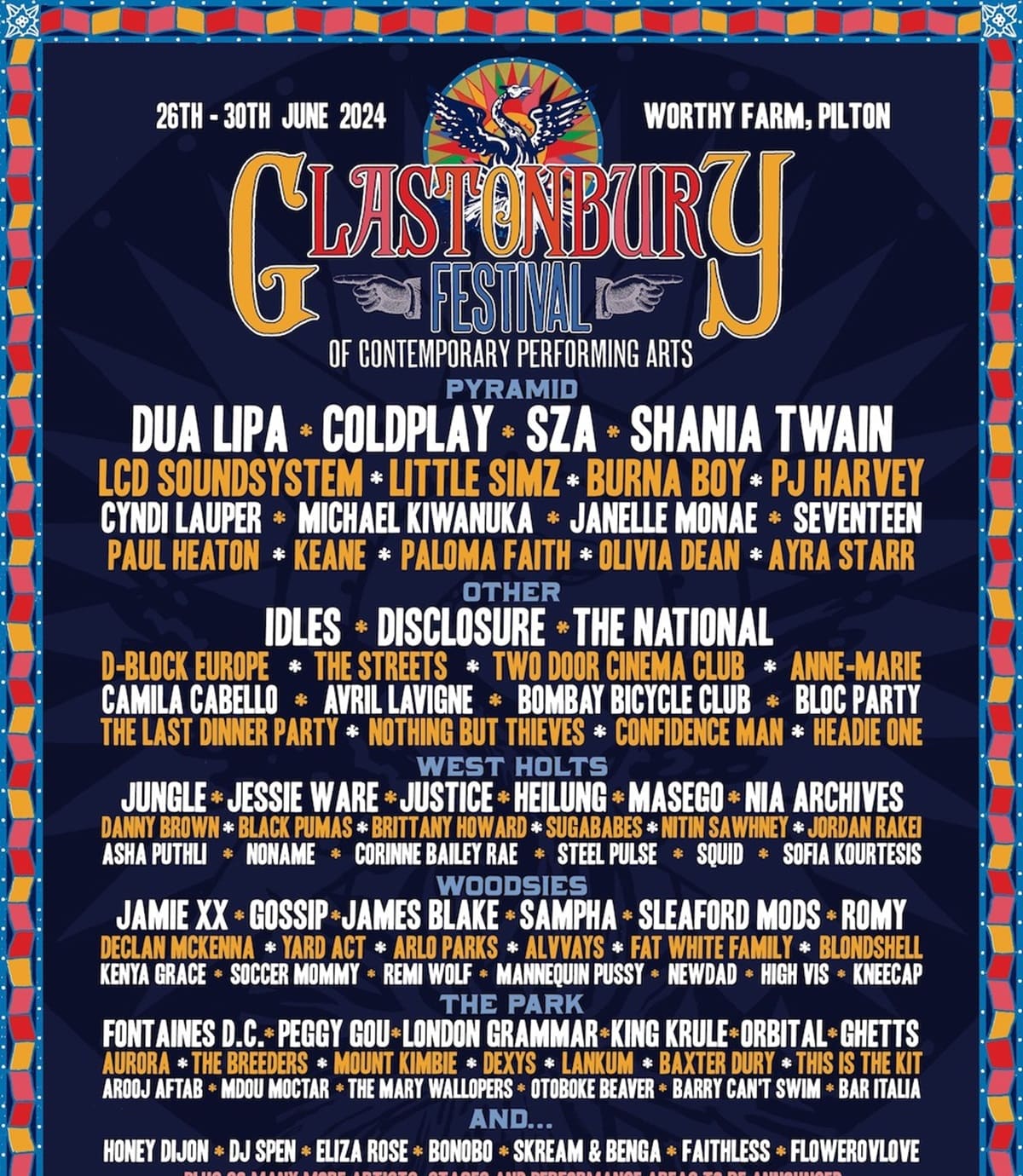

Unconfirmed Glastonbury Lineup Us Bands Social Media Post Creates Frenzy

May 24, 2025

Unconfirmed Glastonbury Lineup Us Bands Social Media Post Creates Frenzy

May 24, 2025 -

Your Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Your Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025